The Week Ahead on Wall Street

Economic Data

Today, the February Markit manufacturing PMI, the February ISM Manufacturing Index, and January construction spending will be released. Construction spending climbed by 1% in January.

Tomorrow, February motor vehicle sales will be released. Automobile sales have been strong recently. General Motors (GM) reported that Q4 of 2020 was its best quarter by retail sales since 2007.

On Wednesday, the February Markit services PMI, the February ISM Services Index, and the February ADP employment report will be released. This monthly data report from the company that handles payroll for about one fifth of US private employment, showed that there was job growth between December and January. In fact, private firms added 174,000 jobs in January—well above Dow Jones estimates of 50,000.

On Thursday, look for January factory orders and initial jobless claims. First time jobless claims were 730,000 last week—a significant decline from the previous week.

On Friday, the January trade deficit, January consumer credit, February nonfarm payrolls, February average hourly earnings, and the February unemployment rate are released. The unemployment rate was 6.3% in January with nonfarm payrolls increasing by 49,000, which was slightly below economist expectations of 50,000.

Earnings Reports

Today, look for an earnings report from Zoom Video Communications (ZM). The company, which has come to be a part of so many people’s lives during the pandemic, has seen its share price climb by almost 300% over the past 12 months. Though companies like Facebook (FB) and Slack (WORK) have created competing video conferencing services, Zoom has remained the go-to for many. Investors are now beginning to think about what role the company will play in a post-pandemic world.

Tomorrow, Target (TGT) will hand in its report card. The retailer has gained significant market share over the course of the pandemic by expanding its ecommerce operations, offering curbside pickup, and other initiatives. As the company begins to think about more people returning to shopping in-person, last week it announced plans to add more mini Apple (AAPL) stores in some Target locations.

On Wednesday, Snowflake (SNOW), the data warehousing solutions provider, will report earnings. The company had a massive IPO in September of 2020. Analysts expect it to stay the dominant data cloud firm for some time. Over the next year, it may not become profitable but it is likely to see substantial growth.

On Thursday, look for an earnings report from Kroger (KR). Like many grocers, the company has seen growth during the pandemic as more people cook and eat at home. Kroger is also working on distributing COVID-19 vaccines through its pharmacies. It recently launched a system for tracking appointments and vaccine supplies which can process over 250,000 requests.

Big Lots (BIG), the Ohio-based discount retailer, will report earnings on Friday. During the pandemic, consumers have been looking to save money and have been sprucing up their houses as they are spending more time at home. Both these trends have given Big Lots a boost.

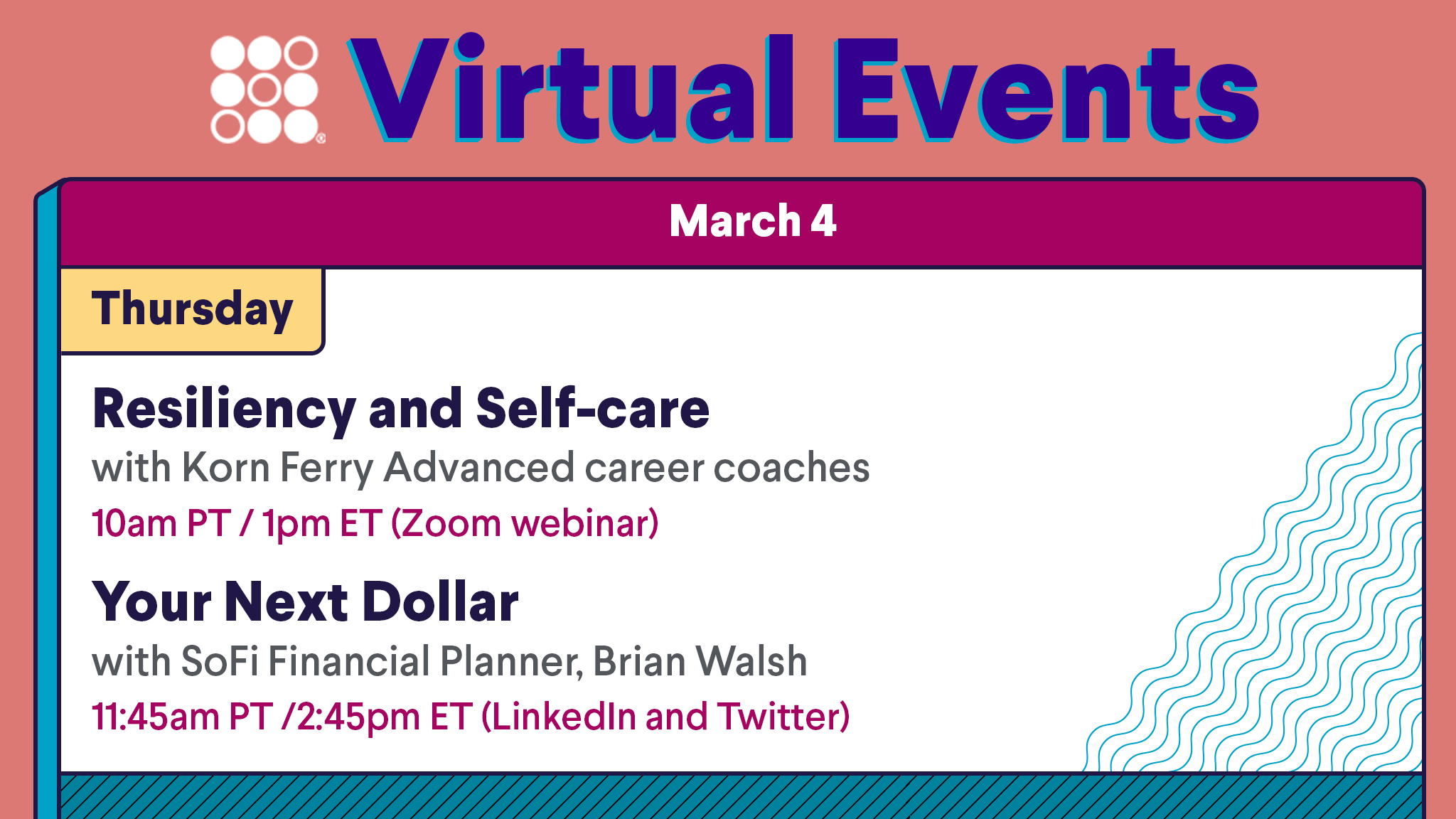

The Week Ahead at SoFi

March is upon us, and so are these upcoming events. Join us for another segment of Your Next Dollar, and a webinar for self-care—live on LinkedIn, Twitter, and Zoom.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Advisor

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

SOSS21030101