Omicron Weighs on the Stock Market

With COVID-19 cases rising and countries imposing restrictions, investors are filled with uncertainty.

Read moreWith COVID-19 cases rising and countries imposing restrictions, investors are filled with uncertainty.

Read moreSoFi launches new site to show commitment to fostering a diverse, welcoming, and inclusive workforce.

Read moreI love a good analogy. When I sat down to gameplan my 2022 market outlook, the best one that came to mind was about running. As a runner, and one who actually prefers to run in less than ideal conditions because it feels like more of an accomplishment afterwards, I can’t help but think that the investor in 2022 will face similar challenges to a runner in inclement weather. While 2021 was akin to running with the wind at our backs, 2022 is more likely to be akin to running into the wind. Challenges don’t guarantee failure, however. In fact, it’s those challenging times when we tend to learn more about how to succeed.

It’s wild to look back at the first couple months of 2021, when vaccines were not yet widely deployed, much of the U.S. was still in lockdown, and we saw a changing of the guard in Washington. Fast forward to December and we are now talking about a pandemic that we are learning to live with, an S&P 500 that’s hit 67 new all-time highs, inflation readings that have hit new highs of their own, and a Federal Reserve that began tapering asset purchases. Through all the twists and turns, major equity asset classes pumped out handsome gains (chart 1). U.S. markets stayed on top of the leaderboard as Europe struggled with more Covid-19 outbreaks and travel restrictions, and China’s regulatory and real estate woes brought down Emerging Markets.

Chart 1: Asset Class Returns 2021 YTD

Source: Clearnomics, Refinitiv

Another major story that dominated markets was that of rotation. At several junctures during the year, markets attempted to make a rotation from the technology stocks that led the pack into cyclical sectors, while the 10-year Treasury yield attempted to rise above 1.75%. After a very strong year of earnings growth (50.0% growth expected for 2021) and another year of easy monetary policy, equity valuations remain above their 5- and 10-year averages and are elevated across most sectors (chart 2).

Chart 2: S&P 500 Earnings Growth and P/E Ratio by Sector

Source: Clearnomics, Refinitiv

Perhaps the biggest story of all was inflation. As of this writing, there have been eight straight months of year-over-year Consumer Price Index (CPI) readings above 4%, with the most recent reading of 6.8% for November. The last time we saw inflation this high was almost 40 years ago in June 1982. Despite the swift and persistent increase in prices, the Treasury yield curve, which would be expected to steepen during times of higher inflation, has flattened in the last few months of the year, and the 10-year Treasury yield remains historically low.

Inflation fears have hit consumer sentiment with the University of Michigan Consumer Sentiment Index falling from 88.3 in April to 70.4 in December. For an economy that’s dependent on the consumer, this can be a worrisome sign. It can also be a sign of consumers trying to get their arms around a different environment as we head into the new year. Handing the baton to the next runner can be nerve-wracking, but it’s also a necessary part of staying in the race.

Investing in 2022 will be a learning experience for both new and seasoned investors. For new investors, this is very likely the first monetary tightening cycle they’ve seen, and with it will come the rotations driven by rate movements, and increased focus on valuations and quality. For seasoned investors, although not the first tightening cycle they’ve seen, it’s the first one in a long time with inflation nearing 7% and the rate-sensitive Information Technology sector at more than 26% of the S&P 500 index.

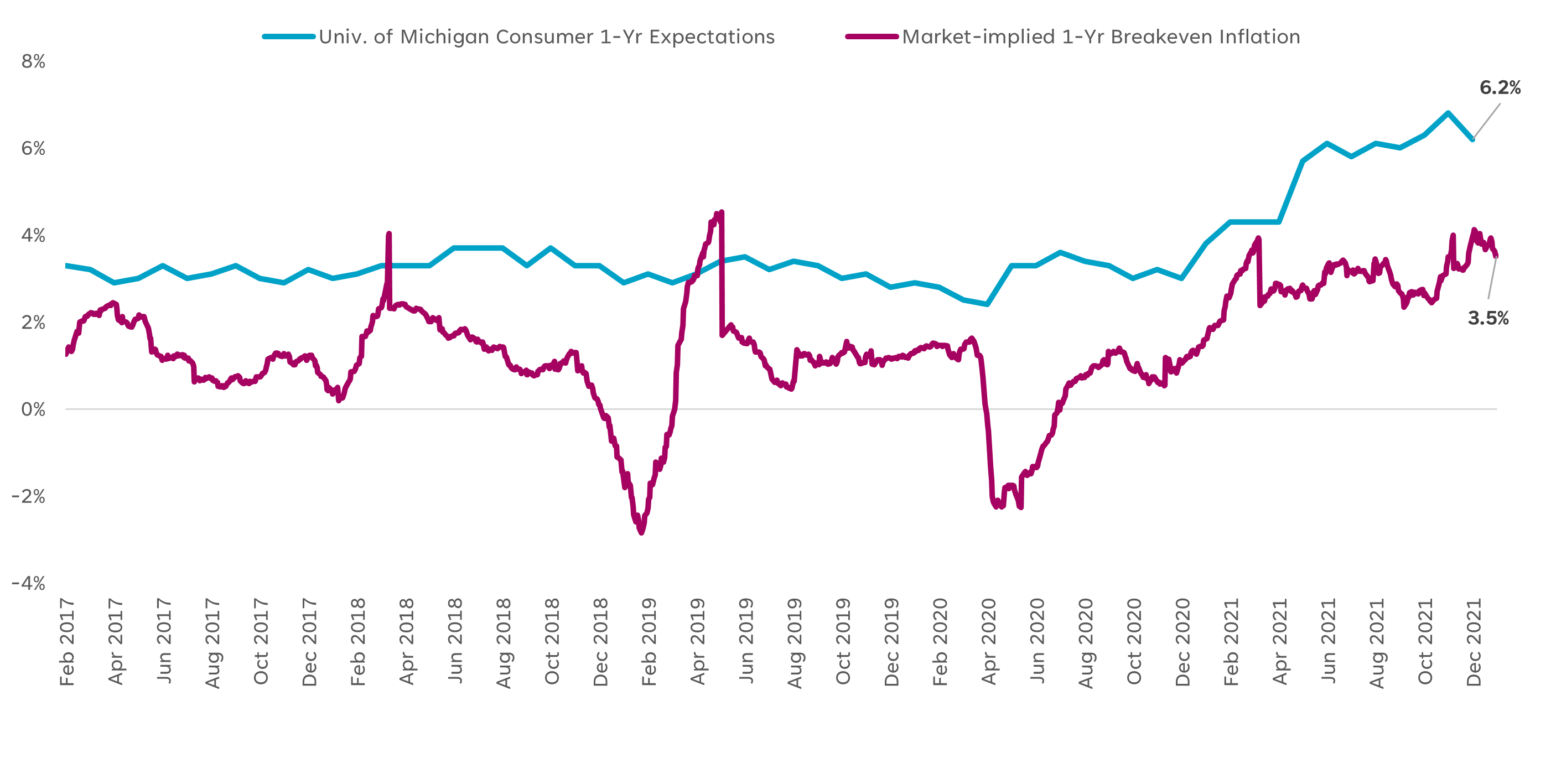

The reality of the inflation situation is that it’s been far from “transitory,” and the Fed has now acknowledged that keeping prices stable plays a critical role in supporting further economic growth. In looking at inflation expectations (chart 3), I’d make a couple observations. First, consumers expect inflation to remain much more elevated in one year’s time (at 6.2%) than the market does (at 3.5%). Second, regardless of who is correct, inflation is expected to remain higher than it was pre-pandemic.

Chart 3: One Year Inflation Expectations

Source: Bloomberg, University of Michigan. Market-implied breakeven inflation is calculated as the difference between the daily yields of nominal Treasury debt and Treasury-Inflation Protected Security of equal maturities.

Cue the Federal Reserve. On Dec. 15, the Fed announced that they would speed up the pace of their tapering program from $15 billion/month to $30 billion/month starting in January, which would put them on track to finish the asset purchasing program in March 2022. Many expect that this also means the Fed will begin raising rates sooner rather than later. Rising rates typically present a headwind to equities, and a particular headwind to high growth stocks. In other words, if investors are the runners, Fed tightening is the wind.

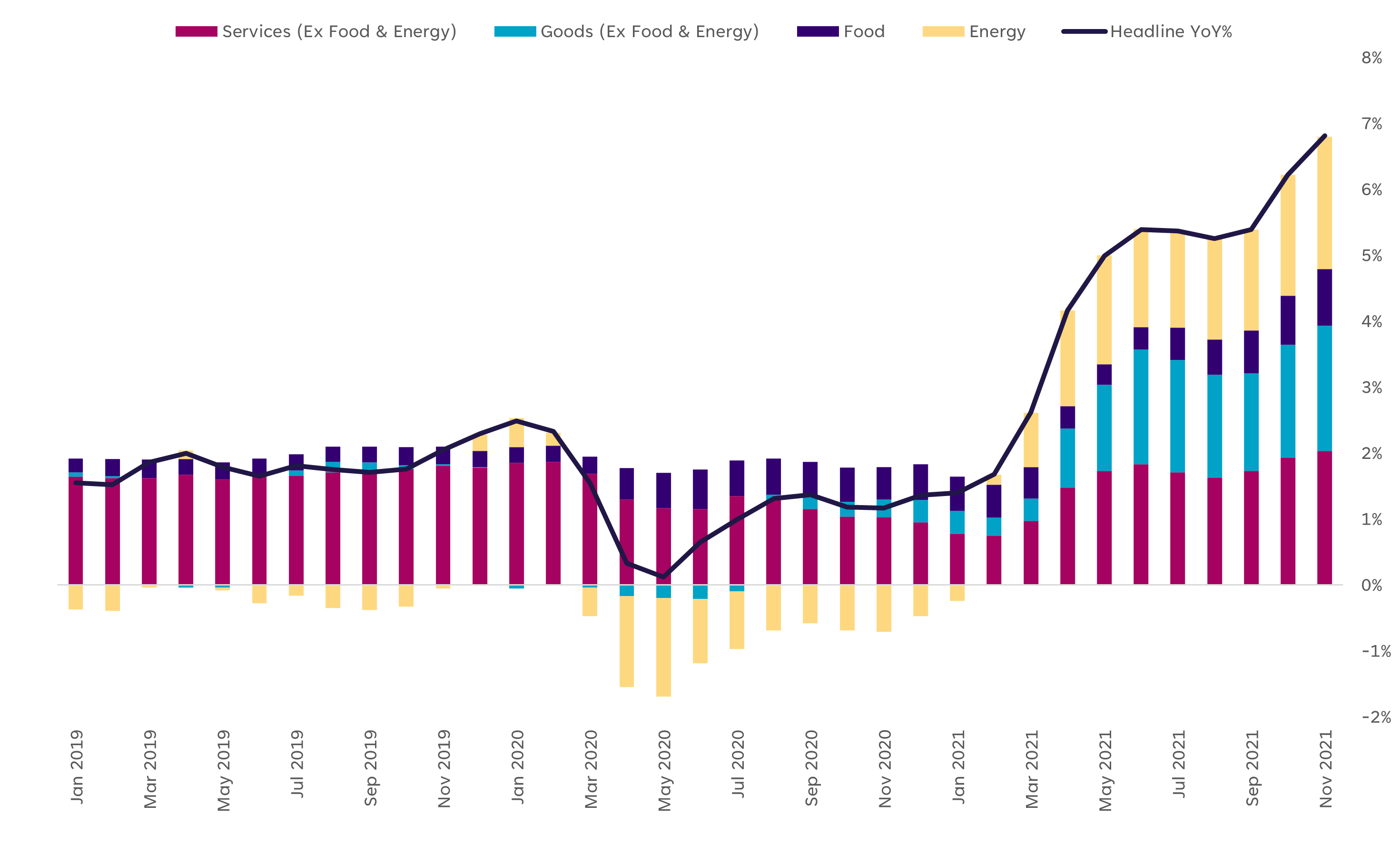

But frankly, it needs to happen, and any extension of loose monetary policy would be more detrimental to consumers and markets over the long run. Chart 4 below shows how inflation has affected U.S. households in 2021. The most basic components of consumption are food and energy—we can see here that energy prices have risen substantially and food prices have increased as well. Gas prices, for example, have risen from an average of $2.25/gallon in Jan. 2021 to $3.33/gallon in mid-December. Given food and energy aren’t exactly “optional” items, price increases like this take a material bite out of household income.

Chart 4: Consumer Price Index and Major Components

Source: Bloomberg, Bureau of Labor Statistics

The bigger the bite taken by necessary items, the less consumers have to spend on other goods and services. And since consumers represent over 70% of U.S. GDP—the less they spend, the less we grow. Finding a more comfortable inflation level is paramount, so the Fed should taper faster. After all, tapering is a much less blunt instrument than rate hikes. Even still, rate hikes in 2022 are all but inevitable. Once the tapering program has ended, I expect the Fed to wait a couple months before beginning the rate hike cycle in order to gauge the effects and, maybe more importantly, avoid the possibility of a “too far, too fast” policy error.

All of my runs have phases—they begin with those first few easy strides, but if I don’t control my speed, my heart rate picks up too fast and I can’t catch my breath. If instead, I manage to find a comfortable speed where I’m working, but not straining, I can settle in and cruise.

Think of this next phase as the Fed trying to find a cruising speed now that the warm-up is over. A number of indicators have now told us that we’ve made meaningful progress on the recovery:

• The unemployment rate is down to 4.2% from a high of 14.8% in April 2020. Initial and continuing jobless claims hit post-pandemic lows in Q4 2021.

• ISM Services PMI hit a post-pandemic high in Nov 2021. Manufacturing PMI hit a high in March 2021 and has remained in expansionary territory since.

• GDP growth is expected to come in at 5.6% for 2021 and is estimated at close to 4.0% for 2022.

Granted there are some weaker data points out there, too, but these are important indicators, and they’re flashing green. One of the areas to keep an eye on is the labor market (chart 5), which hasn’t yet recovered to previous levels, and may not. We’re still about 3.5 million workers short of where we were in Feb 2020, about 7.8 million short of where we would have been if Covid never happened, and the labor force participation rate is stubbornly stuck below 62.0%, versus the pre-pandemic level of 63.3%.

Chart 5: Labor Market Indicators

Source: SoFi, Bureau of Labor Statistics, Bloomberg

The Fed’s intention is to control inflation without hindering economic or labor force growth. A challenge for sure, but when the rate hike cycle begins, it will be in an economy that’s doing pretty darn well.

We’ve established that the economy is in good shape, the Fed is going to tighten, and the market is trepidatious but still near all-time highs. I see this as a perfect time to use the title of a book by Marshall Goldsmith, “What Got You Here Won’t Get You There.”

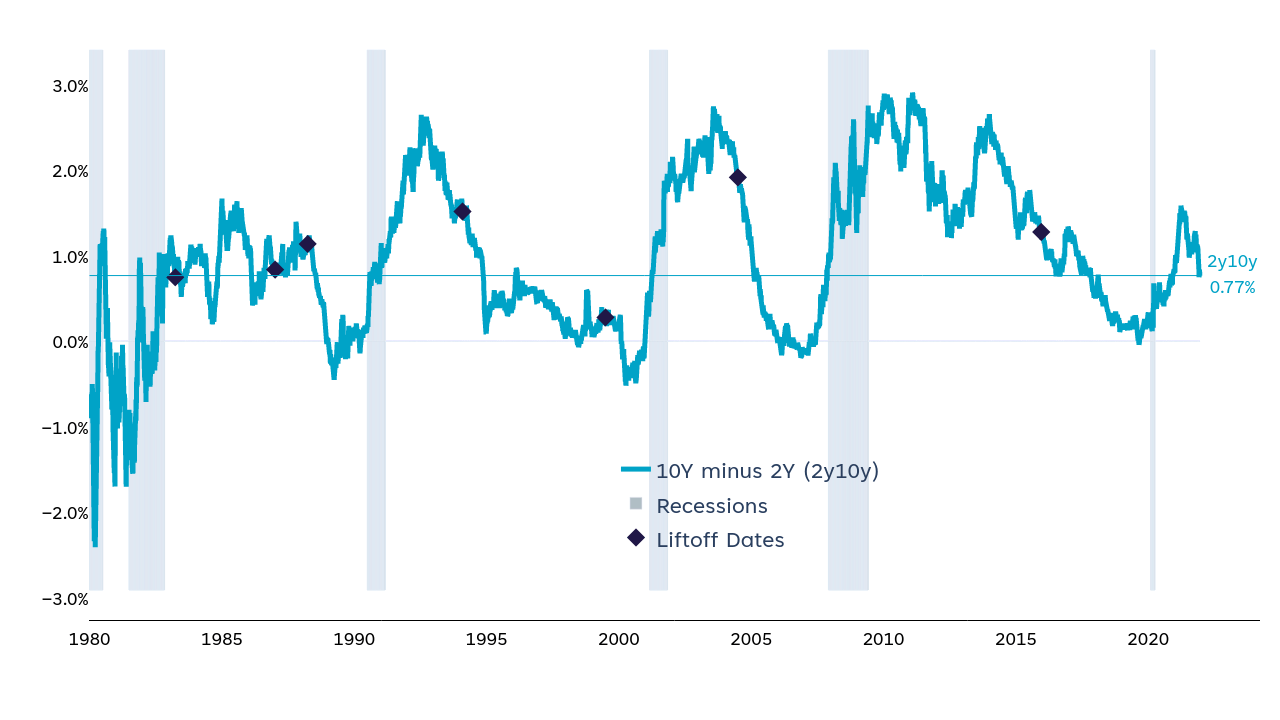

What’s gotten us here is historically low rates that encouraged speculation and discouraged a focus on valuations. Somehow, through all of this, there were even opportunities to make money in fixed income as the 10-Year Treasury yield rose and fell again, like the little engine that couldn’t. Even more surprising has been the flattening of the yield curve, measured by the spread between the yield on 2- and 10-Year Treasurys (chart 6). Only once since the 1980s has this spread been lower when we began a tightening cycle.

Chart 6: Yield Spread Between 2-Year and 10-Year Treasurys

Source: Clearnomics, Federal Reserve, National Bureau of Economic Research

This can’t be sustainable. Of course there are a number of ways this spread could change, but the one I see as more likely is that the 10-year yield moves up and the 2-year yield either stays put or moves up less…meaning, the curve steepens.

Take a steepening yield curve, add it to elevated inflation levels, a Fed that’s trying to find cruise control, and an economy that’s hitting its stride — and I see four major themes for next year’s markets:

1. Tougher competition

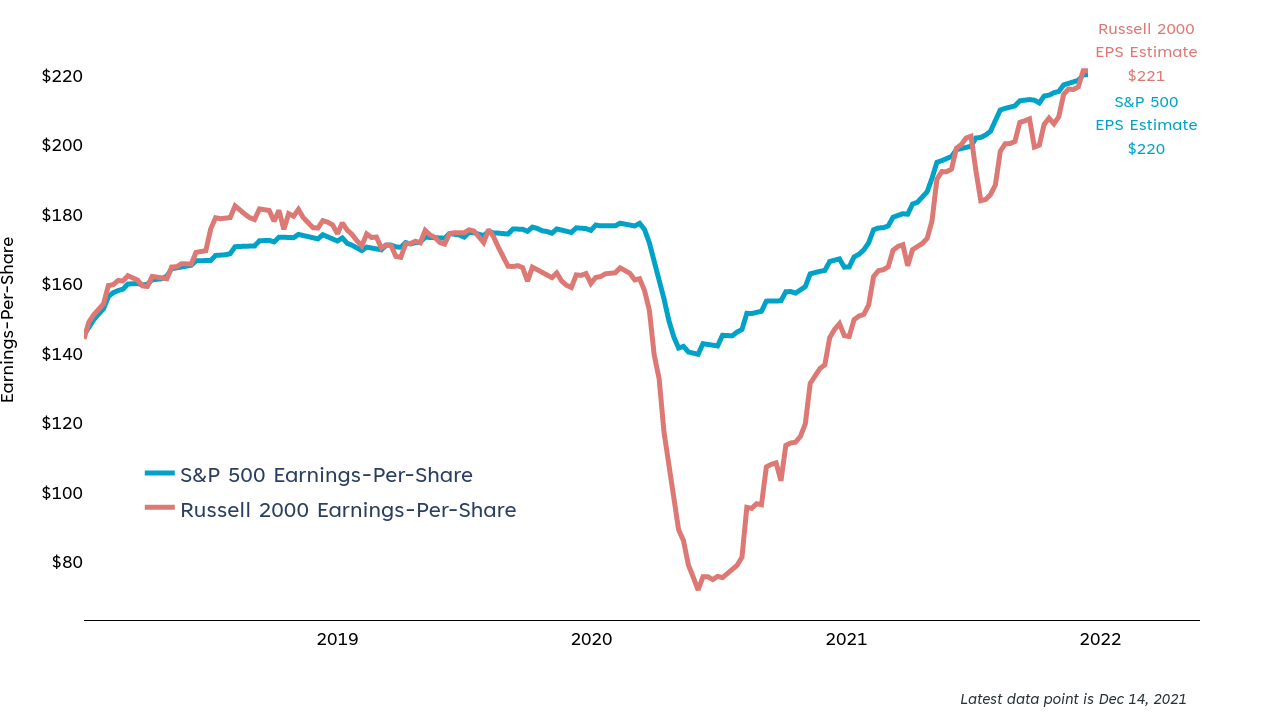

Earnings growth has surged since the market bottom and is still expected to rise 8.2% for the S&P 500 and 33.9% for the small-cap Russell 2000 (chart 7). But the year-over-year comparisons will be more challenging and companies will have to prove their merit to investors. Those with strong competitive positions, healthy cash positions, and an investment thesis that has legs in a reopening environment are my best ideas — I think many will be in Health Care, Industrials, Consumer Discretionary, and Travel & Leisure in 2022.

Chart 7: Earnings Per Share

Source: Clearnomics, Refinitiv

2. Yield curve climbs the hill

If all goes well, the entire curve shifts upward with the 10-year portion rising more than the short end, and the yield curve becoming the little engine that could. That environment would encourage investors to calculate their risks more carefully while a focus on valuations and quality would come back to the forefront. Importantly, rising rates and higher inflation do not have to mean negative stock returns (chart 8). What they do likely mean is pressure on high growth stocks and investors should heed the risks. I would particularly favor Financials in a steepening curve environment, due to better net interest margins, and Small-Caps, due to economic cyclicality, a sector makeup that’s less rate-sensitive, and mostly domestic revenue exposure. Also, the meme theme probably loses more steam.

Chart 8: Equities in Different Inflationary Environments

Source: Clearnomics, Bloomberg, Bureau of Labor Statistics. Returns refer to annual total returns based on dividend reinvestment. Low, moderate, and high inflation are defined as <2%, 2-4%, and >4%, respectively. S&P 500, NASDAQ, and Russell 2000 data are from the start of 1970, 1972, and 1979, respectively.

3. Clean Energy transition

Of course, there’s the possibility of a fiscal spending plan that includes support for the clean energy industry. But it was also clear as a bell this year the enthusiasm investors have for these companies. I see that enthusiasm continuing and more companies ushering in innovation in the electric vehicle space. Remember, you don’t need to only invest in certain auto-makers; you can invest in more diversified ETFs that own a variety of EV-adjacent companies as well. Don’t limit yourself and try to call the winner in a young race.

4. Currency volatility → crypto-adoption accelerating

This hot topic stays hot in 2022. Much of the thesis is dependent on devaluation of fiat currency (see: inflation), decentralization of monetary authority (see: fear of Fed policy mistake), future mindset of investors (see: Gen Z and millennials), and digitization of our lives (see: tech sector advances or any article written in the last five years). None of those themes are going away in 2022. The question mark here is how regulation might impact the asset class. Time will tell.

Safe to say we’ve lived through two unique, dramatic, and frequently surprising years. I hope and believe that 2022 will be a departure from the trend, and that we are starting a new race. One that allows us to find a comfortable cruising pace and leads to solid economic growth and markets that follow in the footsteps of strong fundamentals. This will not be easy, it will not be smooth, the course will be hilly and sometimes it’ll rain. But if we can find the stamina and strength to keep our money in the market and our fear in our pockets, 2022 can be a race we’re glad we kept running through. Hang tough.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov. Liz Young Thomas is a Registered Representative of SoFi Securities and Investment Advisor Representative of SoFi Wealth. Her ADV 2B is available at www.sofi.com/legal/adv.

Sony is taking an agnostic approach to streaming platforms. That means it doesn’t have to worry about streaming cannibalizing box office sales or vice versa.

Read moreNauticus Robotics is going public via a SPAC deal, testing investors’ appetite for another environmentally focused company.

Read more