Top Story

UPS (UPS) could experience the largest single-employer strike in US history within 8 eight weeks.

The logistics company helps move roughly 6% of the nation’s GDP. But if a deal isn’t reached by August 1, it might cease to move at all. Here’s what that could mean for the economy.

US stocks finished higher Tuesday on the back of positive inflation numbers

• Headline CPI for the month of May came in at 4%, the lowest in two years, and below expectations of 4.1%. Meanwhile, core CPI for May was in line with projections at 5.3%. While the overall inflation picture pointed to an easing of consumer prices, shelter, used vehicles, and food prices all headed higher, and the month-over-month inflation rate increased 0.4%. Nevertheless, markets are now pricing a roughly 95% chance the Fed will not raise rates at its upcoming meeting.

• OpenAI CEO Sam Altman believes the world wants efficient AI models, and that the market will deliver. He stated the company is focusing on making AI as affordable as possible and driving the cost of intelligence down. Altman also suggested China should take the lead in AI regulation and South Korea should lead AI chip production.

• OPEC has kept its forecast for global oil demand growth in 2023 steady for a fourth consecutive month. It predicts a rise of 2.35 million barrels per day, or 2.4%. However, the organization has warned that the world economy faces rising uncertainty and slower growth in the second half of the year due to high inflation, elevated key interest rates, and tight labor markets. The report also showed OPEC's oil production fell in May, reflecting the impact of earlier output cuts.

What to be on the lookout for today

• The Federal Reserve is set to announce its latest interest rate decision. After raising interest rates for 10 months straight, the market overwhelmingly expects the Fed will hold off on a rate hike for June.

• Anterix (ATEX) will report its latest quarterly results to investors. Wall Street will look to hear more about the private broadband company’s recent partnership with the Lower Colorado River Authority.

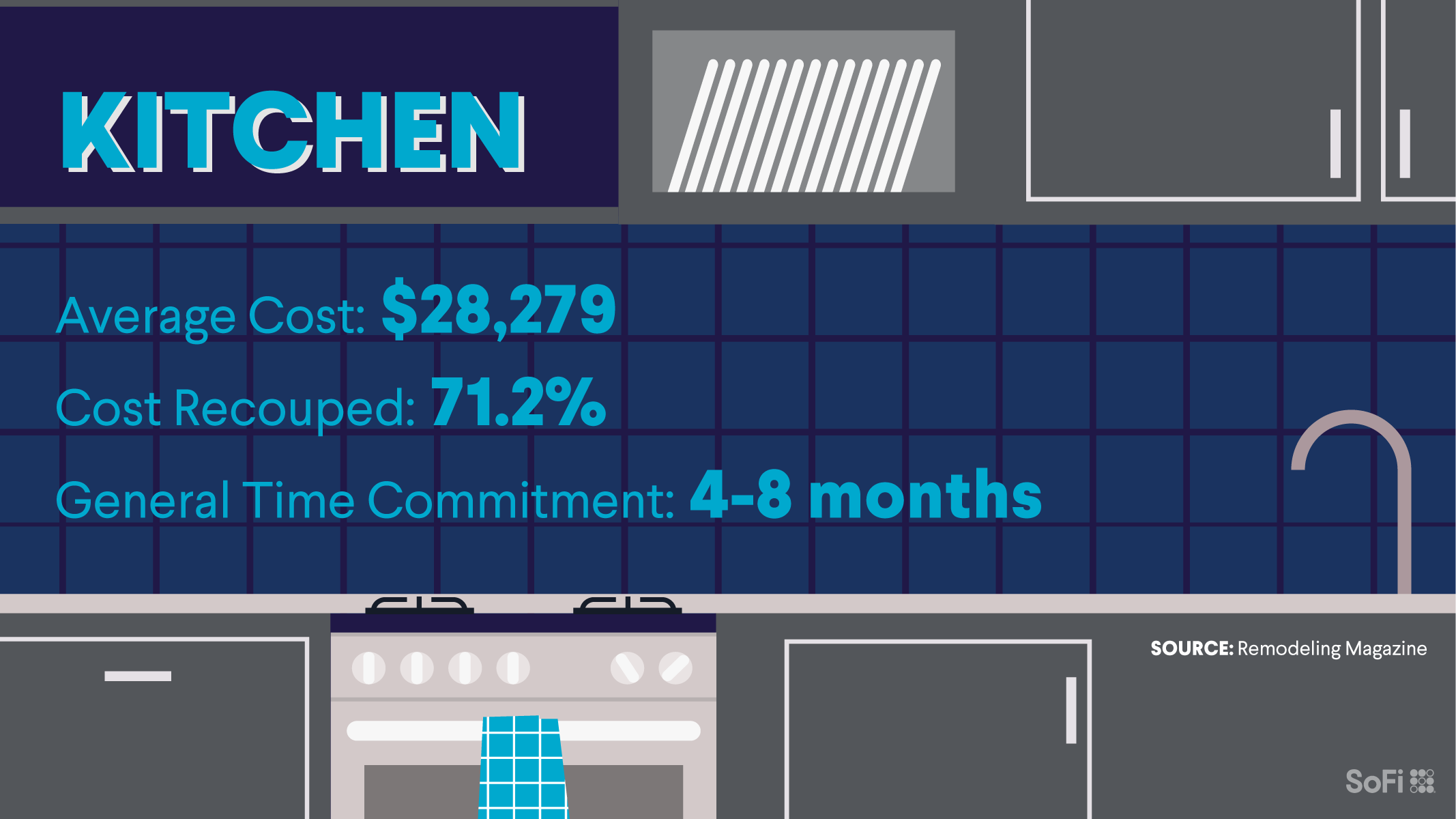

Smart home renovating: Upgrade your kitchen

The kitchen is considered the heart of the home and, with the right updates, you can do a great job of increasing your home’s value.

• Research what’s trending and then resurface or repaint cabinets and swap in new hardware.

• Clean up those countertops. If they are dated or damaged, redoing them can be a moneywise investment. Can’t afford stone? There are many tile, engineered materials, and epoxy options.

• Stainless-steel appliances from a trusted brand name are a good option if commercial ones are too pricey.

• Need a major overhaul? See if a home equity line of credit (HELOC) can provide funding at an affordable rate.

There are a few strategies you can use to get the updates you crave, without emptying your pockets. Here’s 9 ways to keep inflation from ruining your kitchen reno budget.

Today’s top stories

Cases of check fraud increased by 94% from 2021 to 2022. Luckily, in 2023, there are more ways than ever to avoid using checks. Next time you need to send money, be sure to protect yourself by taking these 3 steps. Read more >> More than a quarter of US households believe they’re better prepared for retirement than they really are. A new report shows 28% of households are at risk of financial shortfall in retirement. Are you prepared for your golden years? Read more >> Your basic kitchen remodel can make a large difference in your home’s worth. Whether it’s marble countertops or new flooring, fixing up your kitchen can be a lucrative home investment. Read more >>Not-so-breaking news

-

AI startup Synthesia just raised $90 million from a host of investors, including chip giant NVIDIA (NVDA). The digital media platform aims to enable users to easily create AI-generated videos.

-

The FTC has asked a US court to block Microsoft’s (MSFT) acquisition of Activision Blizzard (ATVI). The regulator is concerned the $69 billion acquisition could reduce competition in the gaming industry.

-

Accenture (ACN) is investing $3 billion over three years into its data and AI practice. This investment will double the number of the company’s employees working on AI.

-

Bunge (BG) and Viterra are merging to create an agricultural trading giant valued at $34 billion. As two of the largest food producers in their respective industries, this merger is likely to draw regulatory scrutiny.

-

Toyota (TM) claims its future EVs will have a range of over 600 miles. That would be about double the range of existing electric vehicles on the market.

Financial planner tip of the day

“As you work your way toward a down payment for a house, setting a goal can be a sound step toward making it a reality. A mortgage calculator can help you estimate how much you can borrow, play with different down payment options, and view different monthly mortgage payment options (how much your monthly mortgage payments will be).”

Brian Walsh, CFP® at SoFi