What Is Considered a Good Return on Investment?

Table of Contents

A “good” return on investment is subjective, but in a very general sense, a good return on investment could be considered to be about 7% per year, based on the average historic return of the S&P 500 index, and adjusting for inflation. But of course what one investor considers a good return might not be ideal for someone else.

And while getting a “good” return on your investments is important, it’s equally important to know that the average return of the U.S. stock market is just that: an average of the market’s performance, typically going back to the 1920s. On a year-by-year basis, investors can expect returns that might be higher or lower — and they also have to face the potential for outright losses. In addition, the S&P 500 is a barometer of the equity markets, and it only reflects the performance of the 500 biggest companies in the U.S. Most investors will hold other types of securities in addition to equities, which can affect their overall portfolio return.

Key Points

• A good return on investment is generally considered to be around 7% per year, based on the average historic return of the S&P 500 index, adjusted for inflation.

• The average return of the U.S. stock market is around 10% per year, adjusted for inflation, dating back to the late 1920s.

• Different investments, such as CDs, bonds, stocks, and real estate, offer varying rates of return and levels of risk.

• It’s important to consider factors like diversification and time when investing long-term.

• Investing in stocks carries higher potential returns but also higher risk, while investments like CDs offer lower returns but are considered lower-risk.

What Is the Historical Average Stock Market Return?

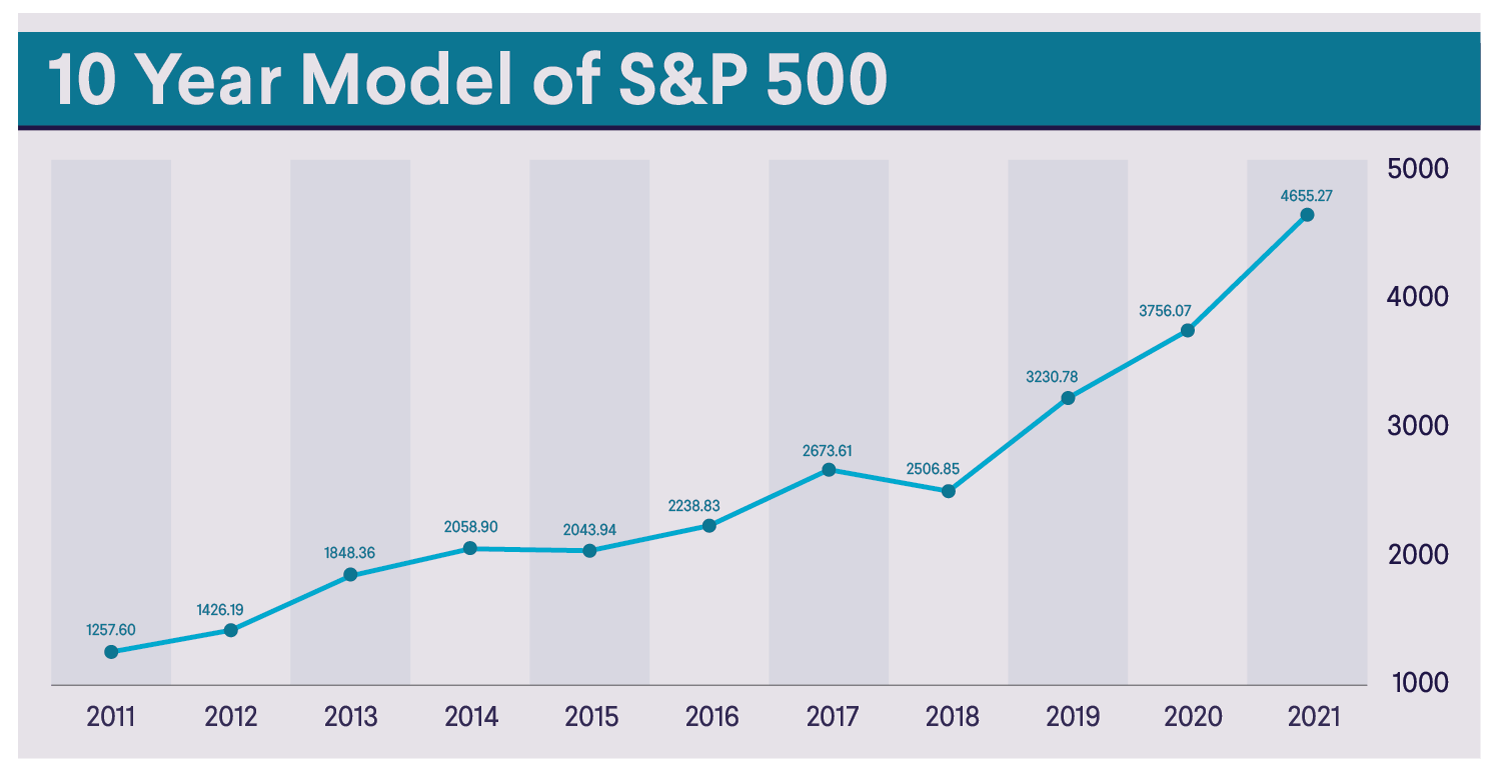

Dating back to the late 1920s, the S&P 500 index has returned, on average, around 10% per year. Adjusted for inflation that’s roughly 7% per year.

Here’s how much a 7% return on investment can earn an individual after 10 years: If an individual starts out by putting in $1,000 into an investment with a 7% average annual return, compounded annually, they would see their money grow to $1,967 after a decade, assuming little or no volatility (which is unlikely in real life). It’s important for investors to have realistic expectations about what type of return they’ll see.

For financial planning purposes however, investors interested in buying stocks should keep in mind that that doesn’t mean the stock market will consistently earn them 7% each year. In fact, S&P 500 share prices have swung violently throughout the years. For instance, the benchmark tumbled 38% in 2008, then completely reversed course the following March to end 2009 up 23%.

Factors such as economic growth, corporate performance, interest rates, and share valuations can affect stock returns. Thus, it can be difficult to say X% or Y% is a good return, as the investing climate varies from year to year.

A better approach is to think about your hoped-for portfolio return in light of a certain goal (e.g. retirement), and focus on the investment strategy that might help you achieve that return.

Why Your Money Might Lose Value If You Don’t Invest it

It’s helpful to consider what happens to the value of your money if you simply hang on to cash.

Keeping cash can feel like a lower-risk alternative to investing, so it may seem like a good idea to deposit your money into a traditional savings account. But cash slowly loses value over time due to inflation; that is, the cost of goods and services increases with time, meaning that cash has less purchasing power. Inflation can also impact your investments.

Interest rates are important, too. Putting money in a savings account that earns interest at a rate that is lower than the inflation rate guarantees that money will lose value over time. This is why, despite the risks, investing money is often considered a better alternative to simply saving it: The inflation risk is typically lower.

Get up to $1,000 in stock when you fund a new Active Invest account.*

Access stock trading, options, alternative investments, IRAs, and more. Get started in just a few minutes.

What Is a Good Rate of Return for Various Investments?

As noted above, determining a good rate of return will also depend on the specific investments you hold, and your asset allocation. You can always calculate the expected rate of return for various securities. Here are different types of securities to consider.

Bonds

Purchasing a bond is basically the same as loaning your money to the bond-issuer, like a government or business. Similar to a CD, a bond is a way of locking up a certain amount of money for a fixed period of time.

Here’s how it works: A bond is purchased for a fixed period of time (the duration), investors receive interest payments over that time, and when the bond matures, the investor receives their initial investment back.

Generally, investors earn higher interest payments when bond issuers are riskier. An example may be a company that’s struggling to stay in business. But interest payments may be lower when the borrower is trustworthy, like the U.S. government, which has never defaulted on its Treasuries.

Stocks

Stocks can be purchased in a number of ways. But the important thing to know is that a stock’s potential return will depend on the specific stock, when it’s purchased, and the risk associated with it. Again, the general idea with stocks is that the riskier the stock, the higher the potential return.

This doesn’t necessarily mean you can put money into the market today and assume you’ll earn a large return on it in the next year. But based on historical precedent, your investment may bear fruit over the long-term. Because the market on average has gone up over time, bringing stock values up with it, but stock investors have to know how to handle a downturn.

As mentioned, the stock market averages a return of roughly 7% per year, adjusted for inflation.

Real Estate

Returns on real estate investing vary widely. It mostly depends on the type of real estate — if you’re purchasing a single house versus a real estate investment trust (REIT), for instance — and where the real estate is located.

As with other investments, it all comes down to risk. The riskier the investment, the higher the chance of greater returns and greater losses. Investors often debate the merit of investing in real estate versus investing in the market.

Likely Return on Investment Assets

For investors who have a high risk tolerance (they’re willing to take big risks to potentially earn high returns), some investments are better than others. So for those who are looking for higher returns, adding riskier investments to a portfolio may be worth considering.

Remember the Principles of Good Investing

Investors focused on seeing huge returns over the short-term may set themselves up for disappointment. Instead, remembering basic tenets of responsible investing can best prepare an investor for long-term success.

First up: diversification. It can be a good idea to invest in a wide variety of assets — stocks, bonds, real estate, etc., and a wide variety of investments within those subgroups. That’s because each type of asset tends to react differently to world events and market forces. Due to that, a diverse portfolio can be a less risky portfolio. Time is another important factor when investing. Investing early for more distant goals, such as retirement, may result in larger returns in the long-term.

Test your understanding of what you just read.

The Takeaway

While every investor wants a “good return” on their investments, there isn’t one way to achieve a good return – and different investments have different rates of return, and different risk levels. Investing in other types of assets tends to deliver lower returns, while stocks (which are more volatile) may deliver higher returns but at much greater risk.

Your own investing strategy and asset allocation will have an influence on the potential returns of your portfolio over time.

Invest in what matters most to you with SoFi Active Invest. In a self-directed account provided by SoFi Securities, you can trade stocks, exchange-traded funds (ETFs), mutual funds, alternative funds, options, and more — all while paying $0 commission on every trade. Other fees may apply. Whether you want to trade after-hours or manage your portfolio using real-time stock insights and analyst ratings, you can invest your way in SoFi's easy-to-use mobile app.

Opening and funding an Active Invest account gives you the opportunity to get up to $1,000 in the stock of your choice.¹

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

For disclosures on SoFi Invest platforms visit SoFi.com/legal. For a full listing of the fees associated with Sofi Invest please view our fee schedule.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

S&P 500 Index: The S&P 500 Index is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S. It is not an investment product, but a measure of U.S. equity performance. Historical performance of the S&P 500 Index does not guarantee similar results in the future. The historical return of the S&P 500 Index shown does not include the reinvestment of dividends or account for investment fees, expenses, or taxes, which would reduce actual returns.

¹Probability of Member receiving $1,000 is a probability of 0.026%; If you don’t make a selection in 45 days, you’ll no longer qualify for the promo. Customer must fund their account with a minimum of $50.00 to qualify. Probability percentage is subject to decrease. See full terms and conditions.

SOIN-Q125-034

Read more