Top Story

Latino entrepreneurs fear VC funding will be a casualty amid economic uncertainty.

Even in the best of times, Latinos have had a hard time attracting capital. Trouble in the banking sector and inflation may make for an even tougher sell.

US stocks finished higher Friday despite more banking uncertainty overseas.

• Amidst ongoing financial stability concerns, Deutsche Bank’s credit default swaps, which represent the cost of insurance for bond holders in the event of default, shot up significantly. As central banks battle inflation with rate hikes, investors remain wary of the stress they are imposing on the banking sector.

• Gold breached $2,000/oz, with the flight to safer assets and a potential pause in rate hikes acting as wind to its sails. The precious metal is up roughly 10% for the month, though notably still off its all-time high of $2,075 made in early August 2020.

• Durable goods orders, which measure orders received for long-lasting manufactured goods, dropped 1% month-over-month. The figure was below market forecasts of a 0.6% increase and marked a second-consecutive decline after a 5% drop in January.

• Shares of Activision Blizzard (ATVI) surged after the UK’s Competition and Markets Authority stated it no longer believes the company’s merger with Microsoft (MSFT) would result in a significant reduction in competition. Nevertheless, the regulatory body still maintains the deal raises concerns in the cloud gaming market.

What to be on the lookout for today

• The Dallas Fed will release its Manufacturing Index. This gauge of general manufacturing activity in Texas has contracted for ten consecutive months.

• Carnival Corporation (CCL) will kick off the earnings week with an update on the state of the cruise industry. Last quarter, the budget cruise line posted revenue of $3.84 billion, a dramatic 198% increase from the year prior. However, the company is still burning cash and posted a $1.6 billion net loss.

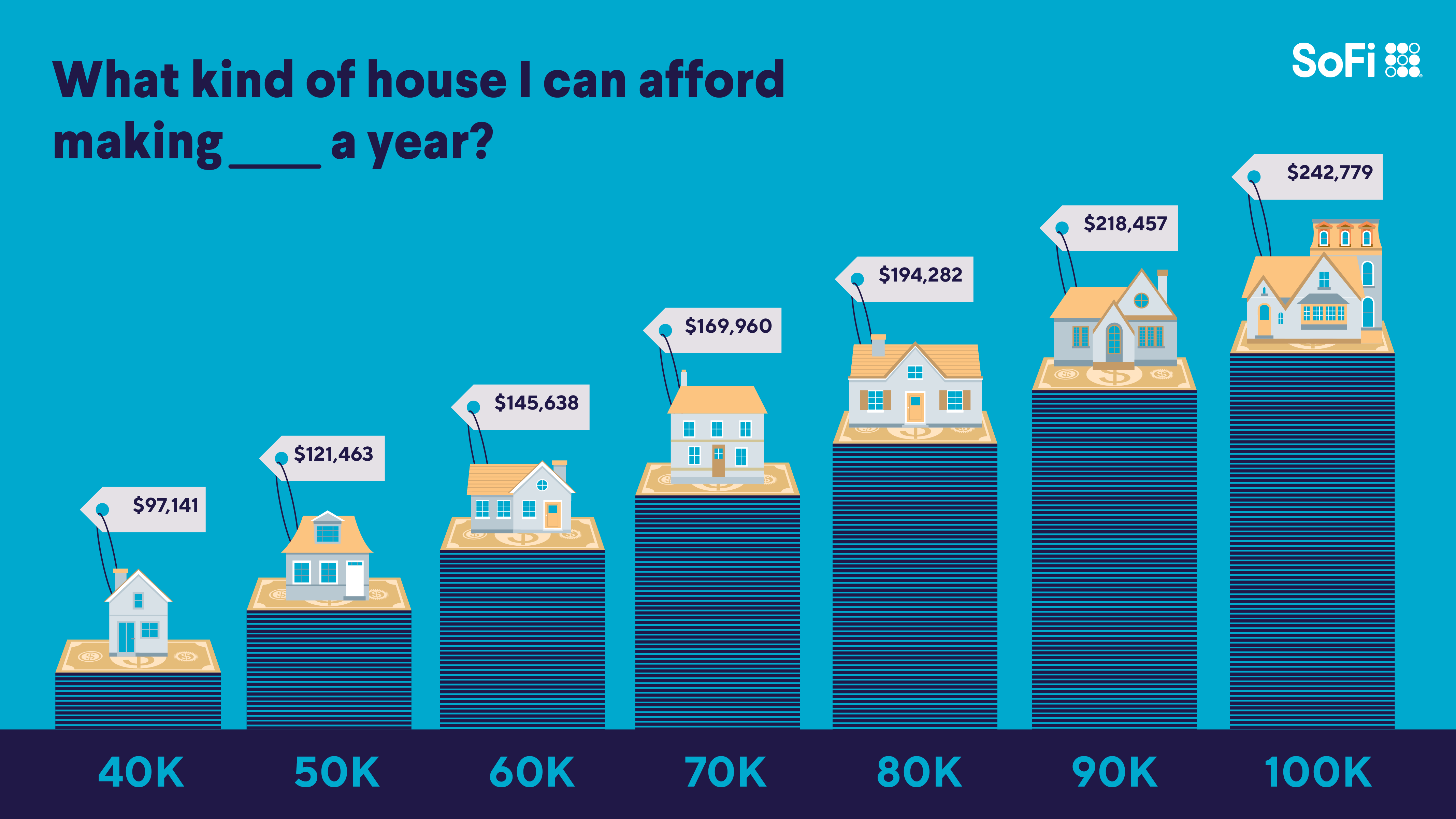

How much house can you afford based on annual income?

If you are a regular reader of this newsletter, you likely have a good idea of how much home you can afford. But the chart below might help you visualize the type of home you’ll be able to buy based on your income.

And remember, you can use our home affordability calculator to help identify how much house you can afford and determine a mortgage payment that fits within your budget.

The chart assumes:

• 10% of monthly income going toward debt payments

• 30 year mortgage term

• 6.29% interest rate

• 25% of salary used for a down payment

Today’s top stories

Cult following? Lululemon (LULU) makes a product that went viral on TikTok. In fact, it was sold out for six months. The company reports its latest results this week and Wall Street wants to know how much of an impact this one product had, and if it can replicate its success. Here's the product TikTokers couldn't get enough of. Read more >> Workplace burnout is happening in the home office, and it’s on the rise. If you’re struggling with symptoms, these tips can help you manage it. You’re also not alone — A whopping 94% of Americans reported feeling at least one symptom of burnout over the past 12 months. Here’s what’s going on with America’s workforce... Read more >> Having a fluctuating income doesn’t exactly mean a hard “no” for your mortgage application. A steady income stream has long been thought of as the only way to qualify for a mortgage, but with a little extra leg-work, non-traditional income streams can still allow you to get the home of your dreams. Read more >>Not-so-breaking news

-

Ford (F) is launching the “Millennium Falcon” of EV trucks under the name Project T3. This new vehicle will rival Tesla’s Cybertruck in taking electric trucks to the next level.

-

Do Kwon, founder of the collasped TerraUSD and Luna cryptocurrencies, was arrested in Montenegro. The crypto founder is wanted for fraud in both South Korea and the US.

-

A leaked document published by Insider shows that Amazon’s (AMZN) hiring practices lacked general oversight or accountability. This likely contributed to overhiring and subsequent layoffs by the world’s largest online retailer.

-

Workers in France are striking over pension reforms and it’s starting to trigger riots. More than 1 million people took to the streets on Thursday with around 1,000 people setting fires and damaging property.

-

Spotify (SPOT) is removing the entire catalog of Zee Music from its platform after failing to reach a licensing agreement with the Indian music label. The music group is the second-largest in India and has nearly 100 million fans on YouTube (GOOGL).

Financial planner tip of the day

“Your Debt-to-Income Ratio, or DTI, tells lenders how much of your monthly income is being used to pay your debts. In general, lenders prefer to see less than about 30% of an applicant’s income going toward debt payments each month. Paying off debts can improve your DTI to a more creditworthy percentage for lenders to consider when assessing your mortgage loan application.”

Brian Walsh, CFP® at SoFi