Table of Contents

While there are formulas and calculators that can help you determine a basic amount that you need to save for retirement, these are just ballpark numbers. In some cases it can be useful to game out a couple of different scenarios — using different assumptions about where you might live, whether you’ll work part time or travel, and so on.

Doing this can help you, and your spouse or partner, decide on the retirement path that suits you. It can also help you make the best estimate of how much you need to retire.

Key Points

• Determining the amount needed for retirement is a personalized calculation influenced by lifestyle, savings, Social Security, and various other factors.

• Guidelines suggest saving 15% to 20% of income for retirement, with targets based on age, such as 10 times salary by age 67.

• The 80% rule recommends replacing 80% of pre-retirement income, while the 4% rule provides a method for estimating required savings based on annual expenses.

• Factors like retirement age, pre-retirement income, desired lifestyle, and future expenses significantly impact the amount needed for a comfortable retirement.

• Starting retirement planning early and regularly assessing savings can help close the gap between current funds and future needs, especially considering inflation and healthcare costs.

This article is part of SoFi’s Retirement Planning Guide, our coverage of retirement readiness and all the steps you need to create a successful retirement plan.

How Much Money Do You Need to Retire?

There isn’t a single number you need to retire that will work for everyone. As mentioned, every person’s situation is unique and comes with its own complications and assumptions for what retirement might mean.

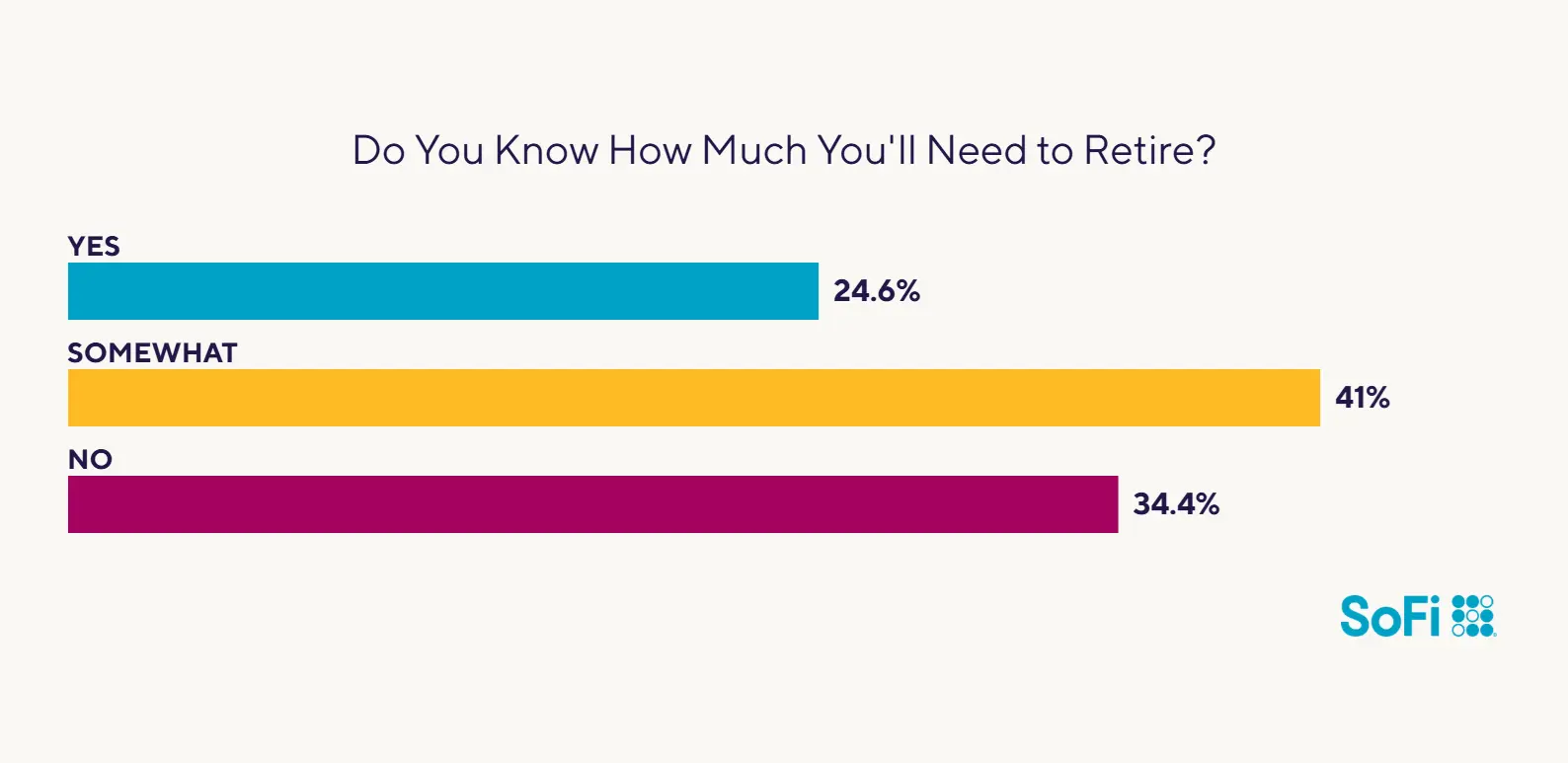

Many Americans aren’t sure where to begin when it comes to figuring out the exact amount they’ll need. In a 2024 SoFi Retirement Survey, 75% of adults don’t know how much they will need to retire. Just 1 in 4 have done the calculations to determine the amount, while 41% have a general sense, and 34% have no idea how much they’ll need for retirement.

Source: SoFi’s 2024 Retirement Survey

Fortunately, there are some rules of thumb to consider to help determine retirement savings.

1. Retirement Savings Targets by Age

If you’re just starting out in life, you might think that with retirement decades away that you don’t have to worry about it. But the sooner you start saving for retirement, the better off you’ll be. Here are a few rough targets for how much you should have saved at certain ages:

| By Age… | You should target saving this much |

|---|---|

| 30 | 1X your salary |

| 40 | 3X your salary |

| 50 | 6X your salary |

| 60 | 8X your salary |

| 67 | 10X your salary |

Source: Fidelity, “When Can I Retire”

These should only be considered as very rough guidelines — for more detailed retirement targets, consider working with a financial advisor.

2. The 80% Rule

One basic guideline is known as the 80% rule, which says you should aim to replace 80% of your pre-retirement income. So, if you earn $100,000, you’ll need about $80,000 per year when you retire.

This is only meant as a guideline, but it has been called into question by some experts as being too high. As the thinking goes, your expenses decline in retirement, largely because you’re no longer saving for retirement, nor are you commuting.

Others have said workers should aim to replace 100% of their pre-retirement income, owing to inflation.

3. The 4% Rule

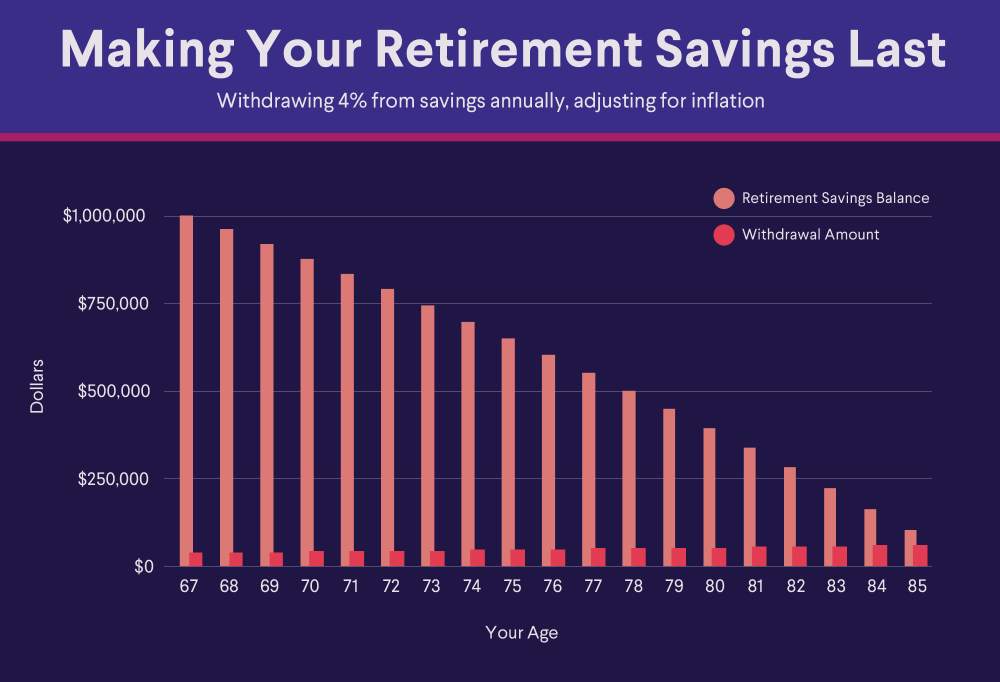

Another popular rule of thumb is the 4% rule, which says that you can take your projected annual retirement expenses and divide them by 4% (0.04) to know how much money you’ll need before you can safely retire.

If you project annual expenses of $50,000, you’ll need $1,250,000 (which is $50,000 divided by 0.04). Then each year you could withdraw 4% (indexed for inflation), which would come mostly if not completely from the appreciation of the portfolio.

Since the 4% rule was introduced in 1994, other advisors have said that it is not conservative enough, due partly to increased longevity, and have suggested 3.33% or even 3.7% might be more appropriate.

💡 Quick Tip: Did you know that opening a brokerage account typically doesn’t come with any setup costs? Often, the only requirement to open a brokerage account — aside from providing personal details — is making an initial deposit.

Are You Currently Saving Enough?

First, take a good long look at how much you’re putting away for retirement. Have you reached —or come close to — the goal of saving 15% to 20% of your income? Unfortunately, many people have not.

In the SoFi Retirement Survey, just 17% of respondents say they’re putting 15% or more of their income toward retirement. The majority are contributing much less. Here’s how the numbers break down:

Retirement Contributions

• 49% contribute less than 10% of their income

• 23% contribute less than 5% of their income

• 17% contribute 15% or more of their income

Of those who are contributing 15% or more of their income to retirement savings, 50% have a household income of $100,000 or more. The older they get, the more likely survey respondents are to contribute. While 32% of those aged 25 to 34 put at least 15% of their income toward retirement savings, the number jumps to 60% for those aged 25 to 44.

Factors That Impact How Much Retirement Savings You’ll Need

When considering how much you’ll need to retire, here are a few things that you will want to keep in mind:

Age You Plan to Retire

In simple terms, your retirement age is the age when you decide to retire. For example, you might set your target retirement date as 62 or 65 or 66 — all of which are related to Social Security benefits in some way.

Social Security has largely shaped how we view retirement age in the U.S. because that monthly payout is what enables the majority of people to leave work. Ninety-seven percent of adults ages 60 or older receive Social Security, according to a 2024 estimate by the Social Security Administration. And most people ages 65 and older say Social Security is the majority of their income, according to an analysis by the Center on Budget and Policy Priorities, a nonpartisan research and policy institute.

While retiring at 62 is the earliest age when you can claim Social Security, that’s not your “full retirement age” – 67 is generally considered the full retirement age for those born in 1960 or later.

Pre-Retirement Income

Some financial planners suggest that you base your retirement projections on your pre-retirement income. You might use 70%, 75%, or 80% of your current income as a basis for estimating how much money you’ll need in retirement.

For a more detailed look, go through your budget and see how each type of expense will change in retirement. You may need more or less income than you think.

Retirement Lifestyle Goals

Another thing to think about is how your lifestyle overall might change in retirement. Consider whether you plan to move or make other big lifestyle changes that can impact both expenses and taxes. While some costs may go down (such as if you pay off the mortgage on your home), others might go up as you change your lifestyle.

As one example, if you want to explore the world or visit grandchildren, your travel budget may drastically increase from pre-retirement levels.

Social Security

Social Security benefits can provide a vital supplement to your retirement income and help you get closer to financial security. However, it’s critical to understand that the amount of your benefit will vary depending on your age.

The earliest you can start receiving Social Security Benefits is age 62, but your benefits will be reduced by as much as 30% if you take them that early — and they will not increase as you age.

If you wait until your full retirement age (FRA) you can begin receiving full benefits. Your full retirement age is based on the year you were born. For example, if you were born in 1960 or later, your full retirement age is 67. You can find a detailed chart of retirement ages on the Social Security website.

But here is the real Social Security bonus: If you can put off claiming your Social Security benefits until age 70, perhaps by working longer or working part time, the size of your benefits will increase considerably. Typically, for each additional year you wait to claim your benefits up to age 70, your benefits will grow by 8%.

Future Retirement Expenses

Creating an estimated budget can help you get a sense of what your retirement expenses might be. For example, you may know how much you’ll pay for things like housing, utilities, and food. But it’s also important to consider any future expenses that could require you to spend more each month in retirement.

Most people aren’t sure how much money they need to retire, according to SoFi’s retirement survey. Just one quarter of respondents say they know the amount they need.

• 41% have a rough estimate of how much they’ll need to retire comfortably

• 25% know how much they’ll need to retire comfortably

• 25% don’t know how much they’ll need to retire comfortably

Of those who don’t know how much they’ll need for retirement, about 40% are aged 45 or older.

That’s why it’s so important to start thinking now about the expenses you might face in retirement. The sooner you start planning and saving for these costs, the more time — and ideally, the more money — you may be able to stash away.

For instance, healthcare can be a major cost in retirement, especially if you retire early. At age 65, you will qualify for Medicare, but if you retire before then, you’ll need to make sure that you have a plan for covering healthcare costs in retirement. Even after qualifying for Medicare, you may still have significant health-related costs, depending on your specific medical situation. While Medicare can pay for many health-related issues, it doesn’t pay for all of them. Long-term nursing care is a big exclusion.

Purchasing long-term care insurance or a long-term care annuity could provide you with the necessary funds to cover those expenses, should you need nursing care. But if you don’t have either of those options in place, you’ll need to consider how you’ll fit long-term care costs into your retirement budget.

Inflation

Inflation eats away at the value of each individual dollar, including savings and investments, so it’s important to keep in mind the inflation rate for retirement planning. There are several strategies you can use when investing during inflation.

The cost of living in the future will be higher than it is today. For example, if rent costs $1,000 today, but next year inflation rises by 2.5%, that cost could rise to $1,025. Over a decade or more, that price could double or triple.

Closing the Gap Between Current Savings and Your Goal

If you realize that you have a gap between your current savings and where you think you need to be when you retire, it’s important to make a plan to address the gap. If you choose to do nothing, the gap will only grow wider.

You have three main ways to close the gap — either start saving more of your money or find a way to increase the returns your investments are earning. You can also consider making different choices about the sort of retirement you want.

Retirement Savings Accounts

You have many different ways that you can invest and save for retirement. Many employers have 401(k) accounts that give tax advantages for saving for retirement. On top of that, some employers offer matching funds when you contribute to a 401(k) account.

Another option can be to open an IRA, which you can set up on your own.

There are two main types: a traditional IRA and a Roth IRA. While both types let you contribute up to $7,000 yearly for 2025, with an additional catch-up contribution of $1,000 for those age 50 and older, and up to $7,500 for 2026, with an additional catch-up contribution of $1,100 for those 50 and older, one key difference is the way the two accounts are taxed: Traditional IRAs let you deduct your contributions up front and pay taxes on distributions when you retire, whereas Roth IRA contributions are not tax deductible, but you can withdraw money tax-free in retirement.

The Takeaway

It would be nice if there was a simple way to calculate the exact amount you need to retire on. Instead, think of your retirement amount as an ongoing series of calculations that you’ll refine as you get older, and as your thinking gets clearer.

There are some things you can predict, but many that you can’t — including the state of your health (or your spouse’s), the turns the market might take, or a change in priorities. All you can do is start early and save steadily for the retirement you hope to have one day.

Prepare for your retirement with an individual retirement account (IRA). It’s easy to get started when you open a traditional or Roth IRA with SoFi. Whether you prefer a hands-on self-directed IRA through SoFi Securities or an automated robo IRA with SoFi Wealth, you can build a portfolio to help support your long-term goals while gaining access to tax-advantaged savings strategies.

FAQ

How much money do you need to retire with a $100,000 salary?

In order to determine how much money you need to retire with a certain amount of salary, you’ll need to make a few assumptions. For example, you can estimate that you’ll need 75% of your pre-retirement income after you retire and follow the 4% rule. That would mean you’ll need $1,875,000 to be able to retire.

If you change your assumptions, it will also change your numbers. If you follow the 80% rule, for instance, you would aim to replace 80% of your $100,000 pre-retirement income — or $80,000 per year.

How can I catch up on retirement savings if I’m behind?

There are two main ways to catch up on retirement savings if you’re not meeting the targets for where you want to be. The first is to increase the amount of money you’re saving each month. Upping your contributions can help close your retirement savings gap. The other would be to try to increase the investment returns that you are earning, though that may also come with increased risk or volatility.

Should I factor in Social Security when determining how much retirement income I’ll need?

It may not be prudent to count on Social Security as a major contributor to your retirement amount, especially if it’s still decades until your retirement date. Current projections indicate that the government may not be able to fully fund Social Security payments at some point fairly soon — a June 2025 report by the Social Security Board of Trustees indicates that this might happen by 2034. Social Security recipients are still likely to receive benefits, though those benefits may be reduced by around 23%, the report said.

It’s conceivable that Congress could take action to address the shortfall, but that’s impossible to know.

Can you comfortably retire with $1.5 million?

Deciding whether $1.5 million is enough for you to comfortably retire depends a lot on your standard of living and annual retirement expenses. Using the 4% rule says that a nest egg of $1.5 million would give an annual amount of $60,000. Depending on the cost of living in your area and your own standard of living, that may be enough to retire comfortably.

Am I on track to retire comfortably?

To gauge if you are on track with your retirement savings, you can use a couple of general guidelines. The 80% rule says you will need 80% of your pre-retirement income per year when you retire. Another guideline recommends having 10 times your annual salary saved by the time you’re 67.

But you also need to factor in your personal financial situation, as well as your retirement goals to determine if you can retire comfortably. Depending on your circumstances, you may need to save more or less than the guidelines recommend.

Photo credit: iStock/Yaroslav Astakhov

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

For disclosures on SoFi Invest platforms visit SoFi.com/legal. For a full listing of the fees associated with Sofi Invest please view our fee schedule.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Disclaimer: The projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

Third Party Trademarks: Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

SOIN-Q325-044

CN-Q425-3236452-42