The Week Ahead on Wall Street

Economic Data

No data is scheduled for release today.

Tomorrow look for the November FHFA house price index and S&P Case-Shiller home price index. The S&P Case-Shiller home price index for October 2020 continued its upward climb. That strength surprised Wall Street, but shows the impact of low rates and low inventory on the housing market. January’s consumer confidence index will also be released tomorrow.

December’s durable goods orders and core capital goods orders will be published on Wednesday. There will also be an announcement from the FOMC. Jerome Powell, Chairman of the Federal Reserve, has a press conference as well.Investors will be tuning in to hear his perspective on the economy. Durable goods orders got a lift in November following a seven month rising streak. Economists are hopeful that this growth will balance out a drop in consumer spending.

On Thursday, economic data reports will include initial jobless claims, Q4 gross domestic product, December’s advance report on trade in goods, December new home sales, and December leading economic indicators. China’s GDP rose 2.3% in December, making it the only major economy in the world to see growth instead of contraction in 2020. Analysts will be eager to gain more insight about how the US economy is performing.

The Q4 employment cost index, December personal income, December consumer spending, December core inflation, January’s Chicago PMI, and the January consumer sentiment index will be released on Friday. Both consumer spending and personal income fell in November as US households struggled due to rising COVID-19 cases and subsequent business restrictions and unemployment.

Earnings Reports

Today Kimberly-Clark (KMB), the paper products company which owns major brands like Kleenex, Scott, and Huggies, will report its latest results. Despite a surge in demand for toilet paper and sanitation products early in the pandemic, which boosted sales and profits, Kimberly-Clark did not perform as well as rivals like Procter & Gamble last year.

Tomorrow Microsoft Corp (MSFT) and LVMH Moet Hennessy Louis Vuitton SE (LVMHF) will both report earnings. Last week Microsoft announced they are investing $2 billion in Cruise, the autonomous vehicle company. The deal makes Microsoft the preferred cloud for Cruise and General Motors (GM). LVMH completed its purchase of Tiffany & Co. earlier this month, a merger that had been in process for over a year. Investors will be curious to see what’s next for the combined company.

On Wednesday Apple Inc (AAPL), Tesla Inc (TSLA), and Facebook Inc (FB) will report earnings. Last week Deutsche Bank published survey results that suggested US investors feel both Bitcoin and Tesla are facing a potential bubble. A majority of participants said Tesla looks vulnerable to them, and said the stock’s value is more likely to drop by half than it is to double. Meanwhile, investors will be watching for the response to Facebook’s indefinite ban on former-President Donald Trump.

On Thursday McDonald’s Corp (MCD) will report earnings. The fast food giant recently announced it will release a southern-style fried chicken sandwich and many other fried chicken options, as chicken has gained in popularity in recent years.

No major earnings reports are scheduled for Friday.

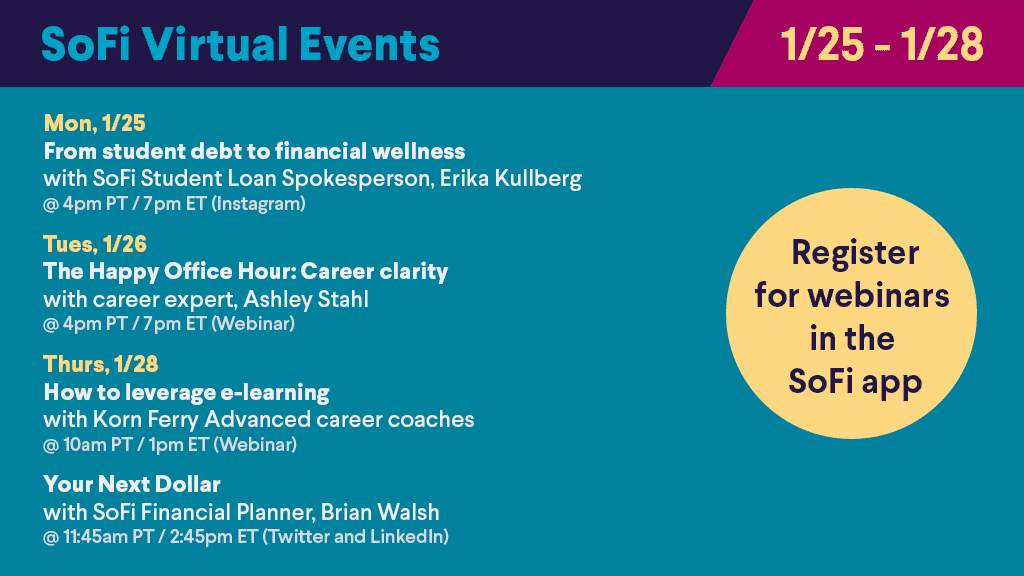

The Week Ahead at SoFi

If your resolution was to attend more virtual events, then now’s your chance. Join us for webinars on financial wellness, e-learning, career clarity, and more, and catch up on past events in our YouTube channel.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Advisor

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

SOSS21012501