The Week Ahead on Wall Street

Economic News

Today, the Empire State Manufacturing Index for November is released. This data point is released monthly by the New York Federal Reserve and provides insight into manufacturing activity in the influential New York State region. In October the index declined to 19.8, which was below market forecasts. Investors will want to see if the metric fell more in November.

Tomorrow, retail sales for October are released. In September, retail sales posted an unexpected 0.7% gain despite supply-chain problems and rising prices. With prices for everything from gas to groceries rising, investors will be eager to see if consumer spending will be impacted.

Wednesday, housing starts for October are released. This tracks the number of new residential construction projects that begin in a given period. In September housing starts fell 1.6%, below expectations as builders dealt with supply and labor shortages. With inflation still rising and supply-chain problems persisting, investors will be paying close attention to this data point.

Thursday, initial and existing unemployment claims for the week prior are released. The number of new people seeking unemployment benefits hit a new pandemic low last week. Claims dropped to 269,000 versus the 275,000 economists expected.

On Friday, there is no economic data scheduled to be released.

Earnings Reports

Tomorrow, Walmart (WMT) reports quarterly earnings. With supply-chain chaos delaying shipments and retailers including Walmart having a tough time staffing stores, investors will be paying close attention to what the company has to say about operations. To get ahead of what is expected to be a busy holiday season, Walmart has already announced its Black Friday holiday shopping deals.

On Wednesday, be on the lookout for Target (TGT) to report quarterly earnings. The retailer is among the companies President Biden asked to help speed up shipments to ensure consumers have access to the goods they want to purchase. Biden has also asked retailers to lower their prices. Investors will want to hear more about this when Target reports quarterly earnings.

Also Wednesday, graphic chipmaker Nvidia (NVDA) shares its quarterly results. Nvidia’s graphic cards business is performing well. It is also churning out products for the autonomous driving market. Nvidia just announced a partnership with Luminar Technologies (LAZR) through which Nvidia will work on hardware for self-driving vehicles. Investors will want to hear more about this collaboration when Nvidia reports.

On Thursday, be on the lookout for Macy’s (M) to report quarterly earnings. The department store operator is competing with other retailers for workers amid severe shortages. To get an edge it’s raising its minimum hourly wage for new and existing workers to $15 per hour. The change goes into effect in May. Macy’s will also cover the total cost of college tuition for its workers. Investors will want to hear about the impact this could have on the retailer’s bottom line.

On Friday, Foot Locker (FL) reports quarterly earnings. Last month the retailer announced the launch of a new apparel line dubbed LCKR by Foot Locker. The line of casualwear includes hoodies, sweatpants, zip-ups, and pants sets. As Foot Locker expands into more categories it will be interesting to hear what the company says about its outlook.

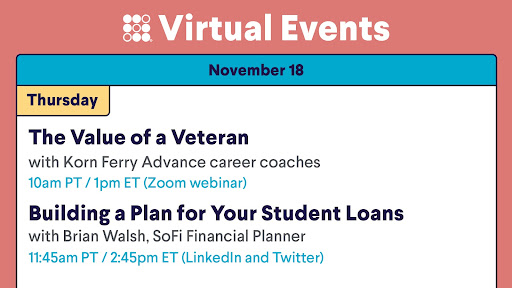

The Week Ahead at SoFi

Join us for a webinar to explore what veterans can bring to the workplace. Then Brian Walsh will discuss how to make a plan for paying back your student loans. RSVP in the SoFi app!

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

SOSS21111501