Tuesday,

April 4, 2023

Market recap

Dow Jones

33,601.15

+327.00 (+0.98%)

S&P 500

4,124.51

+15.20 (+0.37%)

Nasdaq

12,189.45

-32.45 (-0.27%)

Top Story

As “tipflation” impacts business after business, consumers are reaching a tipping point.

The share of remote transactions that offer tipping jumped from 43.4% in February 2020 to 74.5% just three years later.

US stocks were mixed Monday after a surprise OPEC oil output cut over the weekend.

• Several OPEC+ members announced they would cut a combined 1.16 million barrels per day in oil production. This is happening in parallel to Russia’s intentions of trimming 500,000 barrels per day and could make the Fed’s job more challenging as a potential tailwind for inflation.

• The ISM manufacturing PMI, which measures production level across the broader economy, decreased to 46.3. This was the largest month-over-month decline since May 2020 and marked a fifth-straight month of contraction, coming in well below expectations of 47.5.

• The WWE (WWE) agreed to merge with the UFC. The deal, which values WWE at $9.3 billion and UFC at $12.1 billion, will form a new publicly traded company controlled by UFC’s current owner, talent and media holding company Endeavor Group (EDR).

What to be on the lookout for today

• Investors will get the JOLTS Job Openings report for February. In January, the number of open jobs in the US fell by 410,000 to 10.8 million.

• Kirkland’s (KIRK) will kick off the earnings week. The home decor chain has already announced that its comparable sales decreased 5.5% for the 2022 holiday quarter. As the retailer discusses that quarter and the full fiscal year, investors will look for insight into what led to this decrease.

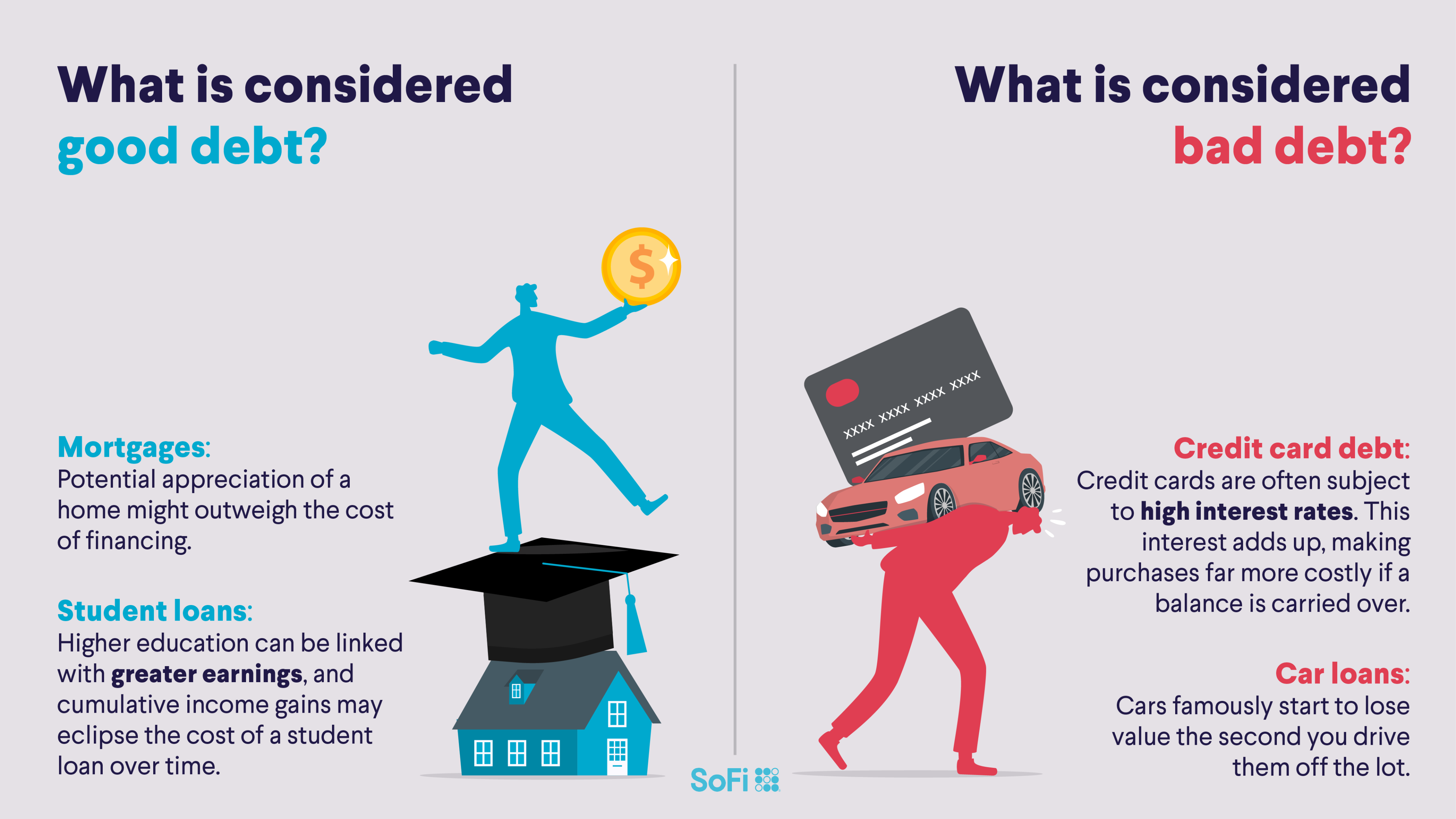

Contrary to popular belief, not all debt is considered bad.

Owing money is no fun, but debt often serves an important function in people’s lives, putting things that can cost tens of thousands of dollars or more — a college degree, a starter home — within reach.

Good debt is seen as money owed on expenditures that can build an individual’s finances over time, such as in order to increase one’s earning potential or in order to purchase something expected to appreciate in value.

Bad debt is money owed for expenses that pose no long-term value to a person’s financial standing, or that may even decrease in value by the time the loan is paid off.

Check out SoFi Learn for a deep dive about navigating the world of debt.

And if you feel stuck in a cycle of bad debt, consider consolidating your debt with lower interest and no required fees.

Here are some examples of good and bad debt:

Today’s top stories

More consumer goods retailers are stocking luxury products. Even discount retailers are targeting the wealthy in the hopes it will help them weather a tough economic climate. Consumers may see fewer affordable options as a result. Read more >> AI-powered tax software startup April hopes to make your April 18th a little easier. April hopes to use automation to make tax season anxiety a thing of the past. Read more >> The average monthly gas bill nationwide is $65-$70, but your cost may vary depending on location, home size, appliances, and more. Read on for a breakdown of what can cause your gas bill to go up and down from one month to the next, how to budget for those price changes, and how you might be able to lower your costs in the future. Read more >>Not-so-breaking news

-

McDonald’s (MCD) closed its corporate offices in preparation for layoffs. Corporate staff has been instructed to work from home until the fast food giant notifies employees of their employment status.

-

Walmart (WMT) redesigned its online store in an effort to improve user experience and engagement. The app now displays more photos, videos, and social media-inspired content.

-

Twitter began removing blue checkmarks from major accounts that don’t pay $8 per month for a premium subscription. The New York Times’ (NYT) official account is no longer verified.

-

California, New Jersey, Maryland, and North Carolina joined a lawsuit to prevent JetBlue Airways (JBLUE) from buying Spirit Airlines (SAVE). The states argue that this merger may lead to higher fares and fewer seats for consumers.

Financial planner tip of the day

"Rebalancing an investment portfolio can help investors stay on track to meet their long-term goals. By ensuring that there is a steady mix — or diversification — of assets in their portfolio, they can stay on top of their investments in a way that works with their risk tolerance and their financial needs."

Brian Walsh, CFP® at SoFi