Week Ahead on Wall Street

Economic Data

Today the Federal Reserve Bank of Chicago releases its national activity index for February. It’s a monthly survey designed to analyze overall economic activity and inflation, which is of course on many investors’ minds. January’s reading was higher than December’s, indicating an uptick in economic growth.

Tomorrow, the Johnson Redbook Index is published, which samples around 9,000 large retail locations to provide advanced estimates of same-store sales growth. The index has been on the decline since early February, which could indicate rising prices are weighing on consumer spending.

Wednesday, new home sales are due for February. January’s number fell 4.5% from the previous month to 801,000 units. Analysts attribute the decrease to higher prices and rising mortgage rates.

Thursday, be on the lookout for jobless claims, which moved lower last week amid the tight labor market. In total 214,000 people filed initial unemployment claims, less than the 220,000 economists expected. Also set for release are February’s durable goods orders and Markit’s flash manufacturing and services indexes for March.

On Friday the National Association of Realtors will publish its February pending home sales index, which is based on signed contracts to purchase previously-owned homes. The index fell by 5.7% in January, marking the third straight month of declines. Market observers say this is largely a result of record-low inventory.

Earnings

Today sports apparel and sneaker giant Nike (NKE) will publish its latest results after beating analyst expectations for revenue and profit in November of last year. The company is facing multiple headwinds at present, with supply-chain disruptions, a slower-than-expected rebound in China, and Russia’s invasion of Ukraine all presenting challenges for the global brand.

Tomorrow, Adobe (ADBE) posts its first-quarter earnings. The software company issued sales guidance that missed analyst expectations in December of last year, sending share prices down 10% for the company’s second-worst day in ten years.

Wednesday, Tencent Holdings (TCEHY) will hand in its latest report card after dealing with a number of challenges. The company recently joined fellow Chinese tech giant Alibaba (BABA) in announcing plans to lay off thousands of workers as the industry faces a regulatory crackdown.

Thursday, Darden Restaurants (DRI) will share its quarterly earnings data. The owner of Capital Grille, Olive Garden, and Longhorn Steakhouse among other brands has beat Wall Street estimates on the top and bottom lines during its last four earnings calls.

Friday, Bombardier Recreational (DOOO) reports its results for the most recent quarter after exceeding analyst expectations for profit but missing on revenue in December 2021. The company makes recreational products such as snowmobiles, personal watercraft, ATVs, and motorcycles.

The Week Ahead at SoFi

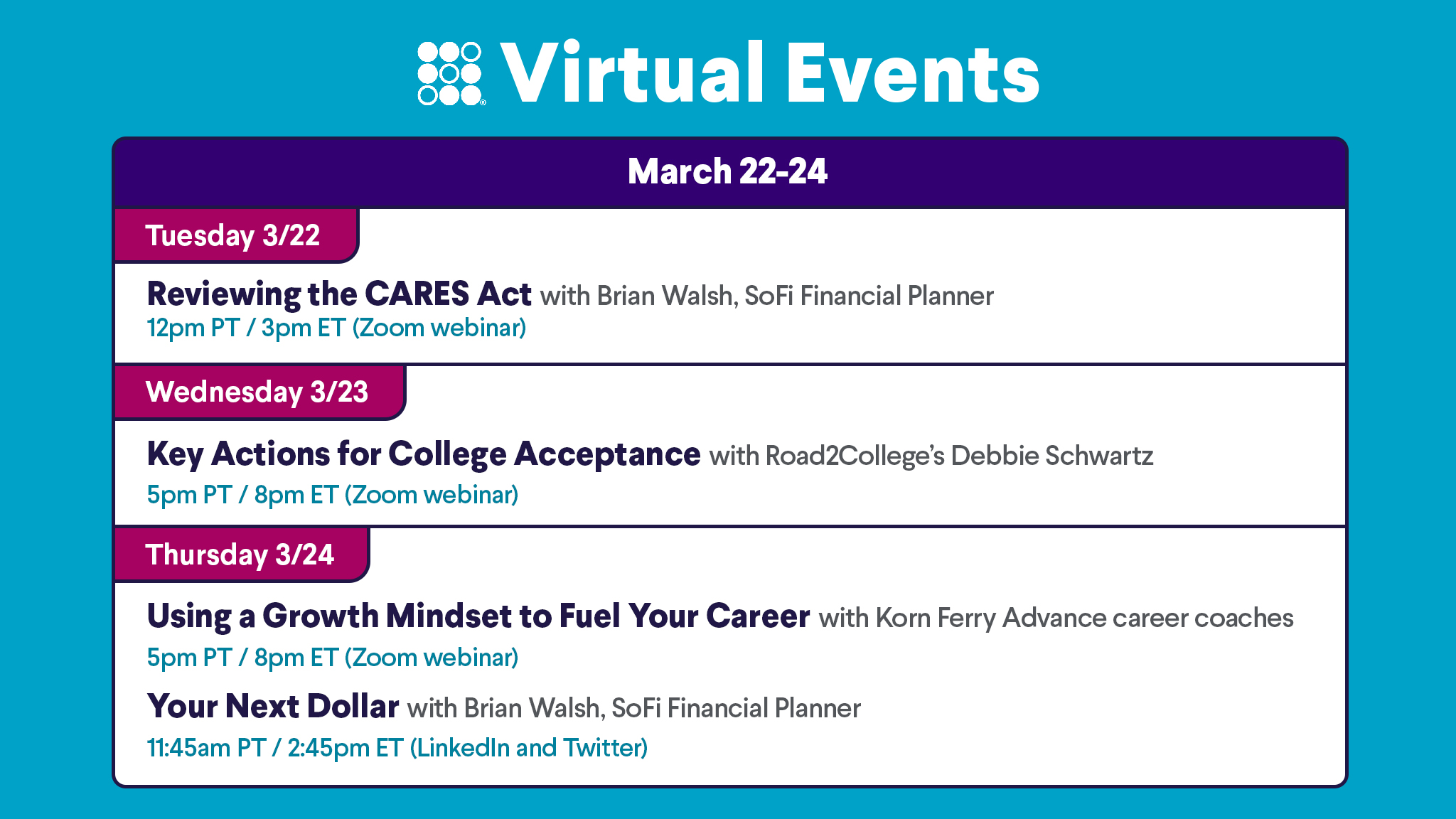

This week’s webinars feature discussions about CARES, college acceptance strategies, and positive mindsets to fuel your career. Plus, tune in to our weekly Your Next Dollar livestream. Save your seat!

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

SOSS22032101