The Week Ahead on Wall Street

Economic Data

Today, January wholesale inventories will be released. This metric measures the change in the total value of goods wholesalers have in their inventories. The metric was $651.5 billion in December—a slight increase from November.

Tomorrow, the NFIB Small-Business Index for February will be published. This metric measures the health of small businesses in the US. It declined slightly between December and January, in part because of slower-than-expected vaccine rollout.

On Wednesday, look for the February federal budget, February Core CPI, and the February Consumer Price Index. This metric tracks the average prices of consumer goods and services like transportation, food, and medical care. In January, it increased by 0.3%.

On Thursday, January job openings will come out. Initial jobless claims will also be reported. Jobless claims rose slightly last week, hitting 745,000. However, the four week moving-average was 800,000—the lowest level since early December.

On Friday, the March preliminary University of Michigan Consumer Sentiment Index will be released along with the February Producer Price Index. This metric was up 1.3% in January.

Earnings Reports

Today, Stitch Fix Inc (SFIX) will report earnings. The online personal styling service has gained new customers during the pandemic as people have been looking for a way to replace the guidance that in-person shopping can provide. However, the company has also seen its marketing and shipping costs rise recently.

Tomorrow, Dick’s Sporting Goods (DKS) hands in its report card. The retailer has seen its sales surge during the pandemic as people have stocked up on at-home workout gear. Dick’s has also invested in ecommerce operations over the past year, but it plans to open three new brick-and-mortar stores this month, showing that it’s making plans for when consumers return to some pre-pandemic shopping habits.

On Wednesday, look out for an earnings report from Bumble (BMBL). This will be the dating app’s first report as a public company. Bumble had a blockbuster IPO last month, trading up nearly 77% on its first day. The stock has stayed strong since then.

On Thursday, DocuSign (DOCU), the electronic signature platform, will report earnings. Like many remote work companies, DocuSign has seen demand for its services surge during the pandemic. The company’s share price climbed 192% between April 1, 2020 and September 1, 2020. DocuSign’s leadership is now thinking about how to retain new customers even after workers return to offices.

GoodRx (GDRX) will also share its latest results on Thursday. The company is best known for its app which allows people to compare prescription drug prices, but it has recently expanded to begin offering telehealth services. GoodRx went public in September 2020 amidst a boom for the telehealth industry.

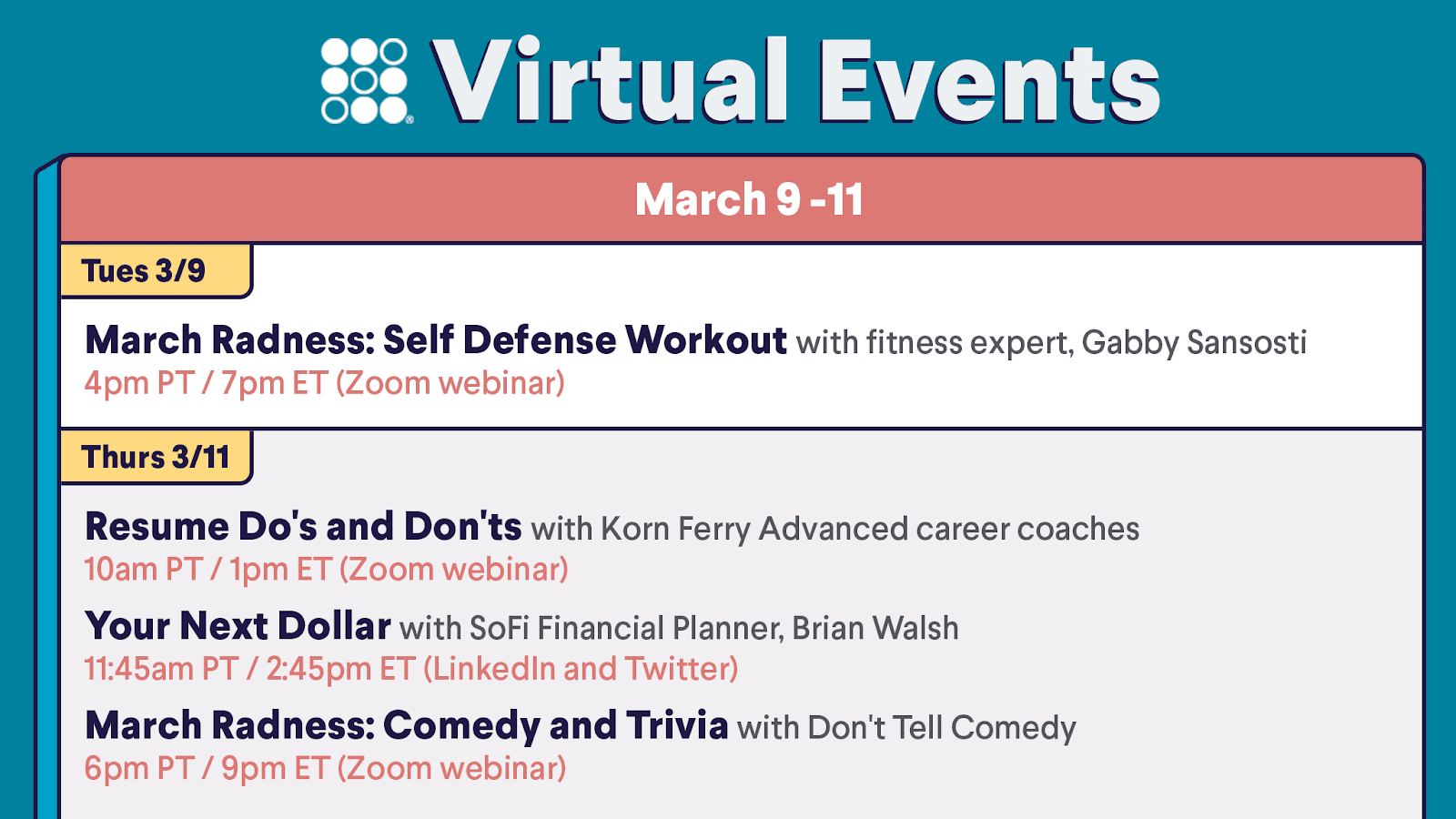

The Week Ahead at SoFi

From a Self Defense Workout to Resume Do’s and Don’ts, there’s a free virtual event for everyone. Join us live to experience them all. Reserve your seat in the SoFi app!

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Advisor

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

SOSS21030801