Amid evolving news surrounding COVID-19 and the economic reopening, your financial needs are our top priority. For more information,click here.

Top Story

The Chip Shortage’s Impact on Apple and Tesla

Apple and Tesla Warn of Product Delays

Apple (AAPL) and Tesla (TSLA) both posted strong revenue for their second quarters, but the semiconductor shortage could stunt that growth in the near future. When reporting quarterly earnings earlier this week, both companies warned that chip shortages will cause supply-chain difficulties for key products.

Industries across the world have been dealing with semiconductor shortages for months, which has wreaked havoc on the global economy. Many automobile makers canceled chip orders during the pandemic and then were unable to access more chips when demand for cars picked up. This chain of events has driven up prices for the limited supply of new vehicles available. As the chip shortage continues, other industries besides car companies are also feeling squeezed.

Apple’s Chip Challenges

When reporting earnings, Apple said that chip shortages would impact its smartphone business in the coming quarter. The warning comes as Apple is gearing up to launch as many as four new iPhone models this fall.

This marks the first time that supply-chain constraints have harmed Apple’s iPhone business. The tech giant warned in April that its iPads and Mac computers could be negatively impacted by the chip shortage, with the possibility of losing $3 billion to $4 billion in sales. The reality wasn’t as bad as many had feared. Apple’s revenue hit was less than $3 billion thanks to mitigation efforts, but now chip shortages could affect all three of the company’s flagship products. This is resulting in slower growth forecasts.

Could Cybertruck Production Get Delayed?

Tesla also had a strong quarter, posting a record profit. The company also shared that demand doubled on a year-over-year basis. To deal with chip shortages, the EV maker found new chip sources and rewrote code to make them work in its vehicles. Those efforts paid off during the second quarter.

Chip shortages could now impact the rollout of Tesla’s Cybertruck, a highly anticipated pickup truck model. Production of the Cybertruck is scheduled to begin later in 2021. But during the company’s earnings conference call earlier this week, Tesla said production could be delayed as a result of chip supply constraints.

Apple and Tesla have been able to weather the global chip shortage relatively unscathed, but it may be catching up to them. It will be interesting to see how both companies respond in the coming months.

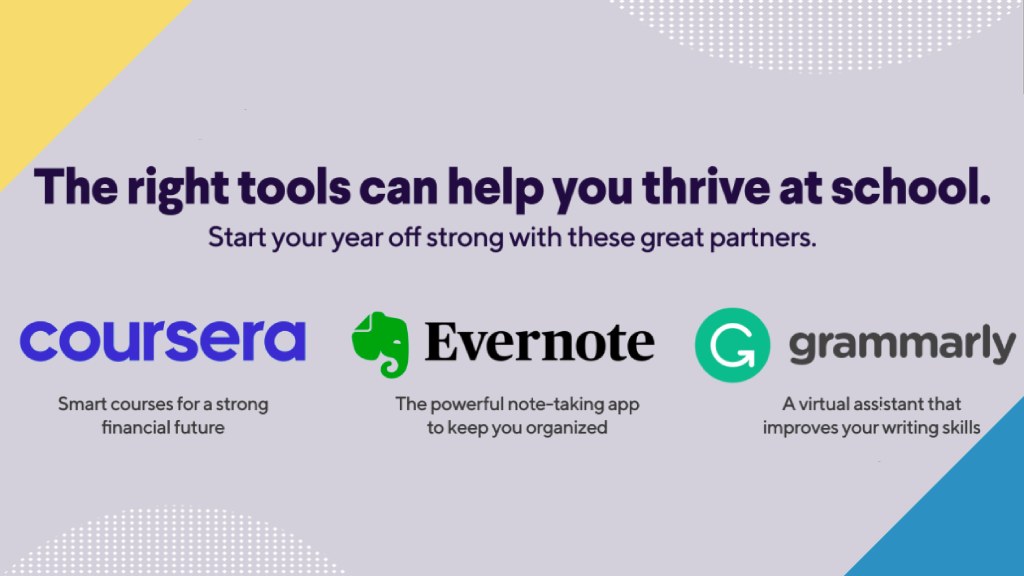

You’re Ready for School—now Start Using the Right Tools.

So far, you’ve probably made some pretty big decisions—selecting a university and how you’re going to pay for it. We’ve got partnerships to help you get the most out of the upcoming academic year.

• Study smarter and get more done with the best of Evernote for 6 months.1

• Get writing style and clarity suggestions from Grammarly Premium for 3 months.2

• Get access to our Personal Financial Fundamentals program on Coursera.3

A student loan with SoFi is already a lot to love—flexible terms, an easy process, zero fees, plus membership rewards that you can use to pay down your student loans, credit monitoring—and more. Take out a student loan with SoFi to take advantage of these new student benefits.

Building an Investment Portfolio

A Weekly Column With Liz Young

Every week, SoFi’s Head of Investment Strategy shares her economic and market insights in order to help empower readers to take a more active role in their financial futures. This week, see what Liz has to say about building an investment portfolio.

One Size Fits None

I’m often asked what the right percentage allocation is for different investments: how much should I have in stocks, bonds, large-caps, small-caps, international stocks, crypto assets, precious metals, you name it. The answer is always the same and likely frustrating to hear—it depends. But let’s talk about what it depends on and how the thinking around some stocks (spoiler alert: big tech) have changed over time.

There are three main objectives any investor should consider when allocating their portfolio: preservation, income, and growth. The importance of each of these objectives will vary by individual and will vary over time for that same individual. For example, if you’re in your 20s or 30s and saving for a goal that’s far off into the future (such as retirement), the growth objective takes center stage while income and preservation are less of a priority.

Risk Budgeting

That said, risk is just as important of an input as return (the “growth” objective) when determining your investment mix. Instead of thinking about how much to allocate to each investment based on its return potential, consider thinking about your investment portfolio as a risk budget.

We all measure risk differently, so there is no prescriptive answer to how big your risk budget should be or how you should spend it. But the way you spend your budget should align with your overall risk tolerance (conservative, moderate, or aggressive) and the return expectations are then a result of that equation—not the driving factor. In other words, start the process with risk, and the end will show you the potential return.

Approaching your asset allocation this way can help prevent over-concentration and keep your return expectations realistic. It also helps keep your ultimate investment goals as the focus, rather than the desire to “beat” the market or some other benchmark over a short period of time.

Redefining Defense

One topic worth covering here is the way investors seem to view “defensive” stocks today, as it may affect the allocation in your risk budget. Traditionally, sectors like consumer staples and utilities were viewed as the less volatile, more defensive areas of the market as compared to sectors like technology.

That’s still true, but some of the stocks we consider “big tech” have behaved differently for a number of years. Since June 2012, an equal-weighted basket of the FAAMG stocks (Facebook, Apple, Amazon, Microsoft and Google) has actually outperformed the S&P 500 in more down months than consumer staples!

As our economy became more reliant on technology, investors started to look at the mega-cap tech stocks differently. They’re viewed as more resilient, more durable, and less susceptible to competitive threats than they were in the early 2000s. Thus, they became “staples” of many investment allocations and are often considered long-term holdings instead of short-term trades.

Leave Room for Change

No risk, no reward. That statement still rings true. And I stand by the idea that investors should think of portfolio allocation with a risk budget mentality. Just be sure to allow for the components of that risk budget to evolve over time in order to capture the evolution of our economy.

Dubai-Based Unicorn to go Public via SPAC Deal

Swvl Valued at $1.5 Billion

Swvl, a Dubai ridesharing company for emerging markets, is going public via a SPAC transaction with Queen’s Gambit Growth Capital (GMBT). The SPAC is led entirely by women, which is uncommon in the industry. Instead of focusing on individual ride-hailing services, Swvl, which was founded in 2017, offers mass transit in underserved markets.

Swvl uses algorithms and proprietary technology to determine the best routes for cutting down on emissions and costs. The deal values Swvl at around $1.5 billion, making it the largest unicorn out of the Middle East to trade on the Nasdaq. It is not yet clear when the transaction will be completed.

Swvl Aims to Disrupt Mass Transit

Swvl is trying to disrupt inefficient mass transit systems around the world. The company says that many public transportation systems cause congestion, reduce productivity, and hurt the environment. It wants to help solve these problems.

Swvl’s service is operational in 10 cities in the Middle East and Africa and it is eyeing more expansion into new markets. Since it debuted, 1.4 million riders have used the service to book around 46 million rides, and its sales hit about $26 million in 2020. That number is expected to increase to $79 million this year. The startup believes it has a $1 trillion opportunity in the global mass transit market, and wants to use its leadership position to capitalize on growth opportunities.

SPAC Deals Still Popular

As part of the deal, Queen’s Gambit CEO Victoria Grace and another executive from the SPAC will get seats on Swvl’s board. The female-led SPAC launched in January with $300 million to invest. In February it launched a second blank-check fund, Queen's Gambit Growth Capital II (QWNBU).

Both funds are focused on deals with companies which are bringing sustainability to the energy, healthcare, mobility, and industrial sectors. SPAC deals gained momentum in 2020 and have remained popular in 2021. Last year, blank check companies raised $83.4 billion. This year they have already raised $115 billion. It will be interesting to see how SPAC deals unfold during the second half of the year.

Not-So-Breaking News

-

Walmart (WMT) is starting to sell its ecommerce software to small- and medium-sized retailers as it looks to diversify its revenue stream. The nation’s largest retailer is teaming up with Adobe (ADBE), which will sell the software on a subscription basis.

- Boeing (BA) posted a quarterly profit for the first time in nearly two years. Demand for commercial jetliners increased during the past quarter as consumers began flying again. Sales also increased in Boeing’s other categories.

-

Pfizer (PFE) had $7.8 billion of COVID-19 vaccine sales in its second quarter, enabling it to top Wall Street’s forecast for the three-month period. The drugmaker also raised its sales forecast for 2021 to $33.5 billion from $26 billion.

-

Mortgage rates recently fell to a low not seen since February, driving borrowers to refinance their home loans. Applications to refinance a mortgage increased 9% last week compared to the week prior.

-

Incoming freshman: Not sure what to do first? Start preparing for college by tackling finances and fun in these 10 ways to prepare for college.

Financial Planner Tip of the Day

"The risks of overspending on a credit card might dissuade students from using them during their college experience, but having one and spending wisely can help college students build credit. Building credit can help a young person improve their credit score. Post-grad, a strong history of on-time payments and responsible spending could make it easier to rent an apartment, apply for a car loan, or start a personal cell phone plan."

Brian Walsh, CFP® at SoFi