The Week Ahead on Wall Street

Economic Data

Today, May’s factory orders are due. The Commerce Department reported factory orders rose 0.3% in April, after increasing 1.8% in March. Also the revised number for May’s capital equipment orders will be released. The preliminary number showed a 0.7% advance, despite rising interest rates. June’s total vehicle sales will also be published, after the number decreased by 12.6% in May.

Tomorrow, the FOMC will release the minutes from its latest meeting. This will provide the market insight as to how the central bank is thinking about inflation and the need for future rate hikes. It also comes as the Fed enacted its sharpest rate hike since 1994 last month, when it increased its target rate by 75-basis-points. Also tomorrow watch for May’s job openings or quits, known as the JOLTS report. Quits have been piling up in recent months amid what economists call the “Great Resignation,” although jobless claims have been inching up over the past month. Investors will be looking for more insight into the labor market with this data point. The ISM services index for June is scheduled for release as well.

Thursday will bring a new set of job market data points. ADP will publish its monthly jobs report for June. In May, private payrolls increased by 128,000. That’s the lowest number observed during the COVID-19 economic recovery. Weekly jobless claims will also be released. Last week’s number declined. That said, the four-week rolling average came in higher than the previous comparable period. May’s foreign trade balance is also due.

Friday, June’s nonfarm payrolls will be published by the Bureau of Labor Statistics. The number increased by 390,000 which exceeded the expectations of economists. June’s average hourly earnings and labor participation rate are also set for release, closing out a week chock full of job market data.

Earnings

Today, Sainsbury’s will release its first-quarter trading statement. Given its the second largest grocery chain in the UK, this will give investors some insight as to how inflation is impacting consumer spending overseas. Last week Sainsbury’s CEO said customers are “watching every penny” and buying more frozen foods in a bid to save money.

Tomorrow, software company Simulations Plus will report its third quarter fiscal year 2022 earnings. The California-based company produces models and simulations for a variety of industries including pharmaceuticals, cosmetics, and foods. Last week Simulations Plus announced record attendance at their second annual pharmacometrics workshop that was held in March. It also disclosed earlier this month that it had worked with a major pharmaceutical company to work on modeling for a COVID-19 therapy.

Thursday, denim retailer Levi Strauss (LEVI) will share its latest results. Americans’ retail spending declined in May as inflation surged, with ecommerce taking a hit. Meanwhile Levi Strauss joined other companies last month in calling for more strict gun laws, while also announcing internally that it would reimburse employees’ expenses if they needed to travel for an abortion. Also on Thursday watch for WD-40 (WDFC) to report earnings. Known for the lubricant that bears its company name, the firm also sells products such as Carpet Fresh, 2000 Flushes toilet freshener, and Lava brand hand soaps. Some analysts argue the company is well positioned to ride out inflation given things like cleaning products are considered non discretionary spending.

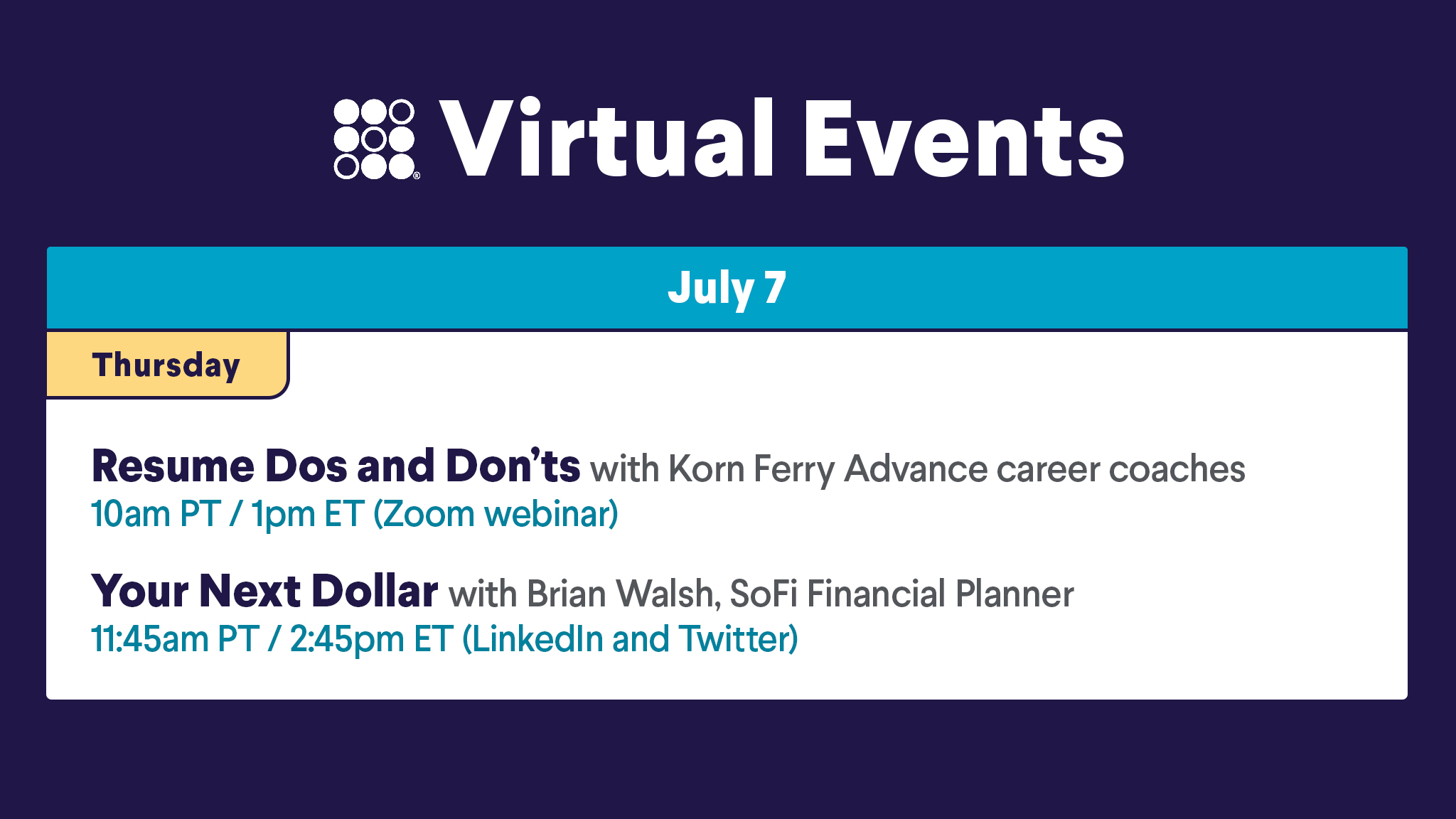

The Week Ahead at SoFi

This week’s events will help you refresh your resume and share steps you can take to better prepare your finances for potential tough times ahead. Save your seat in the SoFi app!

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

SOSS22070501