When Do Student Loan Rates Increase?

Table of Contents

Federal student loan interest rates are set by Congress. Each spring, they determine the next school year’s interest rates based on the high yield of the last 10-year Treasury note auction in May. The new rates apply to loans disbursed between July 1 and June 30 of the next year.

For private student loans, the lender determines the interest rate, and it may vary depending on which financial institution you’re working with as well as your own financial profile. Unlike federal loans, the decision to change rates on a private student loan rate can happen more than once a year. A private lender might change rates monthly, quarterly, or annually — it’s up to them to decide.

If you already hold student loans, then the rates of those loans may or may not change. It depends on whether you have a federal or private loan, and if that loan has a variable or fixed interest rate.

Learn more here about the federal student loan interest rate in 2025-26, what’s being proposed for the future, and options you have if your loan has a variable interest rate.

Key Points

• Federal student loan rates change yearly, based on May’s 10-year Treasury note auction, and apply to new loans disbursed July 1–June 30.

• Rates are fixed for federal loans, meaning once issued, the rate won’t change unless you refinance or consolidate.

• Private loan rates vary by lender, and may change monthly, quarterly, or annually — especially if they are variable-rate.

• Variable-rate loans may rise if market rates increase, making them riskier during periods of economic uncertainty.

• Refinancing can lock in a fixed rate, but refinancing federal loans removes access to federal protections and forgiveness programs.

Federal Student Loan Interest Rates Change Annually

Under a law adopted by Congress in 1993, the federal government pegged federal student loan interest rates to the longer-term US Treasury rates, and those interest rates are adjusted annually for new federal student loans.

Your interest rate will also depend on the type of loan you take out. Direct Subsidized Loans and Direct Unsubsidized Loans tend to have the lowest rates, while Direct PLUS loans have the highest. Sometimes, Congress will lower interest rates. Here’s what rates have been in recent years for Direct loans:

• Loans disbursed between July 1, 2021 and June 30, 2022: 3.73%

• Loans disbursed between July 1, 2022 and June 30, 2023: 4.99%

• Loans disbursed between July 1, 2023 and June 30, 2024: 5.50%

• Loans disbursed between July 1, 2024 and June 30, 2025: 6.53%

• Loans disbursed between July 1, 2025 and June 30, 2026: 6.39%

Student Loan Rates for the 2025–2026 School Year

So what will student loan interest rates be in 2023?

For the 2025-2026 school year, the interest rate on Direct Subsidized or Unsubsidized loans for undergraduates is 6.39%, the rate on Direct Unsubsidized loans for graduate and professional students is 7.94%, and the rate on Direct PLUS loans for graduate students, professional students, and parents is 8.94%. The interest rates on federal student loans are fixed and are set annually by Congress.

In an effort to keep the interest rates on federal student loans from skyrocketing, Congress has set limits on how high-interest rates can go. Undergraduate loans are currently capped at 8.25%, graduate loans can’t go higher than 9.50%, and the limit on parental loans is capped at 10.50%. Since 2006, the highest interest rates reached for Direct Subsidized Loans and Subsidized Federal Stafford Loans was 6.80%.

Recommended: Should You Refinance Your Student Loans?

Private Student Loan Rates Can Change at Any Time

Private student loans are from banks, credit unions, and other financial institutions, and they get to set the interest rates on the loans they disburse. These loans don’t offer the benefits of federal student loans, such as income-driven repayment, deferment and forbearance, and Public Service Loan Forgiveness.

Some private loans have fixed rates, which means you lock in an interest rate and it doesn’t change for the life of the loan. Other private loans have variable rates, which means the interest rate might go up and down over the course of the loan.

As of July 2023, financial institutions use Secured Overnight Financing Rate (SOFR) to help with pricing corporate and consumer loans, including business loans, student loans, mortgages, and credit cards.

Private lenders can raise or lower interest rates at any time, but any changes usually have to do with changes in the economy, such as the Federal Reserve deciding to raise or cut interest rates.

If Your Loan Has a Variable Interest Rate, Your Rate Could Rise

If you take out a federal student loan, the loan’s interest rate is fixed. This means the interest rate stays the same over the life of the loan. But since you need to re-apply for federal aid every year you attend college, you may end up with four loans with four different interest rates.

When you apply for a private student loan or refinance an existing loan, borrowers can typically choose between a fixed and variable interest rate.

When you take out a private student loan, the original rate depends on your credit score, employment history, and current income level — among other factors, which vary by lender.

If your private loan has a variable rate, the rate may fluctuate as the economy changes. In the past year, the Federal Reserve has increased benchmark interest rates numerous times to try to help control inflation. Rates may rise again, but it’s impossible to say for certain.

As of late 2025, it is unclear whether or how student loan interest rates may shift for the 2026-27 school year.

Recommended: Student Loan Refinancing Guide

What to Do if You Have a Variable-Rate Loan

If your private student loan has a variable interest rate and you’re worried that interest rates might increase, you may have some options. Student loan refinancing involves taking out a new loan with a new interest rate and/or new terms. By refinancing, borrowers have the opportunity to make only one monthly payment instead of balancing multiple payments, and they may be able to lock in a fixed rate so they no longer have to be concerned with rate hikes.

Individuals whose financial situation has improved and/or who have built their credit score since originally borrowing their loan(s) may qualify for a lower interest rate.

The Takeaway

If you have federal loans, you’ve already locked in a fixed interest rate so you don’t need to worry about interest rate changes. Plus, it’s important to remember that when federal student loans are refinanced, they are no longer eligible for federal borrower protections. But if you have a private loan with a variable interest rate, it may be worth exploring loan refinancing.

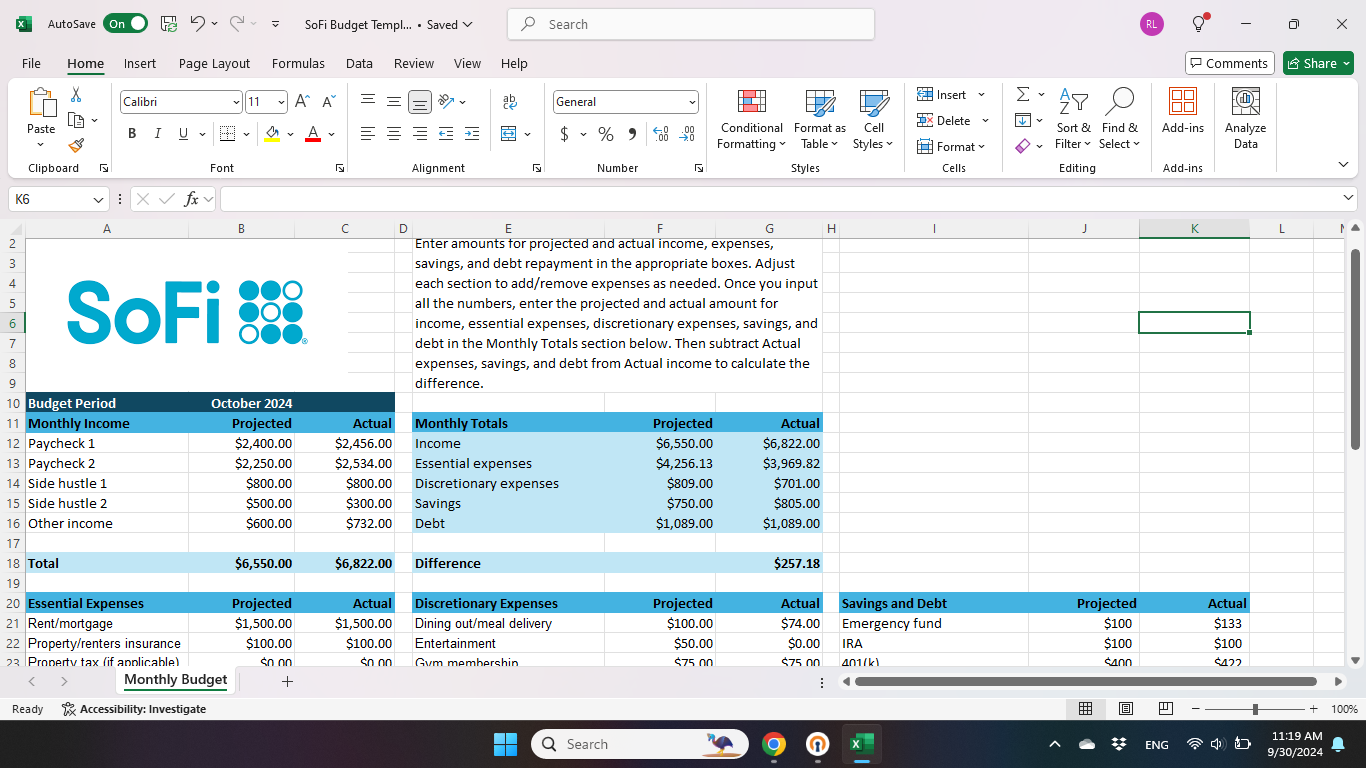

Looking to lower your monthly student loan payment? Refinancing may be one way to do it — by extending your loan term, getting a lower interest rate than what you currently have, or both. (Please note that refinancing federal loans makes them ineligible for federal forgiveness and protections. Also, lengthening your loan term may mean paying more in interest over the life of the loan.) SoFi student loan refinancing offers flexible terms that fit your budget.

FAQ

How often do student loan interest rates change?

Federal student loan rates are fixed rates but are determined by a formula created by Congress, and this rate can change annually. For the 2025-26 school year, Direct undergraduate loans charge an interest rate of 6.39%. Private student loan rates tend to change more frequently, and they can be fixed or variable.

Did student loan interest rates go down?

The rate on Direct undergraduate loans dropped from 6.53% for the 2024-25 school year to 6.39% for the 2025-26 academic year.

Can you write off student loan interest on your taxes?

Yes, you can take a deduction on your taxes for the interest paid on student loans taken out for yourself, your spouse, or your dependent. This is true for all loans (not just federal student loans) used to pay for higher education expenses. Worth noting: The maximum deduction is $2,500 a year.

SoFi Student Loan Refinance SoFi Loan Products

Terms and conditions apply. SoFi Refinance Student Loans are private loans. When you refinance federal loans with a SoFi loan, YOU FORFEIT YOUR ELIGIBILITY FOR ALL FEDERAL LOAN BENEFITS, including all flexible federal repayment and forgiveness options that are or may become available to federal student loan borrowers including, but not limited to: Public Service Loan Forgiveness (PSLF), Income-Based Repayment, Income-Contingent Repayment, extended repayment plans, PAYE or SAVE. Lowest rates reserved for the most creditworthy borrowers. Learn more at SoFi.com/eligibility. SoFi Refinance Student Loans are originated by SoFi Bank, N.A. Member FDIC. NMLS #696891 (www.nmlsconsumeraccess.org).

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

Third Party Trademarks: Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

SOSLR-Q325-080