Tuesday,

June 27, 2023

Market recap

Dow Jones

33,714.71

12.72 (-0.04%)

S&P 500

4,328.82

-19.51 (-0.45%)

Nasdaq

13,335.78

-156.74 (-1.16%)

Top Story

These two class-action lawsuits could change the way we buy and sell homes.

The lawsuits argue something as seemingly mundane as the conventional commission structure for real estate agents could be costing consumers $20 to $30 billion each year. Here’s how.

Read more >>

US stocks finished lower Monday headed into the final week of June and the second quarter.

• The Federal Reserve Bank of Dallas’ general business activity index for manufacturing in Texas rose to -23.2 in June. This marks the highest reading seen in three months, above forecasts of -26.5. Still, the reading continued to point to worsening business conditions, with production, new orders, shipments, and capacity utilization categories all contracting.

• Carnival Cruise Line (CCL) saw post-pandemic demand continue to rise. Total bookings and customer deposits made during the quarter both reached new all-time highs. The company also introduced its SEA Change Program, which includes sustainability targets and a 50% increase in adjusted EBITDA over three years.

• According to OPEC's Secretary General, global oil demand will rise to 110 million barrels per day by 2045, which is a 23% increase in energy demand. He also stated oil will still comprise about 29% of the total energy mix by then. The forecast contradicts the International Energy Agency's predictions of annual demand growth thinning down from 2.4 million barrels per day in 2023 to 400,000 barrels per day in 2028.

What to be on the lookout for today

• Investors will get insight into the state of real estate in the US, with the release of both the home price index and the number of new home sales in May. In April, sales of new homes unexpectedly grew 4.1% to 683,000, the highest figure seen in more than a year.

• Walgreens Boots Alliance (WBA) will report earnings. With retail theft and shrinkage hurting the pharmacist’s earnings calls in recent years, it may mention its new anti-theft store design. A Chicago Walgreens has been revamped to have only two aisles, with most high-price items stocked behind a staffed counter.

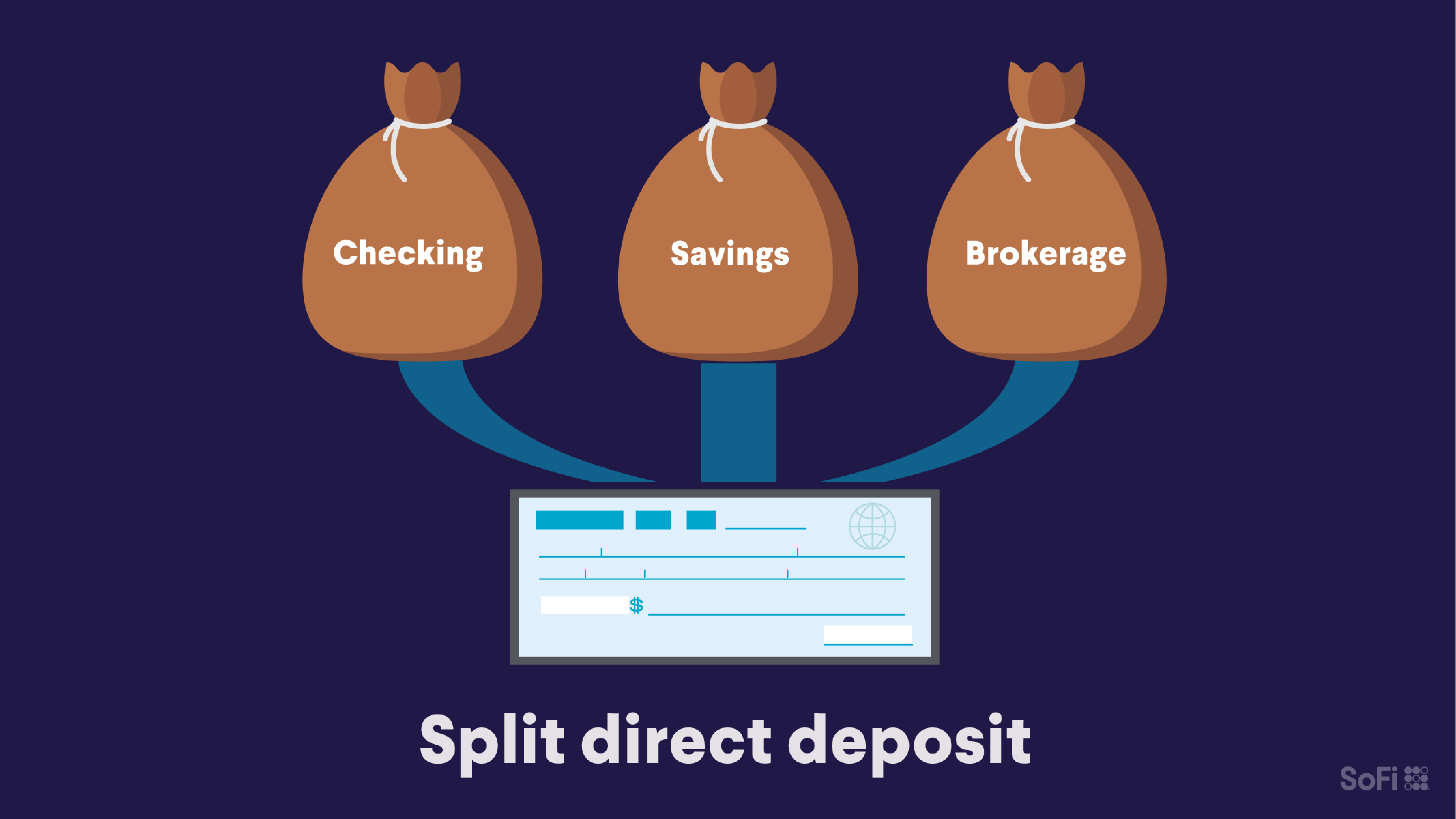

Next-level automation: Split direct deposit

Did you know you can split your paycheck and make direct deposits into more than one account — even at different banks? For instance, you can send some to your checking at Bank A, and the rest to your savings or brokerage account at Bank B. Mind blown! 🤯

Split direct deposit makes budgeting a no-brainer. You can automatically contribute (a flat amount or %) to a money market account, IRA, or 529 plan — or all of the above. The only requirements are:

• Your employer must allow split DD.

• Deposit accounts must be in your name.

• Accounts must have a 9-digit routing number (ABA).

• You’ll need your account number and the account type for setup.

If your company has an online payroll platform, you can quickly add a direct deposit account there. Or ask your HR department for a DD update form.

Besides convenience, direct deposit can pay off in other ways: SoFi members with Direct Deposit now earn a competitive 4.30% APY on their savings balance. Learn more about the perks of SoFi Direct Deposit.

Today's top stories

For investors chasing the proverbial Next Big Thing, here’s a scary campfire story. Poised to pop during the pandemic, the “ghost kitchen” industry collectively raised $3 billion between 2020 and 2022. Where is it now? Read more >> Most millennials would forgo an inheritance for their parents to live comfortably in retirement. We break down how the tables turned in the classic battle of generations — and how to help manage your parents’ future along with your own. Read more >> It can be hard to know how much car insurance you need, and how to keep costs down. We’ll review the different types of policies available, pros and cons of each, and the average cost of full coverage vs. liability. Read more >>Not-so-breaking news

- Lucid Motors (LCID) will supply Aston Martin (AMGDF) with powertrain components for its electric vehicles. The British luxury automaker plans to launch its first EV in 2025.

- IBM (IBM) will acquire Apptio, a software company offering financial and operational IT management tools. Apptio currently has approximately 1,500 clients, including Amazon (AMZN), Microsoft (MSFT), and Google (GOOGL).

- Pizza Hut (YUM) used the NYC subway to deliver pizzas to help promote the upcoming Teenage Mutant Ninja Turtles film. Pizza lovers could order pizza by texting a turtle emoji to a special phone number.

- The Directors Guild of America approved a new three-year contract with studios. The new contract secures gains on wages, global streaming residuals, and creative rights.

- Apple (AAPL) is expected to release a new Apple Watch Ultra this fall, along with the iPhone 15. This follows the closely-watched debut of Apple’s VR headset, Vision Pro.

Financial planner tip of the day

"For money you’ll use in three to seven years, you may be prepared to take slightly more risk than a savings account but still want to take less risk than your retirement money. You might choose to use a brokerage account where you can invest that money in stocks, bonds, cash, or other asset classes. Just be sure to keep your comfort with risk in mind."

Brian Walsh, CFP® at SoFi