Law School Loans | SoFi

Student loans with

competitive rates

for law school degrees.

SoFi takes the headache out of loans for law school, so you can focus on, you know, the actual law school part. Find out just how easy private loans for law school can really be in just a few minutes.

View your rate

New! Cash bonus for good grades.

Up to $2502 with GPAs 3.0 or higher.

Learn more

Received a mailer from us?

Here to help you pay for your student loans for law school.

We know how hard you’ve worked. Now you can pay for that hard work with premium, competitive-rate law school student loans.

All online. All easy.

Fill out our simple online application in minutes—and finish it even quicker for your next law school loan with our fast track application, which will prefill your info. Plus, get access to live customer support 7 days a week.

No fees required. No fuss.

No fees required means no fees required. That means no origination fees, no late fees, and no insufficient funds fees. Period.

Competitive rates.

You’re ambitious and probably competitive–much like our rates. Our student loans with competitive rates and flexible term options for law school can help you in the next stage of your education.

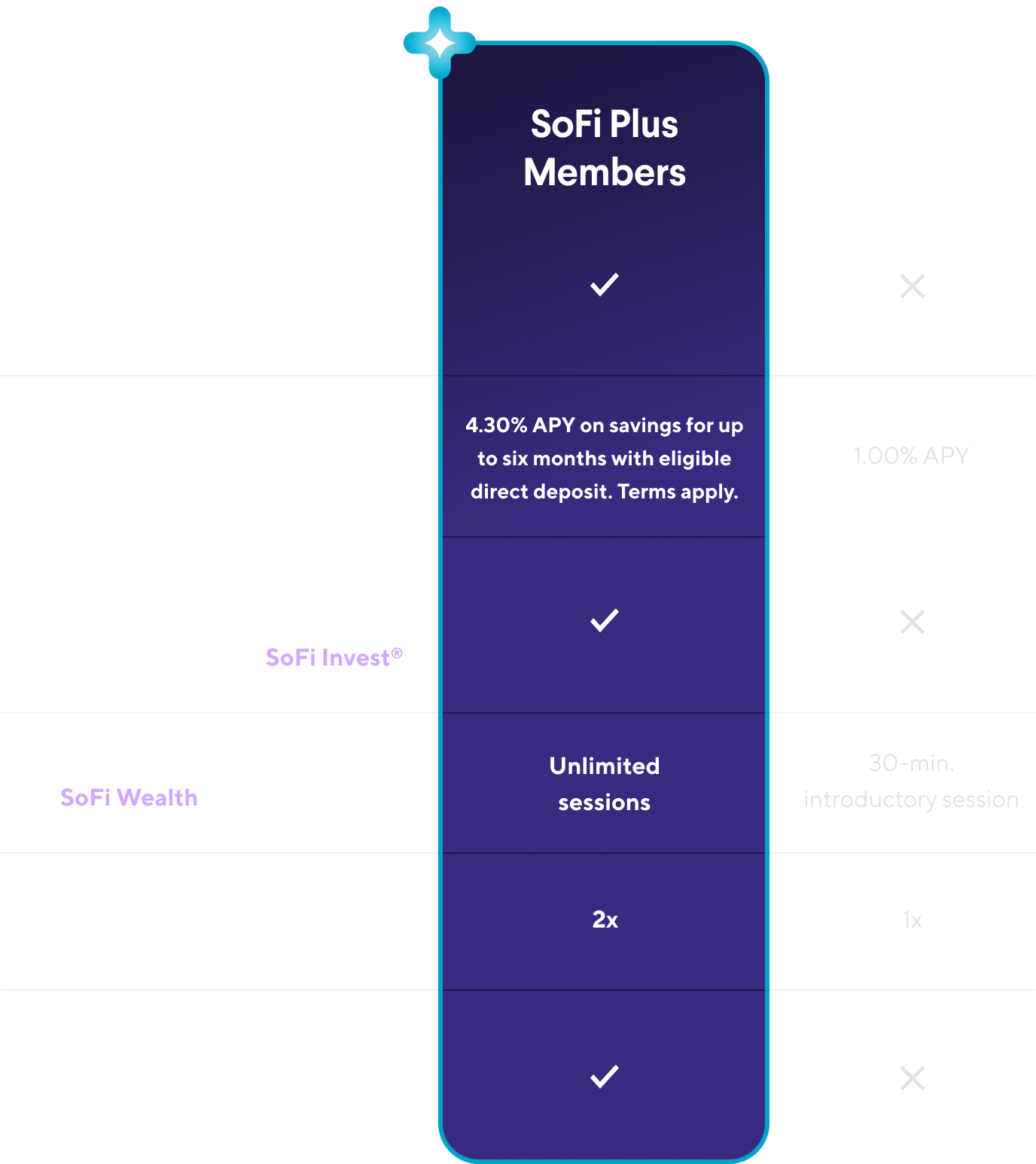

Exclusive member benefits.

SoFi members can qualify for exclusive rate discounts. You’ll get access to financial advisors, networking events, and more—all at no additional cost.

LAW SCHOOL STUDENT LOANS

Earn and redeem points to pay down your SoFi law school loans.

You can redeem your rewards points to pay down your SoFi student loans for law school. Earning rewards points is as easy as setting up bill pay, checking your credit score, and more.

Learn more

For complete Member Rewards details, read our Terms of Service.

Law school student loan rates.

Choose from competitive fixed or variable rates for law school.

Not sure which to choose?

Learn more.→

How to apply for private law school loans from SoFi.

-

1

Apply online in just minutes.

Get your rate fast and find out if you’re prequalified before you even finish the full application. Seamlessly add a cosigner to your law school student loan in just a few clicks.

-

2

Select your rate and repayment option.

Choose from fixed or variable rates. Then, pick from four repayment options.

-

3

Sign and accept your law school loan.

Upload screenshots of your info, sign your paperwork electronically, and voilà—your student loan for law school is in the works! We’ll handle it from there.

View your rate

SoFi law school student loans vs. other lenders.

‘Multiple Repayment Term Options’,

]}

sofiCard={[

‘Sofi’,

‘3 minutes’,

‘No fees’,

‘4’,

‘Yes’,

‘Yes’,

‘Yes (5,7,10,15 year terms)’,

]}

competitorCards={[

[

‘Sallie Mae’,

’15 minutes’,

‘Late fee + returned check’,

‘3’,

‘No’,

‘No’,

‘No (terms assigned by lender)’,

],

[

‘Discover’,

’15 minutes’,

‘No fees’,

‘3’,

‘No’,

‘No’,

‘No (15 year terms)’,

],

]}

/>

Comparisons based on information obtained on lenders’ websites as of July 11, 2021

View your rate

Repay law school loans your way.

Pick the repayment option that works for you and your budget.

Deferred

Start paying principal and interest payments on your law school loan, six months after you graduate.

- No payments while in school

- Highest overall cost option

Interest only

Pay only interest payments while you’re in law school.

- Moderate payment while in school

- Reduces overall cost

Partial

Pay a $25 fixed monthly payment while you’re in law school.

- Lowest payment option while in school

- Reduces some of the overall cost

Immediate

Start paying principal and interest payments on your student loan for law school right away.

- Highest payment option while in school

- Lowest overall cost option

View Law repayment examples

Student loans for law school on your terms.

You’ve got the choice of four different term options for law school loans. Pick the rate and schedule that feels right for you.

You got the job—now get the law degree.

Now you can use your job offer letter as proof of income when applying for a law school loan.3 As long as your start date is within 1 year, you’ll be good to go.

View your rate

Law School Loan FAQs

You can apply and get a credit decision within minutes. If approved, you would then need to accept your terms and electronically sign your loan documents. At that point, we send the loan application information to the school for certification. During this process, schools verify your enrollment status, academic progress, and your financial aid package. Every school has their own processes and timelines, so certification can take several days or sometimes weeks. Once we receive the certification back from the school, we’ll schedule the funds to be sent according to the school’s requested timeline. The entire process from application to actually sending the money to the school typically takes at least 4-6 weeks, but it can be shorter or longer than that depending on the school.

Yes, both federal and private law school student loans can typically be used to cover certain living expenses while you are enrolled. This may include costs such as housing, food, transportation, books, and supplies in addition to tuition and fees. Each lender and loan program sets its own rules, so it is important to review your loan terms carefully and borrow only what you need to manage both academic and personal expenses responsibly.

The timing of a law school loan application can depend on factors such as your school’s tuition deadlines, the financial aid you receive, and the lender’s processing requirements. Reviewing your options and understanding these timelines can help ensure funding is available when needed.

- Social Security number or Tax Identification Number (TIN) are required from all borrowers all the time

- Proof of income: You may be required to provide proof of income if SoFi is not able to validate it automatically. We could use something similar for gov’t id.

- Government-issued ID

- Student’s school information (student’s estimated graduation date and academic term)

- Loan amount (how much you’d like to borrow)

- Financial aid you expect to receive

- Do you already have a private student loan with SoFi? We’ll use your past application to pre-fill as much information as possible in your new application

SoFi’s eligible school list consists of most public and private, degree-granting institutions.

There are a number of law school loan forgiveness and repayment options. Below are some of the most widely used programs.

Public Service Loan Forgiveness (PSLF) is a program that allows your loans to be forgiven if you work in a qualifying public service field and make 120 consecutive qualifying monthly payments over 10 years. Income-driven Repayment Plans (IDR) sets your monthly student loan payment based on your income and family size. State Loan Repayment Assistance Programs is another option, where the specifics of the repayment assistance programs vary from school to school.

You can find more information on law school loan forgiveness resources and options here.

See more FAQs

Law school loan resources, and more.

Got more questions about student loans for law school? Our online resource center covers law school loans and more with over 500 articles, budgeting tools, and guides.

Visit SoFi Learn

Terms and Conditions Apply. SOFI RESERVES THE RIGHT TO MODIFY OR DISCONTINUE PRODUCTS AND BENEFITS AT ANY TIME WITHOUT NOTICE. SoFi Private Student loans are subject to program terms and restrictions, such as completion of a loan application and self-certification form, verification of application information, the student’s at least half-time enrollment in a degree program at a SoFi-participating school and, if applicable, a co-signer. In addition, borrowers must be U.S. citizens or other eligible status, be residing in the U.S., and must meet SoFi’s underwriting requirements, including verification of sufficient income to support your ability to repay. Minimum loan amount is $1,000. See SoFi.com/eligibility for more information. View MBA payment examples. View Law payment examples. Lowest rates reserved for the most creditworthy borrowers. SoFi reserves the right to modify eligibility criteria at any time. This information is subject to change. This information is current as of 12/15/25 and is subject to change.

* Interest Rates: Eligibility and Important Details. Fixed rates range from 3.18% APR to 14.83% APR with all discounts. Variable rates range from 4.39% APR to 15.86% APR with all discounts. Unless required to be lower to comply with applicable law, Variable Interest rates are capped at 17.95%. SoFi rate ranges are current as of 6/1/23 and are subject to change at any time. Your actual rate will be within the range of rates listed above and will depend on the term and type of repayment option you select, evaluation of your creditworthiness, income, presence of a co-signer (if applicable) and a variety of other factors. Lowest rates reserved for the most creditworthy borrowers. Check out our eligibility criteria at https://www.sofi.com/eligibility-criteria/. For the SoFi variable-rate product, the variable interest rate for a given month is derived by adding a margin to the 30-day average SOFR index, published two business days preceding such calendar month, rounded up to the nearest one hundredth of one percent (0.01% or 0.0001). APRs for variable-rate loans may increase after origination if the SOFR index increases. The SoFi 0.25% autopay interest rate reduction requires you to agree to make monthly principal and interest payments by an automatic monthly deduction from a savings or checking account. This benefit will discontinue and be lost for periods in which you do not pay by automatic deduction from a savings or checking account. The benefit lowers your interest rate but does not change the amount of your monthly payment. This benefit is suspended during periods of deferment and forbearance. Autopay is not required to receive a loan from SoFi.