Is Student Loan Refinancing Right for You? [Infographic]

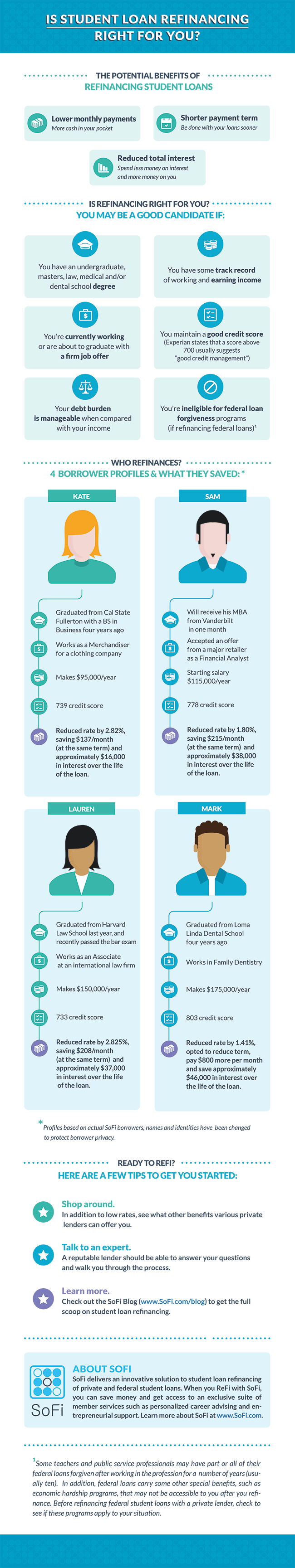

Student loan refinancing can have a huge impact on a borrower’s bottom line, saving you thousands or sometimes tens of thousands of dollars in interest over the life of your loan(s). So how do you know if this option is right for you? We’ve created this handy guide to illustrate the common characteristics of eligible borrowers, including four examples based on the profiles and savings of some of our real borrowers.

Want to know if student loan refinancing is right for you? Read on to find out!

Wow, all of the people in your “who refinances?” Infographic make an enormous amount of money. It looks like I’m sticking with my government Income Based Repayment plan.

Why do all of the profiles make so much money? Are people with average incomes eligible for refinancing? I have an undergraduate degree with a steady job making $50k and $16k in federal student loans can I refinance?

Hi Ben. Thanks for reading our blog and asking a great question. We take a number of factors into account when we review applications for student loan refinancing and income is just one factor. One of our customer service representative will be happy to talk with you about your situation and specific questions. Feel free to call us at: 855-456-SOFI.