The Week Ahead on Wall Street

Economic Data

Today, the Labor Department releases job opening and labor turnover numbers for June. Job openings were little changed in May, hitting 9.2 million. Economists and investors will be paying attention to this data point to gauge when labor shortages may ease.

Tomorrow, the NFIB small-business index for July is released. This data point tracks optimism on the part of the nation’s small-business owners. In June the index increased to 102.5, marking the first time the number was more than 100 since November 2020.

On Wednesday, the Consumer Price Index for July is released by the Bureau of Labor Statistics. In June it surged 5.4% year-over-year, marking the largest increase since August 2008, just ahead of the financial crisis. Investors will be paying close attention to see if inflation is easing or continuing to climb.

On Thursday, initial and existing unemployment claims for the previous week are released. This metric tracks how many people are claiming unemployment for the first time and how many are continuing to receive the benefit. With the Delta variant spreading quickly in some parts of the country, investors will be paying close attention to unemployment numbers. Last week initial unemployment claims hit 385,000.

Friday, be on the lookout for the University of Michigan to release its Consumer Sentiment Index for August. This tracks how consumers feel about their personal finances, the economy, and their purchasing power. In July US consumer sentiment declined to a five-month low as consumers worried about inflation. Now with the Delta variant spreading, consumer confidence may have waned more.

Earnings Reports

Today, BioNTech (BNTX) reports quarterly earnings. Shares of the drugmaker gained in recent days after the FDA said it and Pfizer’s (PFE) COVID-19 vaccination will get full approval in early September. Investors will be paying close attention to see if it will have any impact on its COVID-19 sales, which judging from Pfizer’s and Moderna’s (MRNA) quarterly reports, should be strong.

Tomorrow, be on the lookout for quarterly earnings from Sysco (SYY), a large wholesale food supplies company. Faced with severe labor shortages across the country, the company took the drastic step of delaying deliveries to its customers. Citing unprecedented labor shortages, Sysco said it was aggressively recruiting so it can restore full service. Investors will want to know how long the labor shortages will last and what impact they are having on sales and margins.

On Wednesday, fast-food chain Wendy’s (WEN) reports quarterly earnings. The stock got swept up in the meme craze earlier this summer, but has since given back much of those gains. Like other fast-food chains, Wendy’s saw growth during the pandemic and now has to make sure it’s sustainable. Investors will want to know if recently introduced new menu items and other initiatives will be enough to accomplish that.

Be on the lookout for earnings from Baidu (BIDU) on Thursday. The Chinese internet search company’s stock has been under pressure in recent weeks as Chinese regulators clamp down on technology firms. Investors will be looking for reassurances Baidu is not in Beijing’s crosshairs when it reports earnings.

Also Thursday Palantir Technologies (PLTR) reports quarterly earnings. The data analytics software company has long chased the government and corporate markets but in a dramatic shift is going after small businesses. In late July it announced it would sell its software as a monthly subscription to smaller companies including startups. Investors will surely want to hear more about this strategy and the size of the market opportunity when it reports quarterly earnings.

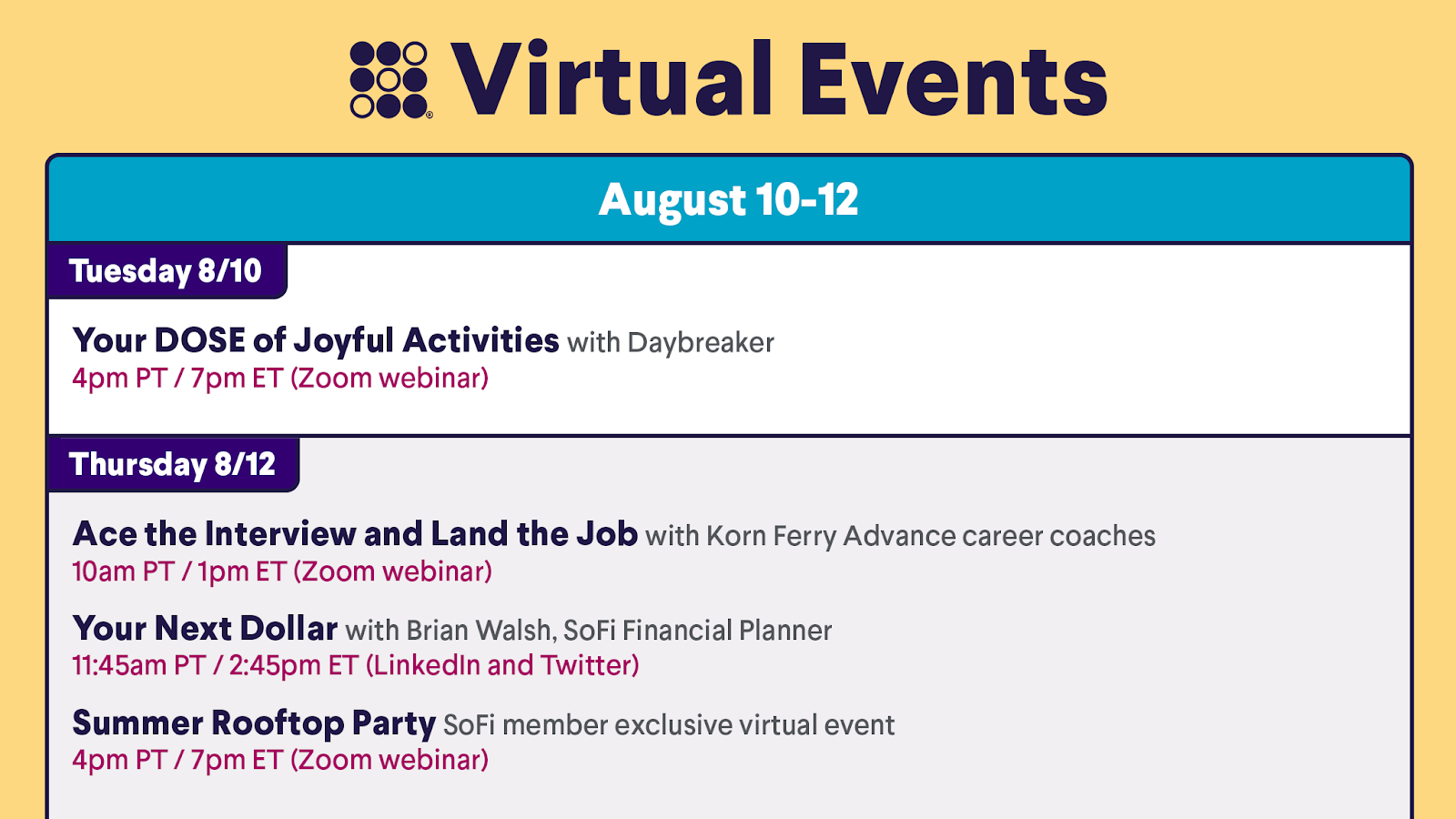

The Week Ahead at SoFi

Join us for SoFi’s Sizzlin’ Summer with an energetic activities event and a rooftop party. Also learn winning interview strategies, plus check out Your Next Dollar.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

SOSS21080901