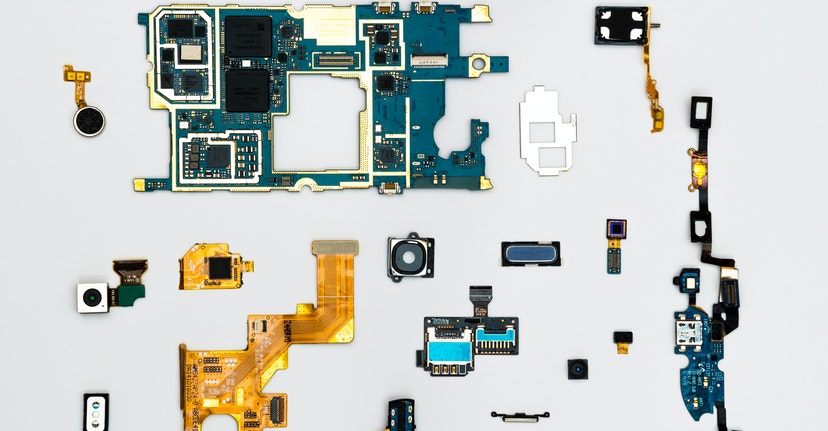

Global Chip Industry Planning Huge Expansion As Shortage Affects Consumers

Business Is Booming for Chip Makers As Revenue Soars

The semiconductor industry broke a record in 2021 with revenue exceeding $500 billion for the first time. According to some calculations, that’s larger than the entire smartphone market. Industry leaders like Samsung and Intel (INTC) said they expect to post similarly strong numbers in 2022.

Market observers say the pandemic helped grow some digital trends and make them more mainstream, such as streaming TV and movies or playing video games. Many businesses adopted additional digital tools like QR code scanners, increasing demand for chips. Chip sales rose by 25% last year from 2020, and factories working on a 24/7 basis couldn’t keep pace with the growth.

Consumers Feel The Pain Amid Chip Shortage

Surging demand for chips and producer inability to match that from an output perspective naturally drove up prices for end users and consumers. As supply-chain pressures and the chip shortage set in over the past two years, everything from cars to smartphones and appliances started to cost more. The shortage persists in 2022, with officials saying US manufacturers have close to a five-day supply of chips and average global wait times are close to 25 weeks.

While the industry’s latest efforts aimed at ramping up production could take years to have an impact, analysts note this might lead to an eventual oversupply. To that end, some point to the history of boom-bust cycles for the chip industry. Still, others argue the modern consumer is more dependent on chips than ever, meaning more chips will be needed in the future for a range of devices.

Eyeing $1 Trillion, Chip Industry Lays Out Growth Plans

Chip industry executives predict the global chip business could top $1 trillion within the next 10 years. A number of major investments indicate the sector’s expansion plans. For one, Intel announced what they say could become the world’s largest chip factory in Columbus, Ohio.

The US government has pushed for companies to invest further in domestic chip manufacturing, as production increasingly shifts overseas. Meanwhile, Intel rival Taiwan Semiconductor Manufacturing (TSM) is planning for a facility in Arizona as well as one in Japan. In another sign of what’s to come for chip production, semiconductor equipment maker ASML Holding NV (ASML) says it is busy selling new machines. In an ever-expanding and relevant market directly affecting consumers, it could take years to know whether these production increases will offset rising prices — and how effectively they will do so.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Advisor

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

SOSS22020102