The Week Ahead on Wall Street

Economic Data

Today, the March Empire State Index will be released, which tracks business activity in New York State. In February it rose to 12.1 which was the highest level of activity seen since July.

Tomorrow, look for January business inventories, the February Import Price Index, February industrial production, February capacity utilization, and February retail sales. Fueled by a round of $600 stimulus checks, retail sales climbed by 5.3% in January. As the Federal Government began distributing an additional round of stimulus over the weekend, many are hoping for a similar boost for the economy this month. The two day Federal Reserve policy meeting also begins today.

On Wednesday, February building permits and February housing starts will be published. Housing starts fell by 6% in January, which was a higher than expected drop. Federal Reserve Chair Jerome Powell will also hold a press conference after the Central Bank’s policy meeting ends. Wall Street will be watching for commentary surrounding rising rates, valuations, and inflation.

On Thursday, the Philadelphia Fed manufacturing survey, the index of leading economic indicators, and initial jobless claims will be published. Initial jobless claims hit a new four-month low of 712,000 the week ending March 6.

There are no major reports scheduled on Friday.

Earnings Reports

Tomorrow, look out for an earnings report from Volkswagen AG (VWAGY). The German automaker is investing heavily in EV production with the goal of selling 70% battery-powered cars in Europe by 2030. Tesla (TSLA) plans to open a manufacturing plant in Germany this summer, so Volkswagen and other German carmakers are scaling up their EV operations.

Lennar Corp (LEN) is also scheduled to report earnings Tuesday. The Florida-based home construction and real estate company beat earnings with its last two reports. Interest rates have ticked upward in recent weeks and investors are curious to see what this will mean for the residential real estate market.

Williams-Sonoma (WSM) is scheduled to report earnings Wednesday. The furniture and kitchenware company, which also owns West Elm and Pottery Barn, has seen a jump in sales during the pandemic. People have turned to the retailer as they have purchased new houses and have set up home offices. But the company faces increasing competition from furniture sellers specializing in ecommerce, like Wayfair (W).

Nike (NKE) hands in its report card on Thursday. Nike has continued to see strong sales during the pandemic as people have turned to the retailer to buy at-home workout gear and comfortable clothes for spending time at home. The brand consistently maintains its ability to notice and create trends, helping it stay ahead of competitors like Lululemon (LULU).

Lastly, Carnival Corp (CCL) is also scheduled to report earnings Thursday. The cruise line recently announced that it will extend its suspension of US cruises until the end of May. However, by then more of the population will be vaccinated, so some are hopeful that Carnival will be able to restart operations by that date after a very difficult year.

The Week Ahead at SoFi

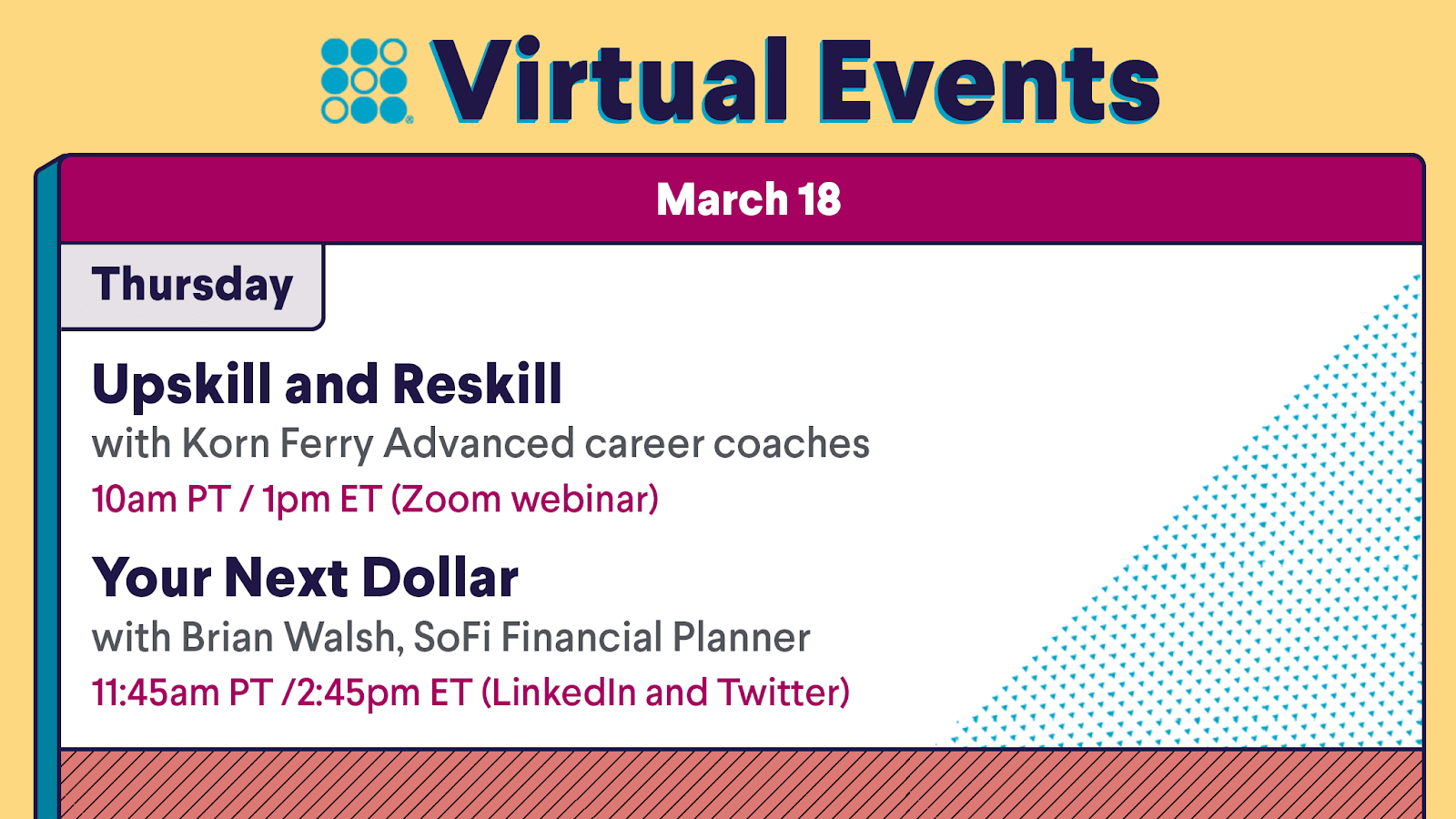

Check out our free virtual events featuring top Upskill and Reskill trends, plus another episode of Your Next Dollar. Join us live on LinkedIn, Twitter, and Zoom, and be sure to register for upcoming events in the SoFi app.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Advisor

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

SOSS21031501