Investing in IPOs: How It Works at SoFi

IPO investing is officially live! Now you can Invest in IPOs before they’re traded on a public market—only in the SoFi app. Want to see how it all works?

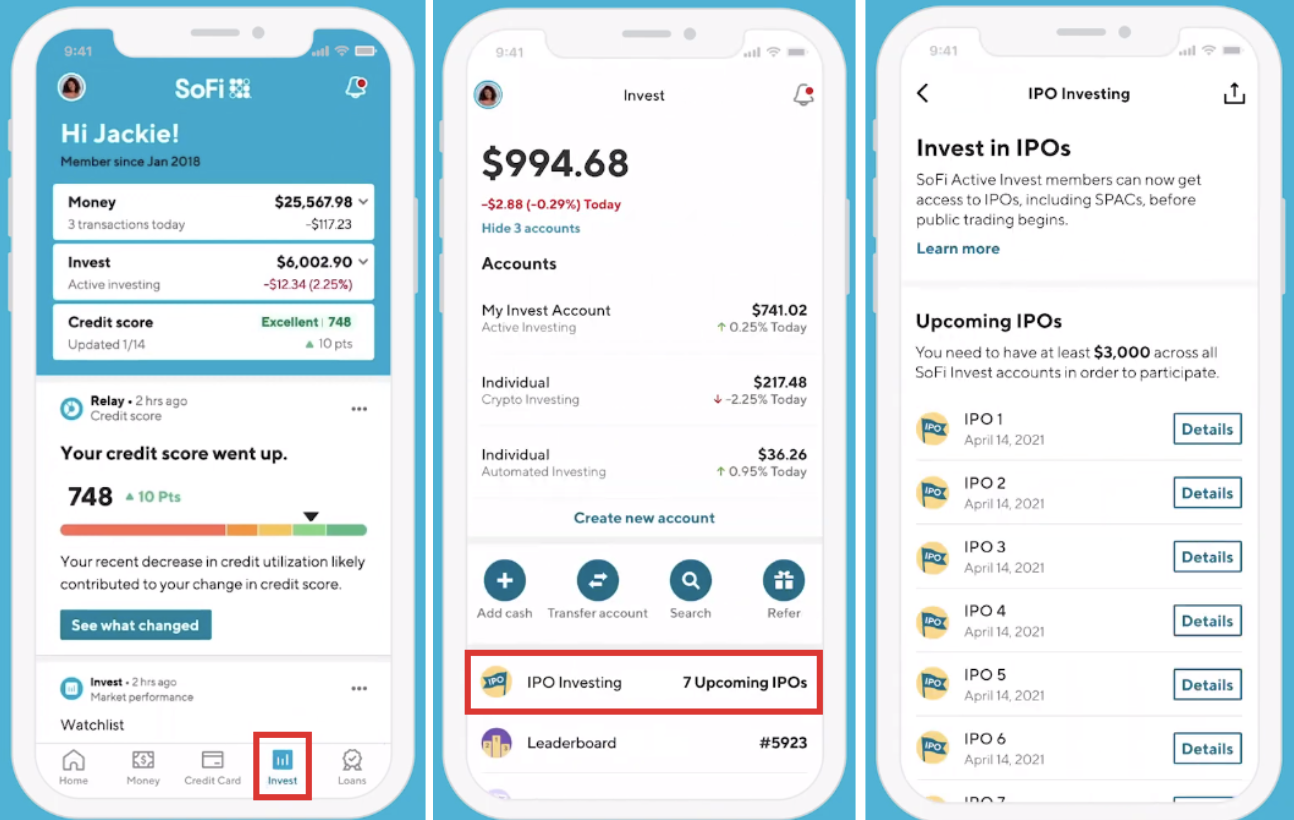

Once you’ve downloaded the SoFi app, opened and funded your SoFi Active Invest account (you must have at least $3,000 total account value across all of your SoFi Invest accounts in order to participate), click the Invest tab and look under IPO Investing.

To get started, select an IPO and submit your indication of interest (IOI). You’ll need to do this for every IPO you’re interested in. IOIs are like reservations. They’re non-binding, and you’ll have to officially confirm your order when it’s time.

There are a few basic eligibility questions you’ll need to answer before you’re allowed to participate. These are standard, and typical whenever you’re investing in IPOs.

Next, you enter the number of shares, or units, you are interested in purchasing. Read all the important notifications on the screen, review your inputs, and submit. You can now repeat this process for as many available IPOs as you want to participate in.

At this point, make sure you’ll have enough money available to purchase those shares when the time comes.

Then…you wait! A day before the IPO, we’ll notify you via push notification and email when it’s time to confirm your buy order(s). IPO dates are not guaranteed, but the SoFi app will always have the most up-to-date info. You only have a short window of time to confirm—so keep an eye out.

It’s important to remember that even after you confirm your order, you may not receive all the units you request. Only a small percentage of any IPOs is allocated to retail investors—and some IPOs have high demand. Learn all about our IPO allocation procedures here.

On the morning of IPO day, your shares will be allocated and will be available in your SoFi Active Invest account. To learn more about IPO investing, visit https://www.sofi.com/invest/ipo-investing/.

This is not an offer, or solicitation of any offer to buy or sell any security, investment or other product.

Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Past performance, historical returns, future projections, and statistical forecasts are no guarantee of future returns or future performance. The firm reserves the right to monitor and retain all incoming and outgoing communications as permitted by applicable law.

SoFi Invest refers to the three investment and trading platforms operated by Social Finance, LLC and its affiliates (described below). Individual customer accounts may be subject to the terms applicable to one or more of the platforms below.

1) Automated Investing and advisory services are provided by SoFi Wealth LLC, an SEC-Registered Investment Adviser (“Sofi Wealth“). Brokerage services are provided to SoFi Wealth LLC by SoFi Securities LLC.

2) Active Investing and brokerage services are provided by SoFi Securities LLC, Member FINRA/SIPC, (“Sofi Securities). Clearing and custody of all securities are provided by APEX Clearing Corporation.

3) Cryptocurrency is offered by SoFi Digital Assets, LLC, a FinCEN registered Money Service Business.

For additional disclosures related to the SoFi Invest platforms described above, including state licensure of Sofi Digital Assets, LLC, please visit legal.

*Investing in an Initial Public Offering (IPO) involves substantial risk, including the risk of loss. Further, there are a variety of risk factors to consider when investing in an IPO, including but not limited to, unproven management, significant debt, and lack of operating history. For a comprehensive discussion of these risks please refer to SoFi Securities’ IPO Risk Disclosure Statement. IPOs offered through SoFi Securities are not a recommendation and investors should carefully read the offering prospectus to determine whether an offering is consistent with their investment objectives, risk tolerance, and financial situation.

New offerings generally have high demand and there are a limited number of shares available for distribution to participants. Many customers may not be allocated shares and share allocations may be significantly smaller than the shares requested in the customer’s initial offer (Indication of Interest). For SoFi’s allocation procedures please refer to IPO Allocation Procedures.

Neither the Investment Advisor Representatives of SoFi Wealth, nor the Registered Representatives of SoFi Securities are compensated for the sale of any product or service sold through any SoFi Invest platform. Information related to lending products contained herein should not be construed as an offer or pre-qualification for any loan product offered by SoFi Lending Corp and/or its affiliates.