How Do Low-Income Home Loans Work?

A low-income home loan is designed to make it possible for borrowers with lower income levels to meet their goals of homeownership. Typically, low-income mortgage programs help borrowers overcome a variety of barriers. Alongside those with a low income, these programs can help if someone has a poor credit score, large amount of debt, or a small down payment.

This guide takes a closer look at such details as:

• How home loans for low-income borrowers work

• Examples of these programs

• How to buy a home when someone has a low income.

What Is a Low-Income Home Loan?

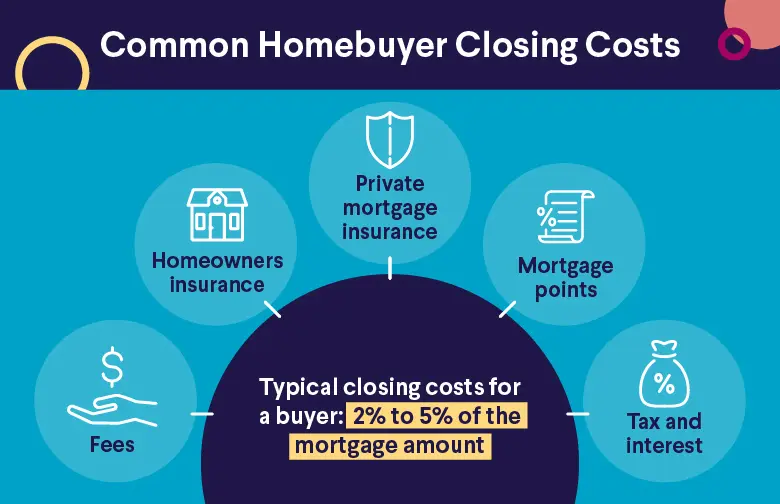

When it comes to home loans with low income requirements, these programs tend to have more relaxed income, credit, and down payment requirements than conventional loans. Other advantages of these programs can include lower interest rates, discounted mortgage insurance, and reduced closing costs.

Many low-income loan programs actually have income limits that prohibit those with higher incomes from qualifying. These programs can make it much easier to qualify for a mortgage when someone has a lower income, but they do still need to be able to afford the cost of their monthly payments.

Some of these programs are specifically designed to help first-time homebuyers, and there can be grants, tax credits, and other types of assistance available to new homeowners.

An April 2024 SoFi survey of 500 would-be homeowners suggests that there is significant need for programs for low-income buyers, yet not enough people are aware of them: Respondents named home availability in their price range as their top concern, and one in five people (19%) said they were not at all optimistic that they would find a home in their budget within the next six months. Yet when asked about their awareness of financing options for buyers with lower incomes, there was widespread lack of knowledge, with one in eight buyers not aware of any of the programs.

💡 Quick Tip: SoFi Home Loans are available with flexible term options and down payments as low as 3%.*

Examples of Low-Income Home Loans

There are a few different types of home loans for low-income borrowers. Here are a few popular examples:

• United States Department of Agriculture (USDA) loans. Even with a low income, it’s possible to qualify for a USDA loan if the borrower plans to buy a home in an eligible rural area. As a bonus, this program doesn’t require a down payment.

• Federal Housing Administration (FHA) loans. These government-backed loans tend to come with lower credit score requirements than conventional loans and only require a 3.5% down payment, no matter what the buyer’s income level is.

• Veterans Affairs (VA) loans. Active service members, veterans, and potentially surviving spouses can use a VA loan to buy a home without making a down payment.

First-time homebuyers can

prequalify for a SoFi mortgage loan,

with as little as 3% down.

Questions? Call (888)-541-0398.

How Do Low-Income Home Loans Work?

How low-income home loans work depend entirely on the specific loan program the borrower is applying to. For example, with FHA low-income home loans, borrowers must make a 3.5% down payment, but income levels don’t make borrowers ineligible for a loan.

VA loans on the other hand don’t require a down payment at all. It’s best for mortgage seekers to do careful research on each loan program to confirm if they qualify for a mortgage or not.

💡 Quick Tip: A VA loan can make home buying simple for qualified borrowers. Because the VA guarantees a portion of the loan, you could skip a down payment. Plus, you could qualify for lower interest rates, enjoy lower closing costs, and even bypass mortgage insurance.†

Pros and Cons of Low-Income Home Loans

Home loans for low-income families come with some unique advantages and disadvantages worth keeping in mind.

Pros of Low-Income Home Loans

First, consider the upsides:

• Low to no down payment requirements

• Easier to qualify for than conventional loans

• Less strict credit score requirements

• May have more favorable interest rates.

Cons of Low-Income Home Loans

Next, review the downsides of these loan programs:

• May only work for specific applicants (like VA loans)

• May require ongoing mortgage insurance

• Can be harder to find low-income loan programs.

Are Low-Income Home Loans Worth It?

Low-income loan programs can be worth it if the math makes sense. It’s generally a good idea to shop around with different lenders to see which mortgage loan will be the most beneficial. It can be a good idea to compare different interest rates, mortgage insurance requirements, and fees to see which loan will cost the least.

Borrowers can research a variety of loan programs to see which may best suit their needs. For example, home loans for low-income single mothers, home loans for low-income seniors, or low-income home improvement loans are designed for different borrowers.

Steps for How to Buy a House With a Low Income

When a borrower has a low income, there are steps they can take to make buying a house easier.

• Build one’s credit score. The higher someone’s credit score is, the easier it can be to qualify for a home loan. It’s a good idea for borrowers to check their credit score to see where they stand and if there are any mistakes on their credit report that might be harming their credit score. Consumers will want to consistently pay their bills on time if they want to help build their credit score before buying a home.

• Pay off debt. Another technique that can help build a credit score is to pay off debt. This can be beneficial to one’s score, and the less debt someone has, the easier it can be to qualify for a home loan. Lenders take a borrower’s debt-to-income (DTI) ratio into account when deciding how much money to lend them and the lower this ratio is, the better.

• Save for a larger down payment. The larger someone’s down payment is, the less money they need to borrow. When someone has a low income, it’s easier to qualify for smaller loans. Conventional wisdom may be that they will put down at least a 20% down payment, even if the low-income mortgage loan program doesn’t require that large of a down payment.

Recommended: What Is a HUD Home?

Low-Income Home Loan Tips

If someone is struggling to qualify for a low-income home loan, these are some steps they can take to make the process easier.

• Find the right program. To start, finding a niche program designed to meet the applicant’s specific needs can help. For example, a single mother may want to look into low-income home loans for single mothers, as well as more general loan programs.

• Use a cosigner. If someone’s credit score or income makes it challenging for them to qualify for a mortgage, they can apply with a cosigner who has the qualifications lenders are looking for. The cosigner needs to know they will be responsible for making payments if the main borrower defaults on the loan.

The Takeaway

While income is a major factor that mortgage loan lenders take into consideration, having a low income doesn’t need to disqualify someone from qualifying for a mortgage loan. There are low-income loan programs that can help consumers meet their goals of homeownership.

Looking for an affordable option for a home mortgage loan? SoFi can help: We offer low down payments (as little as 3% - 5%*) with our competitive and flexible home mortgage loans. Plus, applying is extra convenient: It's online, with access to one-on-one help.

FAQ

Can I buy a house if I make $25k a year?

Whether or not someone can buy a house with only a $25,000 a year income depends on a few different factors. The overall cost of the house, their down payment amount, and the lender they choose to work with can all impact if their income will make it possible to qualify for a loan.

What’s the lowest score you can have to get a home loan?

Generally borrowers need to have a credit score of at least 620 to buy a home. All lenders and loan programs have different requirements though, so it’s worth researching the loan programs that work for each applicant’s credit score.

Is there an income limit for first-time homebuyers in California?

Some first-time homebuyer programs in California have income limits. These limits exist to stop buyers who have high-income from taking advantage of programs designed to support low-income buyers.

About the author

Photo credit: iStock/digitalskillet

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Disclaimer: Many factors affect your credit scores and the interest rates you may receive. SoFi is not a Credit Repair Organization as defined under federal or state law, including the Credit Repair Organizations Act. SoFi does not provide “credit repair” services or advice or assistance regarding “rebuilding” or “improving” your credit record, credit history, or credit rating. For details, see the FTC’s website .

†Veterans, Service members, and members of the National Guard or Reserve may be eligible for a loan guaranteed by the U.S. Department of Veterans Affairs. VA loans are subject to unique terms and conditions established by VA and SoFi. Ask your SoFi loan officer for details about eligibility, documentation, and other requirements. VA loans typically require a one-time funding fee except as may be exempted by VA guidelines. The fee may be financed or paid at closing. The amount of the fee depends on the type of loan, the total amount of the loan, and, depending on loan type, prior use of VA eligibility and down payment amount. The VA funding fee is typically non-refundable. SoFi is not affiliated with any government agency.

SOHL-Q324-107

Read more