The Week Ahead on Wall Street

Economic Data

Today, there is no economic data scheduled to be released.

Tomorrow, the Consumer Price Index for June is published. This data point measures the changes in prices consumers pay for products and services on a monthly basis. The CPI increased 5% year-over-year in May, marking the largest increase in almost 13 years. The markets will be paying close attention to the reading for June to see if inflation is increasing or easing. Also Monday, the federal budget and the NFIB Small Business Index for June are released.

On Wednesday, the Producer Price Index for June is due. This metric measures the average changes in prices from a producer’s or manufacturer’s point of view. In May the PPI increased 0.8% month-over-month and 6.6% from a year ago, which is the biggest annual increase since the Bureau of Labor Statistics began tracking the data in 2010.

On Thursday, initial unemployment claims for the week earlier are released. The results of this metric have fluctuated in recent weeks. Last week 373,000 people filed for unemployment for the first time, which was higher than the 350,000 economists forecast.

On Friday, retail sales for June are released. This is an important data point to measure the health of the economy. With vaccinations widely available and the economy reopening, consumers have been on a spending tear. Whether it is sustainable depends on how retail sales track in the coming months. In May they fell 1.3% as consumers shifted spending to services. Investors are waiting to see if that trend continues or consumers start shopping again.

Earnings

On Tuesday, JPMorgan Chase (JPM) reports quarterly earnings. America’s largest bank by assets has been on a spending spree. JPMorgan Chase has acquired more than 30 companies since the start of this year. The firm has been focused on smaller buys around the globe from a UK online money manager to a digital bank in Brazil. The acquisitions are designed to expand into new and existing businesses. It will be interesting to hear more about this strategy and what it means for the bank’s bottom line.

On Wednesday, be on the lookout for earnings from Delta Air Lines (DAL). Like its rivals, the airline operator is enjoying increased demand as Americans travel again. At the same time, the industry is dealing with labor shortages which have caused American Airlines (AAL) to cut back on some of its scheduled summer flights. Investors will be paying close attention to what Delta has to say about demand—especially from business travelers. Analysts expect that business air travel will not return to normal levels for several years.

On Thursday, Taiwan Semiconductor Manufacturing Company (TSM) reports quarterly earnings. The chip maker is currently constructing a $12 billion plant in the US. At the same time, it is investing $2.8 billion in China to mass-produce chips for vehicles by 2023. The latter is raising concerns for the US government which is worried that TSMC could help China reach its goal of chip independence. At the same time, the global semiconductor industry is still dealing with component shortgages. It will be interesting to hear what TSMC has to say on all three fronts.

Also Thursday, UnitedHealth Group (UNH) reports quarterly earnings. Last month the largest health insurance company in the US said it would deny insurance holders emergency medical care coverage in cases when an event was not an actual emergency that needed immediate care. Doctors, nurses, and hospital management said the change sets a dangerous precedent. It will be interesting to hear what UnitedHealth has to say about that policy when it reports earnings.

On Friday, be on the lookout for Charles Schwab (SCHW) to report quarterly earnings. The online brokerage company just revealed it was fined $200 million by the Securities and Exchange Commission due to practices within its robo advisory service. Meanwhile Goldman Sachs (GS) downgraded its investment rating on the stock, saying the boom in trading revenue is coming to an end. Investors will be paying close attention to what Charles Schwab has to say about trading activity when it reports earnings.

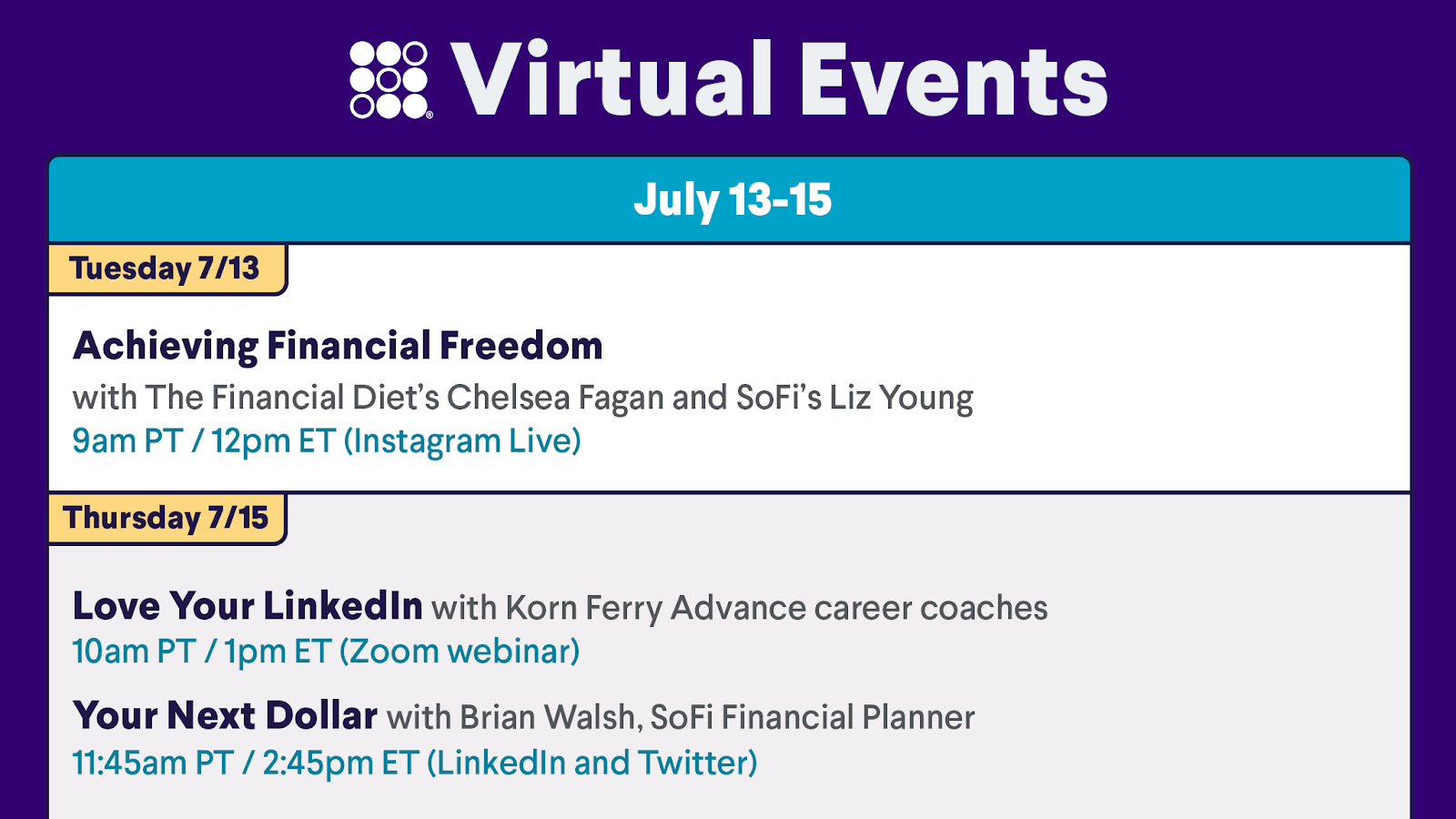

The Week Ahead at SoFi

Learn how to strive toward financial freedom, plus improve your LinkedIn game. Also, tune in to Your Next Dollar—LinkedIn, Twitter, Instagram, and Zoom live. Register for these events and more in the SoFi app.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

SOSS21071201