Table of Contents

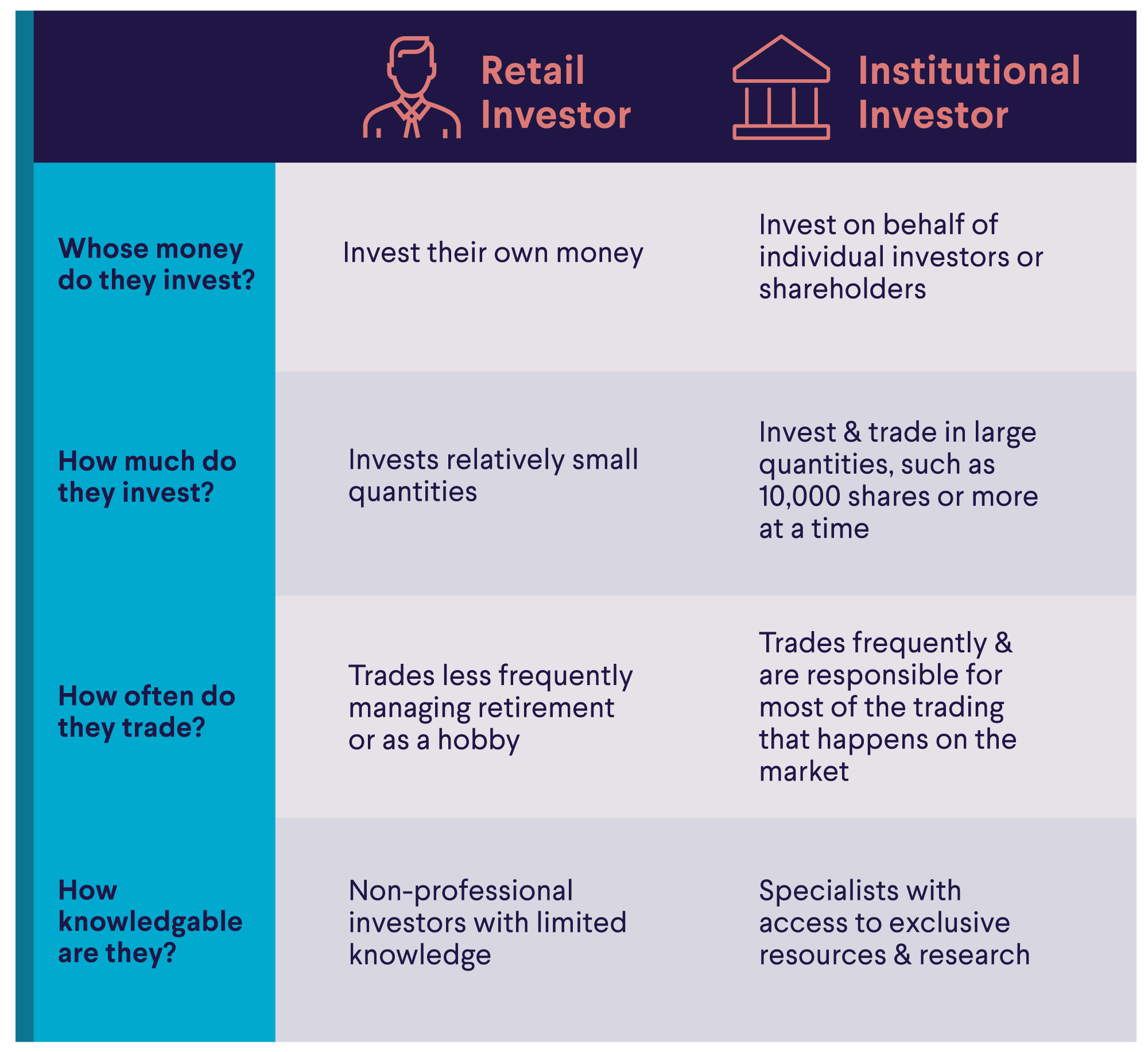

Retail investors are individuals, typically not professional, who invest their own money through a personal brokerage or retirement account. Institutional investors are financial organizations that trade investments in large quantities, on behalf of others (e.g., pension funds, mutual funds, hedge funds, and so on).

While size and scale are two of the main differences between institutional vs. retail investors, there are other distinctions. Retail investors are afforded certain legal protections; institutional investors may have the upside in terms of research and access to capital.

In addition, retail investors typically pay higher fees for investment products, compared to institutions, which generally benefit from taking larger positions.

Key Points

• Retail investors are individual investors who typically invest their own money for their personal goals.

• Institutional investors include large organizations such as banks, mutual funds, and pension funds, which invest large amounts of capital on behalf of others.

• Institutional investors place trades on a much larger scale, which can impact market movements.

• Retail investors may be impacted by institutional trades, but the reverse rarely occurs, although there can be exceptions.

• Institutional investors typically have access to more capital and proprietary data and analysis that retail investors do not.

Who Is Considered a Retail Investor?

Any non-professional individual buying and selling securities such as stocks or mutual funds and exchange traded funds (ETFs) — whether investing online or in a traditional brokerage or other type of account — is typically a retail investor.

The parent who invests in their child’s 529 college savings plan, or the employee who contributes to their 401(k) are both considered retail investors.

So, in this case the term “retail” generally refers to an individual trading on their own behalf, not on behalf of a larger pool of investors. Retail here references the purchase and selling of investments in relatively small quantities.

Who Is Classified as an Institutional Investor?

By comparison, institutional investors make investment decisions on behalf of large pools of individual investors or shareholders. In general, institutional investors trade in large quantities, such as trading stocks by 10,000 shares or more at a time.

The professionals who do this large-scale type of investing typically have access to investments not available to retail investors (such as special classes of shares that come with different cost structures). By virtue of their being part of a larger institution, this type of investor usually has a larger pool of capital to buy, trade, and sell with.

Institutional investors are responsible for most of the trading that happens on the market. Examples of institutional investors include commercial banks, pension funds, mutual funds, hedge funds, endowments, insurance companies, and real estate investment trusts (REIT).

Recommended: Stock Market Basics

What Are the Differences Between Institutional Investors vs Retail Investors?

The main differences between institutional and retail investors include:

• Institutional investors invest on behalf of a large number of constituents (e.g., a mutual fund or municipal pension fund); retail investors are individuals who invest for themselves (e.g., in an IRA or a self-directed brokerage account).

• Size (large institutions vs. individuals) and scale of investments.

• Institutional investors typically have access to professional research and industry resources.

• Retail investors are protected by certain regulations that don’t apply to institutional investors.

| Institutional Investors | Retail Investors |

|---|---|

| Professionals and large companies | Non-professional individuals |

| Invest in large quantities | Invest in small quantities |

| Trades less frequently; may manage retirement or invest as a hobby | Invest for themselves |

| Access to industry-level sources, research | DIY |

| Access to preferred share classes and pricing | Access to retail shares and pricing |

There are very few similarities between institutional vs. retail investors, except that both parties tend to seek returns while minimizing risk factors where possible.

Do Institutional or Retail Investors Get the Highest Returns?

There are no crystal balls on Wall Street, as they say, so there’s no guaranteed way to predict whether institutional investors always get higher returns vs. retail investors.

That said, some institutional investors may have the edge in that they have access to industry-level research, as well as powerful technology and computer algorithms that typically enable them to make faster trades and more profitable calculations.

Does that mean institutional investors always come out ahead? In fact, retail investors who have a longer horizon also have a chance at substantial returns over time, although there are no guarantees on either side.

Get up to $1,000 in stock when you fund a new Active Invest account.*

Access stock trading, options, alternative investments, IRAs, and more. Get started in just a few minutes.

How Many Retail Investors Are There?

In the U.S., it’s fairly common to be a retail investor. About 62% of Americans say they own stock, according to a 2025 Gallup poll, meaning they own individual stocks, stock mutual funds, or they hold stock in a self-directed 401(k) or IRA.

Examples of retail investors include people who manage their retirement accounts online (e.g., an IRA) and those who trade stocks as a hobby.

Because individual investors are generally thought to be more prone to emotional behavior than their professional counterparts (and typically don’t have access to the resources and research of larger institutions), they may be exposed to higher levels of risk. Thus the Security Exchange Commission (SEC) provides certain protections to retail investors.

For example, the 2019 Regulation Best Interest rule states that broker-dealers are required to act in the best interest of a retail customer when making a recommendation of a securities transaction or investment strategy. This federal rule is intended to ensure that broker-dealers aren’t allowed to prioritize their own financial interests at the expense of the customer.

Another protection provided to retail investors is that investment advisors and broker-dealers must provide a relationship summary that covers services, investment fees and costs, conflicts of interest, legal standards of conduct, and more to new clients.

Types of Institutional Investors

The most common institutional investors are listed below.

1. Commercial Banks

Commercial banks are the “main street” banks many people are familiar with, such as Wells Fargo, Citibank, JP Morgan Chase, Bank of America, TD Bank, and countless others. Along with providing retail banking services, such as savings accounts and checking accounts, large banks are also institutional investors.

These large corporations have entire teams dedicated to investing in different markets: e.g., global markets, bond markets, socially responsible investing, and so on.

2. Endowment Funds

Typically connected with universities and higher education, endowment funds are often created to help sustain these nonprofit organizations. Churches, hospitals, nonprofits, and universities generally have endowment funds, whose funds often derive from donations.

Endowment funds generally come with certain restrictions, and have an investment policy that dictates an investment strategy for the manager to follow. This might include stipulations about how aggressive to be when trying to meet return goals, and what types of investments are allowed (some endowment funds avoid controversial holdings like alcohol, firearms, tobacco, and so on).

Another component is how withdrawals work; often, the principal amount invested stays intact while investment income is used for operations or new constructions.

3. Pension Funds

Pension funds generally come in two flavors:

• Defined contribution plans, such as 401(k)s or 403(b)s, where employees contribute what they can to these tax-deferred accounts.

• Defined benefit plans, or pensions, where retirees get a fixed income amount, regardless of how the fund does.

Employers that offer defined-benefit pension plans are becoming less common in the U.S. Where they do exist, they’re often linked to labor unions or the public sector: e.g., a teachers union or auto workers union may offer a pension.

Public pension funds follow the laws defined by state constitutions. Private pension plans are subject to the Employee Retirement Income Security Act of 1974 (ERISA); this act defines the legal rights of plan participants.

As for how a pension invests, it depends. ERISA does not define how private plans must invest, other than requiring that the plan sponsors must be fiduciaries, meaning they put the financial interest of the account holders first.

4. Mutual Funds

As defined by the Securities and Exchange Committee (SEC), mutual funds are companies that pool money from many investors and invest in securities such as bonds, stocks, and short-term debt. Mutual funds are thus considered institutional investors, and are known for offering diversification, professional management, affordability, and liquidity.

Typical mutual fund offerings include money market funds, bond funds, stock funds, index funds, actively managed funds, and target date funds.

The last category here is often designed for retail investors who are planning for retirement. The asset mix of these target date funds, sometimes known as target funds or lifecycle funds, shifts over time to become more conservative as the investor’s target retirement date approaches.

5. Hedge Funds

Like mutual funds, hedge funds pool money from investors and place it into securities and other investments. The difference between these two types of funds is that hedge funds are considered private equity funds, are considered high-risk vehicles, and are only available to accredited investors.

Because hedge funds use strategies and investments that chase higher returns, they also carry a greater risk of losses — similar to high-risk stocks. In general, hedge funds also have higher fees and higher minimum investment requirements. So, they tend to be more popular with wealthier investors and other institutional investors.

6. Insurance Companies

Perhaps surprisingly, insurance companies can also be institutional investors. They might offer products such as various types of annuities (fixed, variable, indexed), as well as other life insurance products which are invested on behalf of the investor, e.g. whole life or universal life insurance policies.

The Takeaway

Institutional investors may be larger, more powerful, and run by professionals — whereas retail investors are individuals who aren’t trained investment experts — but it’s important to remember that these two camps can and do overlap. Institutional investors that run pension funds, mutual funds, and insurance companies, for example, serve retail investors by investing their money for retirement and other long-term goals. While retail investors still have the ability to invest their own money for their own goals.

Invest in what matters most to you with SoFi Active Invest. In a self-directed account provided by SoFi Securities, you can trade stocks, exchange-traded funds (ETFs), mutual funds, alternative funds, options, and more — all while paying $0 commission on every trade. Other fees may apply. Whether you want to trade after-hours or manage your portfolio using real-time stock insights and analyst ratings, you can invest your way in SoFi's easy-to-use mobile app.

FAQ

What are the different types of investors?

Institutional investors are big companies with teams of professional investment managers who invest other people’s money. Retail investors are individuals who typically manage their own investment (e.g. for retirement or college savings).

What percentage of the stock market is made up of institutional investors?

The vast majority of stock market investors are institutional investors. Because they trade on a bigger scale than retail investors, institutional trades can impact the markets.

Are institutional or retail investment strategies better?

Institutional investors have access to more sophisticated research and technology compared with retail investors. Thus their strategies may be considered more complex. But it’s hard to compare outcomes, as both groups are exposed to different levels of risk.

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

For disclosures on SoFi Invest platforms visit SoFi.com/legal. For a full listing of the fees associated with Sofi Invest please view our fee schedule.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Exchange Traded Funds (ETFs): Investors should carefully consider the information contained in the prospectus, which contains the Fund’s investment objectives, risks, charges, expenses, and other relevant information. You may obtain a prospectus from the Fund company’s website or by emailing customer service at [email protected]. Please read the prospectus carefully prior to investing.

Mutual Funds (MFs): Investors should carefully consider the information contained in the prospectus, which contains the Fund’s investment objectives, risks, charges, expenses, and other relevant information. You may obtain a prospectus from the Fund company’s website or clicking the prospectus link on the fund's respective page at sofi.com. You may also contact customer service at: 1.855.456.7634. Please read the prospectus carefully prior to investing.Mutual Funds must be bought and sold at NAV (Net Asset Value); unless otherwise noted in the prospectus, trades are only done once per day after the markets close. Investment returns are subject to risk, include the risk of loss. Shares may be worth more or less their original value when redeemed. The diversification of a mutual fund will not protect against loss. A mutual fund may not achieve its stated investment objective. Rebalancing and other activities within the fund may be subject to tax consequences.

Investment Risk: Diversification can help reduce some investment risk. It cannot guarantee profit, or fully protect in a down market.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

This article is not intended to be legal advice. Please consult an attorney for advice.

Third Party Trademarks: Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®

SOIN-Q325-131