Table of Contents

An emergency savings fund is a lump sum of cash set aside to cover any unanticipated expenses or financial emergencies that may come your way.

Besides offering peace of mind, an emergency fund can help save you from having to rely on high-interest debt options. These include credit cards or unsecured loans which can snowball. Not having rainy-day savings can also threaten to undermine your future security if you wind up tapping into retirement funds to get by.

Key Points

• An emergency fund is a financial safety net that can be used for unexpected expenses, for financial emergencies, or in the event of income loss.

• Financial professionals generally advise having three to six months’ worth of living expenses in your savings account.

• An emergency fund may prevent you from going into debt, provide funds during unemployment, give you the space needed to make better financial decisions, and provide peace of mind.

• To begin building an emergency fund, it can help to start with a smaller goal, such as $1,000.

• Using a high-yield savings account and automating contributions to the account can help you gradually build up your emergency fund to the amount that’s best for your circumstances.

What Is an Emergency Fund?

An emergency fund is essentially a savings fund earmarked for emergency expenses—aka unplanned expenses or financial emergencies. A major home repair, like a leaking roof, is an example of an unplanned expense that needs to be dealt with right away. Losing a job is an example of a financial emergency that can cause a lot of stress if you don’t have an emergency fund to dip into to pay for necessities and bills.

If someone doesn’t have an emergency fund and experiences financial difficulties, they may turn to high-interest debt. For instance, they may use credit cards or personal loans to cover expenses, which can lead to struggling to pay down the debt that’s left in its wake.

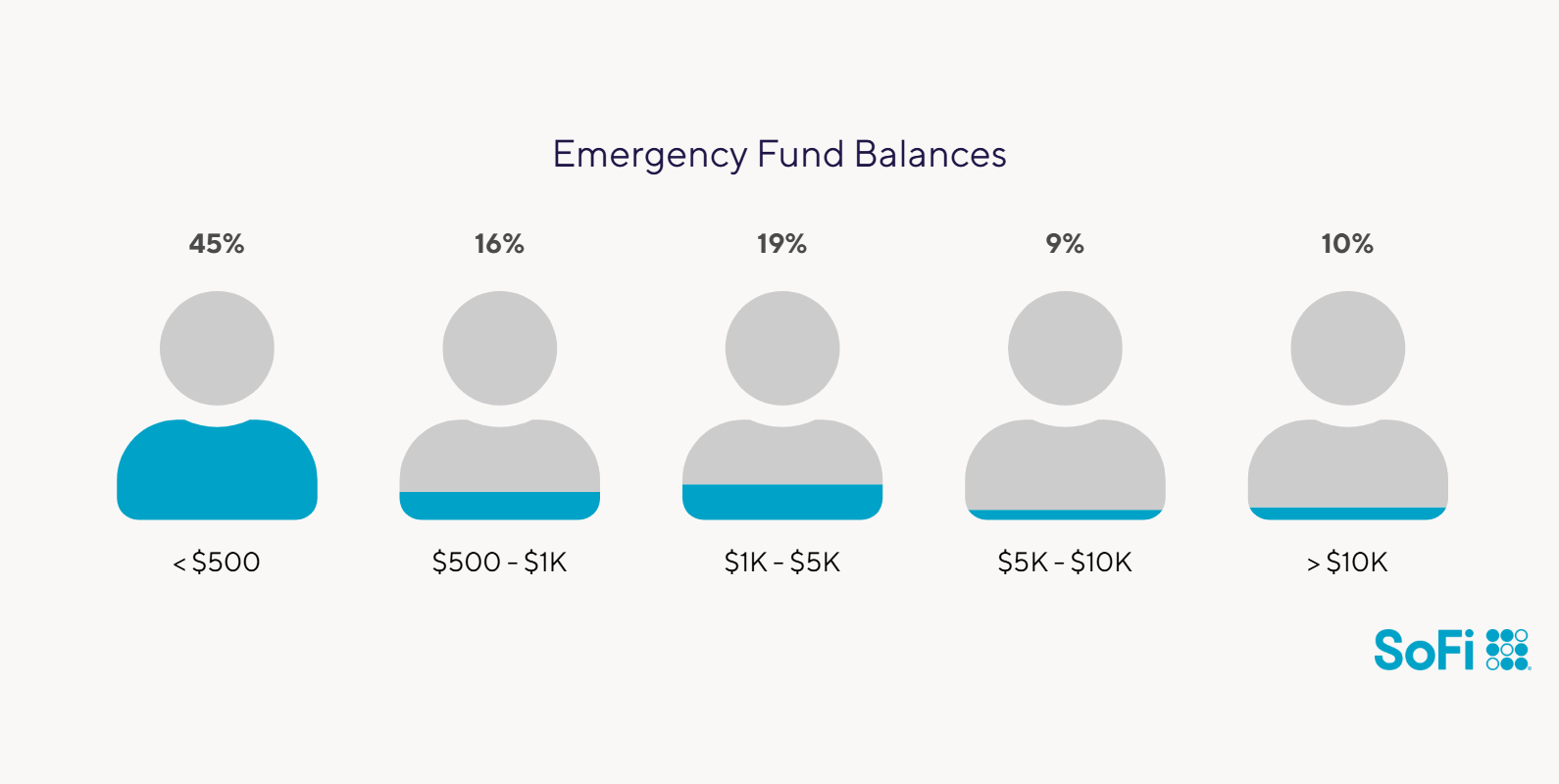

You may be wondering just how much to keep in an emergency fund. Financial experts often recommend having at least three to six months’ worth of basic living expenses set aside in an emergency fund. That can be a lofty goal considering that one recent study showed that about half of all Americans would struggle to come up with $400 in an emergency scenario. And in SoFi’s April 2024 Banking Survey of 500 U.S. adults, 45% of respondents said they have less than $500 set aside in an emergency fund. It’s wise not to be caught short and to prioritize saving an emergency fund.

Source: SoFi’s 2024 Banking Survey

Why Do You Need an Emergency Fund?

With all of the bills that a person typically has to pay, you may wonder, “Why should creating an emergency fund be a top priority?” Here’s why: An emergency fund can be a kind of self-funded insurance policy. Instead of paying an insurance company to back you up if something goes wrong, you’re paying yourself by setting aside these funds for the future. Building this cushion into your budget can be a vital step in better money management.

How you invest emergency funds is of course up to you, but keeping the money in a high-yield savings account typically gives you the liquidity you need while earning some interest.

Having this kind of financial safety net comes with a range of benefits. Below are some of the key perks of having an ample emergency fund.

Preventing You From Going into Debt

Yes, there may be other ways to quickly access cash to cover the cost of an emergency, such as credit cards, unsecured loans, home equity lines of credit, or pulling from other sayings, like retirement funds.

Preventing debt is one of the most important reasons to have an emergency fund.

But these options typically come with high interest fees or penalties. Though there are many reasons for having an emergency fund, preventing debt is among the most important and enticing.

Providing Peace of Mind

Here’s another reason why it is important to have an emergency fund: Living without a safety net and simply hoping to get by can cause you to stress. Thoughts about what would happen if you got hit with a large, unanticipated expense could keep you up at night.

Being prepared with an emergency fund, on the other hand, can give you a sense of confidence that you can tackle any of life’s unexpected events without experiencing financial hardship.

Increase your savings

with a limited-time APY boost.*

Providing Finances During Unemployment

Applying for unemployment benefits, if you are entitled to them, can help you afford some of your daily expenses. Unfortunately, these payments are generally not enough to cover your entire cost of living.

If you have an emergency fund, you can tap into it to cover the cost of everyday expenses — like utility bills, groceries, and insurance payments — while you’re unemployed.

Starting an emergency fund also gives you the freedom to leave a job you dislike, without having to secure a new job first. Sometimes this can be the best move if you are stuck in a toxic situation.

Making Better Financial Decisions

Having extra cash set aside in an emergency fund helps keep that money out of sight and out of mind. Having money out of your immediate reach can make you less likely to spend it on a whim, no matter how much you’d like to.

Also by having a separate emergency account, you’ll know exactly how much you have — and how much you may still need to save. This can be preferable to keeping a cash cushion in your checking account and hoping it will be enough. In fact, 77% of the SoFi survey respondents who have a savings account said they used it specifically for emergencies.

Recommended: Guide to Practicing Financial Self-Care

Emergency Fund Statistics

Curious about how much other people have in their emergency funds? Or what percentage of Americans actually have a rainy-day account? Here are some recent research numbers to know:

• About 75% of people report having emergency savings.

• 46% have enough money to cover three months’ worth of expenses.

• Just 19% of people in SoFi’s report said they have between $1,000 and $5,000 in emergency savings.

• 24% of people overall have no emergency savings at all.

• 37% of Americans said they couldn’t cover a $400 emergency expense, according to Empower data.

• 59% of U.S. survey respondents said they couldn’t cover a $1,000 emergency bill.

How Do You Build an Emergency Fund?

One of the basic steps of how to start a financial plan is saving for emergencies. Stashing money aside for a rainy day is a vital part of financial health.

The good news is that starting an emergency fund doesn’t have to be complicated. These tips can help you get your emergency fund off to a good start.

• Set your savings target. The first step in building an emergency fund is deciding how much to save. The easiest way to do that is to add up your monthly expenses, then multiply that by the number of months you’d like to save (typically, at least three to six months). If the amount seems overwhelming, you can start smaller and aim to save $1,000 first, then build up your emergency fund from there.

• Decide where to keep it. The next step is deciding where to hold your emergency savings. Opening a bank account online could be a good fit, since you can earn a competitive APY (annual percentage yield) on balances while maintaining convenient access to your money. You could also choose to open a traditional bank account and use its online banking features. Forty-eight percent of people say they use online banking daily, according to SoFi’s data.

• Automate contributions. Once you set up an online bank account for your emergency fund, you can schedule automatic transfers from checking. This way, you can easily grow your emergency fund without having to worry about accidentally spending down that money.

One of the most frequently asked emergency fund questions is whether a savings account is really the best place to keep your savings. After all, you could put the money into a certificate of deposit (CD) account instead or invest it in the market. But there are issues with those options.

A CD is a time deposit, meaning you agree to leave your savings in the account for a set maturity period. If you need to withdraw money from a CD in an emergency before maturity, your bank may charge you an early withdrawal penalty.

So, should emergency funds be invested instead? Not so fast. Investing your emergency fund money in the stock market could help you to earn a higher rate of return compared to a savings account. But you’re also taking more risk with that money, since a downturn could reduce your investment’s value. Proceed with caution before taking this step.

How Long Does It Take to Grow an Emergency Fund?

Emergency funds don’t necessarily come together overnight. Saving after-tax dollars to equal six months’ worth of typical living expenses can take some work and time. Here’s an example to consider: If your monthly costs are $3,000, you would want to have between $9,000 and $18,000 set aside for an emergency, such as being laid-off.

• If your goal is $9,000 and you can set aside $200 per month, that would take you 45 months, or almost four years, to accumulate the funds.

• If you can put aside $300 a month, you’d hit your goal in 30 months, or two and a half years.

• If you can stash $500 a month, you’d have $9,000 saved in one and a half years.

A terrific way to grow your emergency fund is to set up automatic transfers from your checking account into your rainy-day savings. That way, you won’t see the money sitting in your checking and feel as if it’s available to be spent.

Recommended: Online Emergency Fund Calculator

How Can You Grow It Faster?

You’ve just seen how gradually saving can build a cash cushion should an emergency hit. Here are some ways to save even faster:

• Put a windfall into your emergency fund. This could be a tax refund, a bonus at work, or gift money from a relative perhaps.

• Sell items you don’t need or use. If you have gently used clothing, electronics, jewelry, or furniture, you might sell it on a local site, such a Facebook group or Craigslist, or, if small in size, on eBay or Etsy.

• Start a side hustle. One of the benefits of a side hustle is bringing in extra cash; it can also be a fun way to explore new directions, build your skills, and fill free time.

These techniques can help you ramp up your savings even faster and be prepared for an emergency that much sooner.

Prioritizing Your Emergency Fund When You Have Other Financial Obligations

Most of us have competing financial goals: paying down student debt or a credit card balance; accumulating enough money for a down payment on a house; saving for college for kids; and socking away money for retirement. In many cases, you’ll see variability in financial goals by age, but there are often several needs vying for your dollars at any given time.

Here’s advice on how to allocate funds:

• Definitely start or continue saving towards your emergency fund. Even if you can only spare $25 per month right now, do it! It will get you on the road to hitting your goal and earning you compound interest. Otherwise, if an emergency were to strike, you’ll likely have to resort to credit cards or tapping any retirement savings, which probably involves a penalty.

• Continue to pay down high-interest debt, like credit card debt. You want to get this kind of debt out of your life, given the interest rates can currently top 20%. You might explore balance transfer offers that let you pay no or very low interest for a period of time (say, 18 months) which can help you pay down your debt. Just make sure you understand the fees that are typically involved.

• Steadily stick to your schedule for low-interest debt, which typically includes student loans and mortgages.

• Fund your retirement savings as much as you can. As with an emergency fund, even a small amount will be worthwhile, especially with the benefit of compound interest. Make sure to contribute enough to take advantage of the company match if your employer offers that as part of a 401(k) plan; that is akin to free money.

Test your understanding of what you just read.

The Takeaway

An emergency fund is an important financial goal. Once you’ve accrued at least three to six months’ worth of basic living expenses, you can feel more secure if a major unexpected expense pops up or job loss happens. It can be wise to store emergency funds in a high-yield savings account to deliver both liquidity and interest.

Interested in opening an online bank account? When you sign up for a SoFi Checking and Savings account with eligible direct deposit, you’ll get a competitive annual percentage yield (APY), pay zero account fees, and enjoy an array of rewards, such as access to the Allpoint Network of 55,000+ fee-free ATMs globally. Qualifying accounts can even access their paycheck up to two days early.

FAQ

What is the purpose of an emergency fund?

An emergency fund is a financial safety net. It’s money set aside that you can use if you are hit with a big, urgent, unexpected bill (like a medical expense or car repair) or endure a loss of income. In these situations, an emergency fund can help you avoid using your credit cards and taking on high-interest debt or hurting your credit score by paying bills late. How to invest an emergency fund is up to you, but a high-interest savings account is one good, liquid option.

Can I use an emergency fund for a non-emergency expense?

Technically, you can use an emergency fund for a non-emergency expense. After all, it’s your money. But it’s not wise to do so and defeats the whole purpose of saving this cash. If you use your emergency funds to pay for a vacation or new clothes, then if a true emergency arises, you won’t be prepared.

How difficult is it to rebuild an emergency fund?

It can be difficult to rebuild an emergency fund, just as it was to accumulate the money in the first place. But even if it takes years to achieve your goal, it is worth it. Putting away money gradually for an emergency is an important step towards being financially fit.

More from the emergency fund series:

SoFi Checking and Savings is offered through SoFi Bank, N.A. Member FDIC. The SoFi® Bank Debit Mastercard® is issued by SoFi Bank, N.A., pursuant to license by Mastercard International Incorporated and can be used everywhere Mastercard is accepted. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Annual percentage yield (APY) is variable and subject to change at any time. Rates are current as of 12/23/25. There is no minimum balance requirement. Fees may reduce earnings. Additional rates and information can be found at https://www.sofi.com/legal/banking-rate-sheet

Eligible Direct Deposit means a recurring deposit of regular income to an account holder’s SoFi Checking or Savings account, including payroll, pension, or government benefit payments (e.g., Social Security), made by the account holder’s employer, payroll or benefits provider or government agency (“Eligible Direct Deposit”) via the Automated Clearing House (“ACH”) Network every 31 calendar days.

Although we do our best to recognize all Eligible Direct Deposits, a small number of employers, payroll providers, benefits providers, or government agencies do not designate payments as direct deposit. To ensure you're earning the APY for account holders with Eligible Direct Deposit, we encourage you to check your APY Details page the day after your Eligible Direct Deposit posts to your SoFi account. If your APY is not showing as the APY for account holders with Eligible Direct Deposit, contact us at 855-456-7634 with the details of your Eligible Direct Deposit. As long as SoFi Bank can validate those details, you will start earning the APY for account holders with Eligible Direct Deposit from the date you contact SoFi for the next 31 calendar days. You will also be eligible for the APY for account holders with Eligible Direct Deposit on future Eligible Direct Deposits, as long as SoFi Bank can validate them.

Deposits that are not from an employer, payroll, or benefits provider or government agency, including but not limited to check deposits, peer-to-peer transfers (e.g., transfers from PayPal, Venmo, Wise, etc.), merchant transactions (e.g., transactions from PayPal, Stripe, Square, etc.), and bank ACH funds transfers and wire transfers from external accounts, or are non-recurring in nature (e.g., IRS tax refunds), do not constitute Eligible Direct Deposit activity. There is no minimum Eligible Direct Deposit amount required to qualify for the stated interest rate. SoFi Bank shall, in its sole discretion, assess each account holder's Eligible Direct Deposit activity to determine the applicability of rates and may request additional documentation for verification of eligibility.

See additional details at https://www.sofi.com/legal/banking-rate-sheet.

*Awards or rankings from NerdWallet are not indicative of future success or results. This award and its ratings are independently determined and awarded by their respective publications.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Disclaimer: Many factors affect your credit scores and the interest rates you may receive. SoFi is not a Credit Repair Organization as defined under federal or state law, including the Credit Repair Organizations Act. SoFi does not provide “credit repair” services or advice or assistance regarding “rebuilding” or “improving” your credit record, credit history, or credit rating. For details, see the FTC’s website .

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

Third Party Trademarks: Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®

SOBNK-Q325-116