Buying a Multifamily Property With No Money Down: What You Should Know First

Real estate investments make money through appreciation and rental income. Real estate can diversify a portfolio and act as a hedge against inflation, since landlords can pass rising costs to tenants. But the down payment on multifamily investment properties? At least 20%, or 25% to get a better rate.

It’s true that eligible borrowers may use a 0% down U.S. Department of Veterans Affairs (VA) loan for a property with up to four units as long as they live there. But those loans serve a relative few and are considered residential financing. Properties with more than four units are considered commercial.

So how can a cash-poor but curiosity-rich person tap the potential of multifamily properties? By not footing the entire bill themselves.

Table of Contents

Key Points

• Real estate investments offer potential income through appreciation and rental income, providing a hedge against inflation.

• Eligible borrowers can use a 0% down VA loan for properties with up to four units.

• Various financing strategies enable purchasing multifamily properties with little to no personal money upfront.

• Options like finding a co-borrower, securing hard money loans, or obtaining seller financing can facilitate the acquisition.

• Indirect investment methods include crowdfunding and real estate investment trusts (REITs), allowing participation without direct landlord responsibilities.

Can You Buy a Multifamily Property With No Money?

When you buy real estate, you typically have two options: Buy with cash or finance your purchase with a mortgage loan.

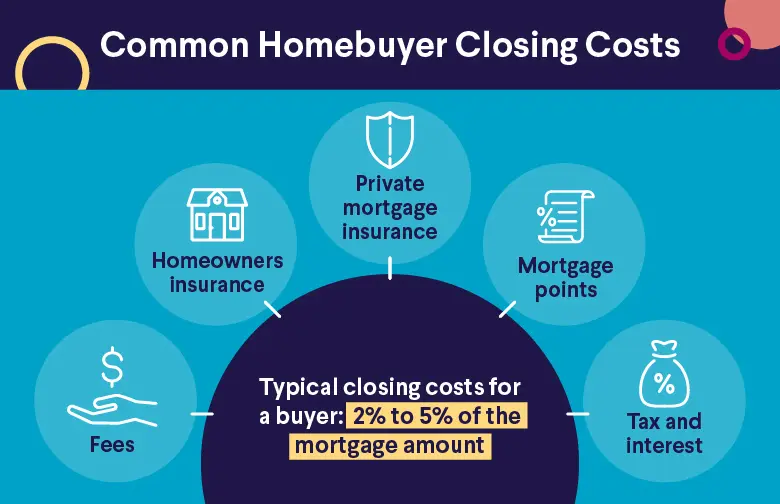

There are various types of mortgages. If you take out a home loan, you’ll likely need to pay a portion of the purchase price in cash in the form of a down payment. The minimum down payment you make will depend on the type of mortgage you choose — the average down payment on a house is well under 20% — and it will help determine what terms and interest rates you’ll be offered by lenders.

This money needs to come from somewhere, but it doesn’t necessarily need to come from your own savings account. When investors buy multifamily properties with “no money down,” it just means they are using little to no personal money to cover the upfront costs.

If you don’t have much cash of your own, there are several ways that you can fund the purchase of a multifamily investment property.

💡 Quick Tip: Jumbo mortgage loans are the answer for borrowers who need to borrow more than the conforming loan limit values set by the Federal Housing Finance Agency ($832,750 in most places, and up to $1,249,125 in high-cost areas). If you have your eye on a pricier property, a jumbo loan could be a good solution.

6 Ways to Pay for a Multifamily Property

Find a Co-Borrower

If you don’t have the money to front the costs of a property yourself, you may be able to partner with a family member, friend, or business partner. They may have the money to cover the down payment, and you might pull your weight by researching properties or managing them.

When you co-borrow with someone, you’ll each be responsible for the monthly mortgage payments. You’ll also share profits in the form of rents or capital gains if you sell the property.

Give an Equity Share

You may give an equity investor a share in the property to cover the down payment. Say a multifamily property costs $750,000, and you need a 20% down payment. An equity investor could give you $150,000 in exchange for 20% of the monthly rental income and 20% of the profit when the property is sold.

Borrow From a Hard Money Lender

Hard money loans are offered by private lenders or investors, not banks. The mortgage underwriting process tends to be less strict than that of traditional mortgages. Depending on the property you want to buy, no down payment may be required.

These loans (also called bridge loans) have high interest rates and short terms — one to three years is typical — with interest-only payments the norm. For this reason, they may be used by investors who may be looking to flip the property in short order, allowing them to make a profit and pay off the loan quickly.

First-time homebuyers can

prequalify for a SoFi mortgage loan,

with as little as 3% down.

Questions? Call (888)-541-0398.

House Hack

House hacking refers to leveraging property you already own to generate income. For example, you might rent out an in-law suite or list your property on Airbnb.

Another option: You could rent out your primary residence and move into one of the units in a multifamily property you buy. This way, you’d probably generate more income than if you had rented out the unit to a tenant.

Finally, you could hop on the ADU bandwagon if you own a single-family home. Accessory dwelling units can take the form of a converted garage, an attached or detached unit, or an interior conversion. The rental income can be sizable. To fund a new ADU, homeowners may tap home equity, look into cash-out refinancing, or even use a personal loan.

Seek Seller Financing

If you don’t have the cash for a down payment on a property, you may be able to forgo financing from a lending institution and get help instead from the seller.

With owner financing, there are no minimum down payment requirements. Several types of seller financing arrangements exist:

• All-inclusive mortgage: The seller extends credit for the entire purchase price of the home, less any down payment.

• Junior mortgage: The buyer finances a portion of the sales price through a lending institution, while the seller finances the difference.

• Land contracts: The buyer and seller share ownership until the buyer makes the final payment on the property and receives the deed.

• Lease purchase: The buyer leases the property from the seller for a set period of time, after which the owner agrees to sell the property at previously agreed-upon terms. Lease payments may count toward the purchase price.

• Assumable mortgage: A buyer may be able to take over a seller’s mortgage if the lender approves and the buyer qualifies. FHA, VA, and USDA loans are assumable mortgages.

Invest Indirectly

Not everyone wants to become a landlord in order to add real estate to their portfolio. Luckily, they can invest indirectly, including through crowdfunding sites and real estate investment trusts (REITs).

The Jumpstart Our Business Startups Act of 2013 allows real estate investors to pool their money through online real estate crowdfunding platforms to buy multifamily and other types of properties. The platforms give average investors access to real estate options that were once only available to the very wealthy.

REITs are companies that own various types of real estate, including apartment buildings. Investors can buy shares on the open market, and the company passes along the profits generated by rent. To qualify as a REIT, the company must pass along at least 90% of its taxable income to shareholders each year.

As investment opportunities go, REITs can be a good choice for passive-income investors.

💡 Quick Tip: To see a house in person, particularly in a tight or expensive market, you may need to show the real estate agent proof that you’re preapproved for a mortgage. SoFi’s online application makes the process simple.

The Takeaway

Buying a multifamily property with no money down is possible if you take the roads less traveled, including leveraging other people’s money. And if you have the means to make a down payment on a property, your first step is to research possible home mortgage loans.

Looking for an affordable option for a home mortgage loan? SoFi can help: We offer low down payments (as little as 3% - 5%*) with our competitive and flexible home mortgage loans. Plus, applying is extra convenient: It's online, with access to one-on-one help.

FAQ

Can I buy a multifamily home with an FHA loan?

It is possible to buy a property with up to four units with a standard mortgage backed by the Federal Housing Administration (FHA) if the buyer plans to live in one of the units for at least a year. The FHA considers homes with up to four units single-family housing. The down payment could be as low as 3.5%. There are loan limits.

A rarer product, an FHA multifamily loan, may be used to buy a property with five or more units. The down payment is higher. You’ll pay mortgage insurance premiums upfront and annually for any FHA loan.

Is a multifamily property considered a commercial property?

Properties with five or more units are generally considered commercial real estate. Commercial real estate loans usually have shorter terms, and higher interest rates and down payment requirements than residential loans. They almost always include a prepayment penalty.

Photo credit: iStock/jsmith

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

¹FHA loans are subject to unique terms and conditions established by FHA and SoFi. Ask your SoFi loan officer for details about eligibility, documentation, and other requirements. FHA loans require an Upfront Mortgage Insurance Premium (UFMIP), which may be financed or paid at closing, in addition to monthly Mortgage Insurance Premiums (MIP). Maximum loan amounts vary by county. The minimum FHA mortgage down payment is 3.5% for those who qualify financially for a primary purchase. SoFi is not affiliated with any government agency.

†Veterans, Service members, and members of the National Guard or Reserve may be eligible for a loan guaranteed by the U.S. Department of Veterans Affairs. VA loans are subject to unique terms and conditions established by VA and SoFi. Ask your SoFi loan officer for details about eligibility, documentation, and other requirements. VA loans typically require a one-time funding fee except as may be exempted by VA guidelines. The fee may be financed or paid at closing. The amount of the fee depends on the type of loan, the total amount of the loan, and, depending on loan type, prior use of VA eligibility and down payment amount. The VA funding fee is typically non-refundable. SoFi is not affiliated with any government agency.

SOHL-Q224-1842703-V1

Read more