The Week Ahead on Wall Street

Economic Data

Today, keep an eye out for the New York Fed’s regional manufacturing survey for May. Known as the Empire State Manufacturing Index, the reading increased significantly from March to April, beating analyst expectations. The report noted this followed three months of sluggish activity, with 40% of respondents saying conditions had improved.

Tomorrow, April’s retail sales are due. The number increased by 0.5% in March, which analysts attributed to a large jump in gasoline and food prices. May’s NAHB/Wells Fargo (WFC) Housing Market Index is also set to be published. In April the reading showed homebuilder confidence had fallen to a seven-month low. That could be connected to rising mortgage rates and ongoing supply chain problems, which has driven costs higher.

Wednesday, the housing market remains in focus, as April’s building permits and housing starts are set for release. In March, housing starts rose 0.3%, which surprised analysts. Still, housing starts for single-family homes fell, which analysts blamed on rising mortgage rates. Meanwhile, building permits for future construction increased 0.4% in March.

Thursday, weekly jobless claims will be published. While still at lows not seen in decades, the number of Americans filing unemployment claims has upticked recently. April’s existing home sales continue the week’s housing market data theme, as the National Association of REALTORS® says the number fell in March by 2.7%.

Finally, on Friday the advance services report is due which provides quarterly estimates of total revenue and revenue changes for certain service industries.

Earnings

Today, Chinese music streaming service company Tencent Music Entertainment (TME) will hand in its latest report card. At the end of last month, Paris-headquartered music company Believe renewed its agreement with Tencent Music. In Q4 2021, Tencent Music reached 76.2 million paying users, up 36.1% year-over-year.

Tomorrow, Home Depot (HD) will hand in its latest report card. The company has beat analyst expectations on the top and bottom lines during its four most recent earnings calls. Some analysts have predicted the sector will face headwinds in the coming months, as home renovation trends return to pre-pandemic levels, and consumers have diminished appetite for price increases.

Wednesday, retailing giant Target (TGT) will share its most recent earnings data. Last month Target announced it was pushing back into the resale market amid a new deal with online retail shop ThredUp. A similar program shutdown after a test run in 2015. The resale market checked in at $15 billion last year but is expected to triple by 2025.

Thursday, Kohl’s (KSS) will publish its latest results, after rival JCPenney recently made an offer to acquire the department-store chain for upwards of $8.6 billion. Earlier this year the Wisconsin-based company put itself up for sale following calls from activist investors who are unhappy with Kohl’s direction.

Friday, sneaker and athletic apparel retailer Foot Locker (FL) will post earnings. While Nike (NKE) has scaled back its relationship with the retailer, competing brand Adidas (ADDYY) is reportedly filling the gap. Nike is moving toward more direct sales, while Adidas announced last week it would expand its partnership with Foot Locker.

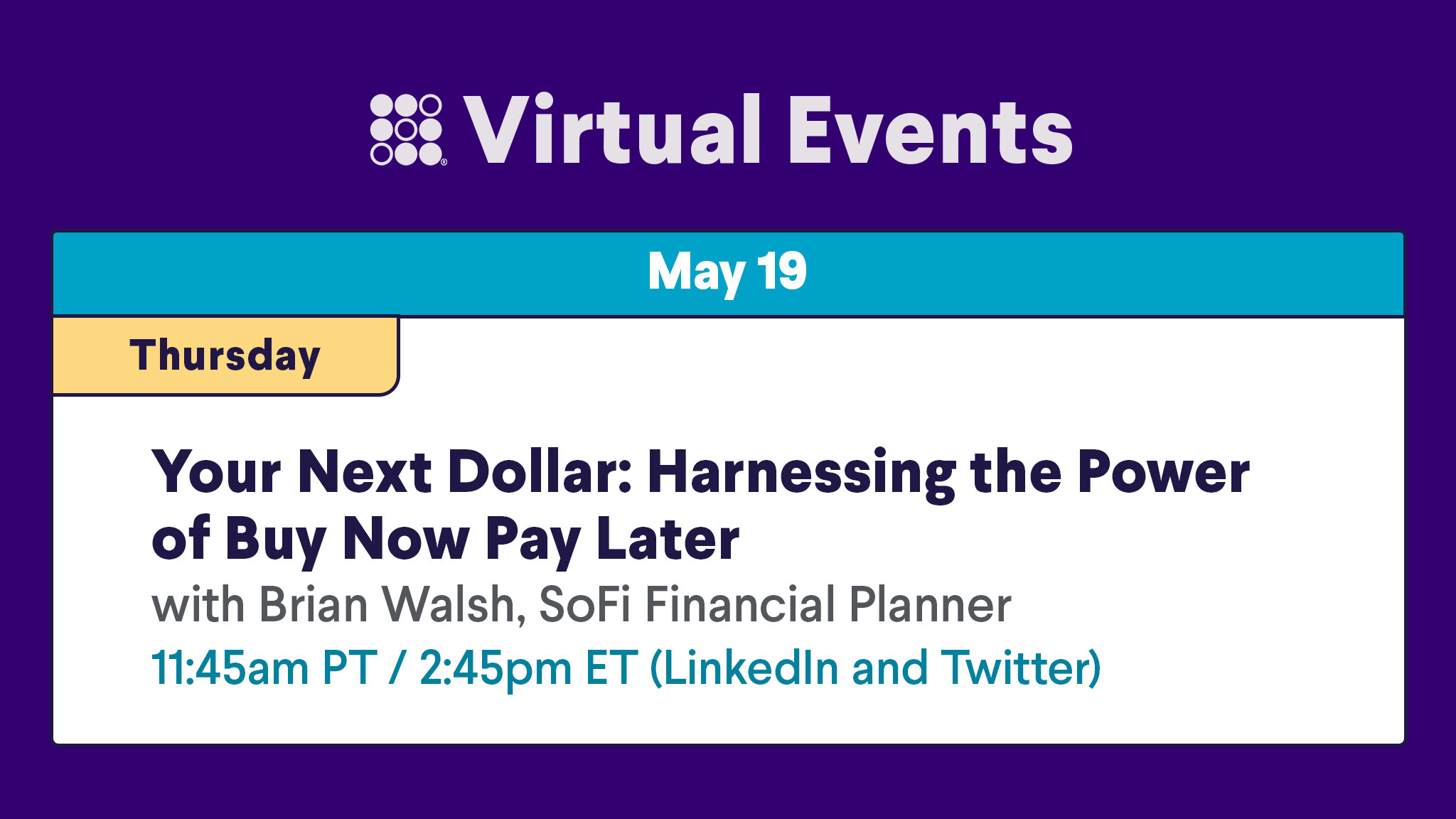

The Week Ahead at SoFi

Join us for the Your Next Dollar livestream for a discussion about buy now pay later financing. Tune in to hear about the pluses and minuses, and see if this is a good option for you. Save your seat in the SoFi app!

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

SOSS22051601