Monday,

May 15, 2023

Market recap

Dow Jones

33,300.62

-8.89 (-0.03%)

S&P 500

4,124.08

-6.54 (-0.16%)

Nasdaq

12,284.74

-43.76 (-0.35%)

Top Story

Middle America's getting a $500M upgrade.

The US government is investing $500 million to turn Middle America into the next tech frontier. See how this game-changing initiative could impact you.

US stocks finished lower Friday after a mixed day of earnings and news of a debt ceiling meeting’s postponement.

• JD.com (JD) reported revenue above expectations at $35 billion. And it turned in a net profit of $945 million compared to the $431 million loss the same period a year prior. The Chinese ecommerce giant also announced new leadership as its current CEO transitions to chairman of the company’s advisory council.

• The Michigan Consumer Sentiment Index fell sharply from 63.5 to 57.7 in May, well below forecasts of 63. This latest reading highlights a renewed concern consumers have about the economy, partially influenced by the ongoing debt ceiling standoff in Washington.

• Wells Fargo (WFC) downgraded Fox Corporation (FOXA). It cited the increasing “cord-cutting” trend and growing cost of sports rights. As one of the most exposed names to the decline of cable, and considering the 7-8% growth in sports rights costs, the bank believes the company will have to compound at least 15% a year to stay earnings neutral.

What to be on the lookout for today

• The week will kick off with a series of speeches from Fed officials. These include Federal Reserve Bank of Atlanta President Raphael Bostic, Federal Reserve Bank of Richmond CEO Thomas Barkin, and Federal Reserve Governor Lisa Cook. Wall Street will listen closely to their comments for hints of the rate hike policy pause anticipated in June.

• United Insurance (UIHC) will kick off the earnings week. Investors will hope the insurance provider addresses the going-concern warning it issued in April, leading shares to plummet by almost 50%. Fittingly for a Monday, Monday.com (MNDY) will also report.

There are 4 steps in building an investment portfolio:

Investing can seem intimidating, especially for beginners who are just starting out. But building an investment portfolio is one of the best ways to grow your wealth over time.

1. Setting your goals: Are you investing to build wealth for retirement, to save for a down payment on a home, or another reason?

2. Choosing the right kind of account: The type of investment accounts that investors should open depends on their investment goals and the investments they plan to make.

3. Choosing investments based on risk tolerance: Risk tolerance refers to the amount of risk you are willing to take with your investments.

4. Allocating your assets: This involves deciding what percentage of your portfolio you want to allocate to different investments, such as stocks, bonds, and real estate.

These are big decisions to make. And sometimes you may need help. That’s where SoFi comes in.

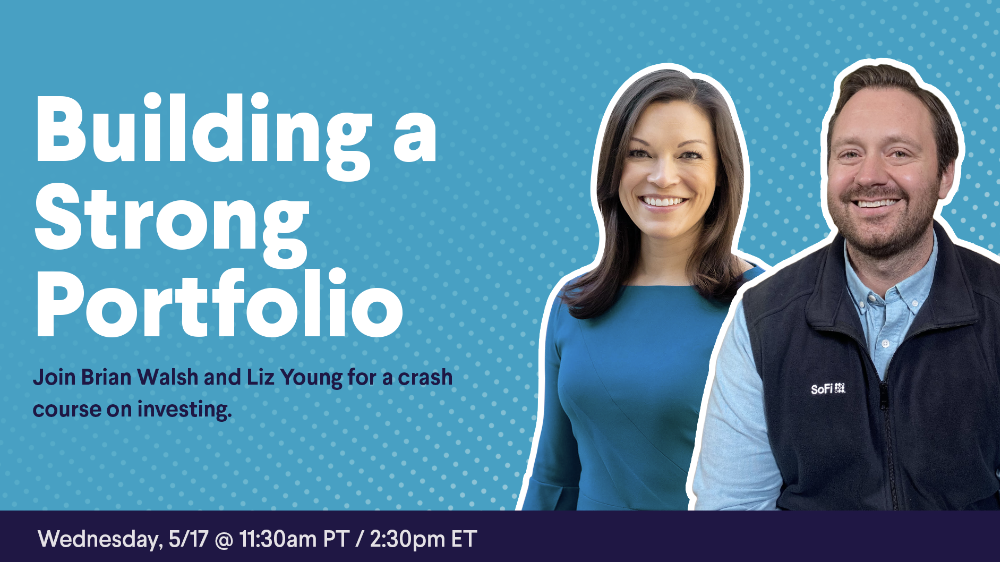

Elevate Your Investing Strategy by joining SoFi’s CFP®, Brian Walsh & Head of Investment Strategy, Liz Young who will teach you how to align your investment approach with your financial goals, understand your risk tolerance, and navigate the ups and downs of the market.

Today’s top stories

Despite a surge in interest rates, home prices remain high across the country. Learn why the country’s housing supply is diminished and how that’s leading to higher home prices. Plus, check out the reports and earnings set to shed more light on this conundrum. Read more >> Most flight delays aren’t due to weather, and the federal government is getting involved. According to a new study from the Department of Transportation, airlines have some explaining to do. Find out more about how this data could change your experience at airports this summer. Read more >> Are you guilty of keeping your credit card statements forever? Here’s when, and how you can clear the clutter. Yes, it can be useful to have these on hand for record keeping and to check for errors, but knowing when you can let go can help you clear your mind, and your filing system. Read more >>Not-so-breaking news

-

Southwest Airlines (LUV) pilots authorized a strike in an attempt to finish negotiations on a new contract. The union apparently does not plan on walking out, so the strike should not affect the airline’s operations over the summer.

-

Elon Musk is stepping down as Twitter CEO. His successor will be the former head of advertising at NBCUniversal (CMCSA), Linda Yaccarino. The Twitter owner plans to stay on at the company as executive chair and CTO.

-

Goldman Sachs (GS) is spinning off an AI-powered social media startup, which employees have already been using internally. The platform, called Louisa, has been described as “an AI-powered LinkedIn (MSFT) on steroids.”

-

Adidas (ADDYY) plans to sell its remaining Yeezy inventory and donate the proceeds to charity. The apparel company still has roughly $1.3 billion in unsold Yeezy merchandise.

-

Peloton (PTON) issued a recall for 2.2 million stationary bikes after reports of seats breaking off. Owners of defunct bikes can request a new seat for free on Peloton’s website.

Financial planner tip of the day

Getting mortgage pre-approval can help you in the homebuying process, especially in a hot housing market. This can both show you’re a serious buyer and provide you a better sense of your budget as you begin house hunting.

Brian Walsh, CFP® at SoFi