Thursday,

April 6, 2023

Market recap

Dow Jones

33,482.72

-80.34 (-0.24%)

S&P 500

4,090.38

-10.22 (-0.25%)

Nasdaq

11,996.86

-129.47 (-1.07%)

Top Story

Many millennials entered the housing market during the Great Recession, and continue to face steep competition when trying to buy a home. New data shows this competition comes largely from baby boomers.

From July 2021 to June 2022, millennials’ share of the housing market dropped from 43% to 28%, while baby boomers’ share now sits at 39%. Here’s how the elders got the upper hand.

US stocks were mixed Wednesday after a flurry of economic releases

• Private payrolls rose much lower than expected in March, adding just 145,000 jobs compared to the 261,000 in February. The number was well below the 210,000 estimate, highlighting a significant pullback in hiring as employers brace for a slowing economy.

• The ISM Services PMI, which measures the health of the broader services economy, fell to 51.2 in March compared to the previous month’s 55.1. The reading pointed to the slowest growth in the services sector in three months.

• In Bed Bath & Beyond’s (BBBY) efforts to avoid bankruptcy, ReStore Capital has agreed to offer a lifeline. The investment management company will buy $120 million in merchandise from the retailer’s key suppliers to improve its inventory levels.

What to Be on the Lookout for Today

• The number of jobless claims will be updated. This weekly metric rose by 7,000 to 198,000 for the week ended March 25th, but still remains historically low, disappointing those hoping for signs of a loosening labor market to influence the Fed in a dovish direction.

• Earnings updates from the largest beer importer in the US, Constellation Brands (STZ), as well as Levi Strauss & Co (LEVI). The 170-year-old denim company recently announced it would implement AI into its business, using AI-generated images as models to help increase diversity and inclusion. The announcement was met with controversy, with some concerned the initiative would actually diminish diverse hiring. Investors will look for clarity from the brand.

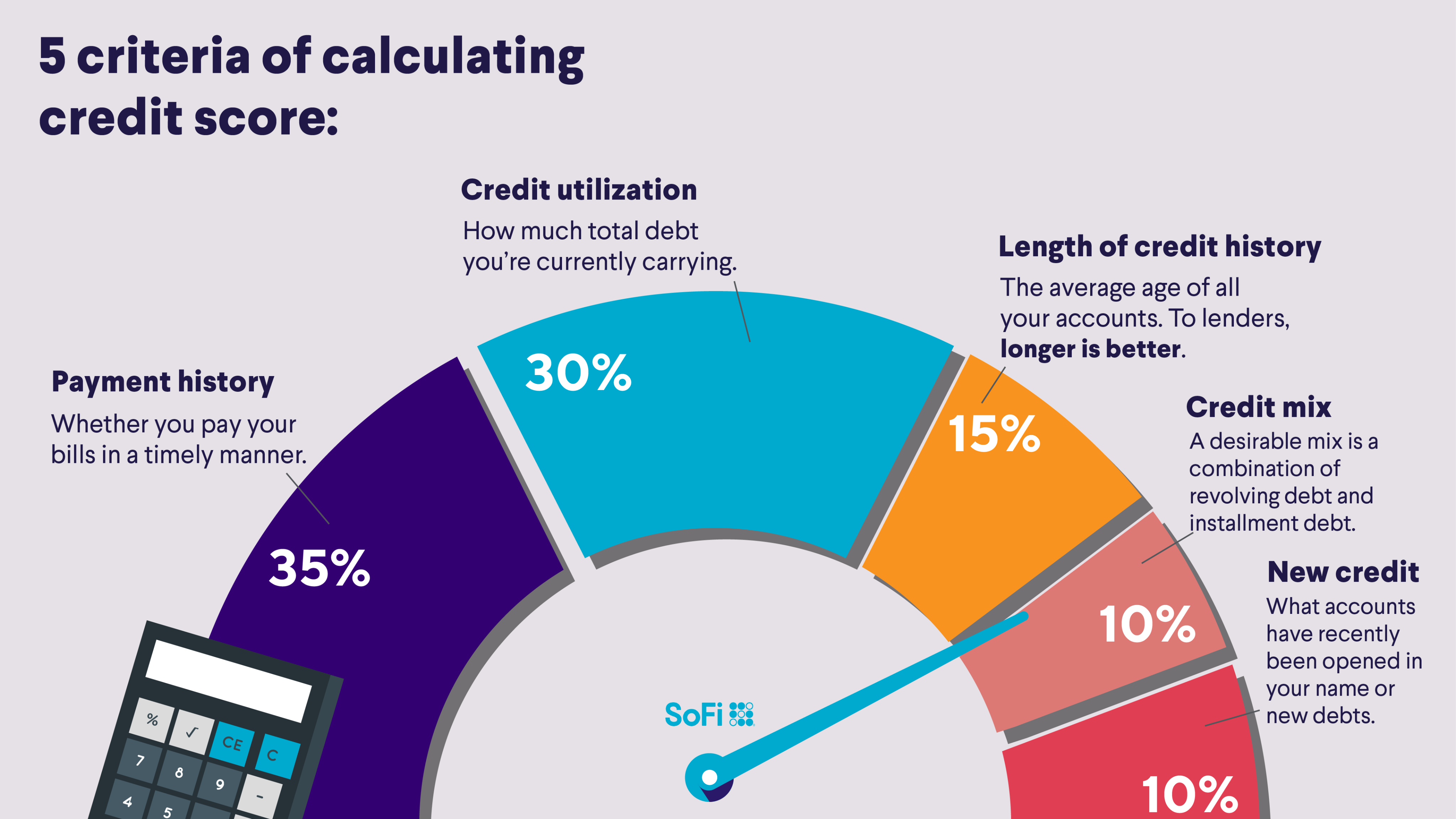

What actually factors into your credit score? It’s a mix of these 5 factors.

A credit score is a three-digit number that attempts to encapsulate your total credit history, meaning your track record of repaying debt.

A person’s credit score can have a significant impact on their ability to get the best deals on loans and credit cards. And that can potentially save borrowers many thousands of dollars over a lifetime.

Find out more about what credit score ranges are by visiting SoFi Learn.

And monitor your credit score for free in the SoFi app, where the factors affecting your score are broken out to make them easier to understand.

Five of the common criteria used to calculate credit scores are:

Today’s top stories

A recent survey indicated that Americans don’t value hard work as much as before – but pessimism may be the real issue. Some experts assert the changing dynamics of the workplace have Americans working harder than ever. They just aren’t being rewarded as well for their efforts. Read more >> Liz is a Bon Jovi fan, but this earnings season does feel a bit like we’re livin’ on a prayer that profit margins don’t contract too much. After the Q4 earnings pullback, another negative result for Q1 could signal a larger economic slowdown. Get the scoop from SoFi’s Head of Investment Strategy. Read more >> If your car is totaled in an accident, you may expect the insurance payment to come to you as the car’s owner. But that’s not necessarily what happens. Read on for a breakdown of how the insurance claims process works and who gets the insurance check when a car is totaled. Read more >>Not-so-breaking news

-

FedEx (FDX) is combining two divisions: its package delivery arm, FedEx Ground, with its overnight air delivery business, FedEx Express. This is part of an effort to cut $4 billion in costs.

-

Tesla’s (TSLA) share of the EV market has continued to shrink as EVs become more widespread. Since January 2022, Tesla’s market share has slipped from 72% to 54%.

-

Uber (UBER) is launching a new service that will ship prescriptions directly to patients' homes. This follows the launch of similar programs by Amazon and Walmart.

-

Johnson & Johnson (JNJ) will pay $8.9 billion to settle lawsuits alleging its talc baby powder causes cancer. The pharmaceutical giant has been sued thousands of times regarding this issue and dismisses any claims, despite the settlement.

-

Google (GOOGL) has launched a new chip used for artificial intelligence called the Tensor Processing Unit. The internet giant claims that this chip is faster and greener than Nvidia’s (NVDA) A100 chip.

Financial planner tip of the day

"With investing there is a relationship between risk and return. Investments with higher expected returns come with substantial volatility along the way. It is important to consider your ability to ride through the volatile times and not just focus on potential returns."

Brian Walsh, CFP® at SoFi