How Much a $300,000 Mortgage Will Cost You

A $300,000 mortgage payment could range from about $1,700 to more than $2,700 per month, depending on your loan’s interest rate, term, and other factors. When you’re shopping for a home, it’s easy to get fixated on how much you can borrow and finding houses in your price range. But understanding how much your home loan could cost, upfront and over time, could be just as important to your success as a homeowner. Read on for a look at what some of the expenses of getting a home mortgage might include.

Table of Contents

- How Much Can a $300,000 Mortgage Cost?

- What Are the Monthly Payments for a $300,000 Mortgage?

- How Much Interest Will You Pay on a $300,000 Mortgage?

- How Does Amortization Work for a $300,000 Mortgage?

- Where Can a Borrower Get a $300,000 Mortgage?

- How to Get a $300,000 Mortgage

- How Much House Can You Afford Quiz

- FAQ

Key Points

• Monthly payments for a $300,000 mortgage can range from about $1,700 to over $2,700, influenced by the interest rate and loan term.

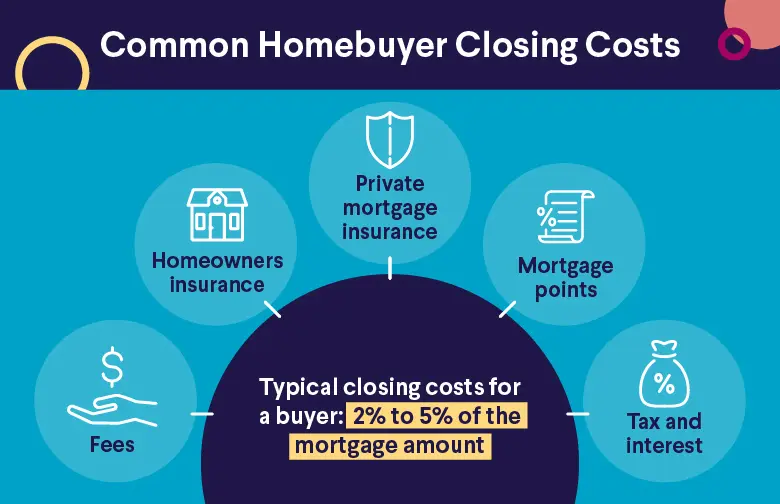

• Closing costs for this mortgage typically range from 2% to 5% of the loan amount.

• Principal and interest are the main components of monthly mortgage payments.

• An escrow account may be used by lenders to ensure timely payment of property taxes and homeowners insurance.

• The total interest paid on a $300,000 mortgage can vary significantly, from $185,367 to $418,527, depending on the interest rate and term of the loan.

How Much Can a $300,000 Mortgage Cost?

You can expect to run into a variety of costs when you take out a home loan. Most of the time these expenses can be broken down into three main categories:

Closing Costs

Closing costs are one-time costs that typically include loan processing fees, third-party services such as appraisals and title insurance, and government fees and taxes. You also may choose to pay discount points upfront on your loan to lower the interest rate. Closing costs can vary significantly, but they generally range from 2% to 5% of the loan amount.

Monthly Payments

The payments borrowers make monthly over the life of a mortgage usually include two main components:

• Principal: This is the part of the mortgage payment that goes directly toward repaying the amount you borrowed.

• Interest: This is the fee you pay the lender for borrowing money. The amount of interest you’ll pay each month will be calculated by multiplying your interest rate by your remaining loan balance.

Escrow

Your lender may collect and hold money in an escrow account to ensure that your homeowners insurance and property taxes are paid on time. The cost of living by state can vary widely and this is due in large part to taxes.

It’s important to pay attention to all your costs as you go through the homebuying process. You may be able to negotiate the amount of some of these expenses, which means doing some comparison shopping could help you save.

First-time homebuyers can

prequalify for a SoFi mortgage loan,

with as little as 3% down.

Questions? Call (888)-541-0398.

What Are the Monthly Payments for a $300,000 Mortgage?

To keep things simple, let’s eliminate any costs that might be associated with an escrow account to get a basic estimate of what a $300,000 mortgage payment might be each month.

Let’s say you wanted to buy a home for $340,000, and you had a down payment of $40,000. If your lender offered you a $300,000 loan with a 15-year fixed-rate term at a 6.00% interest rate, you could expect your monthly payment — principal and interest — to be about $2,531. If you took out a 30-year fixed-rate mortgage with a 6.00% APR, your payment could be about $1,796.

Here are some more examples that show what the difference can be for a 15-year fixed-rate loan vs. a 30-year fixed-rate loan, using SoFi’s Mortgage Calculator.

| Interest Rate | Payment with 15-year Loan | Payment with 30-Year Loan |

| 5.50% | $2,451 | $1,703 |

| 6.50% | $2,613 | $1,896 |

| 7.50% | $2,781 | $2,097 |

Recommended: Home Loan Help Center

How Much Interest Will You Pay on a $300,000 Mortgage?

The interest rate your lender gives you can make a big difference in the overall cost of your mortgage, and so can the mortgage term you choose. With a $300,000 home loan at a 7.00% rate, for example, the total amount you pay in interest could range from $185,367 to $418,527, depending on the length of the loan (15 vs. 30 years).

Spreading out your mortgage payments over a longer term can lower your monthly payment. But keep in mind that if you make this choice, you can expect to pay more for the loan overall. You can get more specific information by plugging various scenarios into a home affordability calculator.

💡 Quick Tip: If you refinance your mortgage and shorten your loan term, you could save a substantial amount in interest over the lifetime of the loan.

How Does Amortization Work for a $300,000 Mortgage?

Though your payment will remain the same every month (if you have a fixed-rate home mortgage loan), you can expect the amount you pay toward interest vs. principal to change over the life of your loan. In the first years, most of your payment will go toward interest. But as your balance goes down, more of your payment will go toward principal.

Your lender can provide you with a repayment schedule, or mortgage amortization schedule, that illustrates how the proportions will change over the length of your loan. Here’s a look at what the amortization schedules for a $300,000 mortgage with 30- and 15-year terms might look like. (Remember that your payments could include other costs besides principal and interest.)

Amortization Schedule, 30-Year Loan at 7.00% APR

| Year | Amount Paid | Interest Paid | Principal Paid | Remaining Balance |

| 1 | $23,950.89 | $20,903.46 | $3,047.43 | $296,952.57 |

| 2 | $23,950.89 | $20,683.16 | $3,267.73 | $293,684.84 |

| 3 | $23,950.89 | $20,446.94 | $3,503.95 | $290,180.89 |

| 4 | $23,950.89 | $20,163.64 | $3,757.25 | $286,423.64 |

| 5 | $23,950.89 | $19,922.02 | $4,028.87 | $282,394.77 |

| 6 | $23,950.89 | $19,630.78 | $4,320.11 | $278,074.66 |

| 7 | $23,950.89 | $19,318.48 | $4,632.41 | $273,442.24 |

| 8 | $23,950.89 | $18,983.60 | $4,967.29 | $268,474.95 |

| 9 | $23,950.89 | $18,624.51 | $5,326.38 | $263,148.57 |

| 10 | $23,950.89 | $18,239.47 | $5,711.42 | $257,437.15 |

| 11 | $23,950.89 | $17,826.59 | $6,124.30 | $251,312.85 |

| 12 | $23,950.89 | $17,383.86 | $6,567.03 | $244,745.82 |

| 13 | $23,950.89 | $16,909.13 | $7,041.76 | $237,704.06 |

| 14 | $23,950.89 | $16,400.08 | $7,550.81 | $230,153.25 |

| 15 | $23,950.89 | $15,854.23 | $8,096.66 | $222,056.60 |

| 16 | $23,950.89 | $15,268.93 | $8,681.96 | $213,374.63 |

| 17 | $23,950.89 | $14,651.31 | $9,309.58 | $204,065.05 |

| 18 | $23,950.89 | $13,968.32 | $9,982.57 | $194,082.48 |

| 19 | $23,950.89 | $13,246.67 | $10,704.22 | $183,378.26 |

| 20 | $23,950.89 | $12,472.87 | $11,478.02 | $171,900.23 |

| 21 | $23,950.89 | $11,643.12 | $12,307.77 | $159,592.46 |

| 22 | $23,950.89 | $10,753.39 | $13,197.50 | $146,394.96 |

| 23 | $23,950.89 | $9,799.34 | $14,151.55 | $132,243.41 |

| 24 | $23,950.89 | $8,776.32 | $15,174.57 | $117,068.84 |

| 25 | $23,950.89 | $7,679.35 | $16,271.54 | $100,797.31 |

| 26 | $23,950.89 | $6,503.08 | $17,447.81 | $83,349.50 |

| 27 | $23,950.89 | $5,241.78 | $18,709.11 | $64,640.39 |

| 28 | $23,950.89 | $3,889.29 | $20,061.59 | $44,578.79 |

| 29 | $23,950.89 | $2,439.04 | $21,511.85 | $23,066.94 |

| 30 | $23,950.89 | $883.95 | $23,066.94 | $0 |

Amortization Schedule, 15-Year Loan at 7.00% APR

| Year | Amount Paid | Interest Paid | Principal Paid | Remaining Balance |

| 1 | $32,357.82 | $20,628.42 | $11,729.39 | $288,270.61 |

| 2 | $32,357.82 | $19,780.51 | $12,577.31 | $275,693.29 |

| 3 | $32,357.82 | $18,871.29 | $13,486.53 | $262,206.77 |

| 4 | $32,357.82 | $17,896.47 | $14,461.47 | $247,745.30 |

| 5 | $32,357.82 | $16,850.93 | $15,506.89 | $232,238.41 |

| 6 | $32,357.82 | $15,729.93 | $16,627.88 | $215,610.52 |

| 7 | $32,357.82 | $14,527.90 | $17,829.92 | $197,780.60 |

| 8 | $32,357.82 | $13,238.98 | $19,118.84 | $178,661.76 |

| 9 | $32,357.82 | $11,856.87 | $20,500.94 | $158,160.82 |

| 10 | $32,357.82 | $10,374.86 | $21,982.96 | $136,177.86 |

| 11 | $32,357.82 | $8,785.71 | $23,572.11 | $112,605.75 |

| 12 | $32,357.82 | $7,081.68 | $25,276.14 | $87,329.61 |

| 13 | $32,357.82 | $5,254.46 | $27,103.35 | $60,226.26 |

| 14 | $32,357.82 | $3,295.16 | $29,062.66 | $31,163.60 |

| 15 | $32,357.82 | $1,194.22 | $31,163.60 | $0 |

Where Can a Borrower Get a $300,000 Mortgage?

Homebuyers have a few different choices when deciding where to go for a loan, including online banks and lenders, and traditional banks and credit unions. Rates and terms can vary from one lender to the next, so it can be a good idea to shop around for a mortgage that fits your specific needs and goals.

Before you start looking for quotes, though, you may want to look at the different types of mortgage loans you might qualify for. Would you be better off with a conventional or government-backed mortgage? Are you eligible for a VA loan or first-time homebuyer assistance? How many years do you want to make payments on your loan, and would you prefer a fixed or adjustable rate?

Once you settle on some loans that might work for you, you may want to read online reviews of the lenders you’re considering. A good old-fashioned pros-and-cons list could also help you evaluate the possibilities.

Get matched with a local

real estate agent and earn up to

$9,500‡ cash back when you close.

Pair up with a local real estate agent through HomeStory and unlock up to

$9,500 cash back at closing.‡ Average cash back received is $1,700.

How to Get a $300,000 Mortgage

Whether you’re a first-time homebuyer or you’ve done this before, the home-buying and mortgage process can be a little daunting. By breaking it down into some manageable steps, you may be able to make things a little easier.

Start by Determining How Much You Can Afford

Looking at your income, debt, monthly spending, credit status, and how much you’ve saved for a down payment can be a good starting point when you’re trying to figure out how much house you can afford. This can help you decide how much of a down payment and monthly payment you can handle.

Research Different Loans and Lenders

Once you know what you can afford to spend, you can start looking for the loan type, interest rate, loan term, and lender that meet your needs. The mortgage professional you choose to work with should be able to walk you through your options and help you evaluate their pros and cons.

Get Preapproved

Once you’ve chosen a loan and lender, it can be a good idea to go through the mortgage preapproval process. Getting a letter from your lender that says you’re preapproved for a certain loan amount can let sellers know you’re a serious buyer. (This could be especially helpful if you find yourself in a bidding war.)

Go House Hunting

With your preapproval letter in hand, you can start your home search — and potentially make an offer on a house. And because you’re prepared and know how much you can afford, you and your real estate agent can target homes in an appropriate price range.

Submit a Full Mortgage Application

When you find a home and you’re ready to seal the deal, you can work with your lender to fill out a formal loan application. Be ready: Your lender will likely ask for more financial information and documentation before approving the loan.

Prepare for Closing

While you’re waiting for your final loan approval and a closing date from your lender, you can shop for homeowners insurance, get a home inspection, and make sure you have all the money you’ll need for your down payment and closing costs.

Take Ownership of Your New Home

At the closing, you’ll be asked to sign a lot of paperwork, and you’ll hand over the necessary funds to make the purchase. Finally — congratulations! — you’ll get the keys to your new home.

Recommended: Tips to Qualify for a Mortgage

How Much House Can You Afford Quiz

The Takeaway

Researching the different costs you might have to pay when taking out a $300,000 mortgage could help you avoid any unpleasant surprises during the homebuying process and improve your chances of sticking to your budget. The decisions you make about the type of loan you get, the interest rate, loan term, and other costs will all impact how much you pay every month — and what you’ll pay for the loan overall. So it can be a good idea to run the numbers and evaluate your options before you decide on a particular loan.

Looking for an affordable option for a home mortgage loan? SoFi can help: We offer low down payments (as little as 3% - 5%*) with our competitive and flexible home mortgage loans. Plus, applying is extra convenient: It's online, with access to one-on-one help.

FAQ

How much is a $300,000 mortgage payment per month?

The monthly payment for a $300,000 mortgage could range from about $1,700 a month to more than $2,700. Your payment will depend on several factors, including your interest rate and loan term.

How much income is required for a $300,000 mortgage?

An annual income in the $90,000-$100,000 range would qualify for a $300,000 mortgage as long as the borrower has few other debts. Mortgage lenders don’t make their decisions based on salary alone. You can expect your lender to look at several factors, including your debt, your credit rating and other factors before deciding how much you’re qualified to borrow.

How much is a down payment on a $300,000 mortgage?

If you borrowed $300,000 and were putting down 20% on the property to avoid having to pay for mortgage insurance, your down payment would be around $75,000 (for a home priced at $375,000). But many borrowers put down less than 20%. A down payment of 3% on a home priced at $310,000 would cost you less than $10,000, and in this scenario you would also have a $300,000 mortgage.

Can I afford a $300,000 mortgage on a $70,000 salary?

If you can keep your monthly debt payments (housing costs and other debts combined) below $2,100 a month, you might be able to afford a $300,000 mortgage on a $70,000 salary, but it could be a stretch. How much mortgage you can afford usually depends on your income and other debts you may have, such as car loans, credit cards, and student loans.

Photo credit: iStock/irina88w

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

‡Up to $9,500 cash back: HomeStory Rewards is offered by HomeStory Real Estate Services, a licensed real estate broker. HomeStory Real Estate Services is not affiliated with SoFi Bank, N.A. (SoFi). SoFi is not responsible for the program provided by HomeStory Real Estate Services. Obtaining a mortgage from SoFi is optional and not required to participate in the program offered by HomeStory Real Estate Services. The borrower may arrange for financing with any lender. Rebate amount based on home sale price, see table for details.

Qualifying for the reward requires using a real estate agent that participates in HomeStory’s broker to broker agreement to complete the real estate buy and/or sell transaction. You retain the right to negotiate buyer and or seller representation agreements. Upon successful close of the transaction, the Real Estate Agent pays a fee to HomeStory Real Estate Services. All Agents have been independently vetted by HomeStory to meet performance expectations required to participate in the program. If you are currently working with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®. A reward is not available where prohibited by state law, including Alaska, Iowa, Louisiana and Missouri. A reduced agent commission may be available for sellers in lieu of the reward in Mississippi, New Jersey, Oklahoma, and Oregon and should be discussed with the agent upon enrollment. No reward will be available for buyers in Mississippi, Oklahoma, and Oregon. A commission credit may be available for buyers in lieu of the reward in New Jersey and must be discussed with the agent upon enrollment and included in a Buyer Agency Agreement with Rebate Provision. Rewards in Kansas and Tennessee are required to be delivered by gift card.

HomeStory will issue the reward using the payment option you select and will be sent to the client enrolled in the program within 45 days of HomeStory Real Estate Services receipt of settlement statements and any other documentation reasonably required to calculate the applicable reward amount. Real estate agent fees and commissions still apply. Short sale transactions do not qualify for the reward. Depending on state regulations highlighted above, reward amount is based on sale price of the home purchased and/or sold and cannot exceed $9,500 per buy or sell transaction. Employer-sponsored relocations may preclude participation in the reward program offering. SoFi is not responsible for the reward.

SoFi Bank, N.A. (NMLS #696891) does not perform any activity that is or could be construed as unlicensed real estate activity, and SoFi is not licensed as a real estate broker. Agents of SoFi are not authorized to perform real estate activity.

If your property is currently listed with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®.

Reward is valid for 18 months from date of enrollment. After 18 months, you must re-enroll to be eligible for a reward.

SoFi loans subject to credit approval. Offer subject to change or cancellation without notice.

The trademarks, logos and names of other companies, products and services are the property of their respective owners.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

Third Party Trademarks: Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®

Checking Your Rates: To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. However, if you choose a product and continue your application, we will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and may affect your credit.

SOHL-Q425-187

Read more