Navigating Finances in the First Year of Marriage

As the saying goes, first comes love, then comes marriage. But after the joyous celebration, what really happens in the first year—and beyond—of wedded bliss?

SoFi recently partnered with Zola , the company reinventing wedding planning and registry with free wedding websites, beautiful wedding paper, the best wedding registry, and more. We’re excited to say that as of today, Zola couples can register for their financial goals like a joint investment account or help with student debt repayment with SoFi.

“Zola’s new partnership with SoFi helps guide couples through the process of creating joint bank accounts so they can save for the future. Couples already rely on Zola to easily plan their wedding and register, so now we are helping them make the transition to newlywed life a little easier too,” says Jennifer Spector, Zola’s Director of Brand.

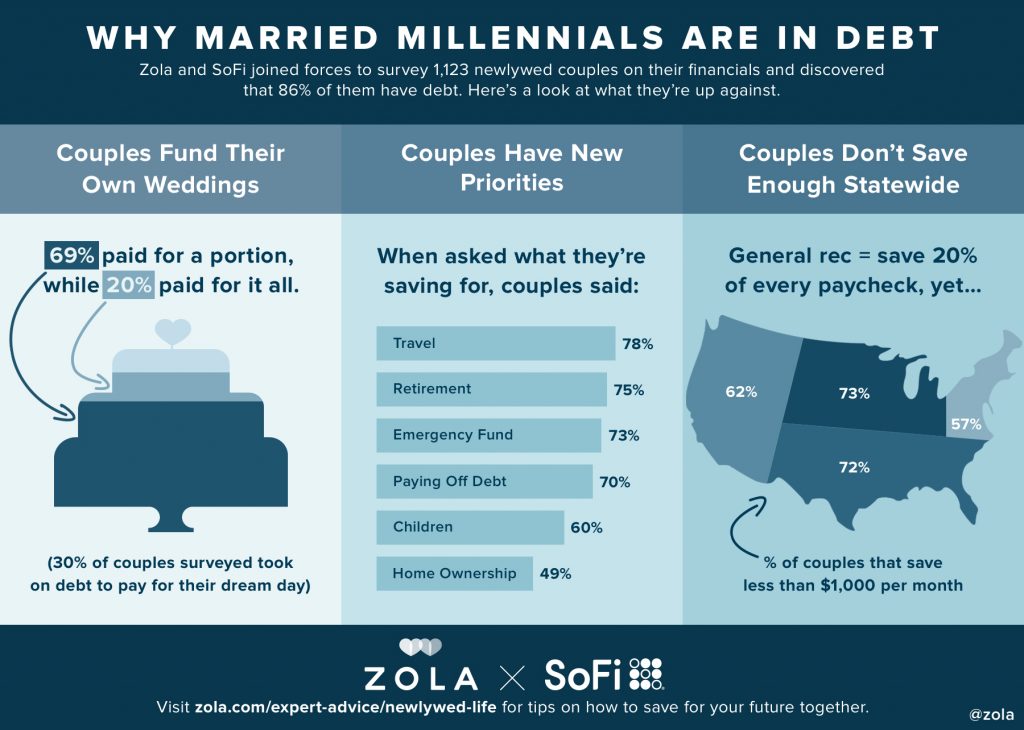

As part of the partnership, Zola and SoFi surveyed over 1,000 newlyweds* to uncover their attitudes toward money.

The good news is, the majority of couples know absolutely everything about their partner’s finances before tying the knot. Even better, 84% of couples said they feel extremely comfortable talking about the good, the bad, and sometimes ugly when it comes to money.

There were other surprise findings from this joint survey. Brian Walsh, SoFi’s manager of financial planning and CFP® professional, offers his advice on how newlywed couples can navigate money within their marriage.

Affording the Engagement and Wedding

The age old question remains—how much should you really spend on an engagement ring? According to our survey, 90% of couples said they bought an engagement ring, with the majority spending between $2,000 to $4,000. Just over one quarter (27%) admitted to taking on debt to afford it.

The average cost of a wedding is over $30k . Our survey found that 69% of couples paid for at least a portion of their own wedding, while 20% covered the cost entirely. Nearly one third (30%) took on debt to pay for their wedding.

One thing is certain—Brian Walsh recommends not getting into debt if you can avoid it. “The simple fact is that debt has been linked to increased anxiety, reduced satisfaction, and tougher adjustment to married life. Knowing that, you need to ask yourself if going into debt is really worth it. As a financial planner, my advice would be a hard no, but as someone who is married, my answer is that it is much more complicated.”

Spector has a similar sentiment. “Couples should never feel like they have to go into debt to pay for the ‘perfect’ wedding. Your wedding is about your commitment to each other, not about elaborate centerpieces or an over the top dinner. To stay within your means, prioritize what’s most important to you from the beginning. I really wanted to get married on New Year’s Eve, a holiday weekend, so we had balloons instead of flowers, which was still festive but less costly!”

In Sickness and in Debt

86% of newlywed couples are entering their marriage with debt, and instead of putting the onus on the partner bringing it into the relationship, couples are partnering to pay it off.

If you fall into the majority, remember there is a difference between “good” and “bad” debt. “Good debt, such as student loans or mortgages, help you get ahead in life and generally charge lower interest. Bad debt, such as credit cards, generally charge higher interest,” says Walsh. If you want to focus on getting out of ”bad debt,” there are possible strategies you could take.

One such strategy is the Debt Fireball method. First, take into account what debt you have and categorize it. If you have bad debt, you’d pay it off as quickly as possible. For good debt, you’d prioritize saving for the future while maintaining minimum payments. Walsh adds, “Historically, the return of the stock market has been more than the interest you pay on good debt, so prioritizing saving makes sense based on the math.”

Saving for the Future From This Day Forward

Our survey found that 98% (!!!) of couples are saving money and have joint financial goals—great news! However, of that group, the majority of couples are saving less than 20% of their annual income, regardless of where they live or what they earn. Walsh suggests couples should aim to save between 15-20% of income for retirement.

And when asked to rank their savings priorities, couples put travel at the top of the list followed by (2) retirement (3) in case of emergency (4) paying off debt (5) children and lastly (6) buying a house or an apartment. While experiences are important, consider making sure your finances are in order first and foremost.

“At SoFi, we developed a framework to guide partners through this process, and we recommend starting with a crisis fund where you keep at least one month of expenses in liquid savings for true emergencies,” says Walsh.

The next step could be to take advantage of your 401(k) match if offered by your employer since it’s essentially “free money.” After setting aside money for retirement, you could protect yourself with insurance since you never know what can happen.

Then, you can plan to tackle your bad debt by prioritizing any debt that has an interest rate higher than 7%. Once you’ve put money towards your monthly living expenses and goals like savings, an emergency fund, and retirement, then you can consider other more “fun” goals, like traveling.

What’s Yours is Mine and What’s Mine is Ours

72% of newly married couples have at least one joint bank account and 58% of married millennials are splitting every bill down the middle.

The number one reason couples do not combine their accounts? The process seems overwhelming. “The size of the effort is often much bigger in our minds than reality, but combining accounts can actually be done in phases to make the process easier and more manageable,” says Walsh. It comes down to a matter of personal preference. If you and your partner have accounts at the same bank, one spouse can add the other to their existing account.

Another option is to start fresh by opening up an account together and keeping your original accounts separate. Once you open the joint account, you can then set aside time to sit down and go over what automatic payments you’ll contribute in and out of the account. Walsh adds, “We understand that every couple is different and there is no one-size fits all approach. The ultimate key is to make a decision together and communicate about your finances regularly.”

Are you heading down the aisle soon? As part of SoFi’s partnership with Zola, members get $75 in registry credit when they register for $500 worth of gifts.** Head to Zola.com today to start registering.

* This survey includes responses from 1,123 newlywed couples inclusive of Zola users and SoFi members that occurred on January 29, 2019 through February 6, 2019.

** You will receive $75 to spend on Zola.com when you set up your wedding registry on Zola.com and receive $500 in Zola gifts. Zola gifts will be defined as any physical products purchased on Zola.com. Cash funds or third party gifts from other websites are not considered Zola gifts. The $75 Zola credit can only be redeemed for Zola gifts and cannot be redeemed for cash, cash funds or third party gifts. Credits will be placed into the couple’s Zola account 4 weeks after a couple receives $500 in Zola gifts.

The information provided is not meant to provide investment or financial advice. Investment decisions should be based on an individual’s specific financial needs, goals and risk profile. Advisory services offered through `SoFi Wealth, LLC. SoFi Securities, LLC, member FINRA/SIPC.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design), and CFP® (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

SOPR19007