Liz Looks at: the Great Tightening

From Zero to Fear-o

Yesterday’s Fed statement was mostly in-line with what many were expecting — and it was met with a moody market that again saw a big swing going from strongly positive to strongly negative in the span of 90 minutes. Rates remained unchanged, the tapering program will continue as planned, and inflation is still a focus. The lack of surprises was better than a hawkish shock, but we’re still on a clear path to tightening as a rate hike in March is now nearly certain. And these intraday swings don’t leave me with a peaceful, easy feeling.

Before I start to sound like a screaming sell signal, let me be clear that I don’t see a treacherous bear market or recession coming. But I do see investors who are not conditioned for this environment and I don’t think the digestion process is over. We haven’t even started tightening yet, we’re still buying bonds for another month, and we have little clarity on what the balance sheet runoff will look like. There’s more wood to chop, and chop will ensue.

Old Heroes, Now Zeros

I don’t like it when markets don’t make sense. There are certain relationships that should hold, and when they dislocate I start to sense something ominous on the horizon. For many periods throughout 2021, there were relationships that broke down: the relationship between the 10-year Treasury yield and inflation (10-year yields should have been higher), the relationship between growth and value in the face of tightening monetary policy (value should have been a clearer winner), and the relationship between valuations and fundamental durability was rarely found.

But I can find a glimmer of positivity in the fact that although the market is down year-to-date, the relationships have started to make more sense. That tells me this needs to happen to bring us closer to rationality, and to set us up for the next phase of the economic cycle.

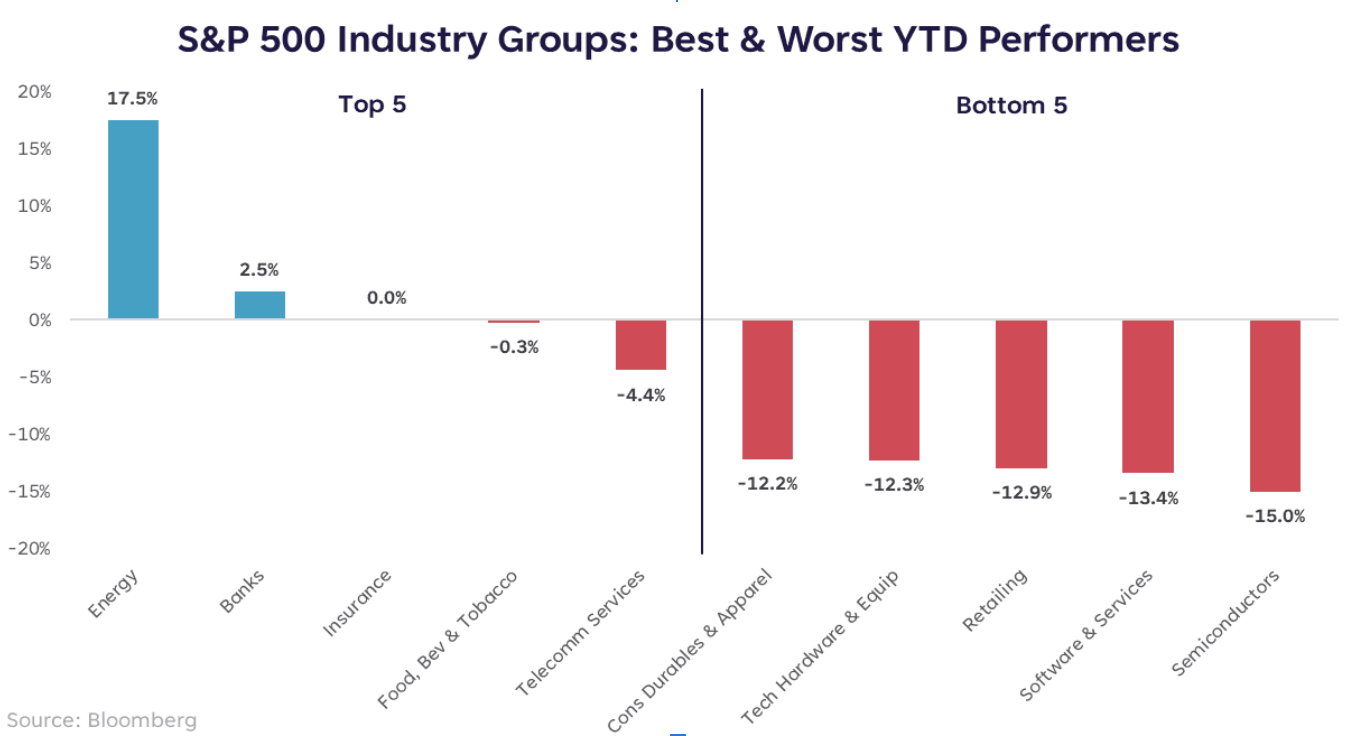

The 10-year Treasury yield has gone from 1.51% on Dec 31 to 1.87% as of yesterday’s close. Taking a look at industry group returns YTD, we see clear underperformance by the high flying areas of Technology. That makes sense when yields have risen more than 30 basis points and we’re embarking on a tightening cycle. The top five industry groups include sectors like Energy, Financials, and Consumer Staples. That also makes sense–cyclical or dividend paying categories that typically do better in rising rate environments.

Believe it or not, this chart makes me feel more calm (although we’ll cover spikes in energy prices at a later date…not a problem, yet). There was a looming feeling last year that things needed to come home to roost. And here we are…roosting.

Doves or Hawks, We All Must Leave the Nest

If the Fed is the nest, it’s telling us we need to fly off for our own good. Inflation runs too hot in the nest, risk is misjudged, and return expectations are feverishly high. This is a process we must go through to move into the next phase — that phase will be slower than the last one, but that doesn’t mean the cycle is ending. The recovery is growing up, not growing old.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov. Liz Young Thomas is a Registered Representative of SoFi Securities and Investment Advisor Representative of SoFi Wealth. Her ADV 2B is available at www.sofi.com/legal/adv.

SOSS22012701