Monday,

July 17, 2023

Market recap

Dow Jones

34,509.03

+113.89 (+0.33%)

S&P 500

4,505.42

-4.62 (-0.10%)

Nasdaq

14,113.70

-24.87 (-0.18%)

Update:

Good news for federal student loan borrowers who have been making payments through an income-driven plan for the equivalent of either 20 or 25 years — and still owe money.

On Friday, President Joe Biden announced that the Department of Education is addressing the past mismanagement of IDR plans by discharging the remaining balances of borrowers as just described.

This debt cancellation will amount to $39 billion and will affect roughly 800,000 federal loan borrowers. It also brings the total amount of federal student loan debt relief provided by the DOE under the Biden Administration to $116.6 billion.

You can read the statement from the Department of Education here , which explains the news more in depth.

Top Story

97% of marketing text messages are opened.

But 96% of consumers say they’re frustrated by SMS marketing. We’ll look at how brands are shifting strategies to ensure their messages are received.

US stocks finished higher Friday after a slew of earnings outperformance by Wall Street’s biggest banks.

• A report by JPMorgan Chase (JPM) exceeded analyst expectations. The beat was largely due to higher interest rates and better-than-expected bond trading results. The bank's net income surged 67% to $14.5 billion, while revenue rose 34% to $42.4 billion. However, the bank's CEO Jamie Dimon warned of "salient risks in the immediate view," citing dwindling consumer balances and the risk of prolonged higher interest rates.

• The University of Michigan consumer sentiment index increased for a second month to 72.6 in July, the highest level since September 2021, and above forecasts of 65.5. Both current economic conditions and consumer expectations improved, largely attributed to an easing of inflation and stability in labor markets.

What to be on the lookout for today

• There are no major economic or earnings reports set to release.

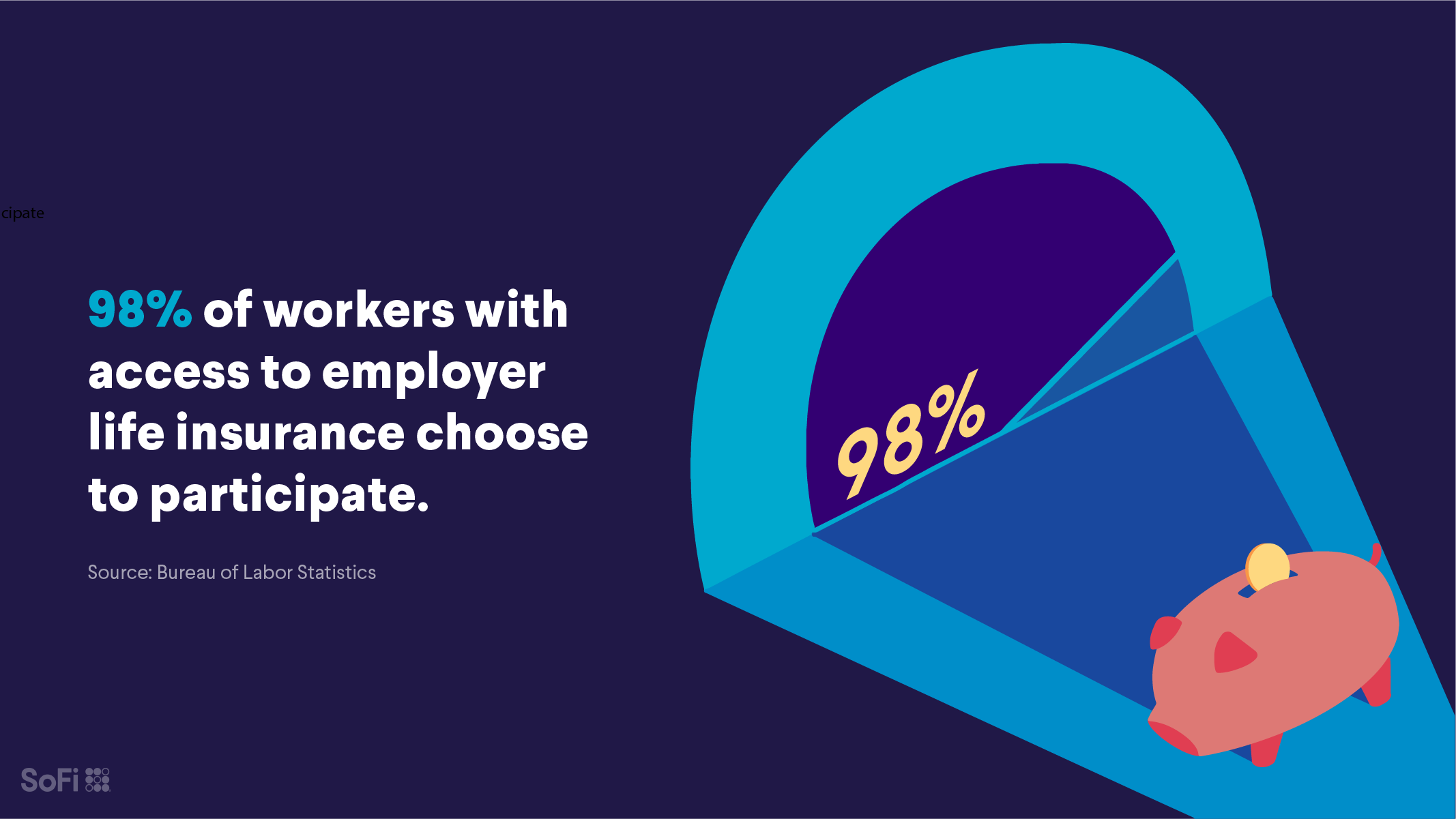

Do you know where your employee benefits are? The benefit you hope you’ll never use.

Life insurance is there to support loved ones in the event of the main breadwinner’s death. Many employers offer life insurance, with policies typically paying out the equivalent of a year’s salary or two. Here’s how to determine if employer insurance will be enough.

1. Calculate how much your family might need. Do you want enough to pay off your mortgage or cover your children’s college costs? Will your parents need financial help during retirement? If these extra expenses don’t apply to you, your employer's plan may be enough to cover your bills and funeral.

2. Consider covering a stay-at-home partner. While they may not contribute to household expenses, your partner likely provides childcare. Would you be able to manage financially without them?

3. Shop around for policies. Once you know who you're covering and how much coverage you need, it’s time to look at premiums. You have the option of upgrading your employer plan or purchasing an independent policy. Term life insurance, which lasts for a set period of time (20 or 30 years), is often the least expensive, with a less intensive application.

It isn’t easy thinking about worst-case scenarios that may never happen. But securing life insurance when you’re young and healthy can make you and your family feel safer.

SoFi has partnered with Ladder to offer competitive life insurance policies that are quick to set up and easy to understand.

Today’s top stories

Actors saw the writers strike and said, “Yes, and…” Hollywood writers and actors are on strike simultaneously for the first time in 63 years, which is expected to bring the movie industry to a screeching halt. Read more >> Bank of America will pay $250 million to regulators and customers. A trio of accusations prompted the fine. Will it mark a paradigm shift for the future of financial “junk fees”? Investors will look for the answer in a finance-heavy week ahead on Wall Street. Read more >> The Biden administration’s recent federal student debt forgiveness announcement comes on the heels of the DOE’s unveiling of the SAVE Plan. The SAVE Plan is an updated income-driven payment plan for federal student loans set to fully take effect in 2024. We’ll break down how SAVE works and who qualifies for it. Read more >>Not-so-breaking news

-

Twitter will start paying creators. The platform’s new ad-driven revenue sharing model is only available to Twitter Blue subscribers.

-

Exxon Mobil (XOM) agreed to a $4.9 billion acquisition of hydrocarbon exploration company Denbury (DEN). The purchase may help accelerate the energy giant’s carbon capture business.

-

The FTC launched an investigation into Open AI’s ChatGPT. The regulator is exploring whether ChatGPT violated laws by scraping public data and providing false information.

-

Disney (DIS) is cutting back on creating new Marvel and Star Wars content, according to CEO Bob Iger. The move was made to cut costs across the organization and prevent oversaturation.

-

Every buybuy BABY store will shut down following Dream On Me’s $15.5 million purchase of the brand’s IP. The deal did not include the former Bed Bath & Beyond subsidiary’s 120 retail stores.

Financial planner tip of the day

"If you can’t afford to pay off your mortgage early in its entirety all at once, you can chip away at the loan over time by making more than the minimum monthly payment. It’s a good idea to ensure that the additional funding is going directly toward your principal balance. That way, you’re dialing down the amount of interest you’ll pay before it can even accrue."

Brian Walsh, CFP® at SoFi