Friday,

March 24, 2023

Market recap

Dow Jones

32,105.25

+75.14 (+0.23%)

S&P 500

3,948.72

+11.75 (+0.30%)

Nasdaq

11,787.40

+117.44 (+1.01%)

Top Story

Fraudsters used an AI-powered phone call scam to steal $11 million from victims last year.

Here’s how this sophisticated scam works and how you can avoid it.

US stocks rebounded Thursday as Wall Street continued to digest the Fed’s interest rate decision and Chairman Powell’s speech.

• The number of Americans filing for unemployment benefits declined to 191,000 in the week ending March 18th. This was below market expectations of 197,000, providing further evidence of a tight labor market.

• The Bank of England and the Swiss National Bank hiked interest rates 25 basis points and 50 basis points, respectively. Despite recent pain points in the US and Swiss banking systems, both central banks believe inflation is still too high and further rate increases could be appropriate.

• Block (SQ) shares plunged double digits following news that the short seller Hindenburg Research accused the company of facilitating fraud. Hindenburg alleged that Block’s flagship product, the Cash App, circumvents a regulatory cap on interchange fees, from which up to 35% of its revenue is derived.

What to be on the lookout for today

• A flurry of economic reports are due. This includes orders for durable goods, as well as S&P Global’s Services, Manufacturing, and Composite PMIs.

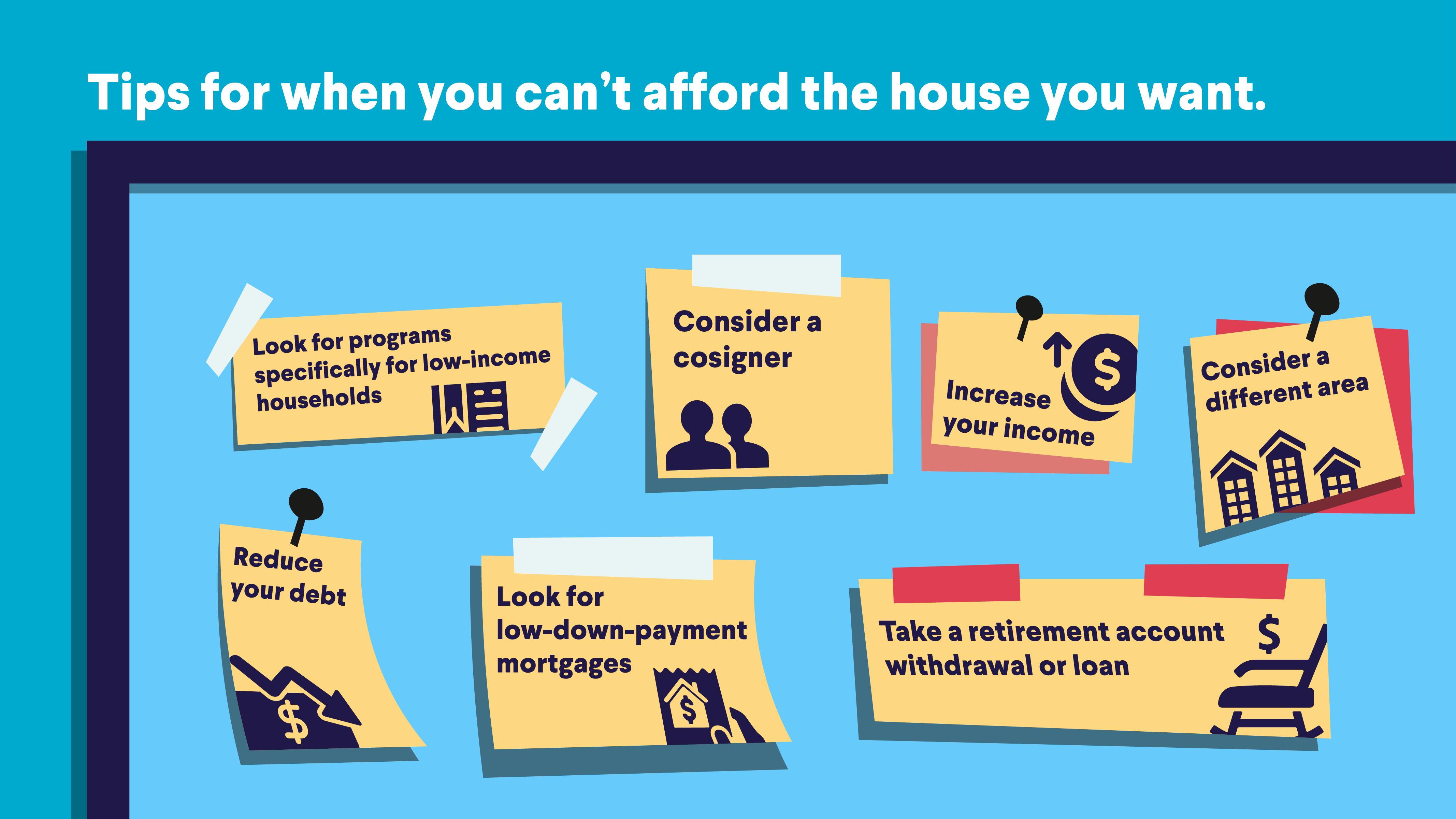

Here are tips for when you can’t afford the house you want.

Let’s say you don’t qualify for a mortgage sufficient to buy a home in your desired area. Don’t give up: There are some things you can do to keep moving toward homeownership.

Use our home affordability calculator to help identify how much house you can afford and determine a mortgage payment that fits within your budget.

Today’s top stories

Struggling to pay your rent? We have 3 strategies that could help. Five million Americans are behind on rent and owe an average of $2,094. With the Covid-19 public health emergency set to officially end in less than months, here’s what you need to know. Read more >> Many companies are now “upskilling” their existing workforce instead of hiring new employees. Workera just raised $23.5 million to help teach employees new, relevant skills. Learn how it might help you grow at your job. Read more >> The deadline for filing 2022 taxes is Tuesday April 18 — or October 16 if you requested an extension. While most people will receive their refund in 21 days, there are several factors to consider. Learn about the tax refund process and how to track the status of your refund. Read more >>Not-so-breaking news

-

TikTok CEO Shou Chew testified before Congress on Thursday in a 5-hour combative hearing about protecting US user data. US lawmakers are intent on banning the popular video sharing app, despite Chew’s claims that the company does not share user info with the Chinese government.

-

Sales of newly constructed homes rose 1.1% in February, marking the third-straight month of increasing sales. Mortgage rates have eased off their recent highs, which is likely encouraging more buyers to enter the market.

-

Hard seltzer brand, White Claw, just announced a line of flavored and unflavored vodka. This marks an industry-wide shift away from hard seltzers in favor of other types of alcohol.

-

Automakers are rolling out plenty of new electric SUVs in the US, putting pressure on Tesla (TSLA). A few examples of upcoming EV SUVs include the Chevrolet Equinox EV (GM), GMC Hummer EV SUV, and the Hyundai Kona (HYMTF).

-

Starbucks (SBUX) CEO Laxman Narasimhan received barista training last October and plans to work one shift at a cafe location each month. The chief executive hopes that this will help him stay close to the company’s culture and customers.

Financial planner tip of the day

“One way to build credit is to display a history of responsible borrowing. For that reason, you may want to place monthly bills and other expenses on your credit card—being sure to pay the bill in full each month by the due date.”

Brian Walsh, CFP® at SoFi