The Week Ahead on Wall Street

Economic Data

Today the Chicago Fed National Activity Index for August is due. This is a monthly report that’s designed to gauge overall economic activity as well as the related impact of inflation. While recessionary fears are gripping the market at present, the Chicago Fed’s index pointed to a pickup in economic growth in July, coming in at +0.27, up from -0.25 in June.

Tomorrow, the Conference Board will publish its Consumer Confidence Index for September. In August, consumer confidence rose more than expected, following three straight months of declines. Also watch for July’s home price index from both S&P Case Shiller and the FHFA, as well as August’s new home sales. The rising-rate environment has put pressure on real estate demand so investors will want to see how pricing is being impacted.

Wednesday, more housing market data is on the way, with the pending home sales index for August due. This leading indicator is organized by the National Association of REALTORS® and looks at signed contracts for the purchase of homes. In July, pending transactions plummeted 19.9% on an annual basis, further demonstrating how high prices and rising mortgage rates have impacted demand.

Thursday, jobless claims are due. Initial claims jumped slightly last week but economists argue the labor market remains strong, noting the number of people collecting unemployment benefits remains close to the pre-pandemic average. Also, Thursday the Bureau of Economic Analysis will issue the revised second-quarter GDP.

Friday, the Personal Consumption Expenditures Price Index or PCE will be released for August. This is the Fed’s preferred inflation gauge. In July the PCE fell, driven largely by a drop in gas prices. Friday’s economic calendar also includes real consumer spending for August, as well as September’s Chicago PMI.

Earnings

Today, CorpHousing Group (CHG) is scheduled to report its second-quarter results and hold a conference call with analysts. The Miami-based real estate company manages short-term rental apartments across the country. As talks of a more severe recession grow, analysts will be curious to hear about the company’s outlook, especially as it relates to business and leisure travel.

Tomorrow, heating and plumbing products distributor, Ferguson (FERG) will report earnings. Earlier this month the company announced it was collaborating with Ford (F) to help test out the automaker’s F550 Fuel Cell Prototype. The first-of-its kind work truck will be used within Ferguson’s fleet on a daily basis for six months.

Wednesday, Cintas (CTAS) is holding a webcast to present its results for the first quarter of fiscal year 2023. The Ohio-based corporation provides services to businesses such as uniform rentals, fire extinguishers, and cleaning supplies. Cintas asked the Supreme Court for help earlier this month as it tries to resolve a three-year-old dispute concerning its retirement plans.

Thursday’s earnings calendar is busy with sneaker and apparel giant Nike (NKE) leading the way. NBA superstar Lebron James just joined Nike last week to unveil the pair’s 20th signature shoe. Since first becoming a client in 2003, James has signed two contract extensions with Nike, including a “lifetime” deal in 2016.

Also, chipmaker Micron Technology (MU) and used car retailer Carmax (KMX) will both report earnings on Thursday. As the supply chain came under pressure throughout the pandemic, both semiconductors and used cars became hard to come by. Investors will be studying these companies to get a snapshot view of each sector.

Friday, newly public GigaCloud Technology (GCT) is set to hand in its latest report card. The Hong Kong-based ecommerce company saw its share price pop at the beginning of September but has been slumping recently. The market will be paying attention to GigaCloud’s earnings during what’s been a volatile period for the IPO market.

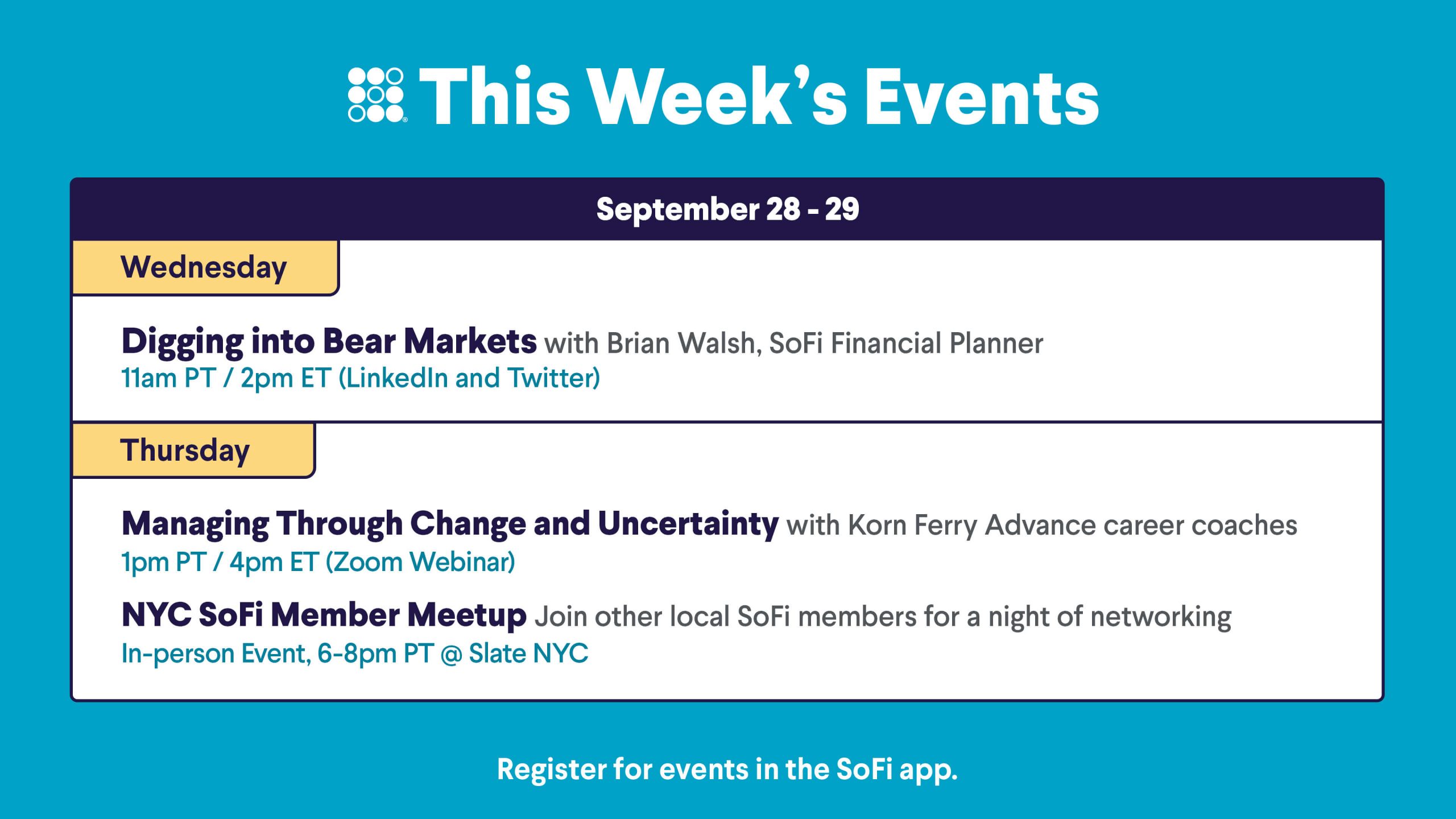

The Week Ahead at SoFi

Calling all Residents and MDs—join us this week for a special med school debt webinar. We’ll break down all your options when it comes to repayment. Save your seat in the SoFi app!

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Advisor

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

SOSS22092601