SoFi Launches Early Access to Pay in 4

Pay in 4¹ is SoFi’s latest innovation designed to provide flexibility for our members when spending with SoFi Checking and Savings². With Pay in 4, SoFi members will now have another way to pay for larger travel or select purchases from local small businesses to major retailers, anywhere Mastercard is accepted. Early access is rolling out to select SoFi members in the coming weeks.

What is Pay in 4?

Pay in 4 offers members the option to split a purchase of $50-$500 into four, interest-free payments. This new feature is designed to offer members another way to pay when it comes to purchases, providing flexibility in budgets for planned, larger purchases, without paying any interest. SoFi is the first bank to launch within the Mastercard Installments program. Pay in 4 allows SoFi members to make purchases at merchants across the country, to instantly support secure, flexible payments at checkout, both in-store and online.

Everything we do at SoFi is geared around helping people get their money right, and our new Pay in 4 offering is the next iteration of that. By allowing people more flexibility in how they pay for bigger purchases, we’re giving members the freedom to manage their money the way that best suits their needs.

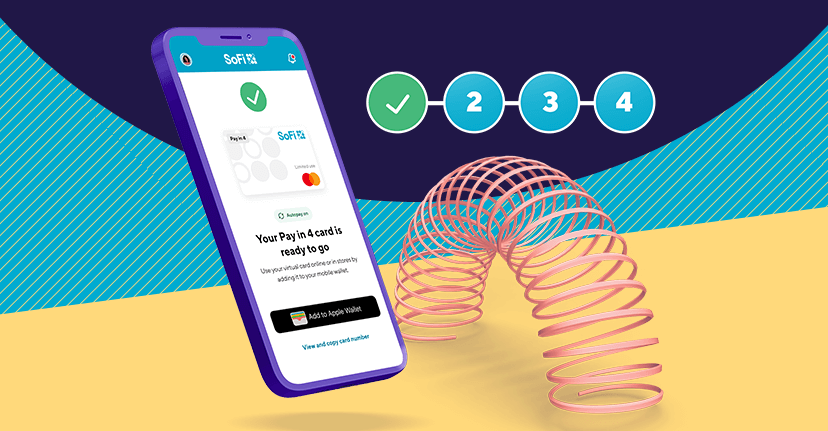

How does Pay in 4 work?

With Pay in 4, eligible members receive a one-time use digital Mastercard card [SJ4] for a purchase from $50 to $500. The digital card can be used as usual during the payments process online or in store, providing members flexibility, familiarity, and the Mastercard Zero Liability protection to cover fraudulent transactions. The first payment is due to SoFi at the time of purchase and may be seamlessly pulled from the member’s SoFi checking account, making it easy to manage payments in one central location. Each remaining payment is due every two weeks

SoFi’s Pay in 4 is designed to help members spread out payments for larger purchases, and can be used for flights, hotels, electronics, clothing, home improvement or at other retailers from local business to national chain department stores.

Pay in 4 cannot be used on everyday purchases such as groceries, at restaurants/bars and gas stations, among other categories. Members must also fully pay off their Pay in 4 loan to be eligible for another one. Both of these restrictions are designed to ensure that the feature is being used to create healthy spending habits, rather than perpetuating a cycle of debt.

SoFi has designed Pay in 4 to make it as simple and easy as possible for members to responsibly manage their money every step of the way. For example, members will be prompted to set up Autopay directly from their SoFi checking account to make it easy for members to stay on track.

Who is eligible for SoFi Pay in 4?

To be eligible for Pay in 4 during early and general access, members must maintain a qualifying direct deposit to a SoFi Checking & Savings account, pass a soft credit check (which does not impact credit scores), as well as meet SoFi’s high-threshold risk requirements. [SJ6] SoFi will only consider select members to ensure members who are using Pay in 4 are financially sound, and members will only be approved for an amount SoFi knows members can pay off based on deposit history.

Once members receive an approval offer, they will have 30 days to use their Pay in 4 Mastercard.

How can I see if I have early access to Pay in 4?

Eligible members will see an offer for Pay in 4 within the banking section online or tab in-app, where they will view the Pay in 4 offer.

When a member goes through the activation process, they will see how much they are eligible for, $50-$500, based on their credit and monthly deposits.

How can I best include Pay in 4 purchases in my budget?

SoFi is committed to helping members better manage their money responsibly, especially as people navigate inflation and holiday shopping. SoFi recently launched “On the Money”, a new digital content hub designed to help anyone and everyone better manage their finances. The new site has an extensive catalog of articles on how to best manage your finances to achieve your goals.

For those looking to dive deeper into their finances, SoFi offers all members complimentary access to financial consultants to receive bespoke financial advice to help them get their money right.

Not a SoFi Checking & Savings member yet? Sign up here!

Disclosures:

1.Pay in 4 offer is only valid to customers receiving the offer directly from SoFi and using the link contained in the email received by the account holder(s). Offers for Pay in 4 are non-transferrable. Eligible members will receive a one-time use virtual card with the first payment due at time of purchase. See Terms & Conditions for payment terms and schedule.

Members are only eligible to have one active Pay in 4 loan at a time, which must be paid in full before the member may be eligible for subsequent Pay in 4 loans. Exceptions may apply. See Terms & Conditions for details. Pay in 4 loans offered by SoFi Bank, N.A.

2. SoFi Checking and Savings is offered through SoFi Bank, N.A. The SoFi® Bank Debit Mastercard® is issued by The Bancorp Bank pursuant to license by Mastercard International Incorporated and can be used everywhere Mastercard is accepted. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.