The Week Ahead on Wall Street

Economic Data

Today, watch for May’s consumer confidence index. Investors will be paying close attention given the recent focus on the retail sector and inflation’s perceived impact on Americans’ spending habits. The Conference Board’s index edged down in April, but remained high by historical standards. May’s national home price index is also due from S&P Case-Shiller and the FHFA, which track the change in single-family home prices, year-over-year.

Tomorrow, April’s Job Openings and Labor Turnover Survey or JOLTS is set for release. In March a record number of people quit their jobs, while job openings rose to roughly 11.6 million, an all-time high. Economists have described this as the “Great Resignation.” April’s construction spending is scheduled to be published as well, after the number rose in March, but less than expected. Also, keep an eye out for S&P Global’s manufacturing PMI, and ISM’s manufacturing index, both of which track this month’s activity.

Thursday, weekly jobless claims are due. Claims for the week ending May 21 checked in 8,000 lower. Unemployment claims are down near pre-pandemic levels observed in 2019, when the labor market was also tight. ADP’s employment report for May will shed further insight into the job market, while April’s factory orders are also scheduled to be published.

Friday, the labor market remains front and center. May’s unemployment rate and nonfarm payrolls will be released. In April the unemployment rate checked in at 3.6%, which was unchanged month-over-month. The economy added 428,000 jobs in April, exceeding expectations. May’s labor-force participation rate and average hourly earnings are also on the calendar.

Earnings

Today, Salesforce (CRM) will announce earnings. Last week it was reported that the cloud-based software company had joined with Microsoft (MSFT) to invest $300 million in the US-based First Movers Coalition, which focuses on new technology aimed at reducing carbon dioxide in the air.

Tomorrow, information technology firm Hewlett Packard Enterprise (HPE) will hand in its latest report card. Earlier this month the company renewed its commitment to projects in Europe, where a new factory will develop artificial intelligence and high-performance computing systems aimed at improving the region’s supply chain.

Thursday, athletic apparel company Lululemon (LULU) will share its first-quarter fiscal 2022 earnings data. While the retailer faces headwinds in the form of higher fuel and labor costs as well as declining consumer confidence, a favorable report from Morgan Stanley (MS) last week argued Lululemon is “well-positioned” to ride out inflation. That same day Hormel Foods (HRL) is scheduled to report earnings, after the company’s board of directors authorized a 26 cents per share dividend last week, to be paid in mid-August.

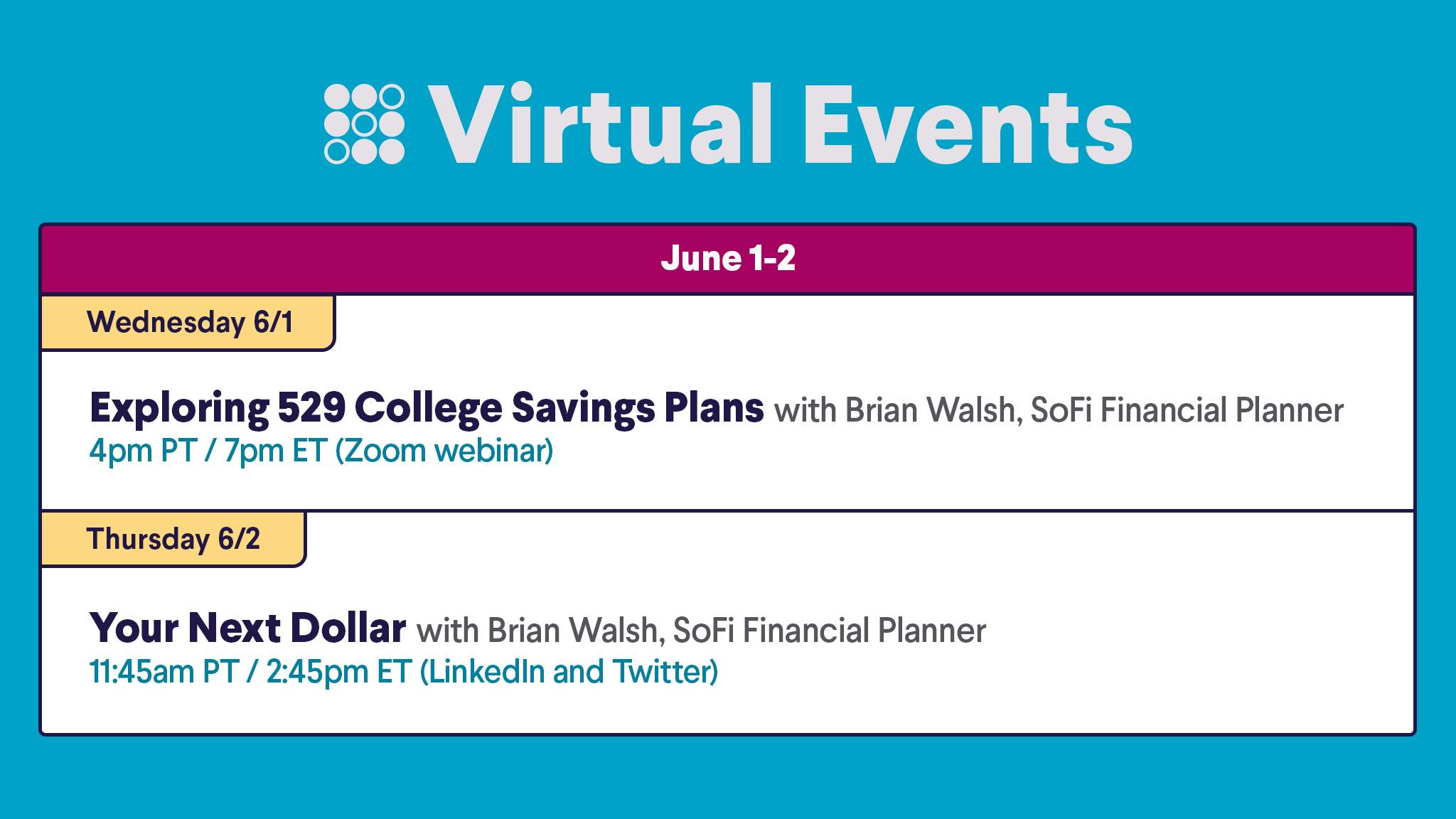

The Week Ahead at SoFi

Ready to get the 411 on 529s? Brian Walsh will share tips on college savings plans, including the tax benefits. Then join Brian for this week’s Your Next Dollar livestream. Save your seat in the SoFi app!

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

SOSS22053101