Saturday,

April 8, 2023

Top Story

The week in review

• The Fed’s inflation index of choice, year-over-year PCE, came in at 5%, compared to analyst expectations of 5.1%. The figure was also notably lower than the previous month’s 5.3%, solidifying a positive downward trend. Month-over-month core PCE experienced a similar decline to 0.3%, compared to the 0.4% estimate, offering a degree of relief after the previous months’ acceleration.

• Private payrolls rose much lower than expected in March, adding just 145,000 jobs compared to the 261,000 in February. The number was well below the 210,000 estimate, highlighting a significant pullback in hiring as employers brace for a slowing economy.

• The ISM Services PMI, which measures the health of the broader services economy, fell to 51.2 in March compared to the previous month’s 55.1. The reading pointed to the slowest growth in the services sector in three months.

For more economic news, visit On the Money — SoFi’s one-stop-shop for news, trends, and tips!

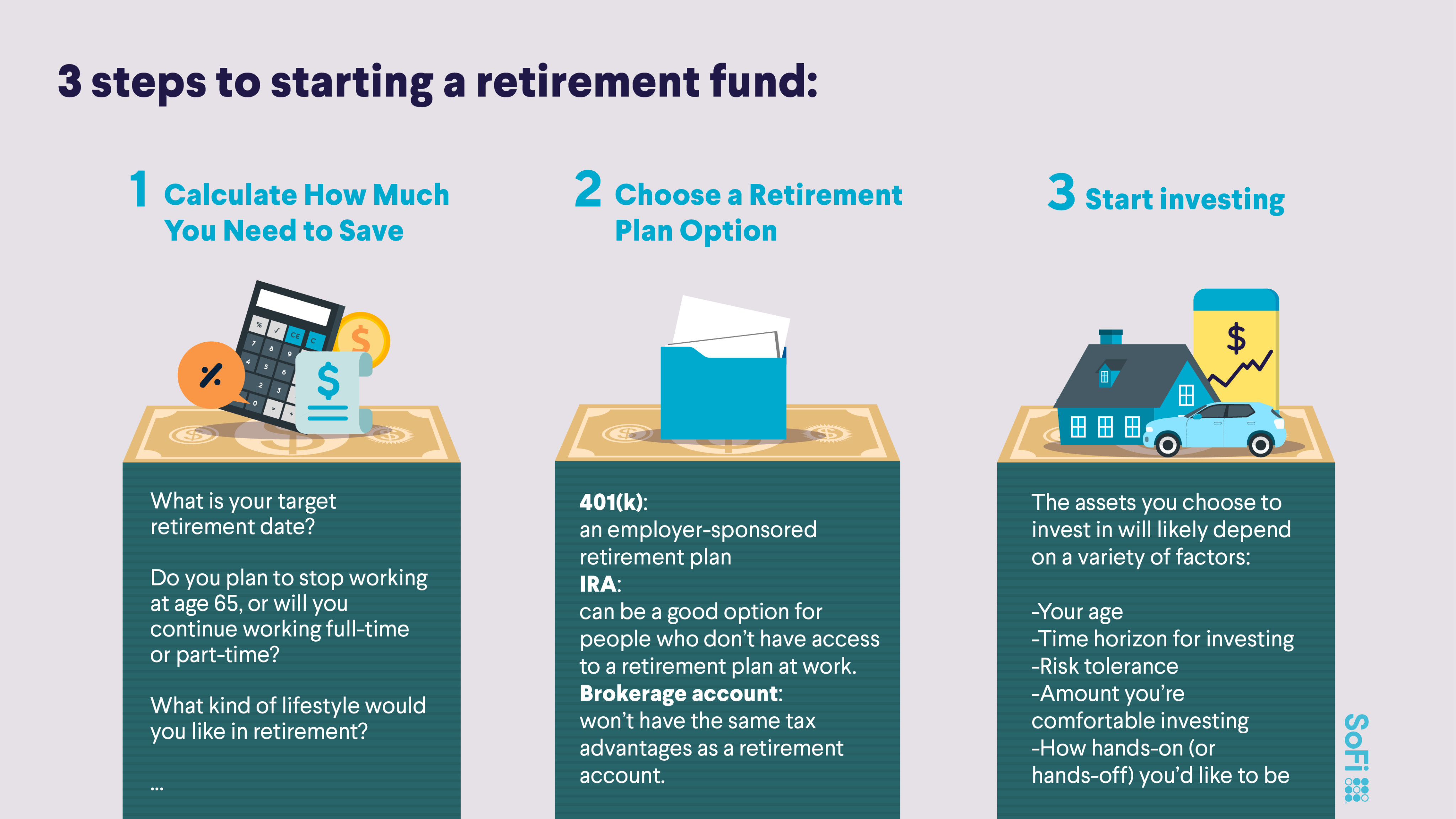

3 easy steps to starting a retirement fund.

Starting a retirement savings plan is one of the most important financial steps you can take in adulthood. The sooner you start, the sooner you can begin saving money for retirement — and rest easy with the knowledge that you are taking care of your future self.

Get an idea of which retirement plan is right for you by visiting SoFi Learn.

And if you’re ready to dive in, find out how SoFi Invest can help you start saving for retirement.

If you’re starting from square one with retirement saving, here are the 3 most important steps to know when opening a retirement fund: