Monday,

September 27, 2021

Market recap

Dow Jones

34,797.60

+32.78 (+0.09%)

S&P 500

4,455.57

+6.59 (+0.15%)

Nasdaq

15,047.70

-4.54 (-0.03%)

Amid evolving news surrounding COVID-19 and the economic reopening, your financial needs are our top priority. For more information,click here.

Top Story

The Week Ahead on Wall Street

Economic News

Today, durable goods orders for August are released. In July, durable goods orders were flat month-over-month, hurt by supply constraints and spending which shifted to services. Investors will be paying close attention to see how orders fared in August given rising energy costs and recent supply-chain issues.

Tomorrow, be on the lookout for the consumer confidence index for September. This is a leading indicator which tracks how consumers are feeling about the economy and their household income. In August, consumer confidence fell to a six-month low as cases of COVID-19 increased. Investors will be paying close attention to see if consumers are growing more pessimistic.

On Wednesday, pending home sales for August are released. This data point measures signed home sale contracts in the month. Pending home sales have declined for two months in a row as homeowners wrestle with limited supply. With inventory easing somewhat it will be interesting to see if pending home sales improved in August.

On Thursday, initial and existing unemployment claims for the prior week are due. Last week, first-time unemployment claims ticked up more than economists expected as increasing COVID-19 cases started to impact employment. Claims were at the highest level seen in a month.

On Friday, a bevy of economic data including the ISM manufacturing index for September will be released. This data point tracks factory output during the month. In August, manufacturing activity increased at a faster pace than what was predicted. Manufacturing has been able to hold up even as consumers shift spending to services. The September reading will indicate if that has continued. Other data released Friday includes core inflation and construction spending.

Earnings Reports

Today, there are no major earnings scheduled to be released.

Tomorrow, be on the lookout for Micron (MU) to report quarterly earnings. The semiconductor maker’s shares have come under pressure in recent weeks as prices for memory chips have tumbled on a few occasions. With expectations that declining prices will continue into the fourth quarter, investors will be paying close attention to Micron’s gross margins and future outlook.

Also tomorrow, First High School Education Group (FHS) reports quarterly earnings. The Chinese company operates private high schools in western China. It and other education companies have been the target of increased regulation by Beijing. Investors will want to know more about how the new regulations impact First High School Education.

On Wednesday, Cintas (CTAS) reports quarterly earnings. Earlier this month the uniform and cleaning products company announced a goal to achieve net zero greenhouse gas emissions by 2050. Cintas also said it is undergoing a comprehensive review to identify opportunities to improve its environmental, social, and governance (ESG) impact. Investors will likely want to hear more about how much it will cost Cintas and how it will help its bottom line when it reports earnings.

On Thursday, Bed Bath & Beyond (BBBY) reports quarterly earnings. The home goods retailer is teaming up with DoorDash (DASH) to provide on-demand delivery from over 700 Bed Bath & Beyond stores and 120 BuyBuy Baby stores across the country. Bed Bath & Beyond is the first home goods retailer to be available on the DoorDash app. Investors will undoubtedly want to hear more about that deal when Bed Bath & Beyond reports.

Also Thursday, be on the lookout for quarterly earnings from CarMax (KMX), the used car retailer. While CarMax was late to start selling cars online, in the past few years it has caught up with its rivals. Those investments in its omnichannel presence appear to have paid off. In CarMax’s first quarter, car sales were up 128% year-over-year, enabling the company to post revenue of $7.7 billion. Sales were up 138% compared to last year, a record for CarMax. Wall Street had forecast revenue of $6.2 billion. It will be interesting to see if the momentum continued in CarMax’s third quarter.

The Week Ahead at SoFi

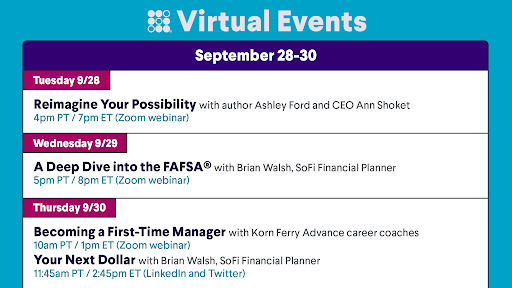

This week’s webinars include discussions on redefining your future, understanding the FAFSA®, and becoming a first-time manager. Plus, tune in to Your Next Dollar. Save your virtual seat!

China Cracks Down on Cryptocurrency

China Makes Cryptocurrency Illegal

China stepped up its crackdown on crypto last week, announcing that all activities associated with digital currencies in the country are now illegal. The People’s Bank of China said it is also illegal for international exchanges to operate in the country. Mobile payment apps are also prohibited from offering crypto services. The news sent Bitcoin (BTC), Ethereum (ETH), and other digital tokens lower. Companies related to cryptocurrency saw their stocks decline as well.

China’s Move Spooks Investors

As part of its ban on cryptocurrency, China said it is developing new systems to protect the country from the risks created by cryptocurrencies. Beijing’s hardline stance spooked investors who were already worried about increased oversight by the US Securities and Exchange Commission. But some believe that the crypto market will recover, pointing to the fact that when China cracked down on crypto miners, the industry shifted mining to other countries.

China’s push to clamp down on the cryptocurrency market is part of its efforts to meet its goal of being carbon neutral in 2060. Mining for Bitcoin requires a lot of energy, which is one of the reasons China is targeting mining.

China’s Digital Coin Aspirations

China’s clampdown on cryptocurrency comes at the same time that the People’s Bank of China is working on its own digital currency. The country is a frontrunner in the race to launch a digital token among central banks. China is already experimenting with its digital version of the yuan in regions across the country. The digital currency e-CNY is being tested in large cities including Shenzhen, Beijing, and Shanghai.

The cryptocurrency market has been facing increased scrutiny by regulators across the globe. China’s tough stance on the industry is not new, but its sudden move last week raised concerns for some crypto investors.

Plant-Based Meat Loses its Luster at Fast Food Chains

Large Fast Food Chains Pull Back on Fake Meat

Beyond Meat’s (BYND) and Impossible Foods’ aspirations to transform the fast-food industry with fake meat are not panning out as hoped. Some of the nation’s biggest chains are pulling back spending on faux meat.

Dunkin Donuts (DNKN) has pulled Beyond Meat breakfast sausage from thousands of stores, while KFC (YUM) tested Beyond Meat’s chicken nuggets but never added them to the menu. Meanwhile, Burger King (QSR) is reducing spending on marketing for the Impossible Whopper.

The pandemic has changed the way Americans dine out and eat in. Comfort food and familiar meals are trending. Sales of plant-based sandwiches and burgers are flat in restaurants for the year as of June. Meanwhile, orders of beef burgers are up 12%.

Demand Better in Small Eateries

Earlier this year Beyond Meat’s stock got a boost after announcing a deal with McDonald’s (MCD) to become the preferred supplier for the McPlant patty. This is expected to be a boon for Beyond Meat. A full rollout in the UK and Ireland is planned for next year.

While plant-based patties have not been a huge hit in large fast-food chains, they are doing well with smaller chains. Epic Burgers, which has seven locations in the Chicago area, said sales of Beyond Meat’s burgers are better than expected.

Pandemic Hits Impossible

Impossible’s fast food debut has been hurt by the pandemic. Last year, Burger King pulled back on marketing which sent awareness for the Impossible Burger plummeting. Carrols Restaurant Group, which is the largest Burger King franchise operator in the country, said sales late last year fell by half since the Impossible Burger was introduced in August 2019.

Prior to the pandemic, plant-based meat was expected to take the fast-food industry by storm. But with consumers seeking comfort foods and familiar meals, those aspirations have been dashed. It will be interesting to see if tastes change in the coming months.

Not-So-Breaking News

-

IAC (IAC) is in talks to acquire Meredith Corporation (MDP), the publisher of People Magazine. IAC is looking for ways to revamp its online offerings after it spun off Match.com and Vimeo.

-

The CDC has approved Pfizer (PFE) and BioNTech’s (BNTX) COVID-19 booster shots for frontline workers, going against recommendations from an advisory panel. The panel approved the third shot for older adults and those with underlying medical conditions but not high-risk workers.

-

Costco (COST) is putting limits on toilet paper, paper towels, water, and cleaning products as it deals with shipping delays. Severe shortages of truck drivers are causing two-to-three-week delays.

-

Nike (NKE) lowered its outlook for fiscal 2022, due to delivery delays, production shutdowns in Vietnam, and labor shortages. The sneaker and apparel company said supply chain issues are hurting business more than anticipated.

-

DoorDash (DASH), Grubhub (GRUB), and Uber Eats (UBER) will face new rules in New York City designed to protect delivery workers. New legislation will address pay, delivery routes, and even require restaurants to grant couriers bathroom access.

-

Bitcoin mining requires a lot of electricity. Learn why, how much, and whether it’s worth it.

Financial Planner Tip of the Day

"With investing there is a relationship between risk and return. Investments with higher expected returns come with substantial volatility along the way. It is important to consider your ability to ride through the volatile times and not just focus on potential returns."

Brian Walsh, CFP® at SoFi