Wednesday,

February 24, 2021

Market recap

Dow Jones

31,537.35

+15.66 (+0.05%)

S&P 500

3,881.37

+4.87 (+0.13%)

Nasdaq

13,465.20

-67.85 (-0.50%)

Amid evolving news + uncertainty surrounding COVID-19, your financial needs are our top priority. For more information on COVID-19 and your finances click here.

Top Story

Facebook Comes Back to the Land Down Under

Facebook Lifts its Ban on Australian News

Facebook (FB) has reached a deal with the Australian government after the social media giant temporarily placed restrictions on how Australians could use the platform. Facebook had prohibited Australian users from sharing links to news articles in the country. It also barred users around the world from sharing links to Australian news sources.

Facebook took these measures because of a proposed law in Australia which would require search engines and social media companies to pay news outlets for displaying links to their content. Supporters of the law argue that tech companies generate enormous amounts of ad revenue because of the news content they display. Meanwhile, news companies are suffering financial hardships.

Falling Traffic for Publishers After Facebook Bans

The law in Australia was meant to help publishers, but traffic to Australian news sites dropped substantially after Facebook’s ban. Lawmakers came to the conclusion that if the social media company simply left the country instead of complying with the new law, publishers would face even greater difficulties than they already do.

In response, the Australian government added four amendments to the law and Facebook agreed to restore news sharing for Australians. The amendments give Facebook more freedom to negotiate deals with publishers independently.

Law Expected to Achieve its Original Goals

Google (GOOGL) has also been in tense negotiations with the Australian government surrounding the new law. At one point the search engine threatened to shut down its services in the country, but it was able to reach agreements with Australian news outlets before doing this. The law in Australia is still expected to pass. Many lawmakers feel that, despite the amendments, the law will still be able to achieve its original goal of helping publishers, but it will not interfere with the way Australians interact with technology in their daily lives.

The law will still likely have an impact on relationships between tech companies and governments around the world. European lawmakers are in the process of drafting legislation that would require tech companies to pay for news. Microsoft (MSFT) has voiced support for these types of laws. On the other hand, while Google and Facebook have found strategies for moving forward in Australia, they are wary of legislation related to media on their platforms elsewhere.

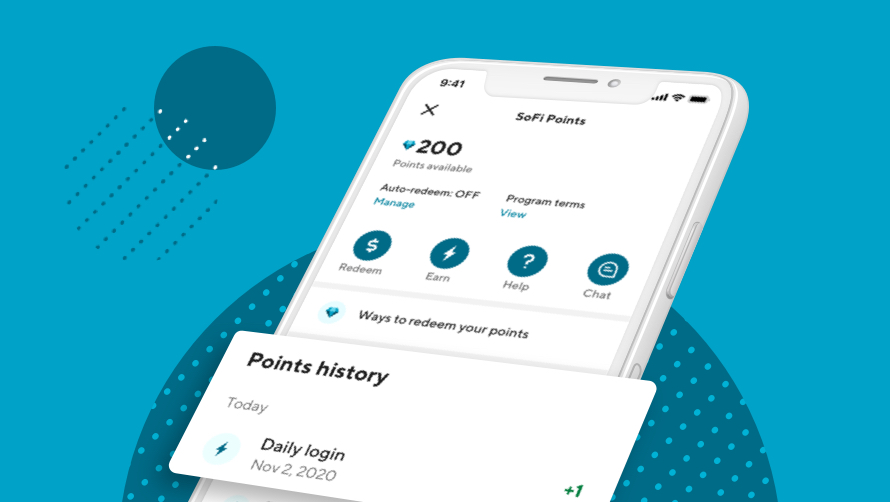

Introducing SoFi Member Rewards!

Earn SoFi points when you spend, save, get paid, monitor your credit, and more.* Enroll in the SoFi app.

Oatly Makes Plans to Go Public

Oat Milk Maker Could Be Valued at $5 Billion

Oatly, the plant-based food and beverage company, has confidentially filed for an IPO. Oatly is best known for its oat milk products and has partnerships with several large restaurant chains, including Starbucks (SBUX). It also sells its products online and in grocery stores. You may also recognize them from their Super Bowl ad, which is being called, “either the worst or best to ever air during the big game.”

Oatly is based in Sweden and has a presence in over 20 countries across Europe, Asia, and North America. Analysts say the company could be valued at over $5 billion.

Oatly Makes a Splash

Oatly was founded in the 1990s. It came to the United States in 2016 and since then has seen explosive growth. Oat milk sales in the US climbed about 350% year-over-year as of September 2020. Oat milk is currently the second most popular plant-based dairy option in the US, after almond milk.

Last summer, Oatly raised $200 million in equity from a group led by Blackstone (BX) which includes celebrities Oprah Winfrey, Natalie Portman, and Jay-Z. Howard Schultz, the former CEO of Starbucks, also participated in the round, which generated buzz about a potential IPO for the company. But until yesterday, the company had not shared concrete plans to go public.

The Plant-Based Food Industry is Poised for Growth

The plant-based food industry has gained significant attention from investors in recent years. A growing number of large restaurant chains and grocery stores are offering plant-based substitutes for milk, meat, and other products. These products are particularly popular among millennials and Gen Z.

Beyond Meat (BYND) has seen its sales and its stock price surge since it went public during the spring of 2019. More traditional food brands like Kellogg (K) and Tyson Foods (TSN) are also looking to gain market share in this booming industry. Soon, investors interested in the plant-based boom will be able to take a sip of Oatly.

The CoreLogic Takeover Battle

CoreLogic Reevaluates its Options

CoreLogic (CLGX) is a firm that provides data about the housing market for real-estate brokers and financial companies. Though its services are widely used, it has been a pretty low-profile company until recently. But demand is booming for housing and for CoreLogic’s services. As a result, the company is the focus of a takeover war.

Earlier this month, CoreLogic agreed to accept an all-cash $6 billion takeover bid from two private equity companies, Stone Point Capital LLC and Insight Partners. CoreLogic chose this offer over an all-stock bid from CoStar Group (CSGP). But CoStar then raised its offer, and CoreLogic is now reevaluating its options.

Investor Enthusiasm for Businesses Linked to the Housing Market

The battle for CoreLogic illustrates how investors are eager to pile into companies linked to the housing market. In 2020, home sales reached their highest level in 14 years. This was a result of low interest rates and demand for more space to work and social distance at home.

This trend has boosted revenue for brokerage companies like Realogy Holdings (RLGY) and Toll Brothers (TOL). Residential real estate data providers like CoreLogic have also been riding the housing market wave. The company’s stock price has more than doubled since the start of 2020.

Future Trends in Home Buying

Much of the recent housing demand has been fueled by millennials and first-time home buyers. This demographic wants technology and data-driven tools to help them buy homes. CoreLogic’s data has been important during this recent boom and will likely become even more in-demand as future generations buy homes.

CoreLogic is currently evaluating the bids from its two potential buyers. A decision could come as early as this week.

Not-So-Breaking News

- Home Depot (HD) earnings topped analysts’ expectations and the company reported a 25% jump in sales. However, the retailer’s shares fell because investors are concerned that the growth it has seen during the pandemic will not be sustainable.

- Wells Fargo (WFC) has agreed to sell its asset management business to private equity firms, GTCR and Reverence Capital Partners for $2.1 billion. The business manages over $603 billion.

- Macy’s (M) announced its first quarterly profit in a year. The retail giant has suffered severely during the pandemic, but its efforts to reduce inventory and avoid big discounts appear to be paying off. The company says that 2021 will be a time for recovery and rebuilding.

- 3M (MMM) is expanding its relationship with Palantir (PLTR) through a multimillion-dollar deal. The company will soon begin improving its supply chain operations using Planter’s Foundry analytics platform.

- Lucid Motors, the American electric vehicle startup, has reached an agreement to go public by merging with the SPAC Churchill Capital IV (CCIV). Several other EV companies have taken this route to the public market, but this is the largest deal between an EV startup and a blank check company yet.

- There are a number of different strategies investors use to hedge against inflation. The common denominators tend to be hard assets with a limited supply and financial assets that tend to see large capital inflows during times of currency devaluation and rising prices. Here are five tips that may help investors hedge against inflation.

Financial Planner Tip of the Day

“What your goals are will largely determine whether or not long-term investing is the right choice for you. So you might want to spend time outlining what you want to achieve—which may depend on your life stage—and how much money you’ll need to achieve it.”

Brian Walsh, CFP® at SoFi