Top Story

During any given week in the 1980s, about 3.3% of the population was on vacation. Today, this metric has dropped by around half to just 1.7%.

This contradicts the notion that individuals are attempting to work less or are unwilling to work hard. Supplementary data implies a possible link with job satisfaction, given that only about 50% of Americans express high levels of satisfaction with their employment in general.

US stocks finished lower Tuesday following concerns the instability for regional banks may not be in the rearview.

• In JPMorgan Chase (JPM) CEO Jamie Dimon’s annual letter to shareholders, he advised there may be lasting repercussions for years to come. However, he made it clear recent events are not comparable to the 2008 crisis.

• The number of job openings in the US fell by 632,000 to 9.9 million in February. The latest figure was well below market expectations of 10.4 million and marked the lowest level of job openings since May 2021.

• Richard Branson’s Virgin Orbit (VORB) officially filed for Chapter 11 bankruptcy protection. The satellite launch company went public in 2021, but after failing to secure a funding lifeline, the company will be looking to sell off its assets. Virgin Orbit has listed assets of $243 million and total debt of $153.5 million.

What to be on the lookout for today

• The non-manufacturing PMI for March will be released, in addition to the US trade deficit for February. Last month, the US trade deficit increased to a three-month high of $68.3 billion. There will also be an update to the interest rate for 30-year fixed-rate mortgages, which currently sits at 6.45%.

• Conagra Brands (CAG), the parent company of Slim Jim, Swiss Miss, and Orville Redenbacher’s, will hand in its report card, as will Atkins-owner Simply Good Foods (SMPL). Investors will watch closely, as food and beverage conglomerates with expansive consumer goods portfolios offer valuable insight into how inflation affects consumer spending.

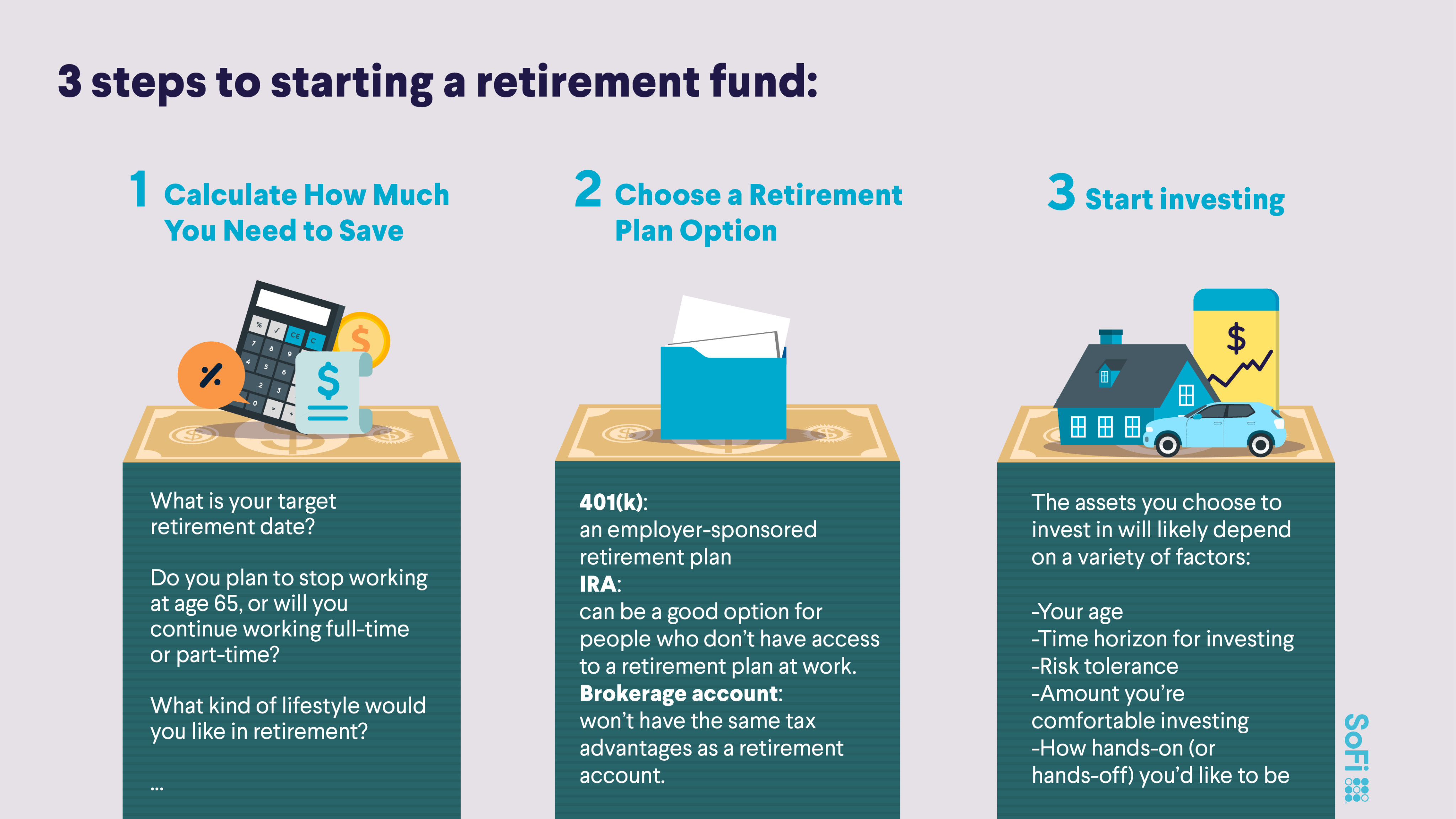

3 easy steps to starting a retirement fund.

Starting a retirement savings plan is one of the most important financial steps you can take in adulthood. The sooner you start, the sooner you can begin saving money for retirement — and rest easy with the knowledge that you are taking care of your future self.

Get an idea of which retirement plan is right for you by visiting SoFi Learn.

And if you’re ready to dive in, find out how SoFi Invest can help you start saving for retirement.

If you’re starting from square one with retirement saving, here are the 3 most important steps to know when opening a retirement fund:

Today’s top stories

Millennials book domestic flights at triple the rate of baby boomers. These travel habits are reshaping the hospitality industry — and putting hotels on notice. Millennials aren’t letting a lack of generational wealth hold them back from spending on things that are important to them. In particular, millennials love to travel. Read more >> Coming soon: fewer EVs will qualify for the maximum $7,500 tax credit. The IRS will release a new and most likely limited list of eligible vehicles on April 18. Here are the revisions — including one that might make getting the tax credit simpler. Read more >> Many good paying jobs don’t require a college degree, if you know which industries to check out. Here’s 25 good paying jobs that don’t require a college degree. Read more >>Not-so-breaking news

-

TikTok was fined with a multimillion-dollar penalty by Britain’s privacy watchdog for mishandling users' personal information, including childrens’ data.

-

The White House announced $450 million will be made available for clean energy projects across the country, including solar farms.

-

Italy became the first country to ban OpenAI's ChatGPT, the wildly popular artificial intelligence tool. Garante, the European country’s data regulator, cited a data breach which allowed users to see the titles of conversations from other users.

-

Disney (DIS) CEO Bob Iger told shareholders that Florida Governor Ron DeSantis’ actions against his company were “anti-business”. The newly reinstated CEO was defending against the state's action to strip the company of special privileges it had over the land that includes Disney World.

-

Tesla (TSLA) has launched a limited edition beer. “GigaBier” is a pilsner brewed in Germany, presented in a bottle meant to emulate Tesla’s Cybertruck.

Financial planner tip of the day

“Once money has been contributed to a retirement account, it’s time to invest that money. To say 'saving for retirement' is a bit misleading — really, it can be considered to be 'investing for retirement.”

Brian Walsh, CFP® at SoFi