The Week Ahead on Wall Street

Economic News

Today, durable goods orders for August are released. In July, durable goods orders were flat month-over-month, hurt by supply constraints and spending which shifted to services. Investors will be paying close attention to see how orders fared in August given rising energy costs and recent supply-chain issues.

Tomorrow, be on the lookout for the consumer confidence index for September. This is a leading indicator which tracks how consumers are feeling about the economy and their household income. In August, consumer confidence fell to a six-month low as cases of COVID-19 increased. Investors will be paying close attention to see if consumers are growing more pessimistic.

On Wednesday, pending home sales for August are released. This data point measures signed home sale contracts in the month. Pending home sales have declined for two months in a row as homeowners wrestle with limited supply. With inventory easing somewhat it will be interesting to see if pending home sales improved in August.

On Thursday, initial and existing unemployment claims for the prior week are due. Last week, first-time unemployment claims ticked up more than economists expected as increasing COVID-19 cases started to impact employment. Claims were at the highest level seen in a month.

On Friday, a bevy of economic data including the ISM manufacturing index for September will be released. This data point tracks factory output during the month. In August, manufacturing activity increased at a faster pace than what was predicted. Manufacturing has been able to hold up even as consumers shift spending to services. The September reading will indicate if that has continued. Other data released Friday includes core inflation and construction spending.

Earnings Reports

Today, there are no major earnings scheduled to be released.

Tomorrow, be on the lookout for Micron (MU) to report quarterly earnings. The semiconductor maker’s shares have come under pressure in recent weeks as prices for memory chips have tumbled on a few occasions. With expectations that declining prices will continue into the fourth quarter, investors will be paying close attention to Micron’s gross margins and future outlook.

Also tomorrow, First High School Education Group (FHS) reports quarterly earnings. The Chinese company operates private high schools in western China. It and other education companies have been the target of increased regulation by Beijing. Investors will want to know more about how the new regulations impact First High School Education.

On Wednesday, Cintas (CTAS) reports quarterly earnings. Earlier this month the uniform and cleaning products company announced a goal to achieve net zero greenhouse gas emissions by 2050. Cintas also said it is undergoing a comprehensive review to identify opportunities to improve its environmental, social, and governance (ESG) impact. Investors will likely want to hear more about how much it will cost Cintas and how it will help its bottom line when it reports earnings.

On Thursday, Bed Bath & Beyond (BBBY) reports quarterly earnings. The home goods retailer is teaming up with DoorDash (DASH) to provide on-demand delivery from over 700 Bed Bath & Beyond stores and 120 BuyBuy Baby stores across the country. Bed Bath & Beyond is the first home goods retailer to be available on the DoorDash app. Investors will undoubtedly want to hear more about that deal when Bed Bath & Beyond reports.

Also Thursday, be on the lookout for quarterly earnings from CarMax (KMX), the used car retailer. While CarMax was late to start selling cars online, in the past few years it has caught up with its rivals. Those investments in its omnichannel presence appear to have paid off. In CarMax’s first quarter, car sales were up 128% year-over-year, enabling the company to post revenue of $7.7 billion. Sales were up 138% compared to last year, a record for CarMax. Wall Street had forecast revenue of $6.2 billion. It will be interesting to see if the momentum continued in CarMax’s third quarter.

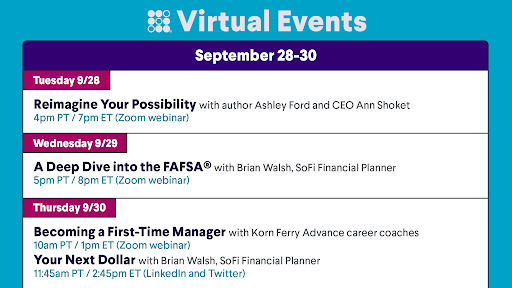

The Week Ahead at SoFi

This week’s webinars include discussions on redefining your future, understanding the FAFSA®, and becoming a first-time manager. Plus, tune in to Your Next Dollar. Save your virtual seat!

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

SOSS21092701