Liz Looks at: A Real Correction

99 Problems

I went on vacation, and so much happened in markets that I feel like I’ve been gone for six months. As of close on Feb 22, the S&P 500 officially crossed into correction territory (drawdown of 10% or more) since its most recent high on Jan 3. That’s the first technical correction since the pandemic fall of March 2020.

Let’s take a minute to look at the new obstacles in our path, review the existing ones, and make sense of how we got here. I know listing off all 99 of our problems doesn’t sound uplifting, but it might help to put them in bite-size pieces so the view isn’t so overwhelmingly negative.

Cleanin’ Out My Closet

The newest obstacle to clean out, and the most popular headline, is the quaking geopolitical landscape between Russia and Ukraine. The sheer size of these two countries by population, land mass, and influence over the world’s energy supply makes the situation feel more dire. Especially at a time when oil prices have already raised some eyebrows (see my column from Feb 10, “The Betting Line on Oil”).

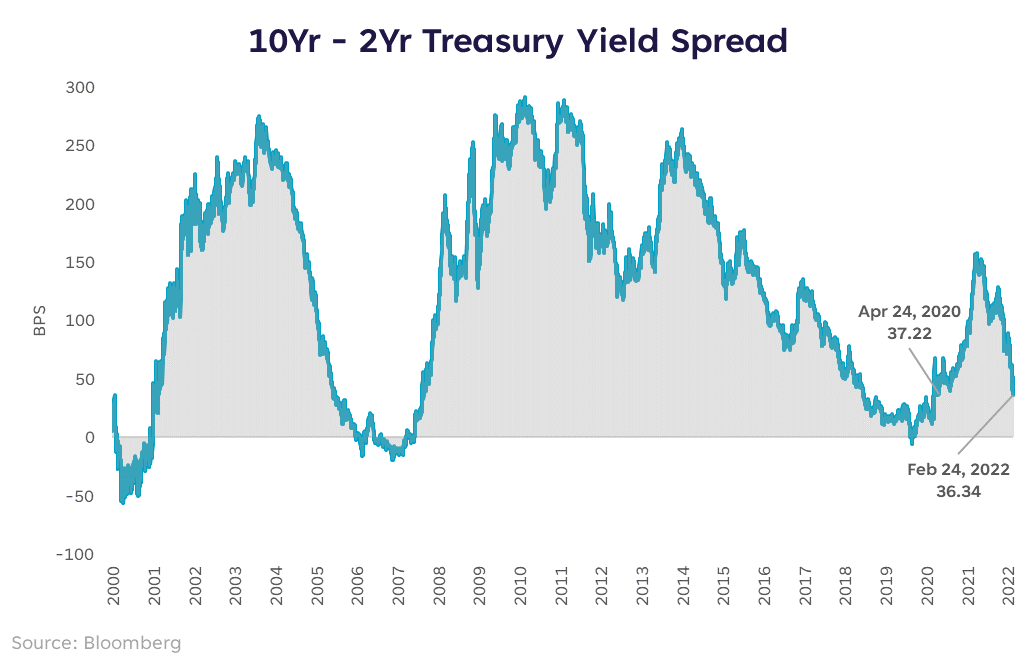

The aggressive stance Russia appears to be poised for makes this even more anxiety-inducing as we hear the word “war” floating around. Market anxiety can be found in the outflows from broad risk-on ETFs such as SPY (S&P 500), QQQ (Nasdaq 100), and IWM (Russell 2000), and the fact that the U.S. yield curve has flattened tremendously. The spread between 2-year Treasuries and 10-year Treasuries is down to 36 basis points — its lowest level since spring 2020.

At this point, the conflict between Russia and Ukraine is still escalating, which runs the risk of more widespread instability — particularly if other nations take military action and the West imposes debilitating economic sanctions. That would continue rippling through risk markets, commodities markets, and threaten growth both here and abroad.

There’s also a chance that a negotiated outcome can be reached and the pain is contained to the short-term. Risk-off sentiment is already affecting U.S. markets, but this outcome would offer the prospect of relief. A strongly unified West gives this outcome a better chance and is the one I think we’re all hoping for.

The silver lining to this is that following spikes in global policy uncertainty, stock markets have seen increasingly positive results 3-, 6-, and 12-months after the spike. All the more reason not to let fear take over and sell into a downturn.

Hot In Here

Still humming in the background are hot inflation prints (both on consumer prices and producer prices), and a Fed meeting that is now looming large as we approach March.

A statement that seemed outrageous and absurd last fall now seems much more plausible: “the first hike could be 50 basis points.”

If the big risk here is that the Fed has lost control of inflation, maybe taking a bigger hammer to it at the start is a way to control that narrative. After all, markets trade on narratives more often than not. But the flattening yield curve and increasing fear from geopolitical conflict likely reduces this chance for now.

Either way, this March meeting is perhaps the most important message we’ll hear from the Fed since March 2020. I’m expecting, like most highly anticipated events, that the anticipation will be worse torture than the actual message.

Until that point though, I anticipate the whipsaw in growth stocks to continue, and will sit on the Nasdaq sidelines until we are decently past the first hike.

The Next Episode

We are now squarely in the next episode of this economic cycle. This episode is full of tests, re-tests, and re-ratings. We’re trying to strike a balance between letting things heat up, but not catch fire. This is a time when investors earn their chops. There is so much to learn in periods when surprises come fast and furious. We may have 99 problems, but boredom ain’t one.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov. Liz Young Thomas is a Registered Representative of SoFi Securities and Investment Advisor Representative of SoFi Wealth. Her ADV 2B is available at www.sofi.com/legal/adv.

SOSS22022402