Monday,

May 10, 2021

Market recap

Dow Jones

34,777.76

+229.23 (+0.66%)

S&P 500

4,232.60

+30.98 (+0.74%)

Nasdaq

13,752.24

+119.39 (+0.88%)

Amid evolving news + uncertainty surrounding COVID-19, your financial needs are our top priority. For more information on COVID-19 and your finances click here.

Top Story

The Week Ahead on Wall Street

Economic Data

Today there is no economic data scheduled to be released.

Tomorrow, the National Federation of Independent Business (NFIB) will release the Small Business Optimism Index for April. This data point tracks the health of US small businesses, which account for 50% of the country’s workforce. In March the index rose 2.4 points to 98.2. March’s reading marks the first return to the average historical reading since last November.

On Wednesday, the Consumer Price Index for April is released. Consumer prices rose 2.6% year-over-year in March, boosted by economic recovery and comparisons with last year when the country was in the throes of the pandemic. March’s reading was the highest since August of 2018. Also Wednesday, Core CPI numbers come out for April.

On Thursday, initial jobless claims and continuing jobless claims for last week will be released. With the economy entering a post-pandemic recovery, unemployment numbers have steadily decreased. For the week ended May 1, unemployment claims fell to 498,000. Also Thursday, the Bureau of Labor Statistics will release the Producer Price Index for April.

On Friday, a number of economic data points will be released including retail sales for April. Retail sales in March, which are tracked monthly by the US Census Bureau, were up 9.8% from February and 27.7% higher year-over-year. Stimulus checks issued in March caused spending to surge, so economists will be looking to see if the momentum continued in April. The import price index, consumer sentiment, and business inventories data is also released Friday.

Earnings Reports

Today, Tyson Foods (TSN) reports quarterly earnings. The food company is taking on Beyond Meat (BYND) in the plant-based meat market, launching its own line of meatless hamburgers and sausages. Tyson and other meat-alternative producers are rolling out new food products just in time for summer barbecues. The company, which is the largest US producer of traditional meat, launched its first plant-based products in 2019.

On Tuesday, be on the lookout for Roblox’s (RBLX) quarterly earnings. The video game maker, which went public in March, has seen its monthly active users surge during the pandemic and users do not seem to be abating. Based on preliminary numbers, Roblox had 202 million estimated monthly active users at the end of April. This is an all-time high for the company and an increase of 10 million users from March. The company expected a slowdown as pandemic restrictions started lifting, so the strong showing is a bit of a surprise for Roblox. Investors will be looking to hear if growth continued in May.

On Wednesday, AppLovin (APP) reports quarterly earnings. It is the first time the mobile app maker will report financial results as a public company. The KKR-backed company went public in March and now sports a market capitalization of $20.3 billion. As of March, AppLovin had more than 410 million daily active users playing one of its more than 200 free mobile games. The company is riding demand for video games from consumers stuck at home during the pandemic. It will be interesting to hear how AppLovin plans to keep up the momentum.

On Thursday, be on the lookout for Disney’s (DIS) quarterly earnings. The media giant’s stock has climbed more than 86% since last May as the company starts to reopen theme parks and demand for Disney+ continues to grow. Investors will be paying close attention to what Disney has to say about its park reopenings, given that this arm of its business represents about 40% of the company’s revenue. The company’s commentary on the state of ESPN and its other television networks will also be closely followed.

Also on Thursday, DoorDash (DASH) reports quarterly earnings. Last week the food delivery company instituted a new pricing model in response to complaints that it charges too much. Restaurants can now choose between paying 15%, 25%, and 30% commissions. The higher the rate the restaurant pays the more marketing and services it gets. DoorDash also lowered the commission on pickup food from 15% to 6%. Look for an update on how the new pricing is going when DoorDash reports earnings.

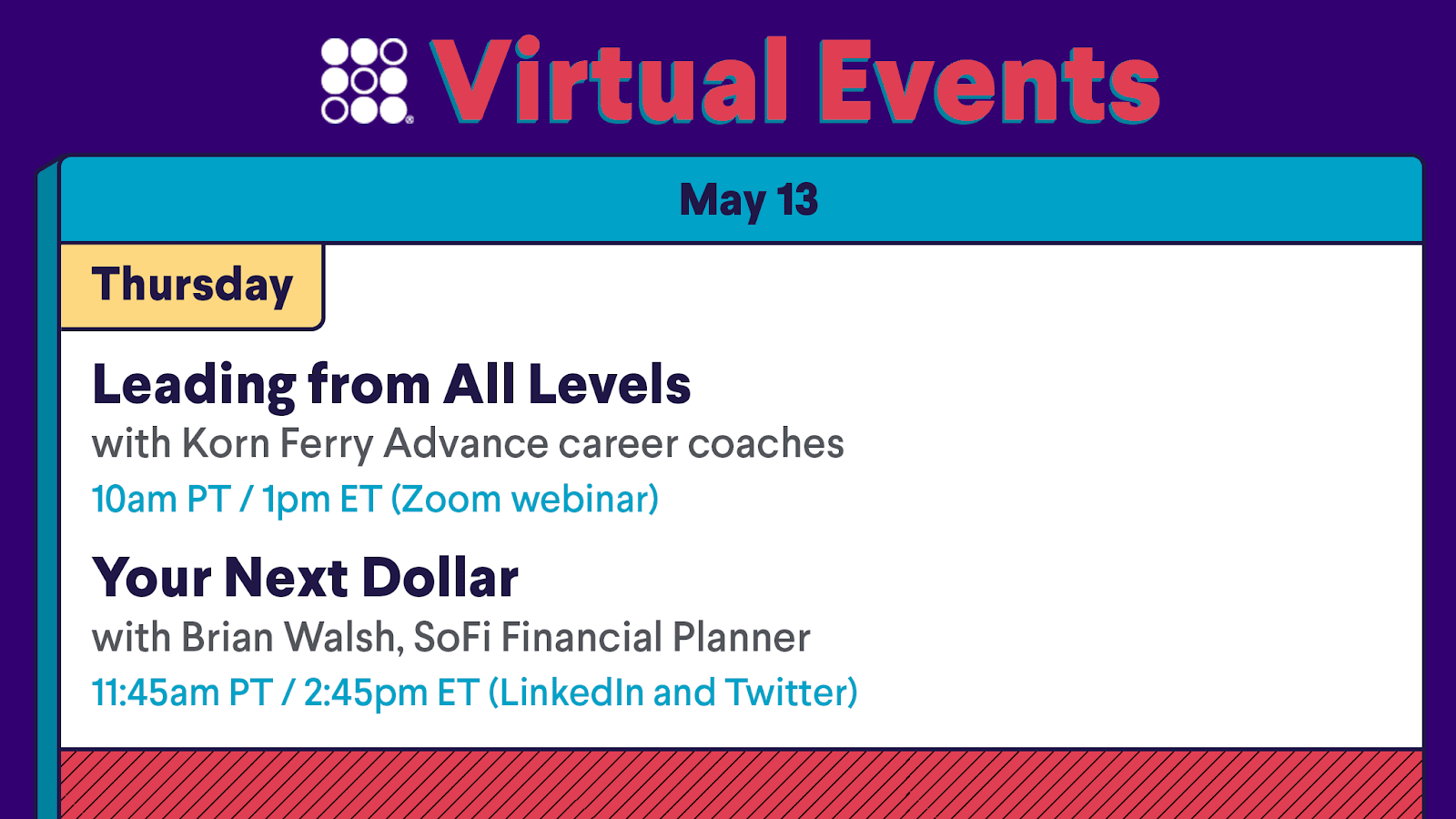

The Week Ahead at SoFi

Tune in to Leading from All Levels and explore the skills required to be an effective leader, plus listen in to Your Next Dollar—live on LinkedIn, Twitter, and Zoom. Register in the SoFi app to reserve your seat!

US Job Growth Slows

Reasons for the Decline in Job Gains

The pace of hiring in the US slowed in April more than expected. At the same time, unemployment ticked higher. This news is causing concern that an economic rebound may not be as smooth or as rapid as many had hoped.

The Labor Department said employers added 266,000 jobs in April and that the unemployment rate climbed to 6.1%. Economists expected the US economy to add 1 million jobs in April and post an unemployment rate of 5.8%. The Labor Department also revised new job gains in March downward from 916,000 to 770,000 .

Economists pointed to labor shortages, supply chain issues, and local economies which are still not fully reopened as reasons for the decline in job gains. Wall Street took the news in stride. Some analysts believe the announcement takes pressure off the Federal Reserve to raise interest rates in the near term.

Companies Struggle to Find Workers

Millions of people are still out of work, yet at the same time, companies across the country are facing labor shortages. There are currently more job openings in the US than before the pandemic hit.

The problem is particularly acute in the manufacturing, construction, and restaurant industries, which were hit hard during the pandemic. Those sectors are struggling to fill open positions, so some construction companies are not bidding on projects, some manufacturers are delaying deliveries, and some restaurant owners are lowering capacity. These actions could ultimately slow the pace of economic recovery.

Others are raising wages to incentivize potential employees to apply.

Labor Shortages Expected to Ease

Surveys suggest there are several reasons why people may not be returning to work. Some are concerned about getting COVID-19 or spreading it at work. Others do not have the skills for available jobs. Some are receiving more money in unemployment aid than they would earn at the jobs that are available. Additionally, businesses are also reopening before children are back in school, leaving parents without childcare.

The labor shortages are expected to ease as more people are vaccinated, schools reopen, and pandemic benefits expire. Until then, the shortages could get worse. The sputter in job gains shows that recovery from the pandemic may not be a completely smooth trajectory.

Walmart Takes on Amazon in the Telehealth Market

Walmart Buys MeMD

Walmart (WMT) recently acquired MeMD, a telehealth provider, as it works to compete with Amazon in the telehealth market. The nation’s largest retailer plans to provide virtual health care services nationwide. Walmart didn’t disclose how much it paid for MeMD.

Walmart’s move comes as Amazon gears up to provide its telehealth service to employees this summer. The ecommerce giant will also offer the service to other employers.

Big Opportunities in the Health Services Industry

Walmart and Amazon are taking the lessons they have learned providing health insurance to their workforces as they begin to offer more healthcare services to consumers. This is enabling the two retailers to enter a large and growing market.

They are not alone. CVS Health (CVS) and Walgreens Boots Alliance (WBA) are also expanding their telehealth services. Both companies have expanded their offerings this past year during the pandemic. The big players’ interest is spurring consolidation in the telehealth market and pressuring the current sector leader, Teladoc Health (TDOC). Teladoc’s shares fell last week on news of Walmart’s acquisition of MeMed.

Consumers Benefit from Competition in the Healthcare Market

Walmart entered the healthcare market two years ago, opening a handful of clinics within its stores. It also partners with telehealth companies including Doctor on Demand, a service which is now available to its 1.3 million employees in the US.

Walmart plans to offer its telehealth services to consumers who want cheaper and more transparent pricing for their healthcare. It plans to leverage its 4,700 stores to expand the business.

Demand for telehealth is growing as individuals seek more affordable healthcare. With competition heating up between the nation’s largest retailer and the country’s biggest ecommerce player, consumers will have more options for how to approach their healthcare.

Not-So-Breaking News

- DraftKings’ (DKNG) loss in the first quarter was less than Wall Street expected. The online betting company’s revenue of $312 million also topped forecasts. DraftKings ended the quarter with 1.5 million monthly unique paying customers.

- Beyond Meat (BYND) reported a net loss for the first quarter. The plant-based meat company said decreased foot traffic at restaurants and shutdown restrictions played a major role in the quarterly loss.

- Peloton’s (PTON) fiscal third-quarter sales surged 141%, benefiting from improvements to its supply chain. The company did warn it expects a $165 million hit in its fiscal fourth quarter due to a safety recall for one of its treadmills.

- Roku’s (ROKU) first-quarter results topped Wall Street targets, driven by better-than-expected advertising revenue. The streaming content provider expects the momentum to continue in the current quarter.

- Shake Shack’s (SHAK) first-quarter revenue beat Wall Street estimates, driven by an unexpected increase in traffic. In Q1, same-store sales were up 5.7%. Analysts expected a decline of 1.74%. Same-store sales in April were up 86% year-over-year.

- In order to protect your capital, it is important to familiarize yourself with fraud related to Bitcoin and cryptocurrency. In this list we cover common scams and tips to avoid them. Read more and Avoid These 5 Bitcoin Scams in 2021.

Financial Planner Tip of the Day

"A well diversified portfolio helps maximize the expected return for a given level of risk. It also helps smooth returns over time compared to the drastic swings of investing in one or two riskier investments."

Brian Walsh, CFP® at SoFi