Top Story

The week in review

• Lululemon (LULU) saw its shares surge after topping analyst estimates with $2.77 billion in revenue and earnings per share of $4.40. The popular athletic-wear company provided full-year guidance surpassing previous projections, adding that it believes it’s one of the few companies in the space with a long pathway for growth.

• First Citizens BancShares (FCNCA) announced that it will be buying Silicon Valley Bank’s deposits and loans. The deal includes roughly $72 billion of SVB assets at a $16.5 billion discount, sparking First Citizen shares to surge by more than 45%.

• Gold breached $2,000/oz, with the flight to safer assets and a potential pause in rate hikes acting as wind to its sails. The precious metal is up roughly 10% for the month, though notably still off its all-time high of $2,075 made in early August 2020.

For more economic news, visit On the Money — SoFi’s one-stop-shop for news, trends, and tips!

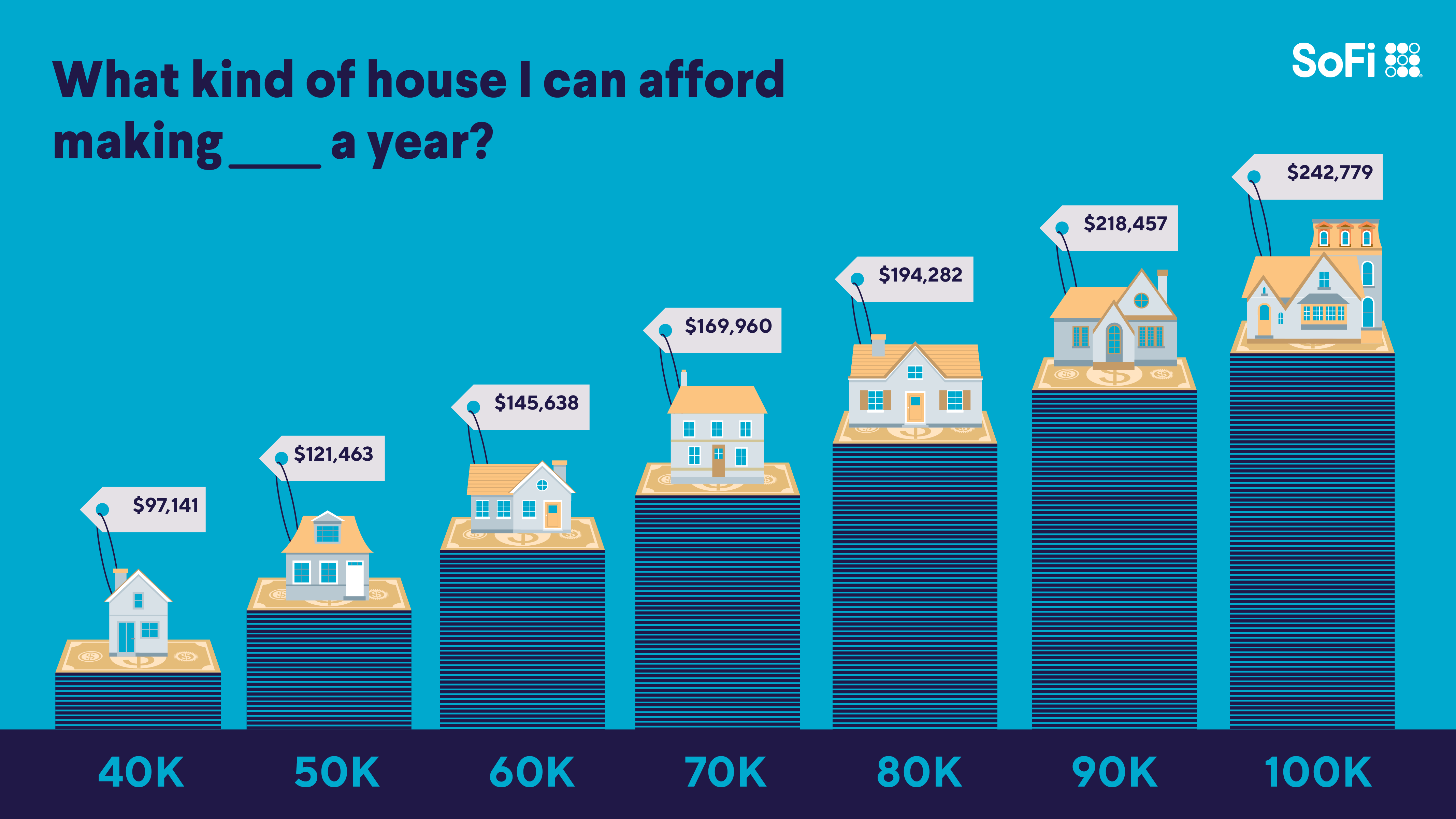

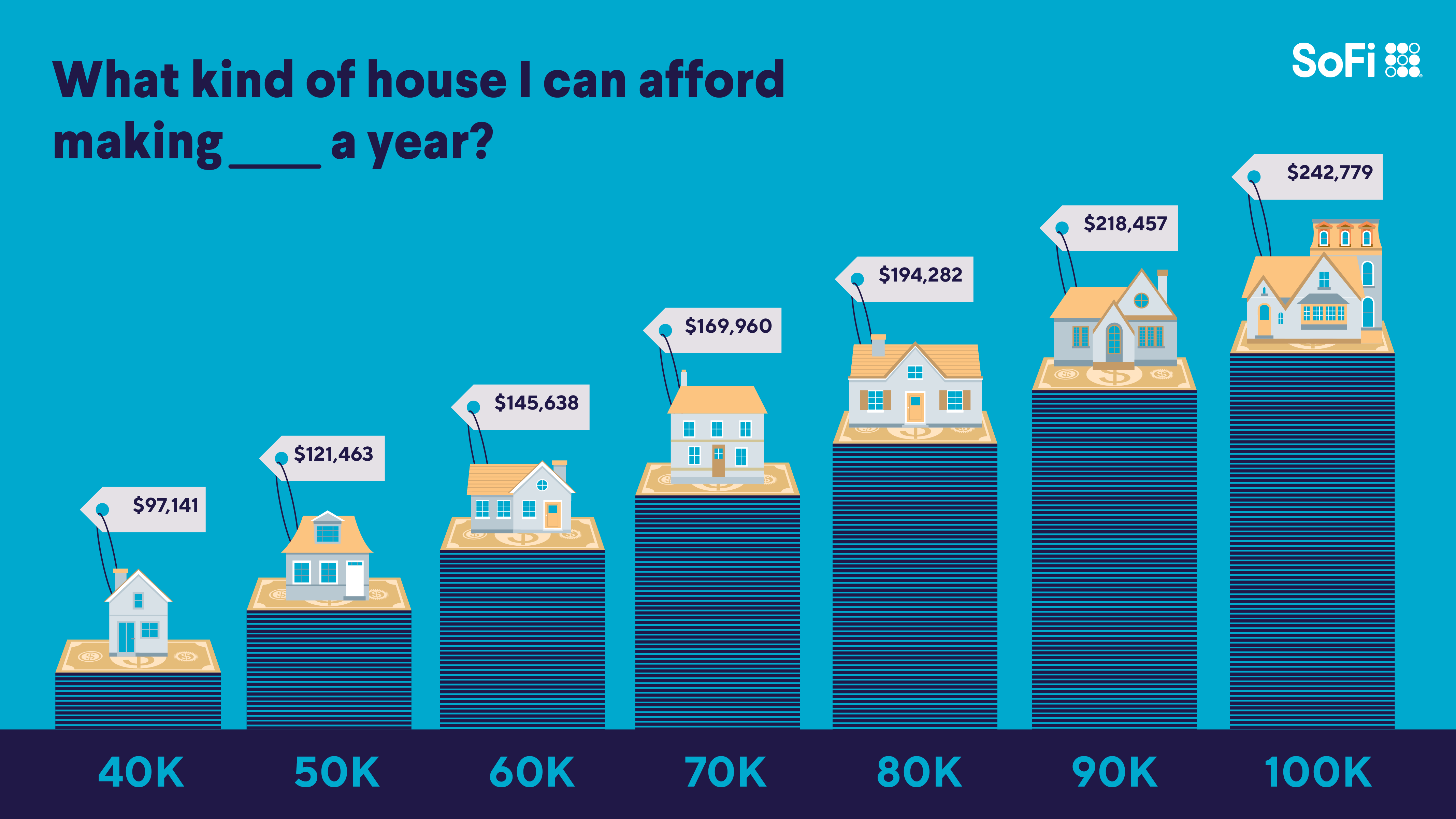

How much house can you afford based on annual income?

If you are a regular reader of this newsletter, you likely have a good idea of how much home you can afford. But the chart below might help you visualize the type of home you’ll be able to buy based on your income.

And remember, you can use our home affordability calculator to help identify how much house you can afford and determine a mortgage payment that fits within your budget.

The chart assumes:

• 10% of monthly income going toward debt payments

• 30 year mortgage term

• 6.29% interest rate

• 25% of salary used for a down payment

This week’s top stories

If you’re expecting a tax refund this year, there are a few things you can do to get your money faster.

With Tax Day just around the corner, we’ll share the information you need to know to ensure a seamless filing process and speedy refund.

Read more >>

Plan on catching a flight over the summer? These airport upgrades may come as a pleasant surprise.

We have a look at recent airport changes, and a sneak peek into other upgrades on the way.

Read more >>

Apple Pay (AAPL) just introduced its own Buy Now, Pay Later service: Apple Pay Later.

Buy Now, Pay Later services have pros and cons. Here’s everything you need to know about using Apple’s latest feature.

Read more >>

Deep dives from SoFi Learn

May 1 is College Decision Day. It’s the time when first-year college applicants typically commit to the school of their choice. For many students and their families, that choice largely depends on the financial aid offered.

Navigating financial aid packages can be confusing and award letters can be difficult to understand. We’ll break down the jargon to help ease your decision-making process.

Read more >>

A hardship loan is a loan that can help you get through unexpected financial challenges such as unemployment, medical bills, and caregiving responsibilities.

If you are in need of a temporary financial cushion, there are a variety of hardship loans to consider, from personal loans to home equity borrowing. We’ll break down the options.

Read more >>

Buying a duplex can be a great opportunity to own two properties, perhaps occupying one and earning rental income on the other.

Here’s a look at the pros and cons, as well as the implications for your finances.

Read more >>