Thursday,

March 4, 2021

Market recap

Dow Jones

31,270.09

-121.43 (-0.39%)

S&P 500

3,819.72

-50.57 (-1.31%)

Nasdaq

12,997.75

-361.04 (-2.70%)

Amid evolving news + uncertainty surrounding COVID-19, your financial needs are our top priority. For more information on COVID-19 and your finances click here.

Top Story

Changes to Google’s Targeted Ads Strategy

Google Plans to Stop Tracking Individual Users

Yesterday, Google (GOOGL) announced plans to stop selling targeted ads based on internet users’ activity across multiple websites. Starting next year, the search engine will no longer invest in buying or building this type of technology.

Google is the world’s largest digital ad company. A total of $292 billion was spent on digital advertising around the world last year, and Google accounted for 52% of that spending. Because Google has so much market share, its decision will have a significant impact on the entire digital ad industry.

No More Third-Party Cookies

Last year, Google decided that by 2022 it would remove its most common tracking technology, called third-party cookies. The tech giant has now promised not to create alternative systems to replace third-party cookies.

Google will instead begin using what it calls a “privacy sandbox.” This will allow the company to send targeted ads without tracking individual people across multiple websites. Google plans to begin buying and testing several versions of this technology in the second quarter of this year.

Opposition to Google’s Plans

While some privacy advocates are cheering Google’s decision, the company has also faced backlash. A number of smaller digital ad firms which use tracking across multiple sites say that Google and Apple are using new privacy systems as a way to crowd out smaller competitors who do not have the resources to pour into new technology.

The UK Competition and Markets Authority opened an investigation into Google’s decision to phase out third party cookies after a group of marketers voiced concerns that these changes would help Google become even more dominant. Advertisers, investors, and everyday Google users will be eager to see how Google’s initiatives will unfold.

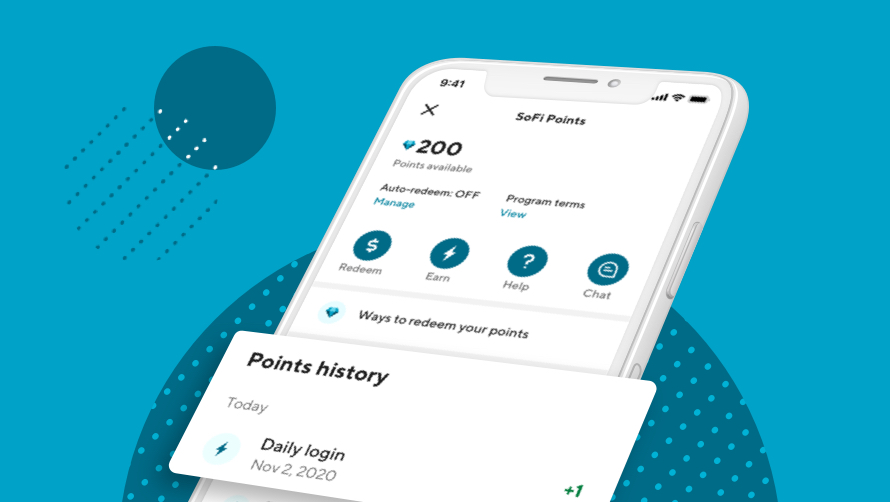

Introducing SoFi Member Rewards!

Earn SoFi points when you spend, save, get paid, monitor your credit, and more.* Enroll in the SoFi app.

Sands Leaves Las Vegas and Sets Its Sights on Asia

Sands Agrees to Sell Its Las Vegas Properties

Las Vegas Sands (LVS) is selling its Las Vegas operations to the private equity firm Apollo Global Management and a real-estate investment trust in order to focus on its businesses in Asia. The deal values the Las Vegas properties at about $6.25 billion.

The pandemic has battered the casino and hospitality industries. Travel bans, temporary shutdowns, and capacity restrictions have hurt casino operators’ bottom lines and stock prices. However, Sands’ share price hit a 52-week high when news of the deal broke yesterday.

A New Chapter for Sands

The announcement comes shortly after Sands’ billionaire founder, Sheldon Adelson passed away in January. Sands’ CEO Robert Goldstein said, “As we announce the sale of the Venetian Resort, we pay tribute to Mr. Adelson’s legacy while starting a new chapter in this company’s history.”

Sands will keep its headquarters in Las Vegas but it wants to focus resources on its properties in Asia. The company is valued at about $44.7 billion, and about 87% of its revenue comes from its operations in Asia, mainly Macau and Singapore. It also plans to explore ways to grow its online gambling business.

Apollo’s Outlook

This will not be Apollo’s first investment in the gambling industry. The company was part of a $30 billion leveraged buyout of Harrah’s Entertainment in 2008, which was later renamed Caesars Entertainment (CZR). Apollo also agreed to buy casino company Great Canadian Gaming last November.

Apollo thinks that Sands’ Las Vegas properties are well positioned for long-term recovery. Many believe there is pent up demand for entertainment, travel, and dining experiences—and that once more people are vaccinated, these industries will see growth.

Oscar Health's IPO Raises $1.4 Billion

Oscar’s Share Price Falls on its First Trading Day

Digital health insurance company Oscar Health (OSCR) went public on the New York Stock Exchange yesterday. Shares of the company began trading at $36 each, but Oscar’s share price was down about 4.7% at the end of the trading day.

The pandemic has caused investors and everyday Americans to become more interested in virtual health care. This period has boosted demand for Oscar’s services, but its net losses climbed to $406.8 million in 2020 from $261.2 million in 2019. The company’s total revenue fell by 5% in 2020 compared to 2019, which may be part of the reason why investors were hesitant about the company on its first trading day.

Oscar’s Leadership

Oscar was founded in New York in 2012 by Mario Schlosser, Kevin Nazemi, and Joshua Kushner, the brother of Donald Trump’s son-in-law Jared Kushner. The company has 529,000 members in 18 states. Oscar offers individual, family, small group, and Medicare Advantage plans. It also offers members free telehealth visits and other benefits.

Oscar competes with big names in the healthcare industry including UnitedHealth (UNH) and Aetna, owned by CVS (CVS). But Oscar’s leadership believes it has an advantage over these larger rivals because of its emphasis on customer service and technology.

Looking Ahead

Several other recent telehealth and insurance IPOs have been successful recently, including Teladoc Health (TDOC), Lemonade (LMND), and American Well Corp. (AMWL)

Oscar’s first trading day was not as successful as some had expected, but many are hopeful that the company will see gains in the coming months. Because people have formed habits of seeking virtual healthcare during the pandemic, many expect the industry to continue growing.

Not-So-Breaking News

- AppLovin, a company helping apps and mobile games with marketing and monetization, has filed for an IPO. Though the filing was initially set to raise up to $100 million, some analysts believe the final deal could raise up to $2 billion.

- Arts and crafts store Michaels (MIK) is going private through a $3.3 billion deal with the private equity company Apollo Global Management. Michaels has seen its sales climb during the pandemic as consumers bought supplies to sew masks and to do other projects as a way to pass time at home.

- Kevin Mayer has been named Chairman of the sports streaming service, DAZN. Mayer was a senior executive at Disney (DIS) who played an important role in launching Disney+.

- Lyft (LYFT) reported its highest volume of rides since March 2020 last week. The company also updated its first-quarter adjusted EBITDA loss expectation to $135 million, which is lower than the $145 million to $150 million it previously expected.

- Recent data showed that US private payrolls climbed less than expected in February. Though vaccine rollout is helping the labor market regain strength, this recovery is not happening at the pace some had hoped for.

- Building an investment portfolio is tough, but it doesn’t have to be! Here are some best practices for how to build an investment portfolio.

Financial Planner Tip of the Day

“If you have savings that is not currently earmarked for a specific financial goal, take some time to think about what goal you’d like to apply it to. A great first saving goal is to have three to six months of living expenses in an emergency fund. After that, it might be good to turn your attention toward retirement savings and investing.”

Brian Walsh, CFP® at SoFi