While many med school students eventually may earn six figures or more, they also can expect to graduate with student debt that averages close to a quarter of a million dollars. According to the Education Data Initiative (EDI), the average medical school debt for students is $234,597.

And that’s just what these graduates owe for their medical school education. EDI found that 31% of indebted medical school graduates also have premedical education debt to pay for.

Because of the high cost of medical school debt, it’s crucial for aspiring and current medical school students and graduates to understand their debt repayment options.

Table of Contents

Key Points

• The average medical school debt for graduates in 2024 was reported at $234,597, contributing to a total education debt of approximately $264,519 when including premedical loans.

• Average medical school debt increased by 48.5% between 1998 and 2019.

• Federal student loans currently available for medical students include Direct Unsubsidized Loans and Grad PLUS loans, but Grad PLUS Loans will be eliminated as of July 1, 2026.

• Graduates facing high debt can consider options like deferment, income-driven repayment, refinancing, or loan consolidation to help manage their financial burden.

• A disparity in student debt exists among medical schools, with some institutions leading to significantly higher debt levels compared to others, highlighting the variability in medical education costs.

Medical School Debt Statistics

Here’s a snapshot of what the average medical school debt can look like for graduates, based on a roundup of the most recent statistics available:

• According to a 2024 report by EducationData.org, medical school graduates had, on average, $264,519 in total education debt (premed and medical school). Compare that with the average educational debt for the class of 1999-2000: $87,020.

• When the Association of American Medical Colleges (AAMC) looked at members of the class of 2020 who took out educational loans (the most recent data available), it found that:

◦ 5.4% borrowed $1 to $49,999 for premed studies and medical school

◦ 6.1% borrowed $50,000 to $99,999

◦ 8.2% borrowed $100,000 to $149,999

◦ 13.7% borrowed $150,000 to $199,999

◦ 25.1% borrowed $200,000 to $299,999

◦ 11.2% borrowed $300,000 to $399,999

◦ 2.9% borrowed $400,000 to $499,999

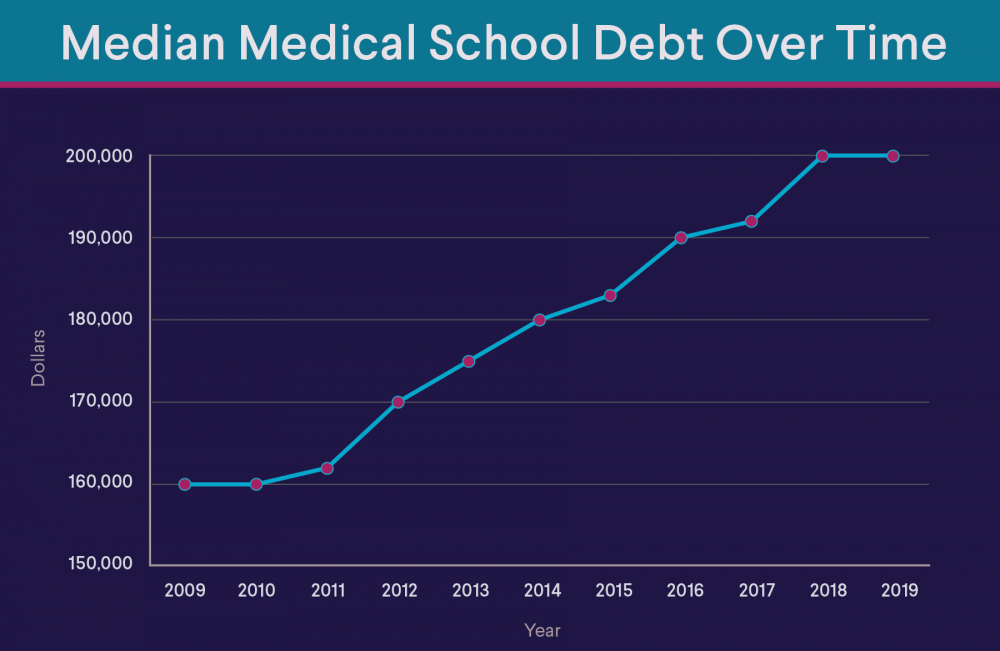

• Between 1998 and 2019, average medical school debt increased by 48.5%.

Source: Association of American Medical Colleges

Factors That Influence Medical School Debt

The increase in medical school debt is due to a number of factors, including the cost of education, the type of medical specialty a student chooses, years spent training, and relocating for a residency, among others.

Tuition and Fees

The cost of medical school increased 39% between 2001 and 2024, according to EDI. The average cost of tuition and fees for a first-year medical student in the 2023-2024 school year was $58,327. The average price of medical application fees alone was almost $3,000 in 2023.

The cost of tuition and fees can vary widely depending on whether a medical student attends a public or private university. According to the AAMC, the average cost of tuition and fees at private schools is more than $60,000 yearly. At public schools, the cost is approximately $41,000 for in-state students.

Cost of Living and Relocation

In addition to tuition and fees, medical students also need to cover cost-of-living expenses, such as housing, food, transportation, and books and other supplies needed for classes. Depending where the student goes to school, these expenses can add upward of $10,000 to the total cost of medical schooling.

When a med student is ready to begin their residency, it will typically involve relocating to another city. Along with travel expenses involved with applying for residency, a medical student will also likely need to pay for movers or to ship their belongings, rent for a new place to live (which typically involves a security deposit), and any necessary fees to hook up utilities and so on. If a med student is doing their residency in a big city, the cost for everything from food to rent may be more expensive as well.

Choice of Specialization

The area of medicine a medical student chooses to specialize in can also impact the average cost of medical school. Certain specialties require longer and more specialized training. For example, med students who want to become surgeons typically need to do an extended residency of five to seven years, compared to three to five years of residency for those studying to become primary care physicians. This can result in a higher overall cost for borrowers in specialties and sub-specialties of medicine.

What Does This Mean for Borrowers?

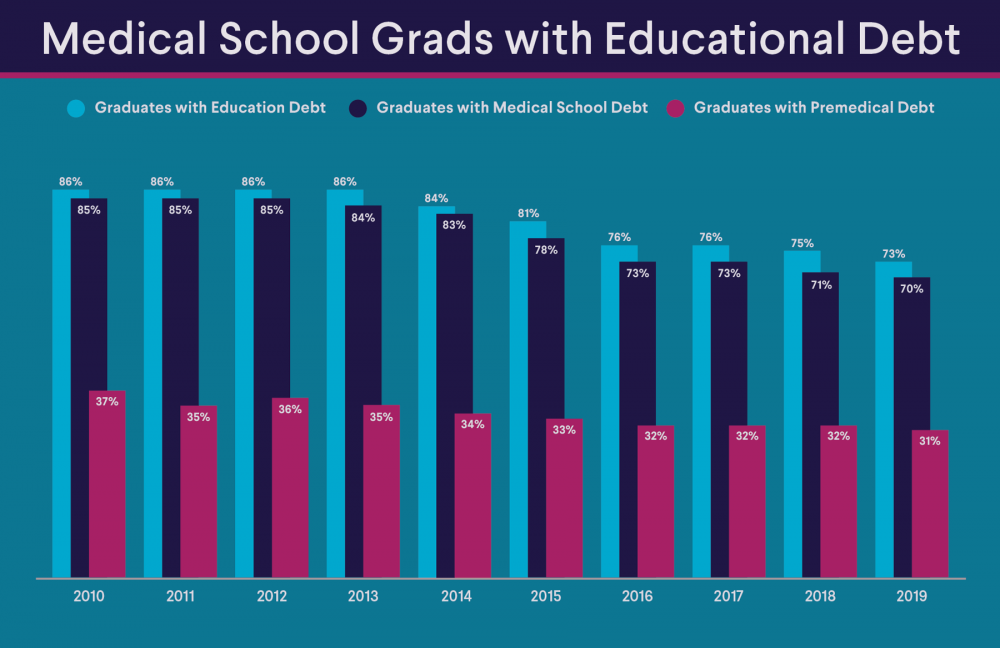

With all these expenses to cover, many aspiring doctors turn to student loans when they’re trying to figure out how to pay for medical school. Data from EDI shows that 70% of medical school students take out loans to help with medical school costs specifically.

It’s important to note that when it comes to borrowing for medical school, loan terms and conditions offered by the federal government might be different from borrowing as an undergrad. This is one of the basics of student loans that it’s helpful to understand when it comes to the average medical school debt.

Some med students may benefit from finding scholarships and loan forgiveness programs that may cut their costs substantially. But many will end up making loan payments for years — or even decades.

So what does the average debt after medical school look like? According to EDI, the average doctor will ultimately pay from $135,000 to $440,000 for their educational loans, with interest factored in.

Source: Association of American Medical Colleges

Medical School Loan Options

Due to upcoming changes to student loans as part of the domestic policy bill that was signed in July 2025, there will be just one type of federal student loan available to medical students as of July 1, 2026 — the Direct Unsubsidized Loan.

Another type of federal student loan that has previously been available to those going to medical school, the Grad PLUS Loan, will be eliminated for new borrowers on July 1, 2026.

Instead graduate students will have new lending limits through the Direct Unsubsidized Loan program. This includes an annual limit of $20,500 for graduate students with a $100,000 lifetime limit. Professional students, such as medical students, may qualify for a Direct Unsubsidized Loan with a yearly limit of $50,000 and a lifetime limit of $200,000.

However, those who already have Grad PLUS Loans before the changes take place, can continue to borrow money under the current limits for three additional academic years.

Medical students also can apply for private student loans to help cover their average medical student debt. Generally, borrowers need a solid credit history for private student loans, among other financial factors that will vary by lender. Private lenders offer different rates, terms, and conditions, so it can be worthwhile to shop around.

Just be aware that federal loans currently come with many student protections and benefits that private loans don’t, such as the Public Service Loan Forgiveness program and income-driven repayment.

How to Deal With Debt

There are several medical school repayment strategies that graduates grappling with the average medical student debt may want to consider.

Deferment

Temporarily delaying payments while in school may seem like a good idea during a stressful time, but delaying can be costly. During student loan deferment, most Direct Unsubsidized Loans and Direct PLUS loans continue to accrue interest. The problem those in medical fields can face is debt accumulation during their residency, which can last anywhere from three to seven years.

Even while making a modest income — in 2024, the average resident earned $70,000, according to Medscape — the debt would grow considerably.

If your loans are in deferment, making interest-only payments and putting that money toward student loans can reduce the amount of interest that could be added to the loan.

Income-Driven Repayment

Medical residents who can’t afford full payments may want to consider an income-driven repayment (IDR) plan. These plans are designed to make student loan payments more manageable by basing monthly payments on the borrower’s discretionary income and family size.

As of August 2025, there are three income-driven repayment plans you can enroll in, but only one of them — the Income-Based Repayment (IBR) Plan — may allow borrowers to have the outstanding balance of their loan forgiven after 20 years.

However, the new U.S. domestic policy bill will eliminate a number of student loan repayment plans. For borrowers taking out their first loans on or after July 1, 2026, there will be only one repayment option that is similar to the current IDR plans: the Repayment Assistance Program (RAP). On RAP, payments range from 1% to 10% of a borrower’s adjusted gross income for up to 30 years. At that point, any remaining debt will be forgiven. If a borrower’s monthly payment doesn’t cover the interest owed, the interest will be cancelled.

Refinancing Loans

Refinancing medical school loans to help cover the average medical student debt is an option during residency, after residency, or both.

Refinancing student loans with a private lender might help save you money if you can get a lower interest rate than the rates of your current student loans.

Student loan refinancing means paying off one or more of your existing student loans with one new loan. An advantage of refinancing student loans is that you’ll only have one monthly payment to make.

If you refinance your student loans and get a better rate, you could choose a term that allows you to pay off the loan more quickly if you’re able to shoulder the payments, which should save you on interest.

However, refinancing federal loans isn’t a good fit for those who wish to take advantage of federal programs and protections. Refinancing federal loans means you no longer have access to these benefits.

Consolidating Loans

The federal government offers Direct Consolidation Loans through which multiple eligible federal student loans may be combined into one. The interest rate on the new loan is the weighted average of the original loans’ interest rates, rounded up to the nearest one-eighth of a percentage point.

If your payment goes down, it’s likely because the term has been extended from the standard 10-year repayment to up to 30 years on the consolidation loan. Although you may pay less each month, you’ll be paying more in interest over the life of your loan.

Schools With the Highest Student Debt

When it comes to student debt, all medical programs are not equal. According to U.S. News and World Report’s “Best Grad School” rankings, the range can be extensive. Out of 122 medical schools listed, the three that left grads with the most debt in 2022 (the most recent year available) were:

• Nova Southeastern University Patel College of Osteopathic Medicine (Patel) in Fort Lauderdale, Florida: $322,067

• Western University of Health Sciences in Pomona, California: $281,104

• West Virginia School of Osteopathic Medicine in Lewisburg, West Virginia: $268,416

On the other end of the spectrum, the school that graduated students with the least amount of debt was the University of Houston Tilman J. Fertitta Family College of Medicine, with about $34,000 of debt, according to a 2025 report by the AAMC.

Public vs. Private Medical School

The cost of attending a private medical school is typically higher than a public school.

According to EDI, these were the average yearly costs of tuition and fees based on the type of school.

• Public medical school: $53,845

• Private medical school: $67,950

• Public school, in-state resident: $52,107

• Public school, nonresident: $67,348

However, EDI also found that the average cost of an out-of-state education has decreased; whereas costs for in-state public schools have risen by more than 10%.

Strategies for Minimizing Medical School Debt

For medical students looking for ways to reduce the amount of debt they accumulate, there are some programs that can help. Here are two options to explore.

Scholarships and Grants

There are many scholarships and grants available to medical school students to help reduce the average cost of medical school. In fact, some of the top medical school scholarships are worth thousands of dollars to those who qualify.

Scholarships are offered by the federal government, state governments, private organizations, and even medical schools. Cast a wide net to search for a scholarship you may be eligible for.

Service-Based Loan Forgiveness Programs

Medical students may also be eligible to have their student loans forgiven. For example, there are loan repayment programs for those in the medical field who choose to work in an underserved area and/or medical specialty.

The National Health Service Corps Loan Repayment Program offers doctors and other eligible health care providers an opportunity to have their qualifying federal or private student loans repaid while serving in communities with limited access to care.

Medical professionals in a variety of fields, including pediatric research, health disparities research, and clinical research, may be eligible for the National Institutes of Health (NIH) Loan Repayment Programs. Payments may be up to $50,000 annually and can be applied to qualifying federal or private educational debt.

And the Public Service Loan Forgiveness (PSLF) program may be an option for doctors who work in public service careers. If they work full-time for a qualifying government, nonprofit, or public health employer and make 120 qualifying student loan payments, borrowers may be eligible to have their remaining federal Direct loan balance erased.

The Takeaway

Studying medicine can lead to a lucrative career, but the expense involved can be daunting. When the average debt of a medical student tops $230,000 (excluding undergraduate debt), some aspiring and newly minted doctors will want to look for a remedy, stat. Options to help make payments more manageable include income-driven repayment, federal Direct Loan Consolidation, and refinancing.

Looking to lower your monthly student loan payment? Refinancing may be one way to do it — by extending your loan term, getting a lower interest rate than what you currently have, or both. (Please note that refinancing federal loans makes them ineligible for federal forgiveness and protections. Also, lengthening your loan term may mean paying more in interest over the life of the loan.) SoFi student loan refinancing offers flexible terms that fit your budget.

FAQ

How long does it take to pay off medical school debt?

The time to pay off medical school debt varies widely, typically ranging from approximately eight to 25 years. Factors include the total debt amount, income, repayment plan, and any loan forgiveness programs. Many doctors aim to pay off their debt within 10 years, but it can take longer depending on individual circumstances.

Is medical school worth it financially?

Medical school can be financially worthwhile due to the high earning potential of physicians. However, it often comes with significant debt. The return on investment depends on factors like specialty choice, career path, and personal financial management. Many find it worth it, but it’s a complex decision.

How can you pay off medical school debt faster?

To pay off medical school debt faster, consider strategies like living frugally, maximizing income through high-paying specialties, refinancing loans, and exploring loan forgiveness programs. Creating a strict budget and making extra payments may also accelerate the process.

What is the average debt for medical students who attend private institutions?

The average debt for medical students in the class of 2024 who attended private schools is $227,839, according to the American Association of Medical Colleges. By comparison, the average debt for medical students who attend public colleges is $203,606, the AAMC found.

Are there medical schools with lower tuition costs?

Yes, there are medical schools with lower tuition costs. Public medical schools with the lowest annual tuition costs include the University of Texas Austin Dell Medical School ($19,994 for residents and $35,058 for nonresidents), the University of Central Florida Medical School ($29,680 for in-state and $59,241 for out-of-state), and the University of Texas Rio Grande Valley School of Medicine ($21,532 for residents and $34,632 for nonresidents).

The least expensive private schools of medicine are New York University Grossman School of Medicine, which is offering a full tuition scholarship, and Baylor College of Medicine ($19,682 for residents and $32,782 for nonresidents).

Terms and conditions apply. SOFI RESERVES THE RIGHT TO MODIFY OR DISCONTINUE PRODUCTS AND BENEFITS AT ANY TIME WITHOUT NOTICE. SoFi Private Student loans are subject to program terms and restrictions, such as completion of a loan application and self-certification form, verification of application information, the student's at least half-time enrollment in a degree program at a SoFi-participating school, and, if applicable, a co-signer. In addition, borrowers must be U.S. citizens or other eligible status, be residing in the U.S., Puerto Rico, U.S. Virgin Islands, or American Samoa, and must meet SoFi’s underwriting requirements, including verification of sufficient income to support your ability to repay. Minimum loan amount is $1,000. See SoFi.com/eligibility for more information. Lowest rates reserved for the most creditworthy borrowers. SoFi reserves the right to modify eligibility criteria at any time. This information is subject to change. This information is current as of 4/22/2025 and is subject to change. SoFi Private Student loans are originated by SoFi Bank, N.A. Member FDIC. NMLS #696891 (www.nmlsconsumeraccess.org).

SoFi Loan Products

SoFi Student Loan Refinance

Terms and conditions apply. SoFi Refinance Student Loans are private loans. When you refinance federal loans with a SoFi loan, YOU FORFEIT YOUR ELIGIBILITY FOR ALL FEDERAL LOAN BENEFITS, including all flexible federal repayment and forgiveness options that are or may become available to federal student loan borrowers including, but not limited to: Public Service Loan Forgiveness (PSLF), Income-Based Repayment, Income-Contingent Repayment, extended repayment plans, PAYE or SAVE. Lowest rates reserved for the most creditworthy borrowers. Learn more at SoFi.com/eligibility. SoFi Refinance Student Loans are originated by SoFi Bank, N.A. Member FDIC. NMLS #696891 (www.nmlsconsumeraccess.org).

SoFi Private Student Loans

Please borrow responsibly. SoFi Private Student loans are not a substitute for federal loans, grants, and work-study programs. We encourage you to evaluate all your federal student aid options before you consider any private loans, including ours. Read our FAQs.

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

Non affiliation: SoFi isn’t affiliated with any of the companies highlighted in this article.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Third Party Trademarks: Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

SOSLR-Q325-020