Liz Looks at: Market Breadth

Casting a Wider Net

The new term du jour is “bear market rally,” and the exercise du jour is trying to determine if any uptrends we see in markets are simply brief rallies in an otherwise downward trending period, or if they’re indications that we’re entering a new phase of positive momentum.

There are various ways to splice the price action and attempt to make a call on the above. I’m going to choose three indicators in order to gauge my confidence level with recent rallies.

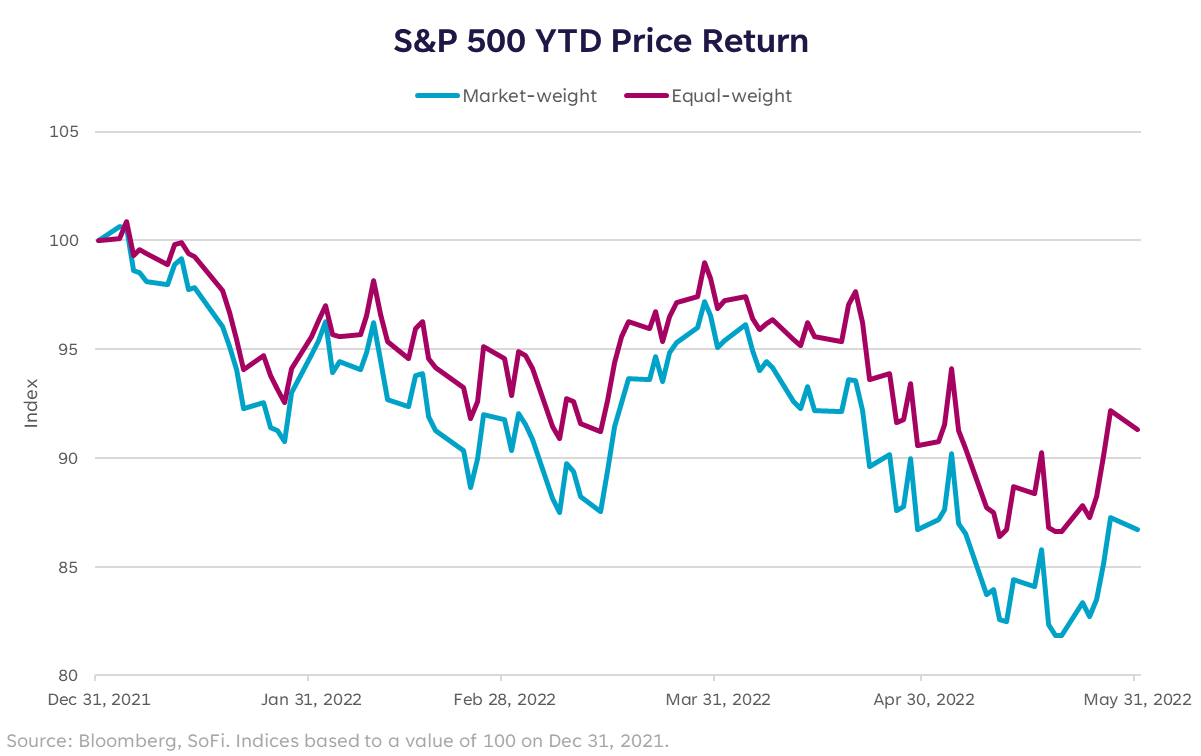

The first, and perhaps most promising, is a simple comparison of the S&P 500 equal weighted Index vs. the S&P 500 market-cap weighted index (the one we use most often). Given that the five largest companies in the S&P 500 (Apple, Microsoft, Alphabet, Amazon, and Tesla) make up nearly 25% of the index, performance numbers are heavily influenced by a very small set of names.

What I want to see is a strengthening in performance from the other stocks in the index, which would give me more confidence that the market has more durability beyond the big names. So far in 2022, the equal weight index has outperformed the market cap weighted index by more than 5 percentage points — one indication that the market is quietly starting to exhibit better breadth.

Catch and Release

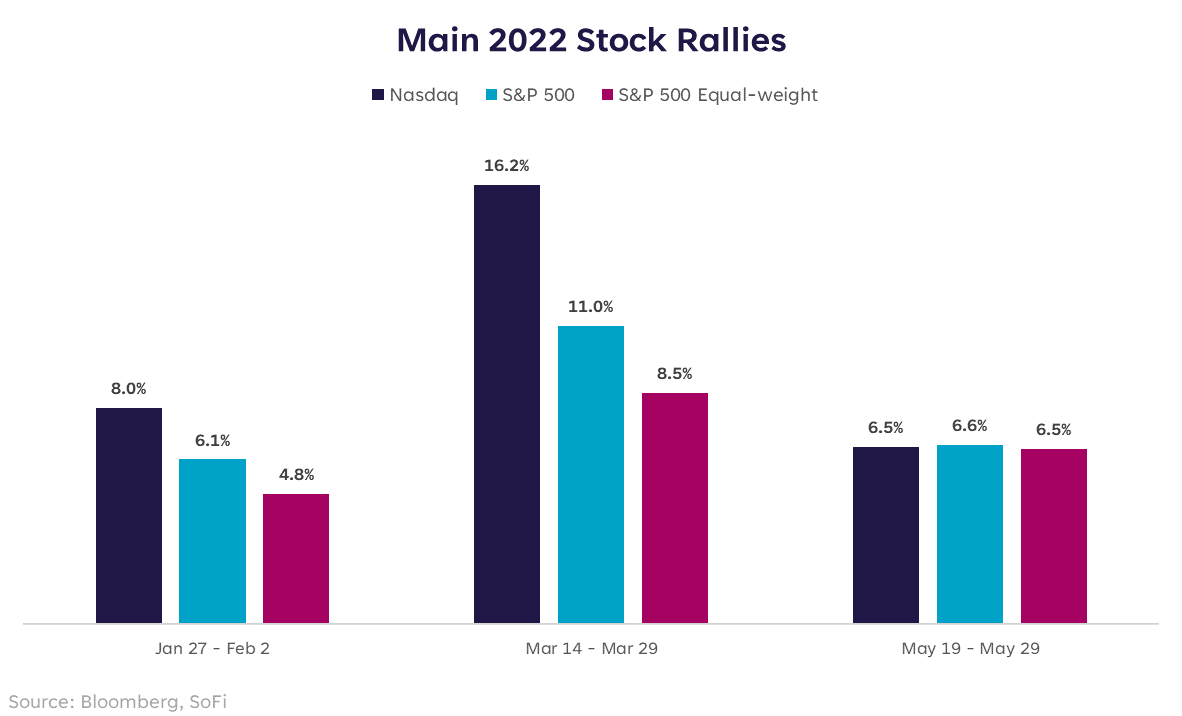

Second, I wanted to look at the action that happened during each of the brief rallies we’ve seen in 2022. There have only been three periods of rallies lasting longer than three consecutive days (remember, this has been the worst start to a year in the stock market since 1970). Although each is a welcome sigh of relief, so far they’ve felt more like a game of catch and release.

Of those periods, the first two were driven by large-cap stocks, particularly the big names in technology and communications. This is evidenced by stronger performance in the S&P 500 and the Nasdaq over those periods as compared to the S&P 500 equal weighted index.

What’s encouraging, however, is the most recent rally that took place between May 19-May 27 when all three indices performed in-line with one another. So rather than the mega caps and headline makers being the only stocks that caught a bid, the buying was spread out among more sectors and constituents. We need to see more of this to convince me though…one period does not make a trend.

Swimming in the Same Direction

Lastly, we can look at the percent of stocks advancing vs. the percent of stocks declining in order to see how many constituents are moving in the right direction. Using a 10-day average to smooth out the choppiness, so far in 2022 the max percent advancing was 67.0%. This compares to a pre-pandemic max of 70.9% in 2019. This measure has been increasing over the recent spring rallies, but is still not quite to convincing levels.

In conclusion, I think we’ve done a lot of work this year in re-rating stocks to more reasonable levels given the rate environment, the inflation environment, and to prepare for the removal of monetary and fiscal stimulus. We’ve also done some work on finding our footing in order to establish a more durable uptrend after the big downdraft. But we still need a few more tallies in the breadth and strength columns to persuade me that we’re out of the woods. I’m optimistic that late June or early July will start to feel more convincing.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov. Liz Young Thomas is a Registered Representative of SoFi Securities and Investment Advisor Representative of SoFi Wealth. Her ADV 2B is available at www.sofi.com/legal/adv.

SOSS22060202