Amid evolving news surrounding COVID-19 and the economic reopening, your financial needs are our top priority. For more information,click here.

Hey SoFi members,

The Biden administration has extended the CARES act until January 31. Get the details and find out what it means for you.

—The SoFi team

Top Story

The Week Ahead on Wall Street

Today, the Labor Department releases job opening and labor turnover numbers for June. Job openings were little changed in May, hitting 9.2 million. Economists and investors will be paying attention to this data point to gauge when labor shortages may ease.

Tomorrow, the NFIB small-business index for July is released. This data point tracks optimism on the part of the nation’s small-business owners. In June the index increased to 102.5, marking the first time the number was more than 100 since November 2020.

On Wednesday, the Consumer Price Index for July is released by the Bureau of Labor Statistics. In June it surged 5.4% year-over-year, marking the largest increase since August 2008, just ahead of the financial crisis. Investors will be paying close attention to see if inflation is easing or continuing to climb.

On Thursday, initial and existing unemployment claims for the previous week are released. This metric tracks how many people are claiming unemployment for the first time and how many are continuing to receive the benefit. With the Delta variant spreading quickly in some parts of the country, investors will be paying close attention to unemployment numbers. Last week initial unemployment claims hit 385,000.

Friday, be on the lookout for the University of Michigan to release its Consumer Sentiment Index for August. This tracks how consumers feel about their personal finances, the economy, and their purchasing power. In July US consumer sentiment declined to a five-month low as consumers worried about inflation. Now with the Delta variant spreading, consumer confidence may have waned more.

Earnings Reports

Today, BioNTech (BNTX) reports quarterly earnings. Shares of the drugmaker gained in recent days after the FDA said it and Pfizer’s (PFE) COVID-19 vaccination will get full approval in early September. Investors will be paying close attention to see if it will have any impact on its COVID-19 sales, which judging from Pfizer’s and Moderna’s (MRNA) quarterly reports, should be strong.

Tomorrow, be on the lookout for quarterly earnings from Sysco (SYY), a large wholesale food supplies company. Faced with severe labor shortages across the country, the company took the drastic step of delaying deliveries to its customers. Citing unprecedented labor shortages, Sysco said it was aggressively recruiting so it can restore full service. Investors will want to know how long the labor shortages will last and what impact they are having on sales and margins.

On Wednesday, fast-food chain Wendy’s (WEN) reports quarterly earnings. The stock got swept up in the meme craze earlier this summer, but has since given back much of those gains. Like other fast-food chains, Wendy’s saw growth during the pandemic and now has to make sure it's sustainable. Investors will want to know if recently introduced new menu items and other initiatives will be enough to accomplish that.

Be on the lookout for earnings from Baidu (BIDU) on Thursday. The Chinese internet search company’s stock has been under pressure in recent weeks as Chinese regulators clamp down on technology firms. Investors will be looking for reassurances Baidu is not in Beijing’s crosshairs when it reports earnings.

Also Thursday Palantir Technologies (PLTR) reports quarterly earnings. The data analytics software company has long chased the government and corporate markets but in a dramatic shift is going after small businesses. In late July it announced it would sell its software as a monthly subscription to smaller companies including startups. Investors will surely want to hear more about this strategy and the size of the market opportunity when it reports quarterly earnings.

The Week Ahead at SoFi

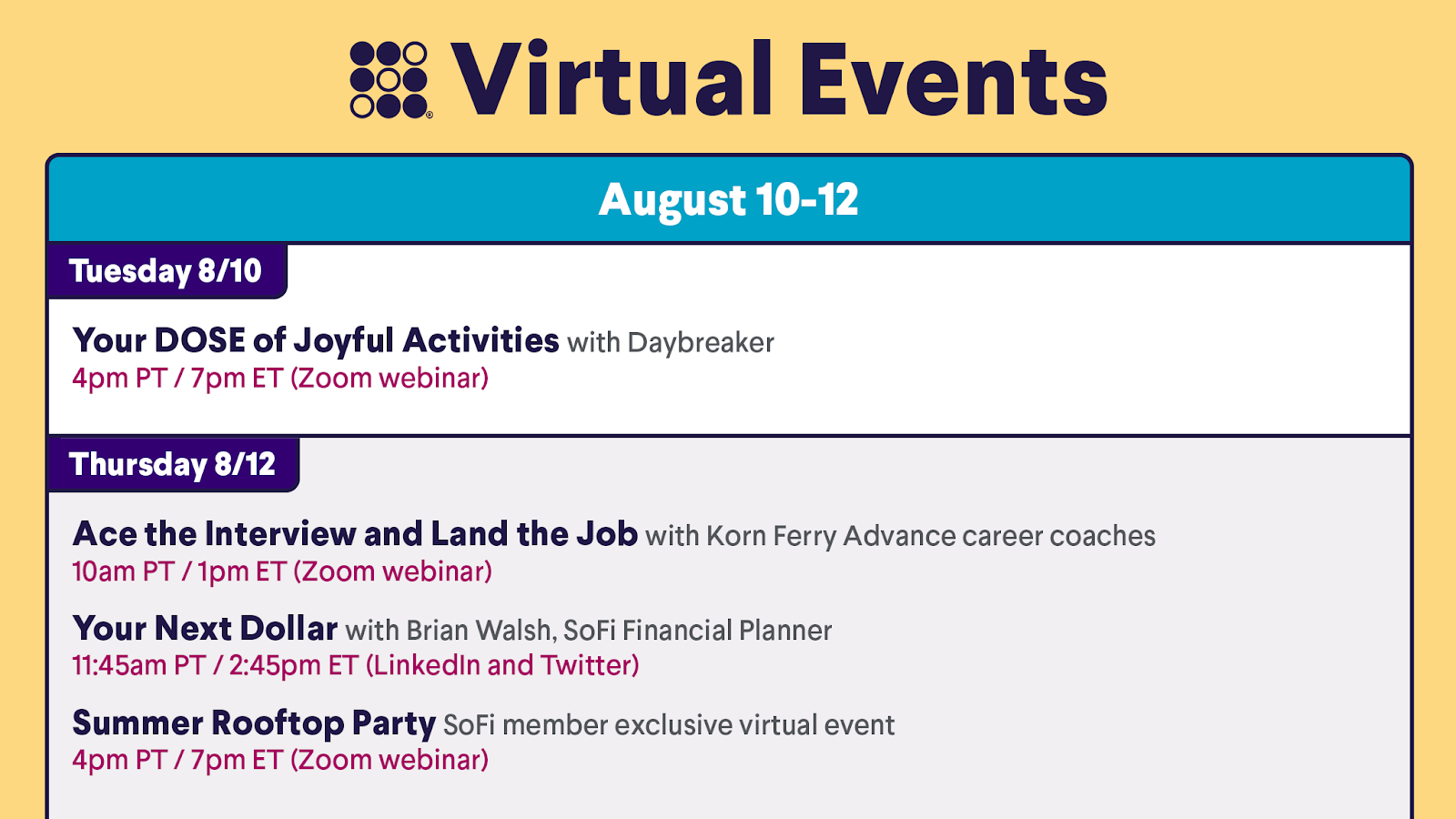

Join us for SoFi’s Sizzlin’ Summer with an energetic activities event and a rooftop party. Also learn winning interview strategies, plus check out Your Next Dollar.

Online Real Estate Stocks Under Pressure

Investors Shrug Off Good News for Zillow, Redfin

Zillow (ZG) and Redfin (RDFN), two online real estate companies, posted strong results for their second quarters, but the performance of their stocks did not reflect this. Both companies blew past Wall Street forecasts, but investors are wary of buying their stocks—partly because the stocks have surged over the past year and the real estate market is cooling down.

Zillow and Redfin benefited from huge demand for their automated home-buying platforms during the pandemic, and their stock prices surged as a result. However, business is expected to slow down a bit as people return to offices, children go back to school, and home inventory increases. All these factors are weighing on the share prices of Zillow and Redfin.

They Really Aren’t Cheap

Online real estate stocks may seem like a bargain at the moment. Zillow and Redfin shares are down about 28% over the past six months while rival Opendoor (OPEN) is 45% lower. However, over the past 11 months they have seen meteoric rise.

Zillow and Redfin are up about 400% from lows in March 2020, which could explain why investors did not pile into the stocks on the positive earnings news and forecasts. Even though Zillow’s revenue target for the third quarter was nearly 40% higher than what Wall Street forecast, this was not enough to send the stock higher.

A Return to Seasonality Expected

Investors are betting the real estate market will start to see a return to more normal seasonality. As more people get vaccinated, businesses reopen, and children head back to school, it could slow the demand for homes. In normal years, home sales decline in the winter and that could happen this year. These factors could cause home prices to fall.

Redfin alluded to these trends when reporting earnings. The company said it expects price appreciation to slow down in the second half of 2021. Zillow had a similar sentiment, warning its iBuying returns should begin to moderate later this year. That does not mean business is going to fall off a cliff, but Wall Street is wary of investing in these stocks.

Retailers Rely on Increased Consumer Spending

Consumer Spending Slows

Nike (NKE), Zara, Walmart (WMT), Amazon (AMZN), and a host of other consumer-facing companies have seen expectations rise as Wall Street bets pent-up-demand will lead to a protracted period of spending. After all, for months, strong demand has played a big role in driving up the prices of everything from vehicles to consumer products.

However, spending on credit cards, transportation usage, and the number of reservations in restaurants in the US and UK are starting to slow down. Attendance at movie theaters has also slowed.

There’s Reasons for Optimism

There are reasons for Wall Street to be hopeful about consumer spending trends. After all, US households' wealth increased by $18 trillion last year, buoyed by pandemic stimulus checks and expanded unemployment benefits.

Meanwhile, European households amassed $711 billion in extra savings last year. Of that, nearly half was because consumers had fewer opportunities to spend money. During the second quarter, personal consumption expenditures in the US increased 11.8% on an annualized basis—the second-sharpest increase since 1952. The third quarter of 2020 holds the record.

For Wall Street’s projections to come true, consumers in the US and Europe will have to spend their savings at a faster rate than is typical. That will depend on how the economy fares. If it begins to slow, consumers may hold on to more of their savings, putting pressure on sales.

Retail Sales Won’t Fall Drastically

Despite the signs consumers may be slowing down their spending, nobody expects retail sales to decrease as much as they did at the onset of the pandemic, thanks to vaccinations.

But the Delta variant of COVID-19 could mean that recovery will not be entirely clear cut. Wall Street bet is that consumers will spend all their newfound cash, driving sales much higher in 2022 compared to where they would be in a world without COVID-19. It will be interesting to see if these predictions come true.

Not-So-Breaking News

-

United Airlines (UAL) is requiring all its 67,000 workers in the US to get vaccinated for COVID-19 by October 25. United is the first major airline to institute this policy.

-

Amazon’s (AMZN) bid to prevent the Indian retailer Future Retail from being sold to Reliance for $3.4 billion, won support from India’s Supreme Court. Both Amazon and Reliance want to control the Indian ecommerce market and see Future Retail as a way to do that.

-

Huawei’s revenue fell nearly 30% in the first half of 2021, hurt by a ban in the US. Despite the steep decline in sales, the Chinese tech company said it is “aiming to survive.”

-

President Joe Biden signed an executive order calling for half of new cars and trucks sold in the US to be electric by 2030. The order, which also proposes stricter fuel-efficiency standards, has the support of GM (GM), Ford (F), and Stellantis (STLA).

-

Norwegian Cruise Line’s (NCLH) second-quarter revenue missed Wall Street’s views although it was able to produce narrower-than expected loss. Revenue of $4.37 million was much lower than the $10 million Wall Street forecasted.

-

Planning a wedding but not sure where to start, or how to pay for it? Learn more about the average costs of a wedding—and wedding financing options.

Financial Planner Tip of the Day

“An emergency fund is intended to be used at a moment’s notice. For the most part, you’ll hear that a healthy emergency fund should cover between three and six months worth of living expenses—which would include rent, mortgage, bills, food, and other essentials. And since you never know when an emergency might happen, it’s best to keep your fund relatively liquid.”

Brian Walsh, CFP® at SoFi