Mortgage Refinance Requirements: How Does Refinancing a Mortgage Work?

Home > Mortgage Loans > Mortgage Refinance > Mortgage Refinance Requirements

How Does Refinancing a Mortgage Work?

By Lauren Ward | Updated February 2, 2026

A mortgage refinance swaps out your old mortgage with a new one, including a fresh set of terms and interest rate. It may or may not come with financial benefits, depending on your goals and how a new loan quote stacks up against your existing home loan.

In this guide to refinancing a mortgage, you’ll learn how a mortgage refinance works and how you qualify for refinancing. We’ll walk you through what a refinance application is like and explain how much you can borrow when you refinance. Get the lowdown on the pros and cons of refinancing your mortgage.

Table of Contents

- What is Mortgage Refinancing?

- Mortgage Refinancing Requirements

- How to Qualify for Mortgage Refinancing

- How Does Mortgage Refinancing Work?

- Types of Mortgage Refinancing

- How Is Mortgage Refinancing Calculated?

- How Much Can You Borrow With Mortgage Refinancing?

- How to Apply for Mortgage Refinancing

- Who Should Get Mortgage Refinancing

- When to Refinance a Mortgage

- What Are Mortgage Refinancing Rates Expected to Do in 2026?

- Mortgage Refinancing Examples

- How Much Does It Cost to Refinance a Mortgage?

- How to Find Competitive Refinance Rates

- Mortgage Refinancing vs. HELOC

- Alternatives to Mortgage Refinancing

- FAQ

Key Points

• Mortgage refinancing requirements are similar to applying for your original home loan.

• Your home must be appraised before you can close on a refinanced mortgage.

• Comparing multiple lenders ensures you find the best terms available.

• Refinancing doesn’t necessarily save you money, so weigh all of your options carefully.

What is Mortgage Refinancing?

Refinancing a mortgage is when you get a new mortgage with different terms from the old one. The new lender pays off the original balance you owed, then begins to receive payments from you.

People refinance for a number of reasons, such as qualifying for a lower interest rate, changing the payment term, or cashing out some of their equity. In order to refinance your home loan, you need to submit a full application, get a home appraisal, and pay closing costs.

Consequently, you should have a clear financial goal in mind that makes up for the time and expense of mortgage refinancing.

Mortgage Refinancing Requirements

• Credit score: Most lenders require a minimum score based on the type of mortgage you’re applying for. For a conventional loan, a score of 620 or better is the norm.

• Equity: If you’re doing a cash-out refinance, you’ll need enough equity to cover the new mortgage balance plus the amount of money you want to borrow against the property.

• Debt: The lender evaluates your current debt load along with the new mortgage payment to make sure it’s affordable.

• Income: Your debt-to-income ratio is calculated to compare how much of your income is put toward debt payments each month (including your mortgage). Each lender has its own requirement, but it’s usually 50% or less.

• Employment verification: You must verify that you have steady income, often with recent pay stubs or federal tax returns.

• Assets for closing costs: Just as with any other home loan, you’ll have to show you have the funds to cover closing costs. Closing costs for a refinance range from 2% to 5% of your loan amount.

• Appraisal: Your home must be appraised to make sure the value is equal to or greater than your new mortgage balance.

If you meet these refinancing mortgage requirements, you’re ready to start the qualification process.

How to Qualify for Mortgage Refinancing

You’re ready to apply, but how does mortgage refinancing work? You can check your eligibility and request lender quotes before you get too far into the application. The mortgage preapproval process is an evaluation with a lender that looks at your credit and income to determine whether or not you meet the mortgage refinance requirements.

You can also look at different types of mortgages and cash-out options with estimated monthly payments before you go through underwriting. Once you have a loan quote you like and the loan officer is confident in your preapproval, your application moves to the underwriting process.

At this point, you may be asked to submit extra documentation and you’ll also need to pay for the appraisal. Home appraisal fees range from $300 to $600, and you usually must pay for it at the time the service is completed.

How Does Mortgage Refinancing Work?

You understand the basic process, but how does refinancing a mortgage work in terms of updating your loan?

Here’s what happens: Depending on your financial situation and your existing mortgage, you may want to change the terms of your home loan (we’ll get to potential reasons to do this in a bit). You typically can’t negotiate those terms with the lender, so you can instead shop around for a new mortgage at different lenders (you can also include your original lender in your search).

Once you find new loan terms that fit your goals, you go through the refinancing application process. After closing, the new lender pays off your mortgage balance with the old lender. Then you start making payments on your new loan according to the updated terms.

Common loan terms that can be changed with a refinanced mortgage include:

• Interest rate (amount and type, such as fixed or adjustable)

• Length of loan term

• Mortgage insurance

• Loan balance

On average, it takes 30 to 45 days to refinance a mortgage.

Types of Mortgage Refinancing

There are several types of mortgage refinancing options, whether you’re trying to lower your cost of living, change your loan term, or get a different rate. Each option depends on your goals and eligibility.

• Rate and term: A rate and term refinance is when you get a new loan in order to access a different rate, loan term, or both. Refinancing mortgage rates could be lower, or you could swap an adjustable-rate loan for a new loan before your current rate adjusts.

• Cash-out refinance: A cash-out refinance allows you to borrow more money than you currently owe. You receive the cash based on your equity and take out a larger mortgage balance, which can be used for just about anything.

• Cash-in refinance: A cash-in refinance is the opposite, where you take out a new mortgage and pay a lump sum to pay down the mortgage balance. This increases your equity and could help you qualify for better loan terms, especially if you made a low down payment when you first purchased your home.

• Streamline refinance: Some borrowers may be eligible for a streamline refinance with government-guaranteed loans for existing FHA, VA, and USDA mortgages. Usually the application process is quicker. The goal is to lower your monthly payments.

• No-closing-cost refinance: While some refinances may be advertised as having “no closing costs,” the term is misleading. You still have to pay closing costs, but you will either roll them into the new mortgage balance or pay them in the form of a higher interest rate.

How Is Mortgage Refinancing Calculated?

You can use an online mortgage refinancing calculator to compare new loan terms to your existing ones. Here is the information you’ll need to see how your payments and overall costs stack up:

• Current mortgage payment and interest rate

• Remaining balance

• Remaining loan term in years

• New interest rate

• New loan term in years

• Refinancing fee estimates

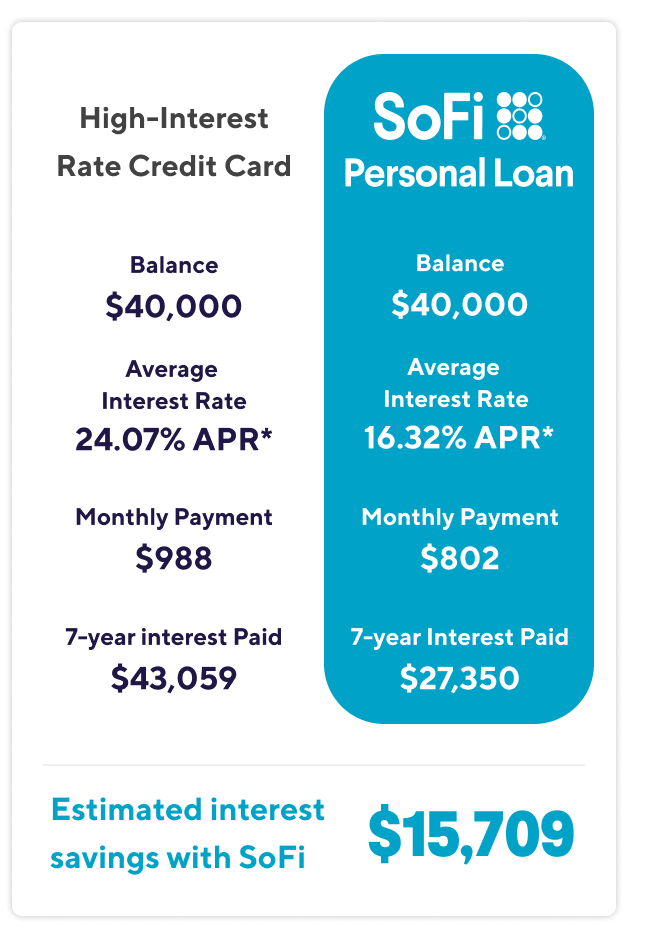

Once you enter in all of these details, you’ll see an estimate of your new monthly payment, along with a comparison of any potential savings (or extra costs) in interest over time. Finally, the calculator will show you how many months it will take to recoup the costs of refinancing so you can estimate whether or not you plan to live in the home that long. “It’s important to understand that not every mortgage refinance will save you money on interest. For example, if you extend the repayment term, you may have smaller monthly payments, but you’ll end up paying more money over the course of the loan,” says -Brian Walsh, CFP® and Head of Advice & Planning at SoFi.

How Much Can You Borrow With Mortgage Refinancing?

With a rate and term refinance, you’ll borrow the same amount as your existing mortgage balance, unless you decide to roll in some closing costs or pay down a lump sum of your loan.

With a cash-out refinance, you can borrow up to 80% of your home’s value. That means you would subtract your outstanding mortgage balance from 80% of the appraised value, and that’s the amount you could borrow — assuming you meet the requirements to handle the new payments.

The cash-out funds can be used however you’d like. Many homeowners use the funds to pay off other debts, pay for home renovations, or cover education expenses. In recent years, the number of cash-out refinances has increased alongside the cost of living in the U.S.

How to Apply for Mortgage Refinancing

Here are the steps for refinancing a mortgage explained.

1. Research lenders based on your refinance goals.

2. Get prequalified for a new mortgage with several lenders based on the terms you’re looking for.

3. Choose a lender based on its provided loan estimates.

4. Submit a formal application, along with financial documents such as bank statements, pay stubs, and tax returns.

5. Answer any questions from your loan officer or underwriter to keep your application on track.

6. Get an appraisal on your home.

7. Review your closing disclosure and sign your new loan agreement.

After you complete your closing, the new lender pays off your old mortgage balance from the previous lender.

Pros and Cons of Mortgage Refinance

As you consider refinancing your mortgage, here are some benefits and drawbacks to consider.

thumb_up

Pros:

• Potential for lower interest rate

• Monthly payment could decrease

• Access equity with a cash-out refinance

• May remove private mortgage insurance

thumb_down

Cons:

• Resetting your loan term could lead to paying more total interest over time

• A cash-out could increase your loan balance and monthly payments

• Closing costs impact any potential savings

Who Should Get Mortgage Refinancing

Is mortgage refinancing right for you? There are several scenarios when it makes sense (and some when it doesn’t).

You plan to stay in your home for a while: Make sure you plan to live in your home for at least the next few years. Even if a refinance saves you money, it takes time to recoup the closing costs.

You qualify for a better interest rate: Whether rates have dropped since you got your original mortgage or your credit score has increased since you qualified as a first-time homebuyer, you could save money over time.

Your adjustable rate is about to change: Refinancing can help you switch from an adjustable rate to a fixed one. If your rate is about to adjust, compare fixed rate options to see what’s a better deal.

You have an FHA loan and 20% equity: Your annual FHA mortgage insurance premium may be permanent if you took out your original loan after 2013 and your down payment was less than 10%. In this scenario, the only way to stop paying the premium is to refinance.

When to Refinance a Mortgage

In addition to the scenarios above, there are a few things you should track when choosing the best time to refinance.

• Your credit score: Avoid refinancing at the same time you’re seeking financing for other major purchases, like a car.

• Interest rates: The biggest changes tend to happen around the Federal Reserve’s Open Market Committee (FOMC) calendar. Check to see if rates drop (or rise) after these meetings.

• Your home equity: Look at sale prices on recently sold homes in your neighborhood to estimate how much yours could be worth or search your property on a real estate site. This gives you an idea of how much equity you may have.

What Are Mortgage Refinancing Rates Expected to Do in 2026?

Average mortgage interest rates for a 30-year loan have drifted downward, hitting a roughly two-year low of 6.06% by mid-January 2026, according to Freddie Mac. Some forecasters expect the 30-year loan rate to drop to 5.50% by mid-2026, though whether this will happen will depend on larger economic forces such as inflation.

Mortgage Refinancing Examples

Here are two examples of how it might look to refinance a mortgage:

1. Rate and term refinance: A homeowner with an FHA mortgage reaches 20% equity in his home. Average monthly expenses have increased, so he wants to cut costs in other areas. He pays 0.5% of his mortgage balance each year in FHA mortgage insurance premium, which is about $1,500 on his $300,000 balance. Refinancing to a conventional loan would save $125 per month, and even more if he can get a lower rate.

2. Cash-out refinance: A married couple has lived in their home for seven years. Over that time, their home value has increased from $250,000 to $500,000, leaving them with more than $250,000 in equity after making payments over the years. Their daughter is about to head to college and they want to tap into their equity to help pay for it. But since their mortgage rate is fixed at 3.99%, they end up opting for a home equity line of credit (HELOC) instead of a cash-out refinance in order to preserve that lower rate.

How Much Does It Cost to Refinance a Mortgage?

There are a number of costs involved with refinancing a mortgage, including:

• Appraisal fee

• Origination fee

• Title insurance

• Recording fee

Your original mortgage lender may also charge a prepayment penalty for closing the loan early. This fee is rare, but it’s still worth researching so you’re not surprised. If you have a jumbo loan, you may also have some extra-large costs associated with refinancing so carefully consider what you will spend on a refinance vs. what you will save.

How to Find Competitive Refinance Rates

To get the best rates and lowest overall cost in a refinance, compare at least three different lenders. Remember, even if a simple interest rate is lower, hefty lender fees could negate any savings.

Mortgage Refinancing vs. HELOC

Both a cash-out refinance and a home equity line of credit (HELOC) allow you to tap into your home’s value, but there are different pros and cons to each option. One key difference is that a HELOC allows you to borrow only as much as you need at any given time, while a cash-out refi will deliver one lump sum payment. Here’s how the differences lineup:

| Cash-out mortgage refinance | HELOC |

| • Fixed interest rate • One lump-sum loan • Rates are usually lower than a HELOC • Interest paid for entire balance for entire mortgage term • Higher closing costs |

• Interest is usually variable • Draw funds only as you need them • Rates may be higher than a refi • Interest only accrues on your balance • Minimal closing costs • Line of credit replenishes as you pay off balance |

Alternatives to Mortgage Refinancing

There are a few other options to consider if refinancing doesn’t feel like a perfect fit.

Recasting: Instead of refinancing with a new loan, you could make a large payment to your existing lender and request that the lender recast your loan. The lender then lowers the balance and re-amortizes your payments so they reflect the lower balance. This is a good solution if you’re looking to lower your monthly expenses and you have cash on hand.

Make extra payments: If you’re considering refinancing to shorten your loan term, you could simply pay more principal each month without getting a new mortgage. You’d still pay off your loan sooner and wouldn’t have to pay closing costs or lose a competitive interest rate if you have one.

Move to a new location: If you need to lower your monthly mortgage payments — or expenses generally — consider moving to a more affordable area where your money could go further.

The Takeaway

Borrowers have two options for a mortgage refinance: a new loan with terms or rates that will ideally lower your monthly payment, or a cash-out refinance that won’t necessarily save you money but can free up funds to help you meet other financial goals. Refinancing is a similar process to applying for a home loan, so consider the decision carefully. Examine the costs associated and consider how long you expect to own your home before committing to a refinance with a lender you can trust.

SoFi can help you save money when you refinance your mortgage. Plus, we make sure the process is as stress-free and transparent as possible. SoFi offers competitive fixed rates on a traditional mortgage refinance or cash-out refinance.

A mortgage refinance could be a game changer for your finances.

FAQ

What is the point of refinancing a mortgage?

Refinancing usually comes with a couple of different outcomes: changing your rate and term with an eye to lowering monthly payments, total interest paid, or both; cashing out some of your equity; or paying off a large chunk of your mortgage to lower your payments.

What are the risks of refinancing a home?

There are risks if the costs of refinancing don’t outweigh the benefits, so you could end up paying more than with your original mortgage. If you choose a cash-out refinance, you use your home as collateral for borrowing a lump sum of money.

Is it ever a good idea to refinance your house?

It could be a good idea to refinance your house if you can reduce your monthly mortgage payment, save on interest, pay off your loan faster, or access funds for renovations or another big expense at a relatively low interest rate.

Do you get money when you refinance your home?

You only get money when you refinance if you choose a cash-out refinance. With this option, you take out a larger mortgage than your current balance and receive the difference as cash.

Does refinancing hurt your credit?

You may see a slight dip in your credit score when you first apply to refinance your mortgage, simply because of the new inquiry on your credit report. Be sure to keep up with on-time payments when you transition between loans; otherwise you could hurt your score with a late payment.

Is it good or bad to refinance a loan?

Whether or not refinancing is a good idea depends on your goals and your loan terms. If you can save money with a lower interest rate, it could be a good thing — provided you own your home long enough to recoup the closing costs on the refi. But you could end up with larger monthly payments, especially if you cash out some of your equity.

Refinance your way to a better mortgage with SoFi.

Read more

(888) 888-8888

(888) 888-8888